Newsroom

Sokoman Minerals Closes Non-Brokered Flow-Through Private Placement Financing and Second Tranche of Non-Flow-Through Private Placement Financing

St. John’s, NL, December 31, 2024, Sokoman Minerals Corp. (TSXV: SIC) (OTCQB: SICNF) (“Sokoman” or the “Company”) is pleased to announce that further to its December 4, 2024 and December 17, 2024 news releases the Company has closed the flow-through portion of its non-brokered flow-through financing (the “FT Financing”) for aggregate gross proceeds of CAD$1,456,500.

The Company has issued 36,412,500 CAD$0.04 flow-through shares (the “FT Shares”), with each flow-through common share of the Company entitling the holder to receive the tax benefits applicable to flow-through shares in accordance with the provisions of the Income Tax Act (Canada).

The Company is also closing the second tranche of its non-flow-through financing (the “NFT Financing”) and has issued an additional 700,000 non-flow-through common shares for an aggregate total of 850,000 non-flow-through common shares for CAD$29,750.

The FT Financing has been effected with one (1) insider subscribing for CAD$10,000 or 250,000 FT Shares, that portion of the FT Financing a “related-party transaction” as such term is defined under MI 61-101 – Protection of Minority Security Holders in Special Transactions. The Company is relying on exemptions from the formal valuation requirement of MI-61-101 under sections 5.5(a) and (b) of MI 61-101 in respect of the transaction as the fair market value of the transaction, insofar as it involves the interested party, is not more than 25% of the Company’s market capitalization.

In connection with the FT Financing, the Company has paid cash finders’ fees totalling CAD$44,400, issued 1,110,000 non-transferable broker warrants, exercisable at CAD$0.06 for one year, and issued 1,200,000 common shares to three finders, as permitted by the policies of the TSX Venture Exchange (the “Exchange”).

All securities issued pursuant to the FT Financing and the NFT Financing (together the “Financings”) are subject to a four-month and one-day hold period.

Final approval of the Financings is subject to Exchange approval.

The Company will use an amount equal to the gross proceeds received by the Company from the sale of the FT Shares, pursuant to the provisions in the Income Tax Act (Canada), to incur eligible “Canadian exploration expenses” that qualify as “flow-through mining expenditures” as both terms are defined in the Income Tax Act (Canada) (the “Qualifying Expenditures”) on or before December 31, 2025, and to renounce all of the Qualifying Expenditures in favour of the subscribers of the FT Shares effective December 31, 2024.

The Company intends to spend CAD$1,000,000 of the flow-through proceeds on the Moosehead gold property, the balance on the Fleur de Lys and Crippleback projects, and hard-dollar proceeds for working capital.

About Sokoman Minerals Corp.

Sokoman Minerals Corp. is a discovery-oriented company and one of the largest landholders in the province of Newfoundland and Labrador, Canada’s emerging gold district. The Company's primary focus is its portfolio of gold projects; the 100%-owned flagship, advanced-stage Moosehead, Crippleback Lake, and the district-scale Fleur de Lys project near Baie Verte in northwestern Newfoundland, targeting Dalradian-type orogenic gold mineralization similar to the Curraghinalt and Cavanacaw deposits in Northern Ireland. The Company entered a strategic alliance with Benton Resources Inc. through three, large-scale, joint-venture properties including Grey River, Golden Hope, and Kepenkeck in Newfoundland.

In October 2023, Sokoman and Benton completed an agreement with Piedmont Lithium Inc., a major developer of lithium projects and processing plants in the USA, and exactly the right partner to have to advance the lithium project. For full details of the agreement please refer to the Company’s press release dated October 11, 2023.

Projects optioned with optionee fully vested are:

East Alder Project optioned to Canterra Minerals Inc. (SIC retains shares of CTM plus 1% NSR)

Startrek Project optioned to Thunder Gold (SIC retains shares of TGOL plus 1% NSR)

The Company would like to thank the Government of Newfoundland and Labrador for the financial support of the Moosehead and Fleur de Lys Projects through the Junior Exploration Assistance Program during the past few years.

For more information, please contact:

Timothy Froude, P.Geo., President & CEO

T: 709-765-1726

E: tim@sokomanmineralscorp.com

Cathy Hume, VP Corporate Development, Director

T: 416-868-1079 x 251

E: cathy@chfir.com

Website: www.sokomanmineralscorp.com

Twitter: @SokomanMinerals

Facebook: @SokomanMinerals

LinkedIn: @SokomanMineralsCorp

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Investors are cautioned that trading in the securities of the Corporation should be considered highly speculative. Except for historical information contained herein, this news release contains forward-looking statements that involve risks and uncertainties. Actual results may differ materially. Sokoman Minerals Corp. will not update these forward-looking statements to reflect events or circumstances after the date hereof. More detailed information about potential factors that could affect financial results is included in the documents filed from time to time with the Canadian securities regulatory authorities by Sokoman Minerals Corp.

Sokoman Minerals Completes Phase 1 Diamond Drilling Program Fleur de Lys Gold Project, NW Newfoundland

More than 50% of the holes intersected mineralized structures

St. John’s, NL, December 24, 2024, Sokoman Minerals Corp. (TSXV: SIC) (OTCQB: SICNF) (“Sokoman” or the “Company”) reports that the Phase 1 drill program at the 100%-owned Fleur de Lys Project, has been completed in 23 drill holes. Twenty reconnaissance drill holes evaluated high-priority geochemical and/or geophysical targets, including seven holes in the immediate vicinity of the gold-bearing Golden Bull boulders. Three others (FDL-24-9,10, and 17) tested showings discovered by Noranda in the late 1980s.

All preliminary* assays have been received and compiled. See the table below. Twelve drill holes, including the three holes on the Noranda targets, intersected gold mineralization (>200 ppb). Exploration, including prospecting, mapping, geophysics, trenching, and a Phase 2 drilling program, is planned for 2025 to locate the source of the large, mineralized boulders.

*Some samples require metallics assaying based on >1000 ppb Au initial assay. The additional analysis will not affect the reported highlight results.

Timothy Froude, P. Geo., President and CEO of Sokoman Minerals, states, “Our inaugural drill program was conducted on an 8 km2 section of the 329 km2 Fleur de Lys Project. It returned many promising results, with 50% of the drill holes intersecting gold-bearing structures. The final and most northerly hole (FDL-24-23) intersected five separate gold-bearing veins, which indicates a new direction for further exploration.

We are highly encouraged by our progress, even though we have yet to pinpoint the source of the high-grade Golden Bull gold-mineralized boulder field. We will be interpreting the information collected to date as well as future geophysical surveys to further define the mineralized structures before planning a Phase 2 drill program.”

Map 1: Drilling Overview

QP

This news release has been reviewed and approved by Timothy Froude, P.Geo., a "Qualified Person" under National Instrument 43-101 and President and CEO of Sokoman Minerals Corp.

Analytical Techniques / QA/QC

Samples, including duplicates, blanks, and standards, are submitted to Eastern Analytical Ltd. in Springdale, Newfoundland for gold analysis. Eastern Analytical Ltd. is an accredited assay lab that conforms to the requirements of ISO/IEC 17025. Samples are delivered in sealed bags directly to the lab by Sokoman personnel. All samples of quartz vein material were submitted for total pulp metallics and gravimetric finish. Total pulp metallic analysis includes: the whole sample is crushed to -10 mesh; and then pulverized to 95% -150 mesh. The total sample is weighed and screened to 150 mesh; the +150 mesh fraction is fire-assayed for Au, and a 30 g subsample of the -150 mesh fraction is fire-assayed for Au; with a calculated weighted average of total Au in the sample reported as well. One blank and one industry-approved standard for every twenty samples submitted is included in the sample stream. Random duplicates of selected samples are analyzed in addition to the in-house standard and duplicate policies of Eastern Analytical Ltd. All reported assays are uncut.

About Sokoman Minerals Corp.

Sokoman Minerals Corp. is a discovery-oriented company and one of the largest landholders in the province of Newfoundland and Labrador, Canada’s emerging gold district. The Company's primary focus is its portfolio of gold projects; the 100%-owned flagship, advanced-stage Moosehead, Crippleback Lake, and the district-scale Fleur de Lys project near Baie Verte in northwestern Newfoundland, targeting Dalradian-type orogenic gold mineralization similar to the Curraghinalt and Cavanacaw deposits in Northern Ireland. The Company entered a strategic alliance with Benton Resources Inc. through three, large-scale, joint-venture properties including Grey River, Golden Hope, and Kepenkeck in Newfoundland.

In October 2023, Sokoman and Benton completed an agreement with Piedmont Lithium Inc., a major developer of lithium projects and processing plants in the USA, and exactly the right partner to have to advance the lithium project. For full details of the agreement please refer to the Company’s press release dated October 11, 2023.

Projects optioned with optionee fully vested are:

East Alder Project optioned to Canterra Minerals Inc. (SIC retains shares of CTM plus 1% NSR)

Startrek Project optioned to Thunder Gold (SIC retains shares of TGOL plus 1% NSR)

The Company would like to thank the Government of Newfoundland and Labrador for the financial support of the Moosehead and Fleur de Lys Projects through the Junior Exploration Assistance Program during the past few years.

