Newsroom

Sokoman Minerals Reports Highest Gold Grain Counts To Date In Till Fleur De Lys Project, North-Central Newfoundland

St. John’s, NL, April 8, 2022 – Sokoman Minerals Corp. (TSXV: SIC) (OTCQB: SICNF) (the “Company” or “Sokoman”) is pleased to provide an updated summary of the results from Phase 1, C Horizon Till survey at the Fleur de Lys Gold Project. This update also summarizes pertinent assay data from 167 rocks (grab samples from float and outcrop), out of a total of 330 samples collected during prospecting prior to and during the till sampling.

A total of 968 till samples were collected in 2021, mainly on lines spaced 1.5 km to 2 km apart, with sample spacing along the lines of 250 m. Approximately 100 till samples of that total were collected as infill samples, in areas of anomalous gold grain counts. To date, 880 till samples have been processed by Ottawa-based Overburden Drilling Management (ODM), that is overseeing the project. Sokoman has previously provided a summary of results for the first 400 of these samples (October 6, 2021, news release). Today’s release summarizes results for 480 additional samples.

The following table summarizes the results for all 880 samples processed by ODM to date.

Based on discussions with ODM, background gold grain counts are herein determined to be 10 grains per sample, whereas an anomalous sample contains at least two times background or 20 gold grains. Of the 880 results, 190 samples have at least 20 gold grains and are considered anomalous. The till data have outlined a district-scale, prospective corridor of approximately 30 km strike length. The two highest values were total gold grain counts of 200 and 230, with 94 and 41 pristine grains respectively, suggesting a local source (less than 200 metres) for some of the anomaly clusters within the prospective corridor.

A total of 282 rock samples have been acquired, prior to and during the till survey, with results received for 167 samples to date. Thirty-four (34) samples returned values >100 ppb Au (0.1 g/t Au); 18 returned values >500 ppb Au (0.5 g/t Au); and ten (10) returned values >1000 ppb Au (>1.0 g/t Au), with a maximum value of 4.60 g/t Au. Follow-up prospecting and continued infill till sampling will commence as soon as possible, upon suitable snowmelt.

Tim Froude, President, and CEO of Sokoman, says: “We are impressed with the number and quality of anomalous till values on the property. Our geochemical exploration is defining a potentially significant bedrock source for the gold in tills in areas with little or no previous exploration. We are also finding significant gold values in both float and bedrock confirming that in situ gold mineralization exists in Dalradian-equivalent rocks in Newfoundland, with several of the strongly anomalous till areas unrelated to any known mineralization. Interpretation of the till results by Overburden Drilling Management estimates the gross target area to be a 30 km strike length, within which a number of better-defined anomalies are found, a priority for detailed follow up.”

The Fleur de Lys Supergroup, which underlies the project, are equivalent rocks to the Dalradian Supergroup in the Appalachian-Caledonian belt in the United Kingdom. In the latter area, three significant gold deposits are known: the Curraghinalt and Cavanacaw deposits in Northern Ireland, and Cononish in Scotland. Dalradian-type gold deposits occur in moderate- to high-grade metamorphic terranes and are typically high grade (the Curraghinalt deposit has in excess of 6 million ounces of NI 43-101 compliant gold resources including 6.3 million tonnes at 14.95 grams per tonne (Measured and Indicated) for 3.06 million ounces; and 7.72 million tonnes at 12.24 grams per tonne gold (Inferred) for 3.03 million ounces (2018 Mineral Resource Statement, Curraghinalt Gold Project, Northern Ireland, SRK Consulting (Canada)).

About the Fleur de Lys Gold Project

The 100%-owned Fleur de Lys Gold Project is located on the Baie Verte Peninsula in north-central Newfoundland. The project is highly prospective for Dalradian-style (e.g., Curraghinalt) orogenic vein-hosted gold deposits and as such, represents a readily accessible yet underexplored, district-scale, gold target in the Newfoundland Appalachians. The property has seen little modern exploration, with some areas remaining completely unexplored although historical grab sample values of 3.3 g/t Au to 25.5 g/t Au are reported from several locations (note: historical assays have not been verified by the Company and should not be relied upon).

QP

This news release has been reviewed and approved by Timothy Froude, P.Geo., a “Qualified Person” under National Instrument 43-101 and President and CEO of Sokoman Minerals Corp.

COVID-19 Protocols

To ensure a working environment that protects the health and safety of the staff and contractors, Sokoman is operating under federally and provincially mandated and recommended guidelines during the current COVID-19 alert level.

Till Sampling QA/QC

The till samples were collected by Sokoman personnel using field collection techniques provided by ODM. All samples were hand dug to the desired depth (C Horizon Till) with a 10 kg – 12 kg sieved sample (8 mesh) placed in a clear plastic sample bag and sealed. Samples were shipped in plastic pails by bonded courier to the ODM lab in Ottawa, Ontario. The till samples are processed using procedures designed to progressively concentrate the heavy minerals, expose the gold grains and prepare a split of the heavy mineral concentrate (“HMC”) suitable for geochemical analysis if requested. The sample is wet screened at 2 mm with a preliminary concentrate extracted from the -2 mm fraction by tabling. Geological observations on the character of the sample are made during both the screening and tabling operations. The table concentrate is purposely large (typically 300 g-400 g) and of low grade (10%-25% heavy minerals) in order to achieve a high, 80% to 90% recovery rate for all desired heavy minerals, irrespective of their grain size or relative specific gravity. The gold grains, more than 95% of which are normally silt-sized (Averill 2001), are observed at this stage with the aid of micro-panning and are counted, measured, and classified as to the degree of wear (ie distance of glacial transport), then returned to the table concentrate. The pyrite content of the pan concentrate is estimated and the number of grains of heavier, visually distinctive indicator minerals such as arsenopyrite, galena, scheelite, cinnabar, etc. is recorded.

Quality Control and Quality Assurance Measures

In addition to using field duplicates to monitor the quality of the indicator mineral data obtained from specific projects, ODM performs blind tests to ensure that the recovery rates for all targeted minerals are consistently in the 80% to 90% range. Furthermore, both the quality of the mineral separation and the overall mineralogy of the concentrate are visible at every stage of the concentration process, minimizing the potential for sample mix-ups, indicator mineral carryover between samples, and other potential contamination issues. For example, gold grains, which are the most important indicator mineral on many surveys, are more susceptible to inter-sample carryover than any other indicator mineral due to their very small size, but these grains are physically observed during the first stage of mineral concentration, tabling, and, if anomalous concentrations are present, blank samples are tabled and carefully inspected for gold grains before the next project sample is processed.

Rock Sample Analysis

Rock sample analysis (gold by fire assay) was completed at Eastern Analytical Ltd. (Eastern), in Springdale NL. Samples were delivered in sealed bags directly to the lab by Sokoman personnel. Eastern is an accredited assay lab that conforms to the requirements of ISO/IEC 17025. Eastern routinely inserts industry-accepted standards and blanks in all sample runs performed as well as completing random duplicate analyses.

About Sokoman Minerals Corp.

Sokoman Minerals Corp. is a discovery-oriented company with projects in the province of Newfoundland and Labrador, Canada. The Company’s primary focus is its portfolio of gold projects; flagship, advanced-stage Moosehead, Crippleback Lake (optioned to Trans Canada Gold Corp.) and East Alder (optioned to Canterra Minerals Corporation) along the Central Newfoundland Gold Belt, and the district-scale Fleur de Lys project in north-central Newfoundland, that is targeting Dalradian-type orogenic gold mineralization similar to the Curraghinalt and Cavanacaw deposits in Northern Ireland. The Company also recently entered into a strategic alliance with Benton Resources Inc. through three, large-scale joint-venture properties including Grey River, Golden Hope, and Kepenkeck in Newfoundland.

Sokoman now controls, independently and through the Benton alliance, over 150,000 hectares (>6,000 claims – 1500 sq. km), making it one of the largest landholders in Newfoundland, in Canada’s newest and rapidly-emerging gold districts. The Company also retains an interest in an early-stage antimony/gold project (Startrek) in Newfoundland, optioned to White Metal Resources Inc., and in Labrador, the Company has a 100% interest in the Iron Horse (Fe) project which has Direct Shipping Ore (DSO) potential.

Mineralization hosted on adjacent and/or nearby and/or referenced properties is not necessarily indicative of the mineralization hosted on the Company’s property.

The Company would like to thank the Government of Newfoundland and Labrador for financial support of the Fleur de Lys Gold Project through the Junior Exploration Assistance Program.

For further information, please contact:

Sokoman Minerals

Timothy Froude, P.Geo., President & CEO

Phone: 709-765-1726

Email: tim@sokomanmineralscorp.com

CHF Capital Markets

Cathy Hume, Director, Investor Relations

Phone: 416-868-1079 x251

Email: cathy@chfir.com

Website: www.sokomanmineralscorp.com

Twitter: @SokomanMinerals

Facebook: @SokomanMinerals

LinkedIn: @SokomanMinerals

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Investors are cautioned that trading in the securities of the Corporation should be considered highly speculative. Except for historical information contained herein, this news release contains forward-looking statements that involve risks and uncertainties. Actual results may differ materially. Sokoman Minerals Corp. will not update these forward-looking statements to reflect events or circumstances after the date hereof. More detailed information about potential factors that could affect financial results is included in the documents filed from time to time with the Canadian securities regulatory authorities by Sokoman Minerals Corp.

