Newsroom

Sokoman Minerals Corp. To Webcast Live At Virtualinvestorconferences.Com December 9th

Sokoman invites individual and institutional investors, as well as advisors and analysts, to attend real-time, interactive presentations on VirtualInvestorConferences.com

St. John’s, NL, December 6, 2021 /PRNewswire/ Sokoman Minerals Corp. (TSXV: SIC) (OTCQB: SICNF), a discovery-oriented company focused on the exploration of gold projects in Newfoundland and Labrador, Canda, today announced that the company’s President & CEO Tim Froude will present live at VirtualInvestorConferences.com on December 9th, 2021.

DATE: December 9th, 2021

TIME: 2:30pm EST

LINK: https://bit.ly/3wQhhRj

This will be a live, interactive online event where investors are invited to ask the company questions in real-time. If attendees are not able to join the event live on the day of the conference, an archived webcast will also be made available after the event.

It is recommended that investors pre-register and run the online system check to expedite participation and receive event updates.

Learn more about the event at www.virtualinvestorconferences.com.

Recent Company Highlights

The 100,000 m drilling program at Sokoman’s flagship Moosehead Gold project has been consistently delivering high-grade gold results, confirming shallow, high-grade, gold-bearing quartz veins. Spectacular highlights from the assayed results include:

MH-20-115: upper interval of 47.20 g/t Au over 4.60 m from 64.00 m downhole

MH-20-115: lower interval of 68.70 g/t Au over 8.10 m from 111.20 m downhole

Sokoman Minerals and Benton Resources (TSXV: BEX) formed a strategic alliance (“the Alliance”) on a 50/50 basis to acquire and explore gold projects, Grey River, Golden Hope and Kepenkeck in Newfoundland.

In November, 2021, the Alliance announced a gold discovery at the Grey River project in Southern Newfoundland, returning results from 1.34 to 37.64 g/t Au.

In August, 2021, the Alliance announced a discovery of high-grade lithium-bearing pegmatites at Golden Hope, returning 1.95% and 0.49% Li₂O, being followed by another high-grade Lithium result of 1.93% Li₂O in November 9, 2021.

About Sokoman Minerals Corp.

Sokoman Minerals Corp. is a discovery-oriented company with projects in the province of Newfoundland and Labrador, Canada. The Company’s primary focus is its portfolio of gold projects; flagship, advanced-stage Moosehead, Crippleback Lake (optioned to Trans Canada Gold Corp.) and East Alder (optioned to Canterra Minerals Corporation) along the Central Newfoundland Gold Belt, and the district-scale Fleur de Lys project in northwestern Newfoundland, that is targeting Dalradian-type orogenic gold mineralization similar to the Curraghinalt and Cavanacaw deposits in Northern Ireland. The Company also recently entered into a strategic alliance with Benton Resources Inc. through three, large-scale joint-venture properties including Grey River, Golden Hope and Kepenkeck in Newfoundland. Recently, the Company and partner Benton Resources Inc. announced a potentially significant lithium discovery on the Golden Hope JV property with chip sample results in excess of 2% Li₂O from the Kraken Pegmatite Field that has grown in size to over 2 km in strike length and up to 1.2 km in apparent width. The alliance partners are completing LiDAR and air photo drone surveys over the pegmatite swarm, as well as detailed mapping and sampling with additional assays pending.

Sokoman now controls, independently and through the Benton alliance, over 150,000 hectares (>6,000 claims – 1500 sq. km), making it one of the largest landholders in Newfoundland, in Canada’s newest and rapidly-emerging gold districts. The Company also retains an interest in an early-stage antimony/gold project (Startrek) in Newfoundland, optioned to White Metal Resources Inc., and in Labrador, the Company has a 100%-interest in the Iron Horse (Fe) project which has Direct Shipping Ore (DSO) potential.

Mineralization hosted on adjacent and/or nearby properties is not necessarily indicative of mineralization hosted on the Company’s property.

About Virtual Investor Conferences®

Virtual Investor Conferences (VIC) is the leading proprietary investor conference series that provides an interactive forum for publicly-traded companies to meet and present directly with investors.

A real-time solution for investor engagement, Virtual Investor Conferences is part of OTC Market Group’s suite of investor relations services specifically designed for more efficient Investor Access. Replicating the look and feel of on-site investor conferences, Virtual Investor Conferences combine leading-edge conferencing and investor communications capabilities with a comprehensive global investor audience network.