For more information, please contact:

Timothy Froude, P.Geo., President & CEO

T: 709-765-1726

E: tim@sokomanmineralscorp.com

Cathy Hume, VP Corporate Development, Director

T: 416-868-1079 x 251

E: cathy@chfir.com

Website: www.sokomanmineralscorp.com

Twitter: @SokomanMinerals

Facebook: @SokomanMinerals

LinkedIn: @SokomanMineralsCorp

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Investors are cautioned that trading in the securities of the Corporation should be considered highly speculative. Except for historical information contained herein, this news release contains forward-looking statements that involve risks and uncertainties. Actual results may differ materially. Sokoman Minerals Corp. will not update these forward-looking statements to reflect events or circumstances after the date hereof. More detailed information about potential factors that could affect financial results is included in the documents filed from time to time with the Canadian securities regulatory authorities by Sokoman Minerals Corp.

Sokoman Minerals Corp. Closes First Tranche of Non-Brokered Flow-Through and Hard-Dollar Private Placement Financing

ST.John’s, NL, December 17, 2024, Sokoman Minerals Corp. (TSXV: SIC) (OTCQB: SICNF) (“Sokoman” or the “Company”) is pleased to announce that further to its December 4, 2024 news release, the Company has received conditional approval from the TSX Venture Exchange (the "Exchange") for its non-brokered flow-through and hard-dollar financing (the "Financing") and will be closing the first tranche of the Financing for aggregate gross proceeds of CAD$1,421,250.

The Company will now issue 35,400,000 CAD$0.04 flow-through shares, with each flow-through common share of the Company entitling the holder to receive the tax benefits applicable to flow-through shares in accordance with provisions of the Income Tax Act (Canada).

The Company is also issuing 150,000 CAD$0.035 non-flow-through common shares.

In connection with the Financings, the Company is paying cash finders' fees totaling CAD$42,000, issuing 1,050,000 non-transferable broker warrants, exercisable at CAD$0.06 for one year. And issuing 1,200,000 common shares to two finders, as permitted by the policies of the Exchange.

All securities issued pursuant to the Financing are subject to a four-month and one-day hold period.

Final approval of the Financing is subject to Exchange approval.

The Company will use an amount equal to the gross proceeds received by the Company from the sale of the FT shares, pursuant to the provisions in the Income Tax Act (Canada), to incur eligible "Canadian exploration expenses" that qualify as "flow-through mining expenditures" as both terms are defined in the Income Tax Act (Canada) (the "Qualifying Expenditures") on or before December 31, 2025, and to renounce all of the Qualifying Expenditures in favour of the subscribers of the FT Units effective December 31, 2024.

The Company intends to spend CAD$1,000,000 of the flow-through proceeds on the Moosehead gold property, the balance on Fleur de Lys and Crippleback, and hard-dollar proceeds for working capital.

About Sokoman Minerals Corp.

Sokoman Minerals Corp. is a discovery-oriented company and one of the largest landholders in the province of Newfoundland and Labrador, Canada's emerging gold district. The Company's primary focus is its portfolio of gold projects; the 100%-owned flagship, advanced-stage Moosehead, Crippleback Lake, and the district-scale Fleur de Lys project near Baie Verte in northwestern Newfoundland, targeting Dalradian-type orogenic gold mineralization similar to the Curraghinalt and Cavanacaw deposits in Northern Ireland. The Company entered a strategic alliance with Benton Resources Inc. through three, large-scale, joint-venture properties including Grey River, Golden Hope, and Kepenkeck in Newfoundland.

In October 2023, Sokoman and Benton completed an agreement with Piedmont Lithium Inc., a major developer of lithium projects and processing plants in the USA, and exactly the right partner to have to advance the lithium project. For full details of the agreement please refer to the Company's press release dated October 11, 2023.

Projects optioned with optionee fully vested are:

East Alder Project optioned to Canterra Minerals Inc. (SIC retains shares of CTM plus 1% NSR)

Startrek Project optioned to Thunder Gold (SIC retains shares of TGOL plus 1% NSR)

The Company would like to thank the Government of Newfoundland and Labrador for the financial support of the Moosehead and Fleur de Lys Projects through the Junior Exploration Assistance Program during the past few years.

For more information, please contact:

Timothy Froude, P.Geo., President & CEO

T: 709-765-1726

E: tim@sokomanmineralscorp.com

Cathy Hume, VP Corporate Development, Director

T: 416-868-1079 x 251

E: cathy@chfir.com

Website: www.sokomanmineralscorp.com

Twitter: @SokomanMinerals

Facebook: @SokomanMinerals

LinkedIn: @SokomanMineralsCorp

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Investors are cautioned that trading in the securities of the Corporation should be considered highly speculative. Except for historical information contained herein, this news release contains forward-looking statements that involve risks and uncertainties. Actual results may differ materially. Sokoman Minerals Corp. will not update these forward-looking statements to reflect events or circumstances after the date hereof. More detailed information about potential factors that could affect financial results is included in the documents filed from time to time with the Canadian securities regulatory authorities by Sokoman Minerals Corp.

Sokoman Provides Project Update, Moosehead Gold Project, Central Newfoundland

13 of 19 holes at the Western Trend intersect gold-bearing quartz veins

St. John’s, NL, December 12, 2024 – Sokoman Minerals Corp. (TSXV: SIC) (OTCQB: SICNF) (“Sokoman” or the “Company”) is pleased to provide an update on the Moosehead Project. The previously announced (see press release dated November 27, 2024) Western Trend diamond-drill program is progressing well, with 1,325 m in 19 holes completed. The drilling is testing the area of the recently completed Western Trend Trench (Figure 1) which is the future site of the planned conventional (drill and blast) bulk sample. Thirteen (13) of the holes intersected visible gold-bearing quartz veins and vein swarms (Photos 1 and 2), similar to the exposures in the trench. All assays are pending and expected early in Q1 2025. Drilling will continue until the Christmas break (December 19, 2024, to mid-January 2025).

The drilling program is testing the strike/dip extents of the newly discovered, east-west trending, gold-bearing vein network, which is a splay off the main north-trending vein system in the trench. Drilling to date has tested 100 m of the strike to 80 m down dip with the zone remaining open. The deeper holes target the potential high-grade plunge of the intersection point between the east-west trending splay and the main north-trending vein system. The new vein system setting is similar to the high-grade Footwall Splay trending off the main Eastern Trend approximately 200 m to the east. The trenching was initiated for a conventional (drill and blast) bulk sample from the Western Trend, with final permits expected soon, and bulk-sample collection is planned for Q2 2025.

The Company is also pleased to report additional Phase 1 metallurgical results from Base Met Labs in Kamloops, B.C., for scoping-level, metallurgical tests of the Western Trend gold mineralization. Gold recoveries from the bulk gravity testing of the quartz vein sample returned 82.0% to 83.0% of the gold, with leaching of the gravity tailings giving a 95.0% to 96.6% gold recovery. Additional testing is ongoing, and the final results are expected in Q1 2025.

Timothy Froude, P.Geo., President and CEO, states, "With the drilling program largely complete at the Western Trend, we expect to have a sample plan in hand early in Q1 2025 with collection of the bulk sample following once all permits have been received. We are evaluating several options for the sample processing, with the aim of deciding by mid-to-late Q1 2025. We also look forward to continued good gold intersections in the Western Trend drilling program, where we have had excellent success. The metallurgical work on the quartz vein portion of the planned bulk sample has yielded excellent recoveries. We are expecting a formal proposal from Novamera on the planned Footwall Splay Zone bulk sample to be taken later in 2025 using its proprietary technology. It looks like 2025 will be a great year for the Moosehead Project and indeed for Sokoman as a whole."

Photo 1: Visible gold in quartz - DDH MH-24-649 Western Trend Trench area

Photo 2: Mineralized vein swarm in MH-24-655 - Western Trend Trench area

Figure 1: Drill Hole Location Map

QP

This news release has been reviewed and approved by Timothy Froude, P.Geo., a "Qualified Person" under National Instrument 43-101 and President and CEO of Sokoman Minerals Corp.

Analytical Techniques / QA/QC

Samples, including duplicates, blanks, and standards, are submitted to Eastern Analytical Ltd. in Springdale, Newfoundland, for gold analysis. All core samples submitted for assay are saw cut by Sokoman personnel, with one-half submitted for assay and one-half retained for reference. Samples are delivered in sealed bags directly to the lab by Sokoman personnel. Eastern Analytical Ltd. is an accredited assay lab that conforms to the requirements of ISO/IEC 17025. Samples with visible gold are submitted for total pulp metallics with a gravimetric finish. All other samples are analyzed by standard fire assay methods. Total pulp metallic analysis includes the entire sample being crushed to -10 mesh and then pulverized to 95% -150 mesh. The total sample is weighed and screened to 150 mesh; the +150-mesh fraction is fire-assayed for Au, and a 30 g subsample of the -150-mesh fraction is fire-assayed for Au, with a calculated weighted average of total Au in the sample reported as well. One blank and one industry-approved standard for every twenty samples submitted is included in the sample stream. Random duplicates of selected samples are analyzed in addition to the in-house standard and duplicate policies of Eastern Analytical Ltd. All reported assays are uncut.