Sokoman And Benton Report First Drill Assay Results From The Kraken Pegmatite Field – Golden Hope Project, Sw Newfoundland

The 8.4 metre pegmatite dike averaged 0.95% Li2O

with grades hitting a high of 1.76% Li2O

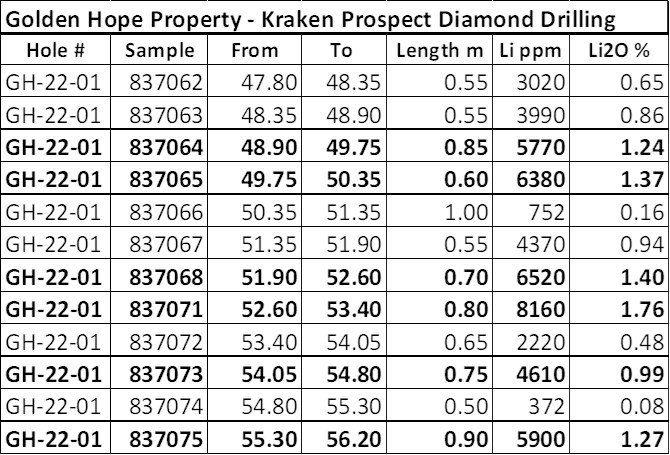

St. John’s, NL, March 24, 2022 – Sokoman Minerals Corp. (TSXV:SIC) (OTCQB:SICNF) (“Sokoman”) and Benton Resources Inc. (TSXV:BEX) (“Benton”) together, (the “Alliance”) are pleased to report the first assay results from the 1,025 m reconnaissance drilling program, that tested the recently discovered Kraken pegmatite field on the Golden Hope Joint Venture Property in southwestern Newfoundland. The samples were cut from an 8.40 m wide (drilled thickness), spodumene-bearing, pegmatite dike that returned the following assays:

Widths reported are believed to be 90% of true thickness

Assay values ranged from 0.08% to 1.76% Li2O reflecting variations of spodumene content, and the presence of occasional barren wall rock or quartz vein inclusions, averaging 0.95% Li2O over 8.40 m from 47.8 to 56.2 m. Other pegmatite dikes ranging from 0.40 m to 2.30 m with variable spodumene content were also intersected in hole GH-22-01 with assays pending. Gold analysis results from the host sericite schist units carrying variable pyrite are also pending. All samples submitted, 1,165 including blanks and standards, for the remainder of GH-22-01 as well as for holes GH-22-02 to 06 are pending.

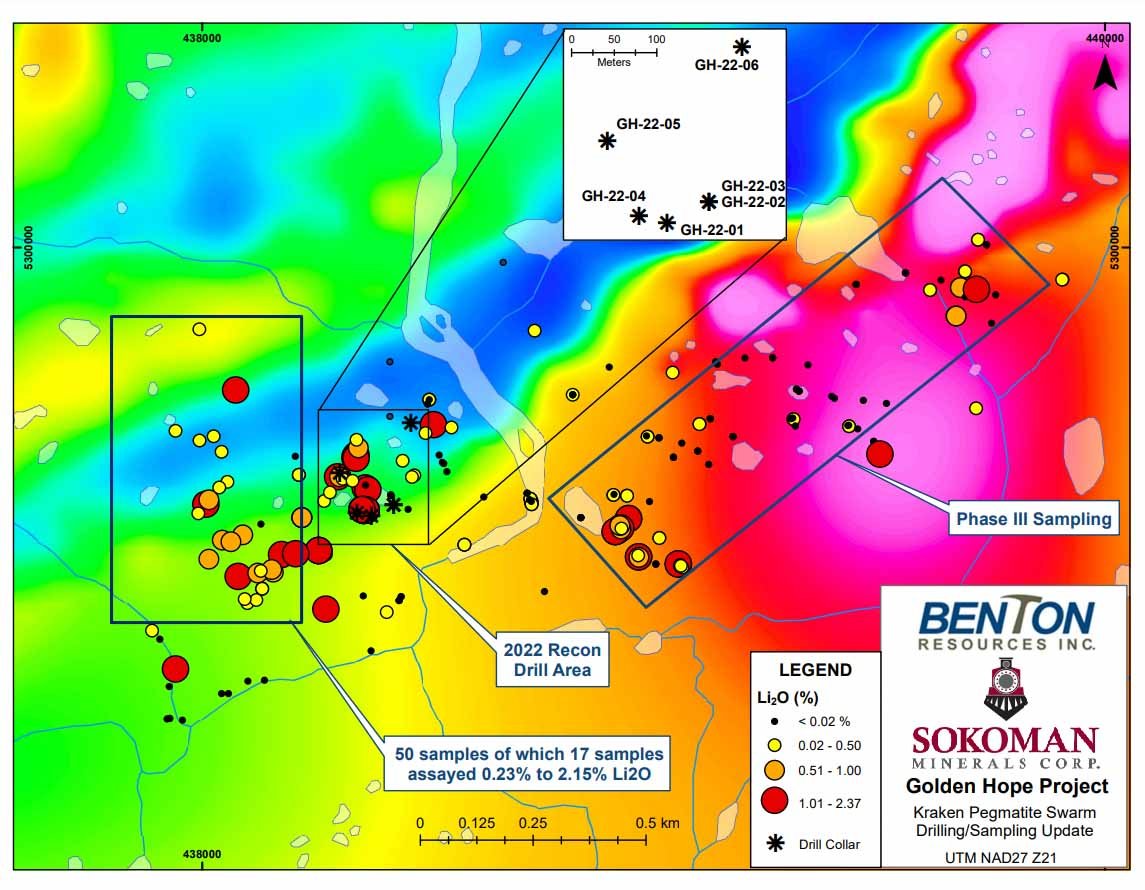

Golden Hope Project – Kraken Pegmatite Swarm Drilling/Sampling Update

The 1,025 m program focused on a 100 m by 150 m area in the vicinity of the initial discovery (see map), which included more than 100 float and outcrop grab samples and composite chip samples, that returned lithium values ranging from 0.05% to 2.37% Li2O. Multiple mineralized, spodumene-bearing dikes were intersected in all drill holes ranging from less than 1.0 m to 8.40 m in drilled thickness (true thicknesses believed to be 90% of drilled thickness), from surface to approximately 50 m vertically below surface. The Kraken pegmatite field has been sampled over a strike length of 2,200 metres and an apparent width of 1,200 metres, and historical assessment work reports pegmatite dikes exposed up to 6 kilometres along trend.

All samples have been shipped to Activation Laboratories in Ancaster, Ontario for multi-element analysis including lithium, tantalum, cesium and other rare/critical metals by Sodium Peroxide Fusion ICPOES + ICPMS. Gold will be analyzed by fire assay.

The property lies along the Bay d’Est fault system, a gold prospective fault structure in southern Newfoundland that extends through the Sokoman/Benton licences. The Alliance continues to evaluate historical data for significant gold and lithium mineralization and will restart ground prospecting and follow-up exploration once weather conditions permit.

Sokoman’s President and CEO Tim Froude, comments: “The Alliance is pleased with the first assays from our recon drilling program at the Kraken pegmatite field. Our objectives for the program were to establish significant lithium values to depth and to better understand the distribution and orientation of the dikes – the results have confirmed our objectives, with grades reported comparing favourably to many global lithium projects currently known. We wish to emphasize that we have just scratched the surface with the exploration to date, and that we have extensive work ahead of us to establish the limits of the dike swarm given that previous workers have reported pegmatites at least six kilometres on trend from the area just drilled. The Alliance is purchasing a camp to facilitate a larger drill program that will be put in place once we receive all required permits. In the meantime, as soon as conditions allow, we will be prospecting and sampling the many reported dike occurrences beyond the area already sampled to establish the true extent of the lithium-enriched dike swarm.”

Benton’s President and CEO Stephen Stares, states: “The first drill hole drilled for lithium on the Island of Newfoundland has confirmed good grades of lithium comparable to other lithium pegmatite systems worldwide. We’ve barely scratched the surface of this extensive system and we’re anxious to get back on the ground, prosecting, sampling, mapping and drilling and completing more regional exploration in general. Both companies are very well financed to execute our upcoming field season plans. I’m confident that this summer will unveil excellent value for our shareholders.”

The Alliance has created a short video for this announcement. Investors can watch it HERE.

QP

This news release has been reviewed and approved by Timothy Froude, P. Geo., President and CEO of Sokoman Minerals Corp. a ‘Qualified Person’ under National Instrument 43-101.

COVID-19 Protocols

To ensure a working environment that protects the health and safety of the staff and contractors, Sokoman and Benton will continue to use best practices in the course of performing our work programs and will follow any future federal or provincially mandated or recommended COVID-19 guidelines.

About Sokoman Minerals Corp.