For further information, please contact:

Sokoman Minerals

Timothy Froude, P.Geo., President & CEO

Phone: 709-765-1726

Email: tim@sokomanmineralscorp.com

CHF Capital Markets

Cathy Hume, CEO

Phone: 416-868-1079 x251

Email: cathy@chfir.com

Website: www.sokomanmineralscorp.com

Twitter: @SokomanMinerals

Facebook: @SokomanMinerals

LinkedIn: @SokomanMinerals

Virtual Investor Conferences

John M. Viglotti

SVP Corporate Services, Investor Access

OTC Markets Group

Phone: 212-220-2221

Email: johnv@otcmarkets.com

Benton And Sokoman Announce Gold Discovery At The Grey River Gold Project, Southern Newfoundland

Assays for six of 13 core samples, “super rushed” for assay, return from 1.34 to 37.64 g/t Au.

Thunder Bay, ON, November 25, 2021 – Benton Resources Inc. (TSXV: BEX) (“Benton”) and Sokoman Minerals Corp. (TSXV: SIC) (OTCQB: SICNF) (“Sokoman”), together (the “Alliance”), are pleased to announce that preliminary results from the maiden drill program at Grey River, Newfoundland, have returned multiple drill intersections of potentially significant gold mineralization. Program highlights include:

1,026 m completed in five holes over a four-kilometre strike length

Widespread pyrite mineralization encountered in all holes

643 core samples cut and delivered for assay of which 13 samples were “super rushed”

for Au analysis; six of the 13 samples “super rushed” returned from 1.34 to 37.64 g/t Au

630 samples are pending assay results

*Lengths are core lengths and believed to be 90% true length

Grey River – Drilling location map

Drill holes GR-21-01 to GR-21-05 were drilled within a 5-km strike length (location map attached) of the 10-km-long quartz/silica zone located 4 km east of the community of Grey River. Drilling operations including crew changes, drill moves, core logging and sampling, as well as camp logistics were helicopter supported with all personnel based in a remote fishing/hunting camp. Five drill holes totaling 1,026 m were completed with hole lengths ranging from 148 m to 235 m. A total of 643 samples ranging from 0.35 m to 1.25 m in length were cut onsite using a diamond core saw. Samples were flown to the town of Burgeo and then delivered to Eastern Analytical Ltd. in Springdale, Newfoundland by road transport halfway through and at the end of the program. Thirteen samples were “super rushed” with the remaining 630 samples awaiting gold analysis by standard fire assay for Au and ICP analysis for other elements. Samples assaying >1 g/t gold, including the “super rush” samples, will be re-analyzed by the “metallics” method.

Gold mineralization in the eastern-half of the property is associated with zones of disseminated and stringer pyrite (from 2-20% pyrite) in the 10-km-long quartz/silica body, and in discreet quartz veins that cut the body. Historic grab samples, and recent grab samples taken by Benton and Sokoman personnel (see September 2, 2021 press release), have given gold values ranging from 50 ppb to a maximum of 225 g/t Au. No prior drilling for gold has taken place in or near the quartz/silica body.

Stephen Stares, President and CEO of Benton states; “This is truly an exciting time for the Alliance. We’ve encountered two significant intercepts in our first hole with a significant number of assays pending. This hole is located 4 km east of the surface high grade encountered from our prospecting program. We believe this very large quartz system could be quite significant and we’re excited to plan the next phase of diamond drilling.”

Timothy Froude, P. Geo., President and CEO of Sokoman states; “These are outstanding results from reconnaissance drill holes on a property that has seen virtually no exploration for gold beyond sporadic grab sampling. The results reported are from three groups of consecutive samples from separate zones of pyrite mineralization from the first two holes completed. We decided to analyze a limited number of samples under “super rush” instructions to see if gold was present, as all that is known about gold in this area is that it is associated with pyrite. Needless to say, we are extremely pleased and already have more than enough evidence to support drilling in 2022. The Grey River property was acquired jointly by the Sokoman/Benton Alliance, which is targeting district scale gold opportunities in Newfoundland. Sokoman is now one of the largest land holders in Newfoundland and is sufficiently funded to advance our portfolio of properties.”