About Sokoman Minerals Corp.

Sokoman Minerals Corp. is a discovery-oriented company with projects in the province of Newfoundland and Labrador, Canada. The Company's primary focus is its portfolio of gold projects: the 100%-owned flagship, advanced-stage Moosehead, Crippleback Lake, and the district-scale Fleur de Lys project near Baie Verte in northwestern Newfoundland, which is targeting Dalradian-type orogenic gold mineralization similar to the Curraghinalt and Cavanacaw deposits in Northern Ireland. The Company entered into a strategic alliance with Benton Resources Inc. through three large-scale, joint-venture properties, including Grey River, Golden Hope, and Kepenkeck in Newfoundland. Sokoman is one of the largest landholders in Newfoundland, in Canada's newest and rapidly emerging gold districts.

In October 2023, Sokoman and Benton completed an agreement with Piedmont Lithium Inc., a major developer of lithium projects and processing plants in the USA, and exactly the right partner to have to advance the lithium project. The agreement provides for Piedmont to earn up to 62.5% of the Killick Lithium Project (formerly Golden Hope project) by funding up to $12 million in exploration expenses and issuing $10 million common shares in three stages. The Killick Lithium Project has been transferred to Killick Lithium Inc. (Killick), a 100%-owned subsidiary of Vinland Lithium Inc. (Vinland). Newly created Vinland has received $2 million in financing from Piedmont for a 19.9% interest, with the balance of ownership between Sokoman and Benton. Sokoman and Benton will continue to operate the exploration efforts at Killick through the earn-in stages. Sokoman and Benton will retain a royalty of 2% NSR on future production. Piedmont will have exclusive marketing rights for the promotion and sale of any lithium products produced from the project on a life-of-mine basis, and the right of first refusal on 100% offtake rights to the lithium concentrates.

Projects optioned with optionee fully vested are:

East Alder Project optioned to Canterra Minerals Inc. (SIC retains shares of CTM plus 1% NSR)

Startrek Project optioned to Thunder Gold (SIC retains shares of TGOL plus 1% NSR)

The Company would like to thank the Government of Newfoundland and Labrador for the financial support of the Moosehead and Fleur de Lys Projects through the Junior Exploration Assistance Program during the past few years.

For more information, please contact:

Timothy Froude, P.Geo., President & CEO

T: 709-765-1726

E: tim@sokomanmineralscorp.com

Cathy Hume, VP Corporate Development, Director

T: 416-868-1079 x 251

E: cathy@chfir.com

Website: www.sokomanmineralscorp.com

Twitter: @SokomanMinerals

Facebook: @SokomanMinerals

LinkedIn: @SokomanMineralsCorp

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Investors are cautioned that trading in the securities of the Corporation should be considered highly speculative. Except for historical information contained herein, this news release contains forward-looking statements that involve risks and uncertainties. Actual results may differ materially. Sokoman Minerals Corp. will not update these forward-looking statements to reflect events or circumstances after the date hereof. More detailed information about potential factors that could affect financial results is included in the documents filed from time to time with the Canadian securities regulatory authorities by Sokoman Minerals Corp.

Sokoman Minerals Corp. Postpones Annual General and Special Meeting

St. John’s, NL, December 11, 2024 – Sokoman Minerals Corp. (TSXV: SIC) (OTCQB: SICNF) (“Sokoman” or the “Company”) today announces that due to the ongoing Canada Post strike, it has postponed its Annual General Meeting (the “Meeting”) set for January 8, 2025. The Meeting will be rescheduled after the Canada Post strike has concluded.

About Sokoman Minerals Corp.

Sokoman Minerals Corp. is a discovery-oriented company with projects in the province of Newfoundland and Labrador, Canada. The Company's primary focus is its portfolio of gold projects: the 100%-owned flagship, advanced-stage Moosehead, Crippleback Lake, and the district-scale Fleur de Lys project near Baie Verte in northwestern Newfoundland, which is targeting Dalradian-type orogenic gold mineralization similar to the Curraghinalt and Cavanacaw deposits in Northern Ireland. The Company entered into a strategic alliance with Benton Resources Inc. through three large-scale, joint-venture properties, including Grey River, Golden Hope, and Kepenkeck in Newfoundland. Sokoman is one of the largest landholders in Newfoundland, in Canada's newest and rapidly emerging gold districts.

In October 2023, Sokoman and Benton completed an agreement with Piedmont Lithium Inc., a major developer of lithium projects and processing plants in the USA, and exactly the right partner to have to advance the lithium project. The agreement provides for Piedmont to earn up to 62.5% of the Killick Lithium Project (formerly Golden Hope project) by funding up to $12 million in exploration expenses and issuing $10 million common shares in three stages. The Killick Lithium Project has been transferred to Killick Lithium Inc. (Killick), a 100%-owned subsidiary of Vinland Lithium Inc. (Vinland). Newly created Vinland has received $2 million in financing from Piedmont for a 19.9% interest, with the balance of ownership between Sokoman and Benton. Sokoman and Benton will continue to operate the exploration efforts at Killick through the earn-in stages. Sokoman and Benton will retain a royalty of 2% NSR on future production. Piedmont will have exclusive marketing rights for the promotion and sale of any lithium products produced from the project on a life-of-mine basis, and the right of first refusal on 100% offtake rights to the lithium concentrates.

Projects optioned with optionee fully vested are:

East Alder Project optioned to Canterra Minerals Inc. (SIC retains shares of CTM plus 1% NSR)

Startrek Project optioned to Thunder Gold (SIC retains shares of TGOL plus 1% NSR)

The Company would like to thank the Government of Newfoundland and Labrador for the financial support of the Moosehead and Fleur de Lys Projects through the Junior Exploration Assistance Program during the past few years.

For more information, please contact:

Timothy Froude, P.Geo., President & CEO

T: 709-765-1726

E: tim@sokomanmineralscorp.com

Cathy Hume, VP Corporate Development, Director

T: 416-868-1079 x 251

E: cathy@chfir.com

Website: www.sokomanmineralscorp.com

Twitter: @SokomanMinerals

Facebook: @SokomanMinerals

LinkedIn: @SokomanMineralsCorp

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Investors are cautioned that trading in the securities of the Corporation should be considered highly speculative. Except for historical information contained herein, this news release contains forward-looking statements that involve risks and uncertainties. Actual results may differ materially. Sokoman Minerals Corp. will not update these forward-looking statements to reflect events or circumstances after the date hereof. More detailed information about potential factors that could affect financial results is included in the documents filed from time to time with the Canadian securities regulatory authorities by Sokoman Minerals Corp.

Sokoman Minerals Corp. Announces Non-Brokered Flow-through Private Placement and Hard-Dollar Financing

ST. JOHN'S, NL, December 4, 2024, Sokoman Minerals Corp. (TSXV: SIC) (OTCQB: SICNF) (“Sokoman” or the “Company”) today announces a non-brokered private placement of flow-through ("FT") shares (the "Private Placement") for gross proceeds of up to CAD$1,500,000. The Private Placement is expected to close on or before December 16, 2024.

The Private Placement is priced at CAD$0.04 per FT share, with each flow-through common share of the Company entitling the holder to receive the tax benefits applicable to flow-through shares in accordance with provisions of the Income Tax Act (Canada).

The Company also announces a non-flow-through CAD$0.035 share financing (the "NFT Financing") for aggregate gross proceeds of up to CAD$250,000.

All securities issued pursuant to the FT Financing and the NFT Financing (together the "Financings") will be subject to a four-month and one-day hold period.

In connection with the Financings, the Company may pay finders' fees in cash and broker warrants as permitted by the policies of the TSX Venture Exchange (the "Exchange"). The Financings are subject to Exchange approval.

The Company will use an amount equal to the gross proceeds received by the Company from the sale of the FT shares, pursuant to the provisions in the Income Tax Act (Canada), to incur eligible "Canadian exploration expenses" that qualify as "flow-through mining expenditures" as both terms are defined in the Income Tax Act (Canada) (the "Qualifying Expenditures") on or before December 31, 2025, and to renounce all of the Qualifying Expenditures in favour of the subscribers of the FT Units effective December 31, 2024.

The Company intends to spend CAD$1,000,000 of the flow-through proceeds on the Moosehead gold property, the balance on Fleur de Lys and Crippleback, and hard-dollar proceeds for working capital.

About Sokoman Minerals Corp.

Sokoman Minerals Corp. is a discovery-oriented company with projects in the province of Newfoundland and Labrador, Canada. The Company's primary focus is its portfolio of gold projects: the 100%-owned flagship, advanced-stage Moosehead, Crippleback Lake, and the district-scale Fleur de Lys project near Baie Verte in northwestern Newfoundland, which is targeting Dalradian-type orogenic gold mineralization similar to the Curraghinalt and Cavanacaw deposits in Northern Ireland. The Company entered into a strategic alliance with Benton Resources Inc. through three large-scale, joint-venture properties, including Grey River, Golden Hope, and Kepenkeck in Newfoundland. Sokoman is one of the largest landholders in Newfoundland, in Canada's newest and rapidly emerging gold districts.