Sokoman Minerals Corp. is a discovery-oriented company with projects in Newfoundland and Labrador, Canada. The company’s primary focus is its portfolio of gold projects: flagship, 100%-owned Moosehead, Crippleback Lake (optioned to Trans Canada Gold Corp.) and East Alder (optioned to Canterra Minerals Corporation) along the Central Newfoundland Gold Belt, and the district-scale Fleur de Lys project in northwestern Newfoundland, that is targeting Dalradian-type orogenic gold mineralization similar to the Curraghinalt and Cavanacaw deposits in Northern Ireland, and Cononish in Scotland. The company has also entered into a strategic alliance (the Alliance) with Benton Resources Inc. through three large-scale joint-venture properties including Grey River Gold, Golden Hope and Kepenkeck on the island of Newfoundland. Sokoman now controls independently and through the Alliance over 150,000 hectares (>6,000 claims – 1,500 sq. km), making it one of the largest landholders in Newfoundland, Canada’s newest and rapidly-emerging gold district. Sokoman also retains an interest in an early-stage antimony/gold project (Startrek) in Newfoundland, optioned to White Metal Resources Inc., and in Labrador, the company has a 100% interest in the Iron Horse (Fe) project that has Direct Shipping Ore (DSO) potential.

About Benton Resources Inc.

Benton Resources Inc. is a well-funded mineral exploration company listed on the TSX Venture Exchange under the symbol BEX. Following a project generation business model, Benton has a diversified, highly prospective property portfolio in Gold, Silver, Nickel, Copper, Lithium, and Platinum Group Elements and currently holds large equity positions in other mining companies that are advancing high-quality assets. Whenever possible, BEX retains Net Smelter Return (NSR) royalties for potential long-term cash flow. In 2021, Benton entered into a 50/50 strategic alliance with Sokoman Minerals Corp. (TSXV: SIC) through three large-scale joint-venture properties including Grey River Gold, Golden Hope and Kepenkeck in Newfoundland that are now being explored.

For further information, please contact:

CHF Capital Markets

Cathy Hume, CEO

Phone: 416-868-1079 x251

Email: cathy@chfir.com

Sokoman Minerals

Timothy Froude, P.Geo., President & CEO

Phone: 709-765-1726

Email: tim@sokomanmineralscorp.com

Benton Resources

Stephen Stares, President & CEO

Phone: 807-475-7474

Email: sstares@bentonresources.ca

Website: www.sokomanmineralscorp.com , www.bentonresources.ca

Twitter: @SokomanMinerals , @BentonResources

Facebook: @SokomanMinerals , @BentonResourcesBEX

LinkedIn: @SokomanMinerals, @BentonResources

THE TSX VENTURE EXCHANGE HAS NOT REVIEWED AND DOES NOT ACCEPT RESPONSIBILITY FOR THE ADEQUACY OR ACCURACY OF THIS RELEASE.

The information contained herein contains “forward-looking statements” within the meaning of applicable securities legislation. Forward-looking statements relate to information that is based on assumptions of management, forecasts of future results, and estimates of amounts not yet determinable. Any statements that express predictions, expectations, beliefs, plans, projections, objectives, assumptions or future events or performance are not statements of historical fact and may be “forward-looking statements.”

Forward-looking statements are subject to a variety of risks and uncertainties which could cause actual events or results to differ from those reflected in the forward-looking statements, including, without limitation: risks related to failure to obtain adequate financing on a timely basis and on acceptable terms; risks related to the outcome of legal proceedings; political and regulatory risks associated with mining and exploration; risks related to the maintenance of stock exchange listings; risks related to environmental regulation and liability; the potential for delays in exploration or development activities or the completion of feasibility studies; the uncertainty of profitability; risks and uncertainties relating to the interpretation of drill results, the geology, grade and continuity of mineral deposits; risks related to the inherent uncertainty of production and cost estimates and the potential for unexpected costs and expenses; results of prefeasibility and feasibility studies, and the possibility that future exploration, development or mining results will not be consistent with the Alliance’s expectations; risks related to gold price and other commodity price fluctuations; and other risks and uncertainties related to the Alliance’s prospects, properties and business detailed elsewhere in the Alliance’s disclosure record. Should one or more of these risks and uncertainties materialize, or should underlying assumptions prove incorrect, actual results may vary materially from those described in forward-looking statements. Investors are cautioned against attributing undue certainty to forward-looking statements. These forward-looking statements are made as of the date hereof and the Alliance does not assume any obligation to update or revise them to reflect new events or circumstances. Actual events or results could differ materially from the Alliance’s expectations or projections.

Sokoman Announces Closing Of Non-Brokered Private Placement With Eric Sprott As Lead Investor

St. John’s, NL, March 21, 2022 – Sokoman Minerals Corp. (‘Sokoman’ or ‘the Company’) (TSX.V: SIC) (OTCQB: SICNF) is pleased to announce that, further to its March 7, 2022 news release, it has received approval from the TSX Venture Exchange (the “Exchange”) to close its non-brokered private placement of flow-through units (the ‘Private Placement’) for gross proceeds of $5,000,000, with $4,000,000 allocated to Mr. Sprott, a strategic, long-term investor.

The Company will now issue 12,500,000 flow-through shares units (“FT Units”) each FT Unit consisting of one (1) common share of the Company and one common share purchase warrant (a “Warrant”), each Warrant being exercisable for an additional common share of the Company, each of which will not qualify as a flow-through share, at an exercise price of $0.45 for 24 months from the date of issue.

All securities issued pursuant to the Private Placement will be subject to a four-month-and-a-day hold period, expiring July 22, 2022.

In connection with the Private Placement, the Company is paying $47,250 in cash finders’ fees to various finders, as permitted by the policies of the TSX Venture Exchange.

The Company will use an amount equal to the gross proceeds received by the Company from the sale of the FT Units, pursuant to the provisions in the Income Tax Act (Canada), to incur eligible “Canadian exploration expenses” that qualify as “flow-through mining expenditures” as both terms are defined in the Income Tax Act (Canada) (the “Qualifying Expenditures”) on or before December 31, 2023, and to renounce all the Qualifying Expenditures in favour of the subscribers of the FT Units effective December 31, 2022. The proceeds from the sale of the Units will be used to advance Sokoman’s various exploration projects.

Mr. Sprott acquired 10,000,000 FT Units pursuant to the Private Placement for total consideration of $4,000,000. Subsequent to the Private placement, Mr. Sprott beneficially owns and controls 60,414,465 Shares and 19,615,385 Warrants, representing approximately 28.2% of the issued and outstanding Shares on a non-diluted basis, and approximately 34.3% on a partially diluted basis assuming exercise of the Warrants. Prior to the Private Placement, Mr. Sprott beneficially owns and controls 50,414,465 Shares and 9,615,385 Warrants, representing approximately 25.0% of the issued and outstanding Shares on a non-diluted basis, and approximately 28.4% on a partially diluted basis assuming exercise of the Warrants

The FT Units were acquired by Mr. Sprott for investment purposes. Mr. Sprott has a long-term view of the investment and may acquire additional securities of the Company including on the open market or through private acquisitions or sell securities of the Company including on the open market or through private dispositions in the future depending on market conditions, reformulation of plans and/or other relevant factors.

A copy of Eric Sprott’s early warning report will appear on the Company’s profile on SEDAR and may also be obtained by calling (416) 945-3294 (200 Bay Street, Suite 2600, Royal Bank Plaza, South Tower, Toronto, Ontario M5J 2J1).

Tim Froude, President and CEO stated “I would like to thank Mr. Sprott and our other loyal investors for their continuous support of the Company. 2022 will be an exciting year for our shareholders.”

About Sokoman Minerals Corp.

Sokoman Minerals Corp. is a discovery-oriented company with projects in the province of Newfoundland and Labrador, Canada. The Company’s primary focus is its portfolio of gold projects; flagship, advanced-stage Moosehead, Crippleback Lake (optioned to Trans Canada Gold Corp.) and East Alder (optioned to Canterra Minerals Corporation) along the Central Newfoundland Gold Belt, and the district-scale Fleur de Lys project in northwestern Newfoundland, that is targeting Dalradian-type orogenic gold mineralization similar to the Curraghinalt and Cavanacaw deposits in Northern Ireland. The Company also recently entered into a strategic alliance with Benton Resources Inc. through three, large-scale, joint-venture properties including Grey River, Golden Hope and Kepenkeck in Newfoundland.

Sokoman now controls, independently and through the Benton alliance, over 150,000 hectares (>6,000 claims – 1500 sq. km), making it one of the largest landholders in Newfoundland, in Canada’s newest and rapidly-emerging gold districts. The Company also retains an interest in an early-stage antimony/gold project (Startrek) in Newfoundland, optioned to White Metal Resources Inc., and in Labrador, the Company has a 100% interest in the Iron Horse (Fe) project which has Direct Shipping Ore (DSO) potential.

Mineralization hosted on adjacent and/or nearby properties is not necessarily indicative of mineralization hosted on the Company’s property.

For further information, please contact:

Sokoman Minerals

Timothy Froude, P.Geo., President & CEO

Phone: 709-765-1726

Email: tim@sokomanmineralscorp.com

CHF Capital Markets

Cathy Hume, Director, Investor Relations

Phone: 416-868-1079 x251

Email: cathy@chfir.com

Website: www.sokomanmineralscorp.com

Twitter: @SokomanMinerals

Facebook: @SokomanMinerals

LinkedIn: @SokomanMinerals

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Investors are cautioned that trading in the securities of the Corporation should be considered highly speculative. Except for historical information contained herein, this news release contains forward- looking statements that involve risks and uncertainties. Actual results may differ materially. Sokoman Minerals Corp. will not update these forward-looking statements to reflect events or circumstances after the date hereof. More detailed information about potential factors that could affect financial results is included in the documents filed from time to time with the Canadian securities regulatory authorities by Sokoman Minerals Corp.