Previous workers have compared the gold mineralization at Grey River to the high-grade Pogo gold mine in the Tintina district of Alaska. The Pogo gold mine, to the end of 2019, produced 3.9M oz gold at 13.6 g/t. March 31, 2021 Probable Mineral Reserves were 5.9M tonnes @ 8 g/t for 1.5M oz and Indicated plus Inferred Mineral Resources were 23M tonnes @ 9.4 g/t for 6.9M oz. gold (See Northern Star Resources website, November 22, 2021. Mineral Resources are inclusive of Mineral Reserves. These resource figures are JORC-compliant and not NI 43-101-compliant. NI 43-101 regulations do not allow Indicated and Inferred Resources to be combined in public disclosures).

Qualified Person

This news release has been reviewed and approved by Timothy Froude, P.Geo., a “Qualified Person” under National Instrument 43-101 and President and CEO of Sokoman Minerals Corp.

Analytical Techniques / QA/QC

All core samples submitted for assay were saw cut by Sokoman personnel with one-half submitted for assay and one-half retained for reference. Samples were delivered in sealed bags directly to the lab by Sokoman personnel. Samples, including duplicates, blanks and standards, were submitted to Eastern Analytical Ltd. in Springdale, Newfoundland for gold analysis using standard fire assay methods as well as for ICP 34 analysis. Industry accepted standards, as well as a blank, were submitted every 20 samples in addition to the in-house standards and duplicate policies of Eastern Analytical Ltd. which is an accredited assay lab that conforms to requirements of ISO/IEC 17025.

COVID-19 Protocols

To ensure a working environment that protects the health and safety of the staff and contractors, Benton and Sokoman are operating under federally and provincially mandated and recommended guidelines during the current COVID-19 alert level.

About Benton Resources Inc.

Benton Resources Inc. is a well-funded mineral exploration company listed on the TSX Venture Exchange under the symbol BEX. Following a project generation business model, Benton has a diversified, highly-prospective property portfolio in Gold, Silver, Nickel, Copper, and Platinum Group Elements and currently holds large equity positions in other mining companies that are advancing high-quality assets. Whenever possible, BEX retains Net Smelter Return (NSR) royalties for potential long-term cash flow. Benton has also recently entered into a 50/50 strategic alliance with Sokoman Minerals Corp. (TSXV: SIC) through three large-scale joint venture properties including Grey River, Golden Hope and Kepenkeck in Newfoundland that are now being explored.

About Sokoman Minerals Corp.

Sokoman Minerals Corp. is a discovery-oriented company with projects in Newfoundland & Labrador, Canada. The company’s primary focus is its portfolio of gold projects Moosehead, Crippleback Lake and East Alder (optioned to Canterra Minerals Corporation) along the Central Newfoundland Gold Belt, and the district scale Fleur de Lys project in northwestern Newfoundland, that is targeting Dalradian type orogenic gold mineralization similar to the Curraghinalt and Cavanacaw deposits in Northern Ireland. The company also recently entered into a Strategic Alliance with Benton Resources Inc. through three, large-scale joint-venture properties including Grey River, Golden Hope and Kepenkeck in Newfoundland. The Alliance recently announced the discovery of potentially significant lithium bearing pegmatite dikes on the Golden Hope JV with grab sample values up to 2.37% Li2O having been returned from a dike swarm measuring over two km in strike length and over one km in apparent width. Sokoman controls one of the largest land holdings in Newfoundland with over 50,000 hectares (2,000 km2) of highly prospective ground in Canada’s newest and rapidly emerging gold districts. The company also retains an interest in an early-stage antimony/gold project (Startrek) in Newfoundland, optioned to White Metal Resources Inc., and in Labrador, the company has a 100% interest in the Iron Horse (Fe) project which has Direct Shipping Ore (DSO) potential.

Mineralization hosted on adjacent and/or nearby properties, or other properties referenced in this news release, is not necessarily indicative of mineralization hosted on the company’s property.

For further information, please contact:

Sokoman Minerals

Timothy Froude, P.Geo., President & CEO

Phone: 709-765-1726

Email: tim@sokomanmineralscorp.com

Benton Resources

Stephen Stares, President & CEO

Phone: 807-475-7474

Email: sstares@bentonresources.ca

CHF Capital Markets

Cathy Hume, CEO

Phone: 416-868-1079 x251

Email: cathy@chfir.com

Website: www.sokomanmineralscorp.com , www.bentonresources.ca

Twitter: @SokomanMinerals , @BentonResources

Facebook: @SokomanMinerals , @BentonResourcesBEX

LinkedIn: @SokomanMinerals, @BentonResources

THE TSX VENTURE EXCHANGE HAS NOT REVIEWED AND DOES NOT ACCEPT RESPONSIBILITY FOR THE ADEQUACY OR ACCURACY OF THIS RELEASE.