In October 2023, Sokoman and Benton completed an agreement with Piedmont Lithium Inc., a major developer of lithium projects and processing plants in the USA, and exactly the right partner to have to advance the lithium project. The agreement provides for Piedmont to earn up to 62.5% of the Killick Lithium Project (formerly Golden Hope project) by funding up to $12 million in exploration expenses and issuing $10 million common shares in three stages. The Killick Lithium Project has been transferred to Killick Lithium Inc. (Killick), a 100%-owned subsidiary of Vinland Lithium Inc. (Vinland). Newly created Vinland has received $2 million in financing from Piedmont for a 19.9% interest, with the balance of ownership between Sokoman and Benton. Sokoman and Benton will continue to operate the exploration efforts at Killick through the earn-in stages. Sokoman and Benton will retain a royalty of 2% NSR on future production. Piedmont will have exclusive marketing rights for the promotion and sale of any lithium products produced from the project on a life-of-mine basis, and the right of first refusal on 100% offtake rights to the lithium concentrates.

Projects optioned with optionee fully vested are:

East Alder Project optioned to Canterra Minerals Inc. (SIC retains shares of CTM plus 1% NSR)

Startrek Project optioned to Thunder Gold (SIC retains shares of TGOL plus 1% NSR)

The Company would like to thank the Government of Newfoundland and Labrador for the financial support of the Moosehead and Fleur de Lys Projects through the Junior Exploration Assistance Program during the past few years.

For more information, please contact:

Timothy Froude, P.Geo., President & CEO

T: 709-765-1726

E: tim@sokomanmineralscorp.com

Cathy Hume, VP Corporate Development, Director

T: 416-868-1079 x 251

E: cathy@chfir.com

Website: www.sokomanmineralscorp.com

Twitter: @SokomanMinerals

Facebook: @SokomanMinerals

LinkedIn: @SokomanMineralsCorp

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Investors are cautioned that trading in the securities of the Corporation should be considered highly speculative. Except for historical information contained herein, this news release contains forward-looking statements that involve risks and uncertainties. Actual results may differ materially. Sokoman Minerals Corp. will not update these forward-looking statements to reflect events or circumstances after the date hereof. More detailed information about potential factors that could affect financial results is included in the documents filed from time to time with the Canadian securities regulatory authorities by Sokoman Minerals Corp.

Sokoman Provides Project Update, Moosehead Gold Project, Central Newfoundland

Channel sample results received / 1,500 m drilling program initiated at the Western Trend.

ST. JOHN'S, NL, November 27, 2024, Sokoman Minerals Corp. (TSXV: SIC) (OTCQB: SICNF) (“Sokoman” or the “Company”) is pleased to announce that a minimum 1,500 m diamond drill program has begun to test the Western Trend gold zone based on information gained in the trenching program. Drilling will consist of 20 to 30 diamond drill holes testing along strike / down dip of the newly discovered, east-west trending, gold-bearing vein network exposed in the Western Trend trench, a splay off of the main, north-trending vein system similar to the Footwall Splay trend off of the main Eastern Trend. The trenching was initiated as a first step towards a conventional (drill and blast) bulk sample from the Western Trend.

The Company also reports the results for the remaining channel samples from the Western Trend trench and preliminary results for the metallurgical samples from Base Met Labs in Kamloops, B.C., for scoping-level, metallurgical testing of the Western Trend gold mineralization.

Timothy Froude, P.Geo., President and CEO, states, "We are excited about the next few months at Moosehead, as we will not only be receiving the first metallurgical test results for the property, we are also beginning a drilling program based on the results of the trenching program at the Western Trend, the first step towards a bulk sample at Moosehead. All three programs are intertwined since the drilling will influence the bulk sample extraction, and the metallurgical work will strongly influence how and possibly where the sample is processed. The final assay results for channel samples in the Western Trend trench confirm the significance of the newly recognized East-West trend of high-grade mineralization, justifying the 1,500 m drill program. Dr. Coller's recent visit to the property, focused on the Western Trend trench exposure, will help him determine the structural setting at Moosehead and ultimately lead to recommendations for deep drilling at Moosehead."

Western Trend Channel Sample Results

The remaining channel sample results, 21 samples from channels 8 to 15, from the Western Trend trench (see channel sample location map) confirm that an east-west trending, high-grade vein system (the East-West Splay) occurs in the Western Trend. It is highlighted by channel #8, which returned 8.10 m of 7.09 g/t Au, including 3.20 m of 14.29 g/t Au. A total of 41.2 m, representing 57 separate samples, ranging from 0.15 to 1.10 m (with a median length of 0.73 m), returned an average weighted grade of 5.79 g/t Au with all samples analyzed by total pulp metallic assaying at Eastern Analytical Ltd. in Springdale, NL.

Channel Sample Location Map

Western Trend Diamond Drilling

Based on observations from the Western Trend trench, a minimum 1,500 m diamond drill program is planned to extend the main vein trend and the newly recognized East-West Splay by up to 200 m along strike and 80 m vertically. To date, four drill holes have been completed with all intersecting visible gold-bearing quartz vein zones. The program is expected to continue to the Christmas Break, on or about December 19, 2024. All analyses are pending.

Bulk Sampling

The proposed 1,000 m3 (approximately 2,700 tonnes) conventional bulk sample from the Western Trend trench area is in the permitting stage. It will await the metallurgical testing results on the 242 kg sample (split between the three types of mineralization) at Base Met Labs in Kamloops, B.C., and the results of the diamond drill program. The Company is in discussion with several groups regarding bulk sample processing. Also, the Company expects a report on progress on the Footwall Splay bulk sample from Novamera Inc. later this quarter, including plans for the next stage of the bulk sample program.

Metallurgical Testing

The 242 kg metallurgical sample (split between the three types of mineralization) is being tested at Base Met Labs in Kamloops, B.C. The first stage work involved establishing the head grade for all three samples, with the results summarized below:

· Quartz veins - 58.8 g/t Au grade

· Wallrock (sediment) - 0.84 g/t Au grade

· Wallrock (altered dyke) - 2.46 g/t Au grade

Other studies, including gravity recoveries, leaching, etc., are ongoing and expected before year end.

QP

This news release has been reviewed and approved by Timothy Froude, P.Geo., a "Qualified Person" under National Instrument 43-101 and President and CEO of Sokoman Minerals Corp.

Analytical Techniques / QA/QC

Samples, including duplicates, blanks, and standards, are submitted to Eastern Analytical Ltd. in Springdale, Newfoundland, for gold analysis. All core samples submitted for assay are saw cut by Sokoman personnel, with one-half submitted for assay and one-half retained for reference. Samples are delivered in sealed bags directly to the lab by Sokoman personnel. Eastern Analytical Ltd. is an accredited assay lab that conforms to the requirements of ISO/IEC 17025. Samples with visible gold are submitted for total pulp metallics with a gravimetric finish. All other samples are analyzed by standard fire assay methods. Total pulp metallic analysis includes: the entire sample being crushed to -10 mesh; and then pulverized to 95% -150 mesh. The total sample is weighed and screened to 150 mesh; the +150-mesh fraction is fire-assayed for Au, and a 30 g subsample of the -150-mesh fraction is fire-assayed for Au, with a calculated weighted average of total Au in the sample reported as well. One blank and one industry-approved standard for every twenty samples submitted is included in the sample stream. Random duplicates of selected samples are analyzed in addition to the in-house standard and duplicate policies of Eastern Analytical Ltd. All reported assays are uncut.

About Sokoman Minerals Corp.

Sokoman Minerals Corp. is a discovery-oriented company with projects in the province of Newfoundland and Labrador, Canada. The Company's primary focus is its portfolio of gold projects: the 100%-owned flagship, advanced-stage Moosehead, Crippleback Lake, and the district-scale Fleur de Lys project near Baie Verte in northwestern Newfoundland, which is targeting Dalradian-type orogenic gold mineralization similar to the Curraghinalt and Cavanacaw deposits in Northern Ireland. The Company entered into a strategic alliance with Benton Resources Inc. through three large-scale, joint-venture properties, including Grey River, Golden Hope, and Kepenkeck in Newfoundland. Sokoman is one of the largest landholders in Newfoundland, in Canada's newest and rapidly emerging gold districts.

In October 2023, Sokoman and Benton completed an agreement with Piedmont Lithium Inc., a major developer of lithium projects and processing plants in the USA, and exactly the right partner to have to advance the lithium project. The agreement provides for Piedmont to earn up to 62.5% of the Killick Lithium Project (formerly Golden Hope project) by funding up to $12 million in exploration expenses and issuing $10 million common shares in three stages. The Killick Lithium Project has been transferred to Killick Lithium Inc. (Killick), a 100%-owned subsidiary of Vinland Lithium Inc. (Vinland). Newly created Vinland has received $2 million in financing from Piedmont for a 19.9% interest, with the balance of ownership between Sokoman and Benton. Sokoman and Benton will continue to operate the exploration efforts at Killick through the earn-in stages. Sokoman and Benton will retain a royalty of 2% NSR on future production. Piedmont will have exclusive marketing rights for the promotion and sale of any lithium products produced from the project on a life-of-mine basis, and the right of first refusal on 100% offtake rights to the lithium concentrates.