Sokoman / Benton Intersect Gold In All Five Drill Holes Over 5 Km Strike Length Confirming Extensive Gold System At Grey River

St. John’s, NL, March 16, 2022 – Sokoman Minerals Corp. (TSXV: SIC) (OTCQB: SICNF) (“Sokoman”) and Benton Resources Inc. (TSXV: BEX) (“Benton”) together (the “Alliance”), are pleased to announce the results from the maiden drill program at Grey River, Newfoundland. The Alliance reports that the drilling has returned multiple intersections in drill holes covering 5.0 kilometers of strike length and is open in all directions. The results are highlighted by GR-21-01, the easternmost hole drilled, that intersected three distinct gold zones including a high-grade interval of 10.58 g/t Au over 1.80 m including 50.13 g/t Au over 0.35 m.

Program highlights include:

Timothy Froude, P. Geo., President and CEO of Sokoman states; “The first drilling that tested the gold potential of this huge system has exceeded our expectations. It is hard to believe that the area has never been drilled for gold even though gold was first reported from the property in the 1980s. In addition to the assays in the table, broad zones of anomalous Au mineralization, from 5 to 250 ppb, were intersected in all holes. More exploration is required to understand the controls on the gold mineralization particularly the high-grade zones which are found in two areas on the property over four kilometers apart. The highest-grade results are from the easternmost hole (GR-21-01) and all the mineralized zones are open in every direction.”

Stephen Stares, President and CEO of Benton states; “It is important for shareholders to understand the scale and potential of this project. We’ve essentially tested random areas of a huge silica zone to see if the system was carrying gold mineralization at depth. This maiden drill program has exceeded our expectations, and not only did we hit gold in every hole over 5 km, but we’ve also confirmed high grades which is open in all directions. The alliance is very excited to get back working on this project and permitting for a more extensive exploration program including 25 to 30 drill holes is underway. I truly believe this very large (>10 km) silica system could be host to a very significant gold deposit and I can hardly wait to get drills turning again.”

Field setup for GR-21-01 – Grey River JV Property

Gold mineralization is associated with extensive silica zones containing 2%–20% disseminated and stringer pyrite in the >10 km quartz/silica body in the eastern half of the property. The higher grades appear to be associated with discreet quartz-sulphide veins that cut the silica body at a low angle. Historic grab samples, and recent grab samples taken by Sokoman and Benton personnel (see September 2, 2021 press release), have given gold values ranging from 5 ppb to 225 g/t Au and drilling has confirmed the gold mineralized zones are extensive. Previously released assay values from GR-21-01 (37.65 g/t Au over 0.35 m) have increased to 50.13 g/t Au over 0.35 m due to re-assaying using the metallic screen method suggesting that free gold is present.

Previous workers have compared the gold mineralization at Grey River to the high-grade Pogo gold mine in the Tintina district of Alaska. The Pogo mine, to the end of 2019, produced 3.9M oz gold at 13.6 g/t Au (Northern Star Resources, November 22, 2021).

Noteworthy of the Grey River project is:

No previous drilling for gold in the silica zone which has been mapped over a 10 km strike length and remains open – most holes collared in, and ended in, the silica zone

Gold mineralization has been located in five holes over a 5 km strike length

Gold zones in multiple drill holes with grades up to 50.13 g/t Au

25–30 drill holes planned to start spring/early summer 2022

QP

This news release has been reviewed and approved by Timothy Froude, P.Geo., President and CEO of Sokoman Minerals Corp., a ‘Qualified Person’ under National Instrument 43-101.

COVID-19 Protocols

To ensure a working environment that protects the health and safety of the staff and contractors, Sokoman and Benton are operating under federally and provincially mandated and recommended guidelines during the current COVID-19 alert level.

About Sokoman Minerals Corp.

Sokoman Minerals Corp. is a discovery-oriented company with projects in Newfoundland and Labrador, Canada. The Company’s primary focus is its portfolio of gold projects including the flagship, 100%-owned Moosehead Project, currently the focus of an ongoing 100,000 m drill program, as well as the Crippleback Lake (optioned to Trans Canada Gold Corp.) and East Alder (optioned to Canterra Minerals Corporation) projects along the Central Newfoundland Gold Belt, and the district-scale Fleur de Lys project in northwestern Newfoundland, which is targeting Dalradian-type orogenic gold mineralization similar to the Curraghinalt and Cavanacaw deposits in Northern Ireland, and Cononish in Scotland. In 2021, the Company entered into a strategic alliance with Benton Resources Inc. through three large-scale joint venture properties in Newfoundland including Grey River Gold, Golden Hope and the Kepenkeck Properties. Sokoman now controls independently and through the Benton alliance over 150,000 hectares (>6,000 claims – 1,500 sq. km), making it one of the largest landholders in Newfoundland, Canada’s newest and rapidly-emerging gold districts. The Company also retains an interest in an early-stage antimony/gold project (Startrek) in Newfoundland, optioned to White Metal Resources Inc., and in Labrador, the Company has a 100% interest in the Iron Horse (Fe) project that has Direct Shipping Ore (DSO) potential.

About Benton Resources Inc.

Benton Resources Inc. is a well-funded mineral exploration company listed on the TSX Venture Exchange under the symbol BEX. Following a project generation business model, Benton has a diversified, highly prospective property portfolio in Lithium, Gold, Silver, Nickel, Copper, and Platinum Group Elements and currently holds large equity positions in other mining companies that are advancing high-quality assets. Whenever possible, BEX retains Net Smelter Return (NSR) royalties for potential long-term cash flow. Benton has also recently entered into a 50/50 strategic alliance with Sokoman Minerals Corp. (TSXV: SIC) through three large-scale joint-venture properties including Grey River Gold, Golden Hope and Kepenkeck in Newfoundland that are now being explored

Mineralization hosted on adjacent and/or nearby properties is not necessarily indicative of mineralization hosted on the Alliance’s property.

For further information, please contact:

CHF Capital Markets

Cathy Hume, CEO

Phone: 416-868-1079 x251

Email: cathy@chfir.com

Sokoman Minerals

Timothy Froude, P.Geo., President & CEO

Phone: 709-765-1726

Email: tim@sokomanmineralscorp.com

Benton Resources

Stephen Stares, President & CEO

Phone: 807-475-7474

Email: sstares@bentonresources.ca

Website: www.sokomanmineralscorp.com , www.bentonresources.ca

Twitter: @SokomanMinerals , @BentonResources

Facebook: @SokomanMinerals , @BentonResourcesBEX

LinkedIn: @SokomanMinerals, @BentonResources

THE TSX VENTURE EXCHANGE HAS NOT REVIEWED AND DOES NOT ACCEPT RESPONSIBILITY FOR THE ADEQUACY OR ACCURACY OF THIS RELEASE.

The information contained herein contains “forward-looking statements” within the meaning of applicable securities legislation. Forward-looking statements relate to information that is based on assumptions of management, forecasts of future results, and estimates of amounts not yet determinable. Any statements that express predictions, expectations, beliefs, plans, projections, objectives, assumptions or future events or performance are not statements of historical fact and may be “forward-looking statements.”

Forward-looking statements are subject to a variety of risks and uncertainties which could cause actual events or results to differ from those reflected in the forward-looking statements, including, without limitation: risks related to failure to obtain adequate financing on a timely basis and on acceptable terms; risks related to the outcome of legal proceedings; political and regulatory risks associated with mining and exploration; risks related to the maintenance of stock exchange listings; risks related to environmental regulation and liability; the potential for delays in exploration or development activities or the completion of feasibility studies; the uncertainty of profitability; risks and uncertainties relating to the interpretation of drill results, the geology, grade and continuity of mineral deposits; risks related to the inherent uncertainty of production and cost estimates and the potential for unexpected costs and expenses; results of prefeasibility and feasibility studies, and the possibility that future exploration, development or mining results will not be consistent with the Alliance’s expectations; risks related to gold price and other commodity price fluctuations; and other risks and uncertainties related to the Alliance’s prospects, properties and business detailed elsewhere in the Alliance’s disclosure record. Should one or more of these risks and uncertainties materialize, or should underlying assumptions prove incorrect, actual results may vary materially from those described in forward-looking statements. Investors are cautioned against attributing undue certainty to forward-looking statements. These forward-looking statements are made as of the date hereof and the Alliance does not assume any obligation to update or revise them to reflect new events or circumstances. Actual events or results could differ materially from the Alliance’s expectations or projections.

Sokoman Announces Non-Brokered Private Placement With Eric Sprott As Lead Investor

St. John’s, NL, March 7, 2022 – Sokoman Minerals Corp. (TSXV: SIC) (OTCQB: SICNF) (“Sokoman”) today announced that the Company intends to complete a non-brokered private placement of flow-though units (the ‘Private Placement’) for gross proceeds of up to $5,000,000 with $4,000,000 allocated to Mr. Sprott. The Private Placement is expected to close on or before March 16, 2022.

On closing the Company will issue up to 12,500,000 flow-through shares units (“FT Units”) at a price of $0.40 per FT Unit, for gross proceeds of $5,000,000. Each FT Unit consists of one common share of the Company and one common share purchase warrant (a “Warrant”), each Warrant being exercisable for an additional common share of the Company, each of which will not qualify as a flow-through share, at an exercise price of $0.45 for 24 months from the date of issue. The FT Units will entitle the holder to receive the tax benefits applicable to flow-through shares, in accordance with provisions of the Income Tax Act (Canada).