The information contained herein contains “forward-looking statements” within the meaning of applicable securities legislation. Forward-looking statements relate to information that is based on assumptions of management, forecasts of future results, and estimates of amounts not yet determinable. Any statements that express predictions, expectations, beliefs, plans, projections, objectives, assumptions or future events or performance are not statements of historical fact and may be “forward-looking statements.”

Forward-looking statements are subject to a variety of risks and uncertainties which could cause actual events or results to differ from those reflected in the forward-looking statements, including, without limitation: risks related to failure to obtain adequate financing on a timely basis and on acceptable terms; risks related to the outcome of legal proceedings; political and regulatory risks associated with mining and exploration; risks related to the maintenance of stock exchange listings; risks related to environmental regulation and liability; the potential for delays in exploration or development activities or the completion of feasibility studies; the uncertainty of profitability; risks and uncertainties relating to the interpretation of drill results, the geology, grade and continuity of mineral deposits; risks related to the inherent uncertainty of production and cost estimates and the potential for unexpected costs and expenses; results of prefeasibility and feasibility studies, and the possibility that future exploration, development or mining results will not be consistent with the Alliances’s expectations; risks related to gold price and other commodity price fluctuations; and other risks and uncertainties related to the Alliance’s prospects, properties and business detailed elsewhere in the Alliances’s disclosure record. Should one or more of these risks and uncertainties materialize, or should underlying assumptions prove incorrect, actual results may vary materially from those described in forward-looking statements. Investors are cautioned against attributing undue certainty to forward-looking statements. These forward-looking statements are made as of the date hereof and the Alliance does not assume any obligation to update or revise them to reflect new events or circumstances. Actual events or results could differ materially from the Alliances’s expectations or projections.