Projects optioned with optionee fully vested:

East Alder Project optioned to Canterra Minerals Inc (SIC retains 850,000 shares of CTM plus 1% NSR)

Startrek Project optioned to Thunder Gold (SIC retains 1,750,000 shares of TGOL plus 1% NSR)

The Company would like to thank the Government of Newfoundland and Labrador for the financial support of the Moosehead and Fleur de Lys Projects through the Junior Exploration Assistance Program over the past few years.

About Sokoman Minerals Corp.

Sokoman Minerals Corp., based in Newfoundland and Labrador, Canada, focuses primarily on its gold projects, including the wholly-owned Moosehead, Crippleback Lake, and the extensive Fleur de Lys project near Baie Verte. This latter project aims to discover Dalradian-type orogenic gold mineralization like the Curraghinalt and Cavanacaw deposits in Northern Ireland. The company has also partnered with Benton Resources Inc. on three large-scale joint ventures: Grey River, Killick Lithium, formerly Golden Hope, and Kepenkeck, positioning Sokoman as one of the largest landholders in Canada’s emerging gold districts.

In October 2023, Sokoman and Benton entered into an agreement with Piedmont Lithium Inc. to advance the Killick Lithium Project. Under this deal, Piedmont can acquire up to 62.5% of the project by investing up to $12 million in exploration and issuing $10 million shares over three phases. The project, previously known as Golden Hope, is now part of Killick Lithium Inc., a subsidiary of Vinland Lithium Inc., in which Piedmont has acquired a 19.9% stake for $2 million. Sokoman and Benton maintain operational control during the earn-in phases and retain a 2% NSR royalty on future production. Additionally, Piedmont holds exclusive marketing and first-refusal rights on the lithium concentrates for the life of the mine.

Projects optioned with optionee fully vested:

East Alder Project optioned to Canterra Minerals Inc (SIC retains 850,000 shares of CTM plus 1% NSR)

Startrek Project optioned to Thunder Gold (SIC retains 1,750,000 shares of TGOL plus 1% NSR)

The Company would like to thank the Government of Newfoundland and Labrador for the financial support of the Moosehead and Fleur de Lys Projects through the Junior Exploration Assistance Program during the past few years.

For more information, please contact:

Timothy Froude, P.Geo., President & CEO

T: 709-765-1726

E: tim@sokomanmineralscorp.com

Cathy Hume, VP Corporate Development, Director

T: 416-868-1079 x 251

E: cathy@chfir.com

Website: www.sokomanmineralscorp.com

Twitter: @SokomanMinerals

Facebook: @SokomanMinerals

LinkedIn: @SokomanMineralsCorp

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Investors are cautioned that trading in the securities of the Corporation should be considered highly speculative. Except for historical information contained herein, this news release contains forward-looking statements that involve risks and uncertainties. Actual results may differ materially. Sokoman Minerals Corp. will not update these forward-looking statements to reflect events or circumstances after the date hereof. More detailed information about potential factors that could affect financial results is included in the documents filed from time to time with the Canadian securities regulatory authorities by Sokoman Minerals Corp.

Sokoman Minerals Corp. to Seek Shareholders Approval to Spin-out Shares of Vinland Lithium Inc.

ST. JOHN'S, NL, November 25, 2024, Sokoman Minerals Corp. (TSXV: SIC) (OTCQB: SICNF) (“Sokoman” or the “Company”) announces that it has filed Management Proxy Materials under its profile on sedarplus.ca for its annual and special general meeting of shareholders (the “Meeting”). The Meeting is currently set to be held on January 8, 2025, in Vancouver, BC, although the actual date is likely to change as a result of the Canadian postal strike. At the Meeting, Sokoman shareholders will be asked to approve a special resolution (two-thirds of votes cast) to reorganize Sokoman’s share capital to facilitate a spin-out to shareholders of approximately 2 million of Sokoman’s 4 million shares of Vinland Lithium Inc. (“Vinland”). Vinland holds the Killick Lithium Project and is currently owned by Sokoman (40%), Benton Resources Inc. (“Benton”) (40%) and Piedmont Lithium Newfoundland Holdings LLC (“Piedmont”), a wholly-owned subsidiary of NASDAQ-listed Piedmont Lithium Inc. (20%). Benton will concurrently seek the approval of its shareholders for a similar 2 million share spin-out. Subject to the two spin-outs being completed, the TSX Venture Exchange has conditionally agreed to list the approximately 10 million issued shares of Vinland, of which approximately 40% will be in the hands of Sokoman and Benton shareholders.

The spin-outs will be substantially pro rata to Sokoman and Benton shareholders; however, the exact ratio of Vinland share per Sokoman share will be determined prior to completion in January 2025. The exchange ratio is dependent on the number of Sokoman shares issued at the time of completion. The ratio is expected to be approximately 50 Vinland shares per 8,000 Sokoman shares. Accounts holding less than 8,000 Sokoman shares (having an approximate $320 market value) will not receive Vinland shares as the immediate and ongoing administration and compliance costs for very small odd-lot Vinland shareholders would be prohibitive.

Some of the key points for shareholders are as follows:

The Killick Lithium Project holds excellent discovery potential in a newly discovered lithium belt

Piedmont, a wholly-owned subsidiary of NASDAQ-listed Piedmont Lithium Inc., completed a 2023 financing in Vinland of CAD$2.0M @ CAD$1.00 per share to hold 19.9%

Piedmont Lithium Inc. is one of North America’s leading lithium companies

Newfoundland is ranked as one of the top jurisdictions to explore and develop mineral potential

Piedmont Lithium Inc. has vast technical and geological knowledge in similar geology to that of the Kraken pegmatites

Vinland holds indirectly, through its subsidiary Killick Lithium Inc., a 100% interest in the Killick Lithium Project

Piedmont will have the option to earn up to a 62.5% direct interest in Killick Lithium Inc. by spending CAD$12.0M in exploration and development during the period of the option

Upon Piedmont completing all earn-in options, Piedmont/Piedmont Lithium Inc. will have paid Sokoman and Benton a total of CAD$10.0M in Piedmont Lithium Inc. shares in addition to having funded all the Vinland exploration and development costs

Sokoman and Benton to collectively retain a 2% NSR on the Killick Lithium Project

In addition to the spin-out resolution, Sokoman shareholders who attend the Meeting will attend to annual matters, including consideration of Sokoman’s June 30, 2024, audited financial statements, the election of directors, appointment of auditors, and approval of Sokoman’s stock option plan.

Full details of the spin-out and the other annual matters are contained in a management information circular dated November 18, 2024, and filed under the Company’s profile on sedarplus.ca. This circular contains detailed information on Vinland as a stand-alone company and will be mailed to registered shareholders once the postal strike is over. It will contain details of the final Meeting date, as that appears likely to change as of the date of this news release.

About Sokoman Minerals Corp.

Sokoman Minerals Corp., based in Newfoundland and Labrador, Canada, focuses primarily on its gold projects, including the wholly-owned Moosehead, Crippleback Lake, and the extensive Fleur de Lys project near Baie Verte. This latter project aims to discover Dalradian-type orogenic gold mineralization like the Curraghinalt and Cavanacaw deposits in Northern Ireland. The company has also partnered with Benton Resources Inc. on three large-scale joint ventures: Grey River, Killick Lithium, formerly Golden Hope, and Kepenkeck, positioning Sokoman as one of the largest landholders in Canada’s emerging gold districts.

In October 2023, Sokoman and Benton entered into an agreement with Piedmont Lithium Inc. to advance the Killick Lithium Project. Under this deal, Piedmont can acquire up to 62.5% of the project by investing up to $12 million in exploration and issuing $10 million shares over three phases. The project, previously known as Golden Hope, is now part of Killick Lithium Inc., a subsidiary of Vinland Lithium Inc., in which Piedmont has acquired a 19.9% stake for $2 million. Sokoman and Benton maintain operational control during the earn-in phases and retain a 2% NSR royalty on future production. Additionally, Piedmont holds exclusive marketing and first-refusal rights on the lithium concentrates for the life of the mine.

Projects optioned with optionee fully vested:

East Alder Project optioned to Canterra Minerals Inc (SIC retains 850,000 shares of CTM plus 1% NSR)

Startrek Project optioned to Thunder Gold (SIC retains 1,750,000 shares of TGOL plus 1% NSR)

The Company would like to thank the Government of Newfoundland and Labrador for the financial support of the Moosehead and Fleur de Lys Projects through the Junior Exploration Assistance Program during the past few years.