All securities issued pursuant to the Private Placement will be subject to a four-month and a day hold period.

In connection with the Private Placement, the Company may pay finders’ fees in cash or securities or a combination of both, as permitted by the policies of the TSX Venture Exchange. The Private Placement is subject to approval by the TSX Venture Exchange.

The Company will use an amount equal to the gross proceeds received by the Company from the sale of the FT Units, pursuant to the provisions in the Income Tax Act (Canada), to incur eligible “Canadian exploration expenses” that qualify as “flow-through mining expenditures” as both terms are defined in the Income Tax Act (Canada) (the “Qualifying Expenditures”) on or before December 31, 2023, and to renounce all the Qualifying Expenditures in favour of the subscribers of the FT Units effective December 31, 2022. The proceeds from the sale of the Units will be used to advance Sokoman’s various exploration projects.

About Sokoman Minerals Corp.

Sokoman Minerals Corp. is a discovery-oriented company with projects in the province of Newfoundland and Labrador, Canada. The Company’s primary focus is its portfolio of gold projects; flagship, advanced-stage Moosehead, Crippleback Lake (optioned to Trans Canada Gold Corp.) and East Alder (optioned to Canterra Minerals Corporation) along the Central Newfoundland Gold Belt, and the district-scale Fleur de Lys project in northwestern Newfoundland, that is targeting Dalradian-type orogenic gold mineralization similar to the Curraghinalt and Cavanacaw deposits in Northern Ireland. The Company also recently entered into a strategic alliance with Benton Resources Inc. through three, large-scale, joint-venture properties including Grey River, Golden Hope and Kepenkeck in Newfoundland.

Sokoman now controls, independently and through the Benton alliance, over 150,000 hectares (>6,000 claims – 1500 sq. km), making it one of the largest landholders in Newfoundland, in Canada’s newest and rapidly-emerging gold districts. The Company also retains an interest in an early-stage antimony/gold project (Startrek) in Newfoundland, optioned to White Metal Resources Inc., and in Labrador, the Company has a 100% interest in the Iron Horse (Fe) project which has Direct Shipping Ore (DSO) potential.

Mineralization hosted on adjacent and/or nearby properties is not necessarily indicative of mineralization hosted on the Company’s property.

For further information, please contact:

Sokoman Minerals

Timothy Froude, P.Geo., President & CEO

Phone: 709-765-1726

Email: tim@sokomanmineralscorp.com

CHF Capital Markets

Cathy Hume, CEO

Phone: 416-868-1079 x251

Email: cathy@chfir.com

Website: www.sokomanmineralscorp.com

Twitter: @SokomanMinerals

Facebook: @SokomanMinerals

LinkedIn: @SokomanMinerals

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Investors are cautioned that trading in the securities of the Corporation should be considered highly speculative. Except for historical information contained herein, this news release contains forward- looking statements that involve risks and uncertainties. Actual results may differ materially. Sokoman Minerals Corp. will not update these forward-looking statements to reflect events or circumstances after the date hereof. More detailed information about potential factors that could affect financial results is included in the documents filed from time to time with the Canadian securities regulatory authorities by Sokoman Minerals Corp.

Sokoman And Benton Complete Recon Drilling At Kraken Pegmatite Field On The Golden Hope Project, Southwestern Newfoundland

Five holes completed; multiple spodumene-bearing dikes intersected

St. John’s, NL; February 24, 2022 – Sokoman Minerals Corp. (TSXV: SIC) (OTCQB: SICNF) (“Sokoman”) and Benton Resources Inc. (TSXV: BEX) (“Benton”) together, (“the Alliance”) are pleased to announce the completion of a 1025 m reconnaissance drilling program testing the recently discovered Kraken Pegmatite Field at the Golden Hope Joint Venture Project in southwestern Newfoundland. This represents the first known drill program directly targeting lithium mineralization in the province of Newfoundland and Labrador, Canada.

The five-hole program focused on a 100 m by 100 m area in the vicinity of the initial discovery (map in progress; will be posted asap), which included more than 100 float and outcrop grab samples and composite chip samples, that returned lithium values ranging from 0.05% to 2.37% Li2O. Multiple mineralized, spodumene-bearing dikes were intersected in all drill holes ranging from less than 1 m to approximately 8 m in drilled thickness (true thicknesses are not known at this time), from surface to approximately 50 m vertically below surface.

Spodumene (pale-green needle-shaped crystals) in GH-22-01 (depth shown in metres)

Core logging and sampling are ongoing and are expected to be completed in one week. All samples will be shipped to Activation Laboratories in Ancaster, Ontario for multi-element analysis including lithium, tantalum, cesium, and other rare / critical metals by Sodium Peroxide Fusion ICPOES + ICPMS. The Kraken Pegmatite Field has been sampled over a strike length of 2200 metres and an apparent width of 1200 metres, and historical assessment work suggests the field could extend beyond the current limits. Geological mapping and prospecting will be underway, as soon as conditions allow, to further expand the mineralized dike swarm.

The area lies along the Baie d’Est fault system, a gold prospective fault structure in southern Newfoundland that extends through the Sokoman / Benton licenses. Samples of the host rock for the pegmatite dikes, mainly a foliated sericite schist, carrying strong pyrite mineralization, will be analyzed for Au at Activation Laboratories by the fire assay method. Two types of potential gold mineralization have been noted:

Pyrite (1-10%), associated with quartz/tourmaline/pyrite (QTP) veins, similar to the mineralization at the Valentine Gold property of Marathon Gold Corporation, 73 km NE

Silicification, with disseminated pyrite, similar to the gold mineralization at the past-producing Hope Brook Gold Mine, located 23 km along trend to the SW

Sokoman’s President and CEO Tim Froude, comments: “The Alliance is extremely pleased with the initial drill program at the Kraken Pegmatite Field and looks forward to receiving the analytical results. Through adverse weather conditions, we were able to complete a 1025 m program in five holes (a sixth hole was collared but was abandoned at 38 m due to poor ground conditions) ranging from 182 m to 224 m in length. We have now taken the first major lithium discovery on the Island of Newfoundland from a surface showing to a drilled prospect with only 5% of the known extent of surface mineralization tested, which remains open in all directions. Future drilling at the Kraken Pegmatite Field will follow compilation of all data including assays, recently flown airborne magnetics, LiDAR, high-resolution aerial photography, and proposed mapping in Q2 2022.”

Benton’s President and CEO Stephen Stares, states: “Even though we only tested a small portion of the Kraken pegmatites, Benton is quite pleased with the data and understanding received in this current program. It’s apparent that the Alliance should establish an onsite camp and use a tracked drill rig to test the scale of the Kraken pegmatite swarm more efficiently. In addition, the large zones of silicification and sulphides are a welcome surprise, and it will be interesting to see if there is gold in this mineralized system. We are excited for the future of this project as we get ready to ramp-up exploration in the coming months.”

QP

This news release has been reviewed and approved by Timothy Froude, P.Geo., President, and CEO of Sokoman Minerals Corp. a ‘Qualified Person’ under National Instrument 43-101.

COVID-19 Protocols

To ensure a working environment that protects the health and safety of the staff and contractors, Sokoman and Benton are operating under federally and provincially mandated and recommended guidelines during the current COVID-19 alert level.

About Sokoman Minerals Corp.

Sokoman Minerals Corp. is a discovery-oriented company with projects in Newfoundland and Labrador, Canada. The company’s primary focus is its portfolio of gold projects: flagship, 100%-owned Moosehead, Crippleback Lake (optioned to Trans Canada Gold Corp.) and East Alder (optioned to Canterra Minerals Corporation) along the Central Newfoundland Gold Belt, and the district-scale Fleur de Lys project in northwestern Newfoundland, that is targeting Dalradian-type orogenic gold mineralization similar to the Curraghinalt and Cavanacaw deposits in Northern Ireland, and Cononish in Scotland. The company also recently entered into a strategic alliance with Benton Resources Inc. through three large-scale joint-venture properties including Grey River Gold, Golden Hope and Kepenkeck in Newfoundland. Sokoman now controls independently and through the Benton alliance over 150,000 hectares (>6,000 claims – 1,500 sq. km), making it one of the largest landholders in Newfoundland, Canada’s newest and rapidly-emerging gold districts. Sokoman also retains an interest in an early-stage antimony/gold project (Startrek) in Newfoundland, optioned to White Metal Resources Inc., and in Labrador, the company has a 100%-interest in the Iron Horse (Fe) project that has Direct Shipping Ore (DSO) potential.

About Benton Resources Inc.

Benton Resources Inc. is a well-funded mineral exploration company listed on the TSX Venture Exchange under the symbol BEX. Following a project generation business model, Benton has a diversified, highly prospective property portfolio in Lithium, Gold, Silver, Nickel, Copper, and Platinum Group Elements and currently holds large equity positions in other mining companies that are advancing high-quality assets. Whenever possible, BEX retains Net Smelter Return (NSR) royalties for potential long-term cash flow. Benton has also recently entered into a 50/50 strategic alliance with Sokoman Minerals Corp. (TSXV: SIC) through three large-scale joint-venture properties including Grey River Gold, Golden Hope and Kepenkeck in Newfoundland that are now being explored.