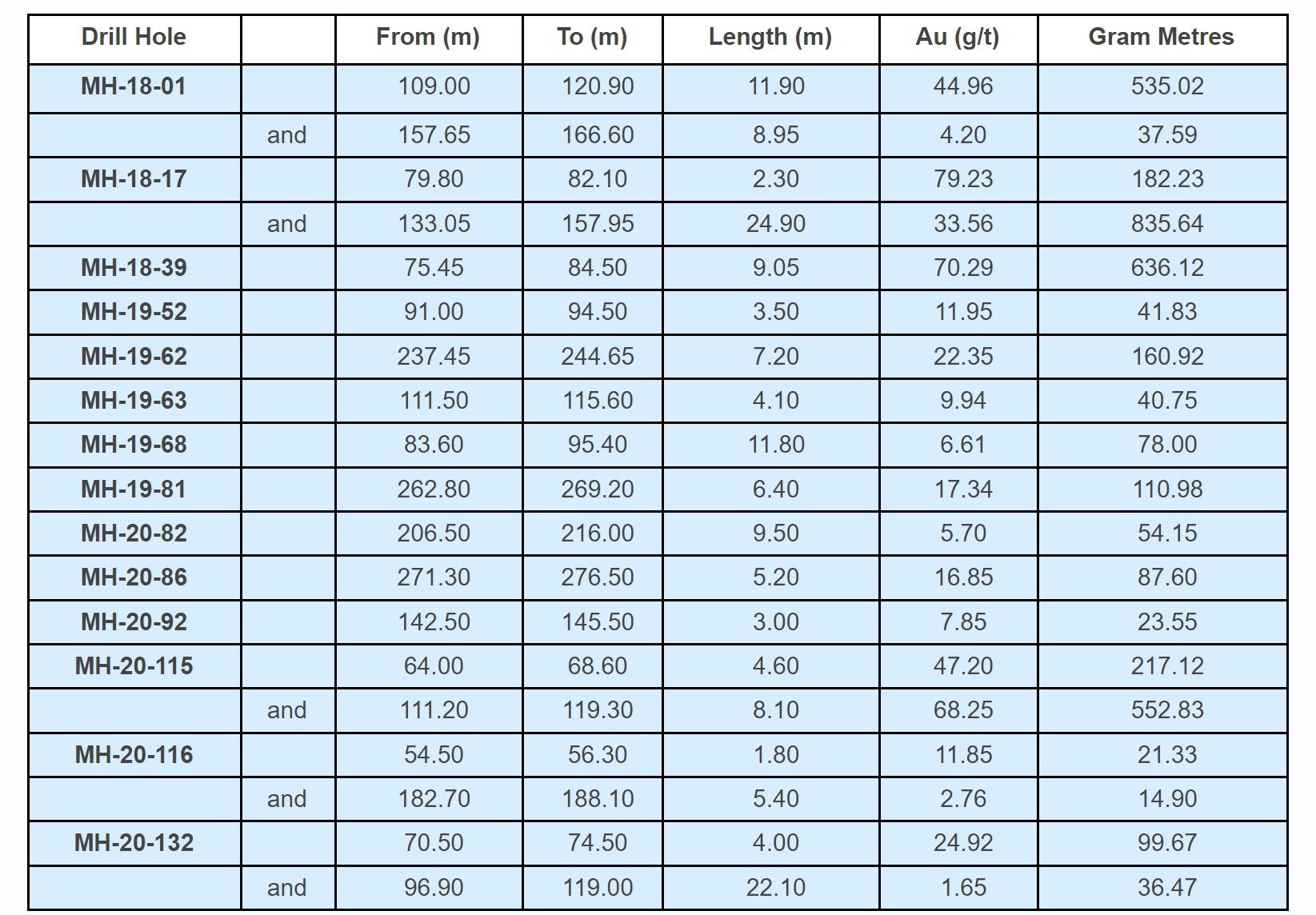

Sokoman Reports First Barge-Based Drill Results Moosehead Gold Project, Central Newfoundland

Phase 6 drill Program doubled to 100,000 m.

St. John’s, NL, November 10, 2021 – Sokoman Minerals Corp. (TSXV: SIC) (OTCQB: SICNF) is pleased to report the first results from the barge-based drilling on North Pond on the 100%-owned Moosehead Project in the Central Newfoundland Gold Belt.

MH-21-291: 4.95 m of 27.70 g/t Au from 41.55 m downhole

MH-21-283: 4.20 m of 14.72 g/t Au within 9.80 m of 6.65 g/t Au from 53.00 m downhole

The results confirm shallow, high-grade, gold-bearing quartz veins which are extensions to the Upper Eastern Trend and the Footwall Splay mineralized zones (plan map attached). The reported holes were drilled on a 10 m to 15 m grid spacing south of MH-20-115, which gave significant intercepts of 4.60 m of 47.20 g/t Au from the Footwall Splay, and further downhole, 8.10 m of 68.70 g/t Au from the Upper Eastern Trend (November 19, 2020 NR). The new holes are on trend towards the 75 Zone, located approximately 150 m further south, and from where recent results include MH-21-234 that returned 4.80 m of 17.56 g/t Au (September 28, 2021 NR).

Tim Froude, President and CEO of Sokoman, says: “We are extremely pleased with the early results from the North Pond, barge-based, drilling. We have been stressing the importance of this program for several months and it is very rewarding to see our expectations met with these strong results. The barge program to date consists of 20 holes with mineralized veins encountered in the majority of the holes. Some holes tested both the Upper Eastern Trend and the Footwall Splay zones with the table above reporting both intersections. The barge program will continue as long as conditions allow. Winter conditions, mainly freezing, are expected in late November to mid-December, at which point the barge will be pulled from the pond and mothballed until spring 2022. We are also pleased to announce that the current 50,000 m program has been increased to 100,000 m with drilling to continue with occasional breaks through 2022. We see growth potential in all areas of the known mineralized corridors as well as discovery potential on our numerous regional targets.”

QP

This news release has been reviewed and approved by Timothy Froude, P.Geo., a “Qualified Person” under National Instrument 43-101 and President and CEO of Sokoman Minerals Corp.

COVID-19 Protocols

To ensure a working environment that protects the health and safety of the staff and contractors, Sokoman is operating under federally and provincially mandated and recommended guidelines during the current COVID-19 alert level.

Analytical Techniques / QA/QC

Samples, including duplicates, blanks and standards, were submitted to Eastern Analytical Ltd. in Springdale, Newfoundland for gold analysis. All core samples submitted for assay were saw cut by Sokoman personnel with one-half submitted for assay and one-half retained for reference. Samples were delivered in sealed bags directly to the lab by Sokoman personnel. Eastern Analytical Ltd. is an accredited assay lab that conforms to the requirements of ISO/IEC 17025. Samples with possible visible gold were submitted for total pulp metallics and gravimetric finish. All other samples were analyzed by standard fire assay methods. Total pulp metallic analysis includes: the whole sample is crushed to -10 mesh; then pulverized to 95% -150 mesh. The total sample is weighed and screened to 150 mesh; the +150 mesh fraction is fire assayed for Au, and a 30 g subsample of the -150 mesh fraction is fire assayed for Au; with a calculated weighted average of total Au in the sample reported as well. One blank and one industry approved standard for every twenty samples submitted, is included in the sample stream. Random duplicates of selected samples are analyzed in addition to the in-house standard and duplicate policies of Eastern Analytical Ltd. All reported assays are uncut.