For more information, please contact:

Timothy Froude, P.Geo., President & CEO

T: 709-765-1726

E: tim@sokomanmineralscorp.com

Cathy Hume, VP Corporate Development, Director

T: 416-868-1079 x 251

E: cathy@chfir.com

Website: www.sokomanmineralscorp.com

Twitter: @SokomanMinerals

Facebook: @SokomanMinerals

LinkedIn: @SokomanMineralsCorp

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Investors are cautioned that trading in the securities of the Corporation should be considered highly speculative. Except for historical information contained herein, this news release contains forward-looking statements that involve risks and uncertainties. Actual results may differ materially. Sokoman Minerals Corp. will not update these forward-looking statements to reflect events or circumstances after the date hereof. More detailed information about potential factors that could affect financial results is included in the documents filed from time to time with the Canadian securities regulatory authorities by Sokoman Minerals Corp.

Sokoman Minerals Seeks Regulatory Approval to Extend Warrants

ST. JOHN'S, NL, November 7, 2024, Sokoman Minerals Corp. (TSXV: SIC) (OTCQB: SICNF) (“Sokoman” or the “Company”) has submitted an application to the TSX Venture Exchange (the “Exchange”) seeking approval to extend the term of 26,946,423 warrants for 12 months. The warrants were issued pursuant to the Company’s Flow-Through Private Placement, which closed in December 2023. On receipt of Exchange approval, 18,942,500 warrants will be extended to November 29, 2025, and 8,003,923 warrants will be extended to December 20, 2025. The warrants’ exercise price of CAD$0.13 remains unchanged.

About Sokoman Minerals Corp.

Sokoman Minerals Corp. is a discovery-oriented company and one of the largest landholders in the province of Newfoundland and Labrador, Canada’s emerging gold district. The Company's primary focus is its portfolio of gold projects; the 100%-owned flagship, advanced-stage Moosehead, Crippleback Lake, and the district-scale Fleur de Lys project near Baie Verte in northwestern Newfoundland, targeting Dalradian-type orogenic gold mineralization similar to the Curraghinalt and Cavanacaw deposits in Northern Ireland. The Company entered a strategic alliance with Benton Resources Inc. through three, large-scale, joint-venture properties including Grey River, Golden Hope, and Kepenkeck in Newfoundland.

In October 2023, Sokoman and Benton completed an agreement with Piedmont Lithium Inc., a major developer of lithium projects and processing plants in the USA, and exactly the right partner to have to advance the lithium project. For full details of the agreement please refer to the Company’s press release dated October 11, 2023.

Projects optioned with optionee fully vested:

East Alder Project optioned to Canterra Minerals Inc (SIC retains 850,000 shares of CTM plus 1% NSR)

Startrek Project optioned to Thunder Gold (SIC retains 1,750,000 shares of TGOL plus 1% NSR)

For more information, please contact:

Timothy Froude, P.Geo., President & CEO

T: 709-765-1726

E: tim@sokomanmineralscorp.com

Cathy Hume, VP Corporate Development, Director

T: 416-868-1079 x 251

E: cathy@chfir.com

Website: www.sokomanmineralscorp.com

Twitter: @SokomanMinerals

Facebook: @SokomanMinerals

LinkedIn: @SokomanMineralsCorp

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Investors are cautioned that trading in the securities of the Corporation should be considered highly speculative. Except for historical information contained herein, this news release contains forward-looking statements that involve risks and uncertainties. Actual results may differ materially. Sokoman Minerals Corp. will not update these forward-looking statements to reflect events or circumstances after the date hereof. More detailed information about potential factors that could affect financial results is included in the documents filed from time to time with the Canadian securities regulatory authorities by Sokoman Minerals Corp.

Sokoman Exploration Update – Trenching / Bulk Sampling / Drilling Moosehead Gold Project, Central Newfoundland

Western Trend trench channel samples - 22.45 g/t Au / 4.05 m incl. 35.93 g/t Au / 3.00 m

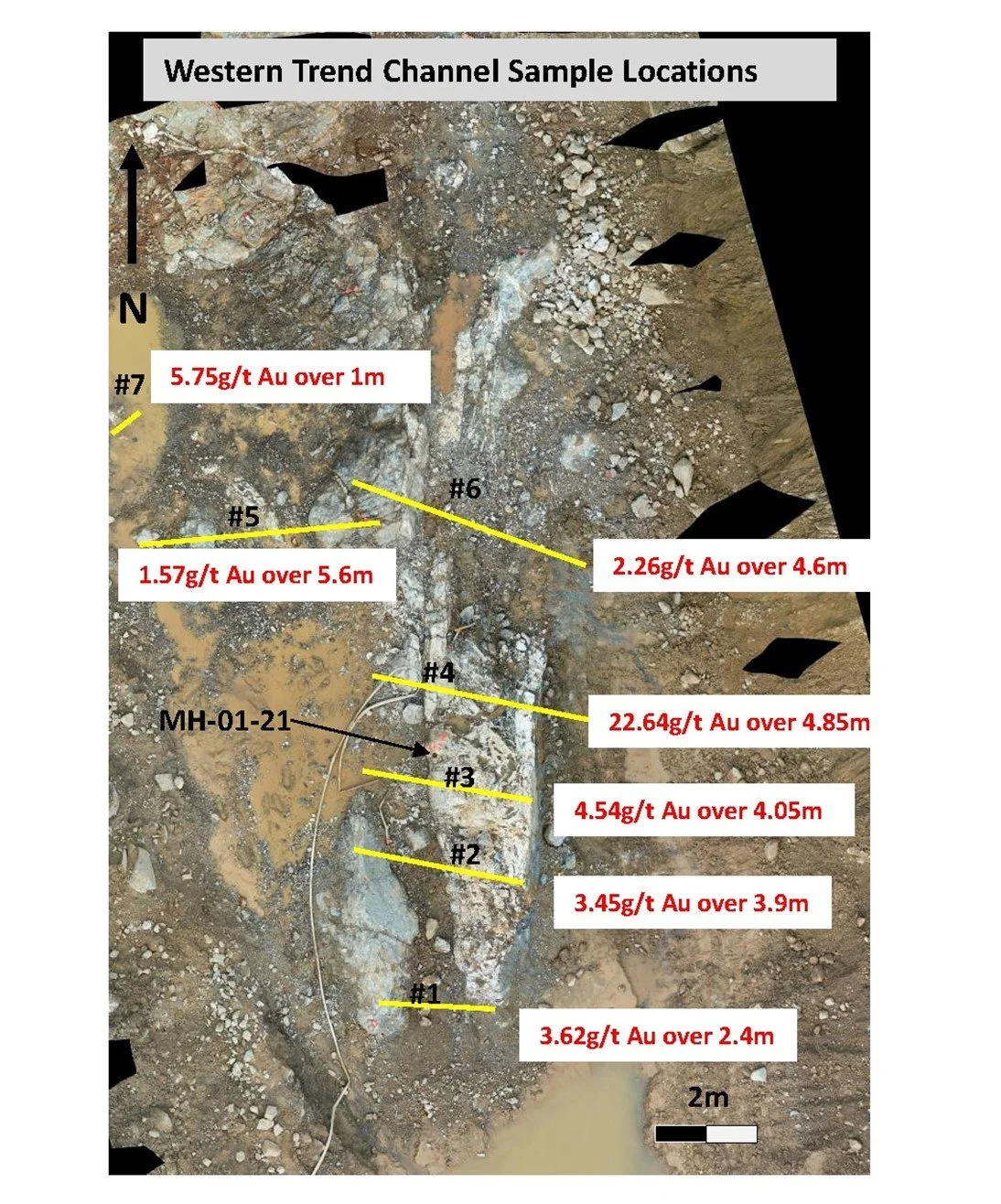

ST. JOHN'S, NL, October 31, 2024, Sokoman Minerals Corp. (TSXV: SIC) (OTCQB: SICNF) (“Sokoman” or the “Company”) provides the following update on the exploration of the 100%-owned Moosehead Gold Project. The current focus is on the Western Trend conventional bulk sample where trenching has exposed the quartz mineralized zone with 50% of mapping and channel sampling completed. A 150 kg sample, 50 kg of each of the three gold-bearing rock types, has been taken and sent to Base Met Labs in Kamloops, B.C., for scoping-level, metallurgical testing of the Moosehead Gold Project gold mineralization. Results are expected in late Q4 2024 or Q1 2025.

Timothy Froude, P.Geo., President and CEO states; “There’s a lot going on at the project presently, in a series of positive, forward-looking steps, including preparing for the first of two bulk samples, early-stage metallurgical work, additional structural mapping by consultant Dr. David Coller, and planning additional diamond drilling on the Western Trend, based on new information gained through the trenching. For the first time, trenching allows us to see in the outcrop the relationships between the high-grade, gold-bearing quartz veins and the host rocks. Dr. Coller will examine the exposed Western Trend high-grade mineralization and its structural setting for a week, comparing it with the other high-grade gold zones on the Moosehead property. Dr. Coller's observations will undoubtedly help him formulate his theories on mineralization and where high-grade mineralization may lie at depth. The trenching has also exposed previously unknown gold-bearing veins that trend towards areas with little to no previous drilling, as a result, additional drilling is being planned.”