For further information, please contact:

CHF Capital Markets

Cathy Hume, CEO

Phone: 416-868-1079 x251

Email: cathy@chfir.com

Sokoman Minerals

Timothy Froude, P.Geo., President & CEO

Phone: 709-765-1726

Email: tim@sokomanmineralscorp.com

Benton Resources

Stephen Stares, President & CEO

Phone: 807-475-7474

Email: sstares@bentonresources.ca

Website: www.sokomanmineralscorp.com , www.bentonresources.ca

Twitter: @SokomanMinerals , @BentonResources

Facebook: @SokomanMinerals , @BentonResourcesBEX

LinkedIn: @SokomanMinerals, @BentonResources

THE TSX VENTURE EXCHANGE HAS NOT REVIEWED AND DOES NOT ACCEPT RESPONSIBILITY FOR THE ADEQUACY OR ACCURACY OF THIS RELEASE.

The information contained herein contains “forward-looking statements” within the meaning of applicable securities legislation. Forward-looking statements relate to information that is based on assumptions of management, forecasts of future results, and estimates of amounts not yet determinable. Any statements that express predictions, expectations, beliefs, plans, projections, objectives, assumptions or future events or performance are not statements of historical fact and may be “forward-looking statements.”

Forward-looking statements are subject to a variety of risks and uncertainties which could cause actual events or results to differ from those reflected in the forward-looking statements, including, without limitation: risks related to failure to obtain adequate financing on a timely basis and on acceptable terms; risks related to the outcome of legal proceedings; political and regulatory risks associated with mining and exploration; risks related to the maintenance of stock exchange listings; risks related to environmental regulation and liability; the potential for delays in exploration or development activities or the completion of feasibility studies; the uncertainty of profitability; risks and uncertainties relating to the interpretation of drill results, the geology, grade and continuity of mineral deposits; risks related to the inherent uncertainty of production and cost estimates and the potential for unexpected costs and expenses; results of prefeasibility and feasibility studies, and the possibility that future exploration, development or mining results will not be consistent with the Alliance’s expectations; risks related to gold price and other commodity price fluctuations; and other risks and uncertainties related to the Alliance’s prospects, properties and business detailed elsewhere in the Alliance’s disclosure record. Should one or more of these risks and uncertainties materialize, or should underlying assumptions prove incorrect, actual results may vary materially from those described in forward-looking statements. Investors are cautioned against attributing undue certainty to forward-looking statements. These forward-looking statements are made as of the date hereof and the Alliance does not assume any obligation to update or revise them to reflect new events or circumstances. Actual events or results could differ materially from the Alliance’s expectations or projections.

Sokoman And Benton Initiate Drill Program At The Kraken Lithium Prospect On The Golden Hope Jv; Spodumene-Bearing Pegmatite Encountered In First Hole

St. John’s, NL, January 21, 2022 – Sokoman Minerals Corp. (TSXV:SIC) (OTCQB:SICNF) (“Sokoman”) and Benton Resources Inc. (TSXV:BEX) (“Benton”) together, (the “Alliance”) are pleased to announce that the Alliance has commenced the Phase 1 diamond drilling program at the Kraken Lithium prospect on the Golden Hope JV project located in southwest Newfoundland near the village of Burgeo. The diamond drilling program is expected to consist of 1,000 to 2,000 metres of diamond drill core in 4-6 holes designed to test an extensive system of spodumene- bearing dykes which have been sampled over a strike length of two kilometres within a corridor measuring 1,000 metres in apparent width and open in all directions. The Alliance is also pleased to announce that the first hole, with planned drill depth of 350 m-400 m across stratigraphy, has intercepted several spodumene-bearing (an important source of lithium) dykes near surface and the hole continues. Pictures of the core will be posted on both Benton’s and Sokoman’s websites in order to keep shareholders engaged in its progress at the Kraken dyke swarm. The Alliance is very pleased with the progress thus far and is in the process of logging, cutting and sampling the core to be submitted for assay as soon as possible. Kraken is the first-ever high-grade lithium discovery in Newfoundland and Labrador, with surface grab samples returning grades from trace to 2.37% Li2O (see Alliance joint press release dated August 16, 2021). This is also the first Newfoundland drilling program designed to target lithium.

The Kraken Pegmatites are highly evolved, pegmatite swarms similar to the geological environment and setting of other large systems in the Appalachian belt, including the important deposits held by Piedmont Lithium Inc. in the Carolinas, eastern US, as well as in the geologically equivalent Avalonia Project being advanced by Ganfeng Lithium in the Caledonides of Ireland. All samples will be submitted to Actlabs in Ancaster, Ontario for analysis by Sodium Peroxide Fusion ICPOES + ICPMS.

Timothy Froude, President and CEO of Sokoman stated: “With the first hole we have confirmed a potentially significant lithium prospect on the Golden Hope Property. The presence of both fine-grained and coarse-grained spodumene identical in habit and mode of occurrence as our high-grade surface showings is very reassuring, and detailed core logging and core sampling is underway. The weather has been challenging and we appreciate the efforts of our drill contractor, Springdale Forest Resources. With spodumene-bearing pegmatite dykes now in drill core, we have no doubt the Kraken dyke swarm will be a significant development moving forward for shareholders of Sokoman and Benton.”

Stephen Stares, President and CEO of Benton stated: “We were very excited to conduct the first-ever drill program targeting lithium in Newfoundland and Labrador, Canada and are thrilled that we have intercepted spodumene in pegmatites in our maiden drill hole. This confirms that the dykes continue to depth. Collectively, our teams are confident that our Alliance has discovered something very special and we look forward to our initial drilling assay results.”

QP

This news release has been reviewed and approved by Timothy Froude, P.Geo., President and CEO of Sokoman Minerals Corp., a ‘Qualified Person’ under National Instrument 43-101.

COVID-19 Protocols

To ensure a working environment that protects the health and safety of the staff and contractors, Benton and Sokoman are operating under federally and provincially mandated and recommended guidelines during the current COVID-19 alert level.

About Sokoman Minerals Corp.

Sokoman Minerals Corp. is a discovery-oriented company with projects in Newfoundland and Labrador, Canada. The company’s primary focus is its portfolio of gold projects: flagship, 100%-owned Moosehead, Crippleback Lake (optioned to Trans Canada Gold Corp.) and East Alder (optioned to Canterra Minerals Corporation) along the Central Newfoundland Gold Belt, and the district-scale Fleur de Lys project in northwestern Newfoundland, which is targeting Dalradian-type orogenic gold mineralization similar to the Curraghinalt and Cavanacaw deposits in Northern Ireland, and Cononish in Scotland. The company also recently entered into a strategic alliance with Benton Resources Inc. through three large-scale joint-venture properties including Grey River , Golden Hope, and Kepenkeck in Newfoundland. Sokoman now controls independently and through the Benton alliance over 150,000 hectares (>6,000 claims – 1,500 sq. km), making it one of the largest landholders in Newfoundland, Canada’s newest and rapidly-emerging gold districts. The company also retains an interest in an early-stage antimony/gold project (Startrek) in Newfoundland, optioned to White Metal Resources Inc., and in Labrador, the company has a 100% interest in the Iron Horse (Fe) project that has Direct Shipping Ore (DSO) potential.

Mineralization hosted on adjacent and/or nearby properties is not necessarily indicative of mineralization hosted on the company’s property.

About Benton Resources Inc.

Benton Resources Inc. is a well-funded mineral exploration company listed on the TSX Venture Exchange under the symbol BEX. Following a project generation business model, Benton has a diversified, highly-prospective property portfolio of Gold, Silver, Nickel, Copper, Platinum Group Elements and most-recently Lithium assets. In addition, it currently holds large equity positions in other mining companies that are advancing high-quality assets. Whenever possible, BEX retains Net Smelter Return (NSR) royalties with potential long-term cash flow value. Benton also recently entered into a 50/50 strategic alliance with Sokoman Minerals Corp. (TSXV: SIC) through three large-scale joint-venture properties including Grey River, Golden Hope, and Kepenkeck in Newfoundland and Labrador, Canada that are now being explored.

For further information, please contact:

Sokoman Minerals

Timothy Froude, P.Geo., President & CEO

Phone: 709-765-1726

Email: tim@sokomanmineralscorp.com

Benton Resources

Stephen Stares, President & CEO

Phone: 807-475-7474

Email: sstares@bentonresources.ca

CHF Capital Markets

Cathy Hume, CEO

Phone: 416-868-1079 x251

Email: cathy@chfir.com

Website: www.sokomanmineralscorp.com , www.bentonresources.ca

Twitter: @SokomanMinerals , @BentonResources

Facebook: @SokomanMinerals , @BentonResourcesBEX

LinkedIn: @SokomanMinerals, @BentonResources

THE TSX VENTURE EXCHANGE HAS NOT REVIEWED AND DOES NOT ACCEPT RESPONSIBILITY FOR THE ADEQUACY OR ACCURACY OF THIS RELEASE.

The information contained herein contains “forward-looking statements” within the meaning of applicable securities legislation. Forward-looking statements relate to information that is based on assumptions of management, forecasts of future results, and estimates of amounts not yet determinable. Any statements that express predictions, expectations, beliefs, plans, projections, objectives, assumptions or future events or performance are not statements of historical fact and may be “forward-looking statements.”