About Sokoman Minerals Corp.

Sokoman Minerals Corp. is a discovery-oriented company with projects in the province of Newfoundland and Labrador, Canada. The Company’s primary focus is its portfolio of gold projects; flagship, advanced-stage Moosehead, Crippleback Lake (optioned to Trans Canada Gold Corp.) and East Alder (optioned to Canterra Minerals Corporation) along the Central Newfoundland Gold Belt, and the district-scale Fleur de Lys project in northwestern Newfoundland, that is targeting Dalradian-type orogenic gold mineralization similar to the Curraghinalt and Cavanacaw deposits in Northern Ireland. The Company also recently entered into a strategic alliance with Benton Resources Inc. through three, large-scale joint-venture properties including Grey River, Golden Hope and Kepenkeck in Newfoundland. Recently, the Company and partner Benton Resources Inc. announced a potentially significant lithium discovery on the Golden Hope JV with chip sample results in excess of 2% Li₂O from the Kraken Pegmatite Field which has grown in size to over 2 km in strike length and up to 1.2 km in apparent width. The alliance partners are completing LiDAR and air photo drone surveys over the pegmatite swarm, as well as detailed mapping and sampling with additional assays pending.

Sokoman now controls, independently and through the Benton alliance, over 150,000 hectares (>6,000 claims – 1500 sq. km), making it one of the largest landholders in Newfoundland, in Canada’s newest and rapidly-emerging gold districts. The Company also retains an interest in an early-stage antimony/gold project (Startrek) in Newfoundland, optioned to White Metal Resources Inc., and in Labrador, the Company has a 100%-interest in the Iron Horse (Fe) project which has Direct Shipping Ore (DSO) potential.

Mineralization hosted on adjacent and/or nearby properties is not necessarily indicative of mineralization hosted on the Company’s property.

For further information, please contact:

Sokoman Minerals

Timothy Froude, P.Geo., President & CEO

Phone: 709-765-1726

Email: tim@sokomanmineralscorp.com

CHF Capital Markets

Cathy Hume, CEO

Phone: 416-868-1079 x251

Email: cathy@chfir.com

Website: www.sokomanmineralscorp.com

Twitter: @SokomanMinerals

Facebook: @SokomanMinerals

LinkedIn: @SokomanMinerals

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Investors are cautioned that trading in the securities of the Corporation should be considered highly speculative. Except for historical information contained herein, this news release contains forward- looking statements that involve risks and uncertainties. Actual results may differ materially. Sokoman Minerals Corp. will not update these forward-looking statements to reflect events or circumstances after the date hereof. More detailed information about potential factors that could affect financial results is included in the documents filed from time to time with the Canadian securities regulatory authorities by Sokoman Minerals Corp.