Conventional Bulk Sample – Western Trend

Channel sample results from the Western Trend trench are highlighted by multiple high-grade assays including channel #4 which returned a weighted average of 22.64 g/t Au / 4.85 m including 35.93 g/t Au / 3.00 m (assay summaries are shown in Table 1). The trench covers an area approximately 35 m along strike by 20 m across strike, which has been washed, with approximately 50% mapped and channel sampled. Recent stripping has uncovered veining, with specks of VG, trending to the north and south, to areas with little to no drilling and additional drilling is being planned to define these veins in the next week to 10 days. A total of 36 saw-cut channel samples were analyzed at Eastern Analytical Ltd. in Springdale, NL, with 16 selected for metallic pulp assaying (Table 2), based on the quartz host. Eleven of the 16 metallics assays gave values from >50 g/t Au to 2,090 g/t Au from the coarse (+150 mesh) fraction, suggesting coarse visible gold (VG). Sampling continues as the trench has been expanded since the first channel samples were taken. The Company has submitted the bulk-sample permit application.

A 2001 Altius vertical drill hole (MH-01-21), is located between trench channel samples 3 and 4 near the western edge of the main quartz zone (see channel sample location map). It collared in and cut, 3.19 m of quartz with five samples grading from 0.27 g/t Au / 0.60 m to 8.98 g/t Au / 0.60 m (averaging 2.82 g/t Au / 3.19 m). Channel samples 3 and 4 averaged 4.54 g/t Au / 4.05 m, and 22.64 g/t Au / 4.85 m, including 6.59 g/t Au / 2.55 m and 35.93 g/t Au / 3.00 m respectively from the quartz vein portions. The lower grades in the Altius drill hole possibly reflect the impact of the nugget effect on a drill intercept with smaller drill core. Sokoman drill hole MH-24-618 undercuts the trench approximately 10 m to the south of the southern limit of the exposed quartz vein giving 8.18 g/t Au / 1.80 m in a quartz vein at a downhole depth of 14.70 m suggesting a southern continuation of the exposed vein. As per the most recent press release on Moosehead, the Company is expecting an update report on progress on the Footwall Splay bulk sample from Novamera Inc. later this quarter, which will include plans for the next stage of the program.

Channel Sample Location Map

Table 1: Western Trend Trench Channel Samples

Table 2: Metallic assaying results from Eastern Analytical Ltd – all samples returning assaying > 50,000 ppb Au (50 g/t) in the coarse (+150 mesh fraction) are highlighted (Eastern Analytical Ltd.)

Diamond Drilling

Results from recent drilling at the 552 Zone (12 holes), and recon holes (5 holes) from an area 750 m north of North Pond (Bowtie Pond - see Plan) have been received. All five recon holes (MH-24-594 to 598) gave insignificant results while the 12 holes in the 552 Zone area gave mixed results including seven holes with insignificant values. The zone remains open down dip as shown by a 6.63 m intercept in MH-24-601 averaging 0.75 g/t Au at 243.70 m downhole and the other four holes gave values over 0.30 to 1.00 m, up to 1.50 g/t Au.

Diamond drilling, focused on the Western Trend, will resume immediately, with deep-drilling planning awaiting the final structural report from Dr. Coller, expected in H1 2025.

Plan of recent drilling and test sites for Western Trend Bulk Sample (A,B,C)

QP

This news release has been reviewed and approved by Timothy Froude, P.Geo., a "Qualified Person" under National Instrument 43-101 and President and CEO of Sokoman Minerals Corp.

Analytical Techniques / QA/QC

Samples, including duplicates, blanks, and standards, are submitted to Eastern Analytical Ltd. in Springdale, Newfoundland for gold analysis. All core samples submitted for assay are saw cut by Sokoman personnel with one-half submitted for assay and one-half retained for reference. Samples are delivered in sealed bags directly to the lab by Sokoman personnel. Eastern Analytical Ltd. is an accredited assay lab that conforms to the requirements of ISO/IEC 17025. Samples with visible gold are submitted for total pulp metallics with a gravimetric finish. All other samples are analyzed by standard fire assay methods. Total pulp metallic analysis includes: the entire sample being crushed to -10 mesh; and then pulverized to 95% -150 mesh. The total sample is weighed and screened to 150 mesh; the +150-mesh fraction is fire-assayed for Au, and a 30 g subsample of the -150-mesh fraction is fire-assayed for Au; with a calculated weighted average of total Au in the sample reported as well. One blank and one industry-approved standard for every twenty samples submitted is included in the sample stream. Random duplicates of selected samples are analyzed in addition to the in-house standard and duplicate policies of Eastern Analytical Ltd. All reported assays are uncut.

About Sokoman Minerals Corp.

Sokoman Minerals Corp. is a discovery-oriented company and one of the largest landholders in the province of Newfoundland and Labrador, Canada’s emerging gold district. The Company's primary focus is its portfolio of gold projects; the 100%-owned flagship, advanced-stage Moosehead, Crippleback Lake, and the district-scale Fleur de Lys project near Baie Verte in northwestern Newfoundland, targeting Dalradian-type orogenic gold mineralization similar to the Curraghinalt and Cavanacaw deposits in Northern Ireland. The Company entered a strategic alliance with Benton Resources Inc. through three, large-scale, joint-venture properties including Grey River, Golden Hope, and Kepenkeck in Newfoundland.

In October 2023, Sokoman and Benton completed an agreement with Piedmont Lithium Inc., a major developer of lithium projects and processing plants in the USA, and exactly the right partner to have to advance the lithium project. For full details of the agreement please refer to the Company’s press release dated October 11, 2023.

Projects optioned with optionee fully vested:

East Alder Project optioned to Canterra Minerals Inc (SIC retains 850,000 shares of CTM plus 1% NSR)

Startrek Project optioned to Thunder Gold (SIC retains 1,750,000 shares of TGOL plus 1% NSR)

For more information, please contact:

Timothy Froude, P.Geo., President & CEO

T: 709-765-1726

E: tim@sokomanmineralscorp.com

Cathy Hume, VP Corporate Development, Director

T: 416-868-1079 x 251

E: cathy@chfir.com

Website: www.sokomanmineralscorp.com

Twitter: @SokomanMinerals

Facebook: @SokomanMinerals

LinkedIn: @SokomanMineralsCorp

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Investors are cautioned that trading in the securities of the Corporation should be considered highly speculative. Except for historical information contained herein, this news release contains forward-looking statements that involve risks and uncertainties. Actual results may differ materially. Sokoman Minerals Corp. will not update these forward-looking statements to reflect events or circumstances after the date hereof. More detailed information about potential factors that could affect financial results is included in the documents filed from time to time with the Canadian securities regulatory authorities by Sokoman Minerals Corp.

Sokoman Minerals Updates Phase 1 Diamond Drilling Program Fleur de Lys Gold Project, NW Newfoundland

ST. JOHN'S, NL, October 3, 2024, Sokoman Minerals Corp. (TSXV: SIC) (OTCQB: SICNF) (“Sokoman” or the “Company”) provides an update on the maiden drilling program at the 100%-owned Fleur de Lys Property located in the mineral-rich Baie Verte Mining District of northwestern Newfoundland. To date, 1,442 metres of NQ-sized diamond core drilling has been completed in 16 holes. No assays have been received from the 465 core samples sent to Eastern Analytical Ltd. in Springdale, Newfoundland.

Timothy Froude, P. Geo., President and CEO of Sokoman Minerals states; “We are pleased with the results of our first drill program on the Fleur de Lys gold property. Our drilling is the first in the area except for holes FDL-24-09 and 10 which undercut a 1988 drill hole by Noranda which tested a showing they discovered. The drilling has intersected previously unknown structures, shear and quartz vein zones with associated sulphide mineralization, that show the potential for gold mineralization. We are awaiting assays from all holes including four holes testing the area of the Golden Bull Prospect, an area of mineralized float with no bedrock exposure. To date only a narrow, 15 cm stylolitic quartz vein vaguely resembling the large float boulders has been intersected. Drilling will continue in the Golden Bull boulder field in the coming two to three weeks to locate the source of the mineralized boulders and additional targets in the northern portion of the property will also be tested.

Exploration during the past three years has targeted world-class “Dalradian-type” orogenic gold mineralization in a similar geological environment in the Caledonian domain of Northern Ireland and the United Kingdom where the Curraghinalt deposit in Northern Ireland is one of the largest undeveloped gold deposits in the Caledonian-Appalachian Orogen hosting more than 6 million ounces of gold.”

Program to Date

The 2,000 m Phase 1 program is testing two historical, as well as new targets generated by Sokoman’s 2021-2024 till and prospecting programs that include the Golden Bull Prospect (boulder field) discovered late in 2023. Drilling is focussing on an approximately 8 km2 area that includes several discrete targets highlighted by the Golden Bull Prospect area. Drilling has tested six separate targets (see Map 1) with no assays received to date. Other targets located several kilometres further north will be tested in the coming weeks.