Forward-looking statements are subject to a variety of risks and uncertainties which could cause actual events or results to differ from those reflected in the forward-looking statements, including, without limitation: risks related to failure to obtain adequate financing on a timely basis and on acceptable terms; risks related to the outcome of legal proceedings; political and regulatory risks associated with mining and exploration; risks related to the maintenance of stock exchange listings; risks related to environmental regulation and liability; the potential for delays in exploration or development activities or the completion of feasibility studies; the uncertainty of profitability; risks and uncertainties relating to the interpretation of drill results, the geology, grade and continuity of mineral deposits; risks related to the inherent uncertainty of production and cost estimates and the potential for unexpected costs and expenses; results of prefeasibility and feasibility studies, and the possibility that future exploration, development or mining results will not be consistent with the Alliance’s expectations; risks related to gold price and other commodity price fluctuations; and other risks and uncertainties related to the Alliance’s prospects, properties and business detailed elsewhere in the Alliance’s disclosure record. Should one or more of these risks and uncertainties materialize, or should underlying assumptions prove incorrect, actual results may vary materially from those described in forward-looking statements. Investors are cautioned against attributing undue certainty to forward-looking statements. These forward-looking statements are made as of the date hereof and the Alliance does not assume any obligation to update or revise them to reflect new events or circumstances. Actual events or results could differ materially from the Alliance’s expectations or projections.

Sokoman’s Barge Drilling Program Delivers Strong Au Results Moosehead Project, Central Newfoundland

Multiple shallow intercepts including 3.10 m of 100 g/t Au in MH-21-342

St. John’s, NL, January 20, 2022 – Sokoman Minerals Corp. (TSXV: SIC) (OTCQB: SICNF) is pleased to report additional high-grade assays from the Moosehead Project including several barge-based drill holes completed just prior to the Christmas break, which were “super rushed” for metallics assaying at Eastern Analytical Ltd. in Springdale, NL.

Assay highlights include:

MH-21-342 – 5.55 m of 56.58 g/t Au incl. 3.10 m of 100.00 g/t Au from 67.80 m

MH-21-345 – 4.75 m of 20.75 g/t Au incl. 2.25 m of 39.57 g/t Au from 117.65 m

MH-21-346 – 9.60 m of 7.33 g/t Au incl. 4.55 m of 12.98 g/t Au from 122.20 m

Also included are drill holes from the 75 Zone which has been extended to the north towards the Main Eastern Trend (MH-21-298), as well as holes from the southern limit of the Eastern Trend (MH-21-259 and MH-21-263) stepping southwards towards the 75 Zone (see Drill Plan Map below). Additional drilling is planned to close the approximately 100 m gap between the two zones. Modelling is suggesting that shallow intercepts in the 75 Zone, including MH-21-298, 17.50 m downhole with 2.30 m at 9.75 g/t in 8.40 m of 3.35 g/t Au, may be a splay off the Eastern Zone and that the 75 Zone actually is the southward extension of the Main Eastern Trend which includes high-grade splays.

The drilling confirms very shallow, high-grade, gold-bearing veins lying in the Main Eastern Trend, as well as in splays or offshoots from it, as shown in an expanded table of results below included with this news release. Intersected, downhole, Au values quoted are thought to be 80-90% of true widths.

Tim Froude, President and CEO of Sokoman, says: “We continue to see strong, near surface Au values over good widths, from the Main Eastern Trend/Footwall Splay area, as well as the northern end of the 75 Zone (MH-21-298) enhancing our belief that the two zones will eventually merge. The barge drilling program is intersecting excellent infill and step-out Au values in holes in the Upper Eastern Trend/Footwall Splay including holes MH-21-345 and MH-21-346 that are located on the northernmost section drilled from the barge (see Cross Section Map below). These holes confirm a strong, high-grade Au zone that remains open, up-plunge to surface, and down plunge below 200 metres including previously released holes MH-19-62 (33.59 g/t Au over 4.80 m) and MH-21-200 (10.26 g/t Au over 3.80 m). The Au mineralization in Section A-B is defined over a minimum of 150 m down dip remaining open to depth and to surface. Additional drilling will take place either from the ice if conditions allow (permit is in hand) or from the barge in the spring.”

Modelling confirms that Moosehead Au mineralization is focused around the Eastern Trend and that mineralized offsets such as the Footwall Splay, may include others such as the 75 and South Pond Zones. An important goal for the remaining 50,000+ metres in the drilling program is to merge all of the zones into a single mineralized body.

Other gold mineralized areas:

253 Zone – located approximately 300 m to the east of the Eastern Trend – cut two zones of Au mineralization – 7.5 m of 0.31 g/t, 32 m downhole, and 1.78 g/t Au over 1.40 m, 54.8 m downhole, drilled last fall, require additional drilling to evaluate. Twelve (12) holes were drilled around hole 253 but due to logistical issues (streams and wetlands), were not able to properly test the zone. Assays for most holes are pending including the western-most hole (MH-20-273) which intersected quartz veining with two specks of visible gold noted. The 253 Zone is considered highly prospective as only 75 m of strike length has been tested, but most likely not tested properly, and the zone is mineralized, quartz float boulders with visible gold and high-grade Au values are found in the vicinity, and geophysics (VLF-EM) suggests a strike length of the structure, hosting the mineralized veins, of several kilometres. The 253 Zone is a separate structure and is not part of the Eastern Trend although the two zones are parallel to sub-parallel (see Drill Plan Map below). Winter conditions, snow and freezing temperatures, will allow for better positioning of the drills testing the 253 Zone over the next couple of months.

South Pond Zone – drilling on-hold pending additional modelling to get a better understanding of the structures controlling the Au mineralization. To date 29 holes (4250 m) completed with the high-grade zone traced 50 m along strike and 100 m down dip. The high-grade zone is believed to be a splay off of the Main Eastern Trend structure with the area where the two zones are projected to join being the focus of the next round of drilling this winter.

Near-surface gold mineralization, first intersected in MH-21-152 (3.0 m @1.82 g/t Au) is believed to be in the same structure as recent hole MH-21-251 which cut 3.65 m at 2.47 g/t Au in the southern part of the 75 Zone. Reconnaissance drilling in early December, to the east of the South Pond Zone, intersected 5.25 m at 1.93 g/t Au in hole MH-21-344 with textures and mineralogy indicating the mineralization is part of the Main Eastern Trend structure. The intersection is approximately 330 m to the south of MH-21-263 which is at the southern limit of the Eastern Trend. Additional drilling will test both targets at the start of the winter drilling program.

QP

This news release has been reviewed and approved by Timothy Froude, P.Geo., a “Qualified Person” under National Instrument 43-101 and President and CEO of Sokoman Minerals Corp.

COVID-19 Protocols

To ensure a working environment that protects the health and safety of the staff and contractors, Sokoman is operating under federally and provincially mandated and recommended guidelines during the current COVID-19 alert level.

About Sokoman Minerals Corp.

Sokoman Minerals Corp. is a discovery-oriented company with projects in the province of Newfoundland and Labrador, Canada. The Company’s primary focus is its portfolio of gold projects; flagship, advanced-stage Moosehead, Crippleback Lake (optioned to Trans Canada Gold Corp.) and East Alder (optioned to Canterra Minerals Corporation) along the Central Newfoundland Gold Belt, and the district-scale Fleur de Lys project in northwestern Newfoundland, that is targeting Dalradian-type orogenic gold mineralization similar to the Curraghinalt and Cavanacaw deposits in Northern Ireland. The Company also recently entered into a strategic alliance with Benton Resources Inc. through three, large-scale, joint-venture properties including Grey River, Golden Hope and Kepenkeck in Newfoundland.

Sokoman now controls, independently and through the Benton alliance, over 150,000 hectares (>6,000 claims – 1500 sq. km), making it one of the largest landholders in Newfoundland, in Canada’s newest and rapidly-emerging gold districts. The Company also retains an interest in an early-stage antimony/gold project (Startrek) in Newfoundland, optioned to White Metal Resources Inc., and in Labrador, the Company has a 100% interest in the Iron Horse (Fe) project which has Direct Shipping Ore (DSO) potential.

Mineralization hosted on adjacent and/or nearby properties is not necessarily indicative of mineralization hosted on the Company’s property.

The Company would like to thank the Government of Newfoundland and Labrador for financial support of the Fleur de Lys Project through the Junior Exploration Assistance Program.

Table of Results

Cross Section Map – Moosehead Gold Project

Drill Plan Map – Moosehead Gold Project

For further information, please contact:

Sokoman Minerals

Timothy Froude, P.Geo., President & CEO

Phone: 709-765-1726

Email: tim@sokomanmineralscorp.com

CHF Capital Markets

Cathy Hume, Director, Investor Relations

Phone: 416-868-1079 x251

Email: cathy@chfir.com

Website: www.sokomanmineralscorp.com

Twitter: @SokomanMinerals

Facebook: @SokomanMinerals

LinkedIn: @SokomanMinerals

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Investors are cautioned that trading in the securities of the Corporation should be considered highly speculative. Except for historical information contained herein, this news release contains forward- looking statements that involve risks and uncertainties. Actual results may differ materially. Sokoman Minerals Corp. will not update these forward-looking statements to reflect events or circumstances after the date hereof. More detailed information about potential factors that could affect financial results is included in the documents filed from time to time with the Canadian securities regulatory authorities by Sokoman Minerals Corp.