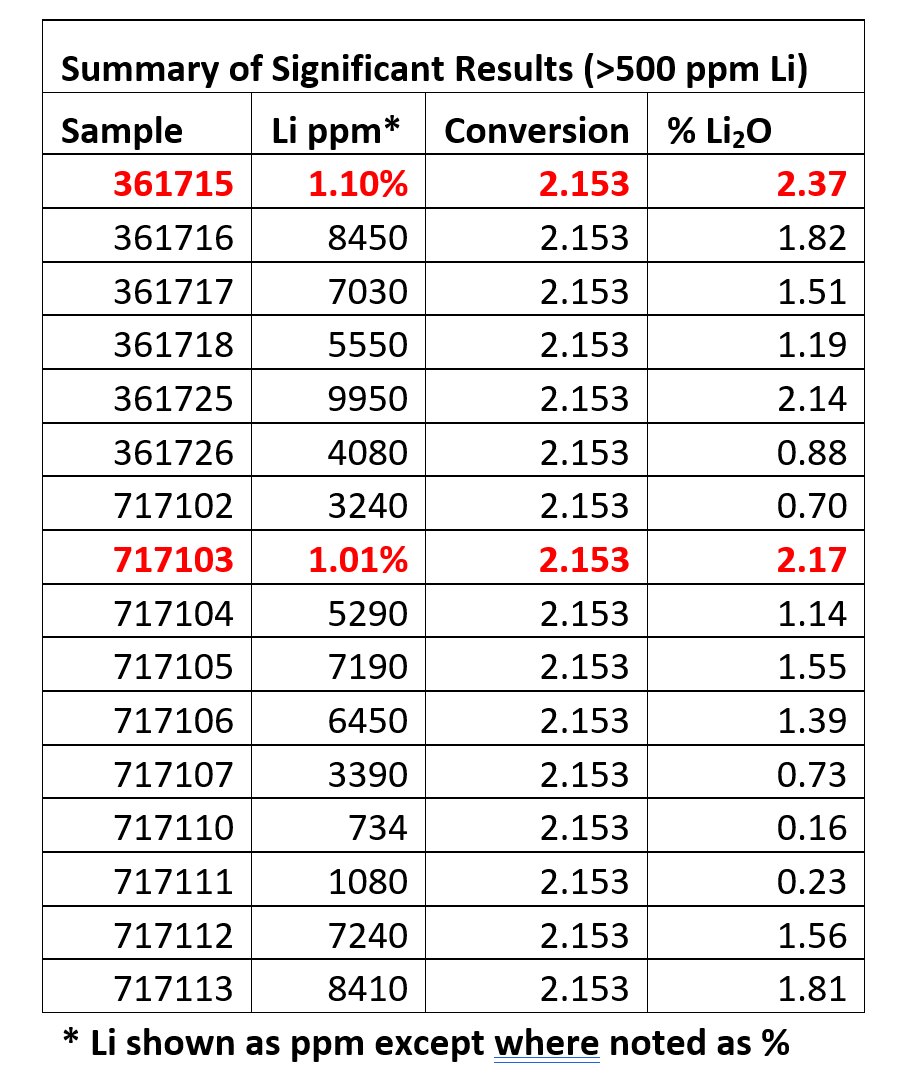

Sokoman And Benton – More High-Grade Lithium Results Kraken Pegmatites In Newfoundland

Further grab sampling returns values up to 1.93% Li2O.

St. John’s, NL November 9, 2021 – Sokoman Minerals Corp. (TSXV: SIC) (OTCQB: SICNF) (“Sokoman”) and Benton Resources Inc. (TSXV: BEX) (“Benton”) together, (“the Alliance”) are pleased to announce that they continue to expand the extent of the recently-discovered Kraken pegmatite field at the Golden Hope Joint Venture Project located in southwestern Newfoundland. This is the first significant discovery of Lithium mineralization documented in the province of Newfoundland and Labrador, Canada.

Phase 3 sampling at the Kraken pegmatite field has given grab-sample results grading from trace up to 1.93% Li2O with 11 samples having values >0.5% Li2O, and six samples >1% Li2O. The 49 grab samples were collected over a 0.5 km2 area over the swarm of poorly-exposed pegmatite and aplite dykes which display characteristics of significant pegmatite fields around the world including zonation of Tantalum, Rubidium and Cesium minerals, all considered Critical Specialty elements for the Green electric future.

The Alliance has also discovered several new spodumene-bearing pegmatites to the west of the original discovery, further expanding the dyke swarm. The dyke swarm has now been sampled over a strike length of 2200 metres and an apparent width of 1200 metres. A further 50 samples were taken with results to be released in the coming weeks.

A detailed LiDAR / Photogrammetry survey covering 8.4 km2 of the pegmatite field has now been completed, extending westward to cover the high-grade Beryllium showing which had two samples with >5000 ppm Be, and associated anomalous Lithium, Cesium, Rubidium and Tantalum values, and also eastward to cover the possible extension of the newly-discovered eastern pegmatite swarm.

Samples were submitted to Actlabs in Ancaster, Ontario for analysis by Sodium Peroxide Fusion ICPOES + ICPMS.

Sokoman’s President and CEO Tim Froude, adds: “The Alliance has made great strides in expanding this exciting new discovery and the mineralization is still open in all directions. It is clear we need to gather as much critical data as we can prior to proposing a Phase 1 drilling program to maximize the potential of this discovery. We are about to begin discussions with our respective Boards of Directors and advisors as to how to proceed with this exciting opportunity for the maximum benefit of our shareholders.”