Map 1: Drilling overview

Holes FDL-24-01 to FDL-24-04 tested quartz breccia zones 2 km southwest of the Golden Bull Prospect target area and that gave anomalous gold values up to 2 g/t Au from random rock grab (outcrop and float) samples in 2022 and 2023. No previous drilling tested the zones. All four holes intersected sheared / locally brecciated psammitic schists with variable quartz veining and 1%-2% disseminated pyrite over core lengths of 0.5 m to 4.0 m (true thickness approximately 90% of core length).

Drill holes FDL-24-05 to FDL-24-08 tested geophysical / soil geochemical targets underlain by a strong north-trending structural corridor, originally defined by Noranda in 1988 but never tested. Two of the holes (FDL-24-07 and 08) intersected quartz veining with variable sulphide (1%-3% disseminated pyrite and pyrrhotite) over 2.9 m to 10.0 m core length (true thickness 80% of core length).

Figure 1: FDL-24-01 quartz breccia zone with 1%-2% sulphide (40 m - 44 m downhole)

Figure 2: FDL-24-08 quartz chlorite breccia with 1%-3% sulphide (17.5 m - 21.9 m downhole)

Drill holes FDL-24-09 and 10 tested two gold showings discovered by Noranda in 1988 with only one, the Castor's Brook showing, trenched and drill-tested by Noranda. It consists of a quartz breccia zone exposed in four trenches and tested by a single 107 m drill hole with drill assays of 0.42 g/t Au / 0.20 m and 0.30 g/t Au / 0.30 m. Noranda trench values range up to 8.25 grams per tonne gold (g/t Au) over 0.4 m, and 3.00 g/t Au over 0.70 m from trenches 50 m apart. Sokoman DDH FDL-24-09 was drilled to test the 8.25 g/t Au trench values. Results remain pending.

Figure 3: FDL-24-09 shear zone with variable quartz veining and 1%-2% sulphide (41 m - 48 m downhole)

Diamond drill hole FDL-24-10 tested the Castor's North showing also discovered by Noranda in 1988 located 300 m north of the Castor's Brook showing. It is a 0.5 m to 3.0 m wide quartz breccia zone with reported Noranda grab sample results of 7.46 g/t Au and 3.4 g/t Au. The showing was not drilled by Noranda. FDL-24-10, a 100 m hole, which intersected a 10.3 m wide (core length - true thickness believed to be 80% of core length) zone of shearing with variable quartz veining and 1%-2% sulphide from 5.7 m to 16 m.

Holes FDL-24-11, 12, 13 & 16 tested anomalous gold values in float samples, including the stylolitic Golden Bull boulders, which gave up to 9.03 g/t and a north-south trending VLF EM conductor located just to the east of the anomalous boulders. Hole FDL-24-11 intersected psammites and amphibolites with zones of elevated sulphides, up to 1%. Hole FDL-24-12 intersected a 14 cm banded quartz vein with trace disseminated pyrite at 87.66 m. This vein was hosted in a 10.52 m graphitic zone with 2%-3% blebby sulphides from 79.8 m. Hole FDL-24-13 intersected a 72 cm smoky quartz breccia zone with 1% blebby pyrite from 115.72 m and a 2.54 m graphitic shear zone with 2% dusty disseminated pyrite from 124.39 m. Hole FDL-24-16 intersected 2.72 m of graphitic schist with up to 2% coarse / blebby pyrite at 46.95 m and a 50 cm quartz albite zone with up to 6% sulphides from 49.76 m.

Holes FDL-24-14 and 15 targeted a breccia zone outcrop which gave values up to 1.67 g/t Au in grab samples, located just south of the Golden Bull Prospect area. FDL-24-14 intersected 2.11 m of quartz cemented breccia comprising at least three phases of quartz from 11.4 m, with trace dusty, disseminated, pyrite in the quartz. FDL-24-15 intersected a 1.26 m breccia zone at 34.31 m.

Figure 4: FDL-24-14 quartz breccia with disseminated pyrite (11.40 m – 13.51 m downhole)

Drilling will continue for two to three more weeks with a decision on follow-up drilling this fall to be made once all assays have been received.

About Sokoman Minerals Corp.

Sokoman Minerals Corp. is a discovery-oriented company and one of the largest landholders in the province of Newfoundland and Labrador, Canada’s emerging gold district. The Company's primary focus is its portfolio of gold projects; the 100%-owned flagship, advanced-stage Moosehead, Crippleback Lake, and the district-scale Fleur de Lys project near Baie Verte in northwestern Newfoundland, targeting Dalradian-type orogenic gold mineralization similar to the Curraghinalt and Cavanacaw deposits in Northern Ireland. The Company entered a strategic alliance with Benton Resources Inc. through three, large-scale, joint-venture properties including Grey River, Golden Hope, and Kepenkeck in Newfoundland.

In October 2023, Sokoman and Benton completed an agreement with Piedmont Lithium Inc., a major developer of lithium projects and processing plants in the USA, and exactly the right partner to have to advance the lithium project. For full details of the agreement please refer to the Company’s press release dated October 11, 2023.

Projects optioned with optionee fully vested:

East Alder Project optioned to Canterra Minerals Inc (SIC retains 850,000 shares of CTM plus 1% NSR)

Startrek Project optioned to Thunder Gold (SIC retains 1,750,000 shares of TGOL plus 1% NSR)

For more information, please contact:

Timothy Froude, P.Geo., President & CEO

T: 709-765-1726

E: tim@sokomanmineralscorp.com

Cathy Hume, VP Corporate Development, Director

T: 416-868-1079 x 251

E: cathy@chfir.com

Website: www.sokomanmineralscorp.com

Twitter: @SokomanMinerals

Facebook: @SokomanMinerals

LinkedIn: @SokomanMineralsCorp

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Investors are cautioned that trading in the securities of the Corporation should be considered highly speculative. Except for historical information contained herein, this news release contains forward- looking statements that involve risks and uncertainties. Actual results may differ materially. Sokoman Minerals Corp. will not update these forward-looking statements to reflect events or circumstances after the date hereof. More detailed information about potential factors that could affect financial results is included in the documents filed from time to time with the Canadian securities regulatory authorities by Sokoman Minerals Corp.

Sokoman Minerals Reports Strongly-Mineralized Veining in the Western Trend Bulk-Sample Trench at Moosehead Gold Project, Central Newfoundland

ST. JOHN'S, NL, September 26, 2024, Sokoman Minerals Corp. (TSXV: SIC) (OTCQB: SICNF) (“Sokoman” or the “Company”) is pleased to provide the following updates from the 100%-owned Moosehead Gold Project in central Newfoundland. The current focus at Moosehead is on plans to extract bulk samples. The first sample is a conventional bulk sample on the Western Trend using drill and blast methods (see Plan Map 1 for proposed locations). The second bulk sample is with Novamera Inc. at the Footwall Splay in the Eastern Trend, utilizing Novamera’s proprietary surgical mining technique. Due to lengthy lab turnaround times, the Company is waiting for the gold assay results from 28 holes.

Timothy Froude, P. Geo., President and CEO, states, “We are thrilled with the advances we've made on both bulk-sample projects and eagerly anticipate the completion of the Western Trend bulk sample this year. The exposed quartz veining is reminiscent of some of the best drill holes on the Moosehead property. This pivotal step will yield critical insights into the metallurgy and gold recoveries at Moosehead, marking a significant milestone in our project's development.”

Conventional Bulk Sample – Western Trend

Three areas (labelled A, B and C on Plan Map 2) within the Western Trend were drill tested with a series of short holes to determine the best location to extract a conventional bulk sample of 1,000 cubic metres (approximately 2,700 tonnes). Area C (see Plan Map 2) was chosen, and the excavation is underway. A zone of quartz veining with associated altered and mineralized mafic dyke has been exposed in the center of the trench (see Image 1), which is believed to be linked to a 1.5 m wide quartz vein intersected in drill hole MH-24-618, which contained 25 specks of visible gold. MH-24-618 is located approximately 10 m south of the end of the exposed vein. The trench has yet to be fully excavated, with mapping and sampling to commence immediately upon completion. Preliminary examination of the exposed quartz veining has identified locally abundant boulangerite and arsenopyrite mineralization with random specks of visible gold noted in multiple locations. The final layout of the bulk sample dimensions will be completed in about two weeks once all sampling of the exposed mineralization has been done. All assays are pending.

Novamera Partnered Bulk Sample – Footwall Splay

To date, two sets of historical and Novamera drilled holes, six in total, have been surveyed by Novamera in the Footwall Splay area, and final modelling is ongoing. The objective is to define a similar-sized area to the conventional bulk sample to be extracted utilizing Novamera’s surgical mining technique. Meanwhile, the Company has been informed by Novamera that the rig that will be taking the potential sample is under contract until June 2025, at which time it will be available for Sokoman’s program. It is the Company’s intention to use leftover material from the conventional bulk sample as ballast for the Novamera rig, saving time and cost on that program. The Company will provide further updates from Novamera as they become available.

Plan Map 1: Proposed bulk-sample areas

Image 1: Western Trend trench with exposed quartz veining

Plan Map 2: Recent drilling and test sites for Western Trend bulk sample (A, B, C)

Diamond Drilling