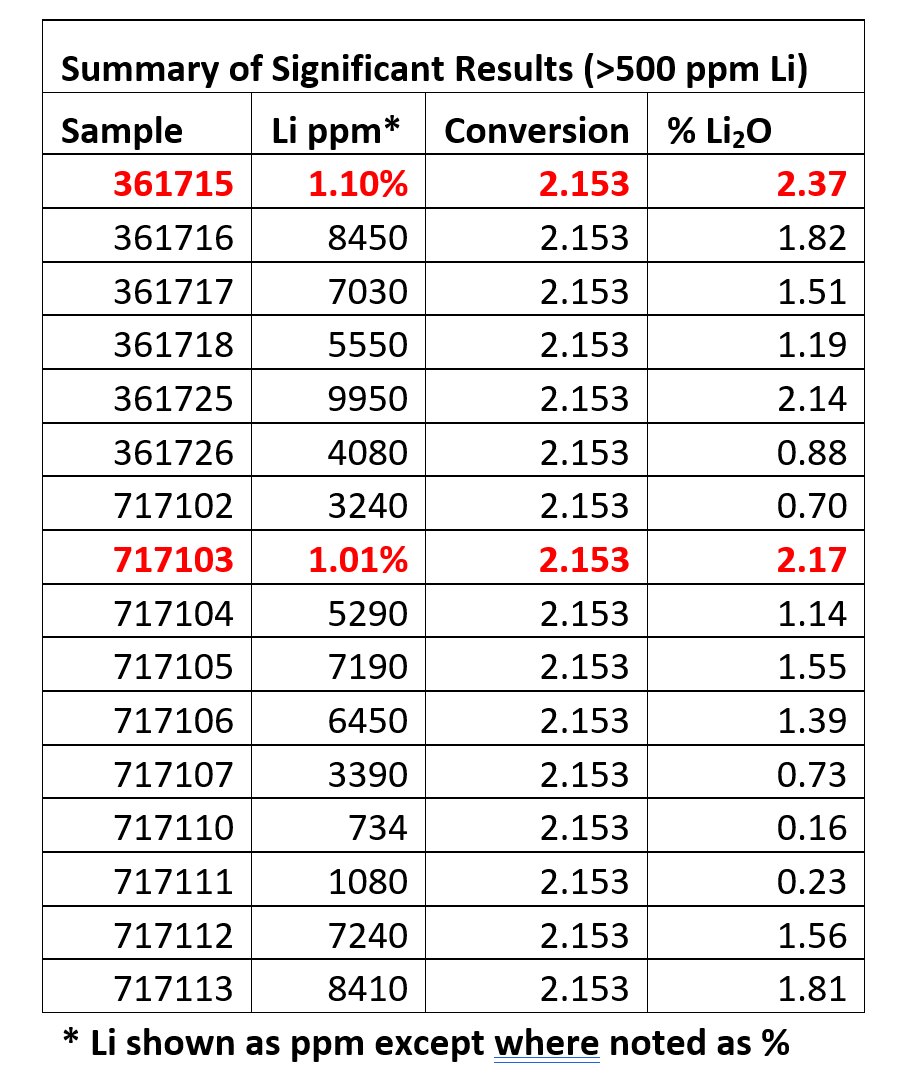

Sokoman And Benton Continue To Expand The Kraken Lithium Pegmatite Swarm In Newfoundland And Initiate Drill Mobilization

St. John’s, NL, January 6, 2022 – Sokoman Minerals Corp. (TSXV: SIC) (OTCQB: SICNF) (“Sokoman”) and Benton Resources Inc. (TSXV: BEX) (“Benton”) together, (the “Alliance”) are pleased to announce that the Alliance has received additional assays confirming the discovery of several new parallel lithium-bearing dykes located 200 m – 300 m to the West-Northwest and to the East and Northeast of the main Kraken Pegmatite discovery. The Alliance collected 50 grab samples of which 17 contained significant spodumene grading from 0.23% Li2O to >2.15% Li2O (over limit assaying pending). These samples were collected from various large sub-crop boulders and poorly-exposed dykes ranging from one metre – three metres in width. The Alliance is extremely pleased with the new results and has planned an inaugural diamond drilling program to commence in the coming weeks. In addition, the Alliance will also initiate a large regional till survey along the favourable 60 km-long structural trend which the Alliance controls. The till survey results will assist with targeting and prospecting in early-spring work programs. The Kraken Pegmatites are highly-evolved pegmatite swarms in a geological environment similar to that of other large systems in the Appalachian belt, including the important deposits held by Piedmont Lithium Inc. in the Carolinas, eastern US, as well as in the geologically equivalent Avalonia Project being advanced by Ganfeng Lithium in the Caledonides of Ireland. All samples were submitted to Actlabs in Ancaster, Ontario for analysis by Sodium Peroxide Fusion ICPOES + ICPMS.

Timothy Froude, P.Geo., President and CEO of Sokoman stated: “We are thrilled with the latest assay results which further expand the Kraken field of lithium-bearing pegmatites. The upcoming drill program will be instrumental in properly valuing the project with a view to potentially spinning out the asset if results are favourable.”

Stephen Stares, President and CEO of Benton stated: “With continued discoveries of additional lithium-bearing dykes, we are very confident that our Alliance has discovered something very special in Newfoundland. We are also very excited to initiate our upcoming maiden drill program, that will assist us in furthering our understanding of the dimensions, size and grade of the main discovery area around the Kraken dyke swarm.”

QP

This news release has been reviewed and approved by Timothy Froude, P.Geo., President and CEO of Sokoman Minerals Corp., a ‘Qualified Person’ under National Instrument 43-101.

COVID-19 Protocols

To ensure a working environment that protects the health and safety of the staff and contractors, Sokoman and Benton are operating under federally and provincially mandated and recommended guidelines during the current COVID-19 alert level.

About Sokoman Minerals Corp.

Sokoman Minerals Corp. is a discovery-oriented company with projects in Newfoundland and Labrador, Canada. Sokoman’s primary focus is its portfolio of gold projects: flagship, 100%-owned Moosehead, Crippleback Lake (optioned to Trans Canada Gold Corp.) and East Alder (optioned to Canterra Minerals Corporation) along the Central Newfoundland Gold Belt, and the district-scale Fleur de Lys project in northwestern Newfoundland, which is targeting Dalradian-type orogenic gold mineralization similar to the Curraghinalt and Cavanacaw deposits in Northern Ireland, and Cononish in Scotland. The company also recently entered into a strategic alliance with Benton Resources Inc. through three large-scale joint venture properties including Grey River Gold, Golden Hope and Kepenkeck in Newfoundland. Sokoman now controls independently and through the Benton alliance over 150,000 hectares (>6,000 claims – 1,500 sq. km), making it one of the largest landholders in Newfoundland, Canada’s newest and rapidly-emerging gold districts. The company also retains an interest in an early-stage antimony/gold project (Startrek) in Newfoundland, optioned to White Metal Resources Inc., and in Labrador, the Company has a 100% interest in the Iron Horse (Fe) project that has Direct Shipping Ore (DSO) potential.

Mineralization hosted on adjacent and/or nearby properties is not necessarily indicative of mineralization hosted on the Company’s property.

About Benton Resources Inc.

Benton Resources Inc. is a well-funded mineral exploration company listed on the TSX Venture Exchange under the symbol BEX. Following a project generation business model, Benton has a diversified, highly-prospective property portfolio of Gold, Silver, Nickel, Copper, Platinum Group Elements and most-recently Lithium assets. In addition, it currently holds large equity positions in other mining companies that are advancing high-quality assets. Whenever possible, BEX retains Net Smelter Return (NSR) royalties with potential long-term cash flow.

Benton also recently entered into a 50/50 strategic alliance with Sokoman Minerals Corp. (TSXV:SIC) through three large-scale, joint-venture properties including Grey River, Golden Hope and Kepenkeck in Newfoundland that are now being explored or will be later in 2022.

For further information, please contact:

CHF Capital Markets

Cathy Hume, CEO

Phone: 416-868-1079 x251

Email: cathy@chfir.com

Sokoman Minerals

Timothy Froude, P.Geo., President & CEO

Phone: 709-765-1726

Email: tim@sokomanmineralscorp.com

Benton Resources

Stephen Stares, President & CEO

Phone: 807-475-7474

Email: sstares@bentonresources.ca

Website: www.sokomanmineralscorp.com , www.bentonresources.ca

Twitter: @SokomanMinerals , @BentonResources

Facebook: @SokomanMinerals , @BentonResourcesBEX

LinkedIn: @SokomanMinerals, @BentonResources

THE TSX VENTURE EXCHANGE HAS NOT REVIEWED AND DOES NOT ACCEPT RESPONSIBILITY FOR THE ADEQUACY OR ACCURACY OF THIS RELEASE.

The information contained herein contains “forward-looking statements” within the meaning of applicable securities legislation. Forward-looking statements relate to information that is based on assumptions of management, forecasts of future results, and estimates of amounts not yet determinable. Any statements that express predictions, expectations, beliefs, plans, projections, objectives, assumptions or future events or performance are not statements of historical fact and may be “forward-looking statements.”