Benton’s President and CEO Stephen Stares, states: “It is very evident that the Kraken pegmatite field is quickly becoming something of potential economic interest. To find something brand new and of this extent is truly exciting. With the growing demand for Lithium and other critical metals we are very happy to be entering the race with this new discovery.”

QP

This news release has been reviewed and approved by Timothy Froude, P.Geo., President and CEO of Sokoman Minerals Corp., and Nathan Sims, P.Geo., Senior Exploration Manager for Benton Resources Inc., both the ‘Qualified Person’ under National Instrument 43-101.

COVID-19 Protocols

To ensure a working environment that protects the health and safety of the staff and contractors, Sokoman and Benton are operating under federally and provincially mandated and recommended guidelines during the current COVID-19 alert level.

About Sokoman Minerals Corp.

Sokoman Minerals Corp. is a discovery-oriented company with projects in Newfoundland and Labrador, Canada. Sokoman’s primary focus is its portfolio of gold projects: flagship, 100%-owned Moosehead, Crippleback Lake (optioned to Trans Canada Gold Corp.) and East Alder (optioned to Canterra Minerals Corporation) along the Central Newfoundland Gold Belt, and the district-scale Fleur de Lys project in northwestern Newfoundland, that is targeting Dalradian-type orogenic gold mineralization similar to the Curraghinalt and Cavanacaw deposits in Northern Ireland, and Cononish in Scotland. The company also recently entered into a strategic alliance with Benton Resources Inc. through three large-scale joint-venture properties including Grey River Gold, Golden Hope and Kepenkeck in Newfoundland. Sokoman now controls independently and through the Benton alliance over 150,000 hectares (>6,000 claims – 1,500 sq. km), making it one of the largest landholders in Newfoundland, Canada’s newest and rapidly-emerging gold districts. Sokoman also retains an interest in an early-stage antimony/gold project (Startrek) in Newfoundland, optioned to White Metal Resources Inc., and in Labrador, the company has a 100%-interest in the Iron Horse (Fe) project that has Direct Shipping Ore (DSO) potential.

About Benton Resources Inc.

Benton Resources Inc. is a well-funded mineral exploration company listed on the TSX Venture Exchange under the symbol BEX. Following a project generation business model, Benton has a diversified, highly-prospective property portfolio in Gold, Silver, Nickel, Copper, and Platinum Group Elements and currently holds large equity positions in other mining companies that are advancing high-quality assets. Whenever possible, BEX retains Net Smelter Return (NSR) royalties for potential long-term cash flow. Benton has also recently entered into a 50/50 strategic alliance with Sokoman Minerals Corp. (TSXV: SIC) through three large-scale joint venture properties including Grey River Gold, Golden Hope and Kepenkeck in Newfoundland that are now being explored.

Golden Hope Project – Kraken Sampling Update

For further information, please contact:

CHF Capital Markets

Cathy Hume, CEO

Phone: 416-868-1079 x251

Email: cathy@chfir.com

Sokoman Minerals

Timothy Froude, P.Geo., President & CEO

Phone: 709-765-1726

Email: tim@sokomanmineralscorp.com

Benton Resources

Stephen Stares, President & CEO

Phone: 807-475-7474

Email: sstares@bentonresources.ca

Website: www.sokomanmineralscorp.com , www.bentonresources.ca

Twitter: @SokomanMinerals , @BentonResources

Facebook: @SokomanMinerals , @BentonResourcesBEX

LinkedIn: @SokomanMinerals, @BentonResources

THE TSX VENTURE EXCHANGE HAS NOT REVIEWED AND DOES NOT ACCEPT RESPONSIBILITY FOR THE ADEQUACY OR ACCURACY OF THIS RELEASE.

The information contained herein contains “forward-looking statements” within the meaning of applicable securities legislation. Forward-looking statements relate to information that is based on assumptions of management, forecasts of future results, and estimates of amounts not yet determinable. Any statements that express predictions, expectations, beliefs, plans, projections, objectives, assumptions or future events or performance are not statements of historical fact and may be “forward-looking statements.”

Forward-looking statements are subject to a variety of risks and uncertainties which could cause actual events or results to differ from those reflected in the forward-looking statements, including, without limitation: risks related to failure to obtain adequate financing on a timely basis and on acceptable terms; risks related to the outcome of legal proceedings; political and regulatory risks associated with mining and exploration; risks related to the maintenance of stock exchange listings; risks related to environmental regulation and liability; the potential for delays in exploration or development activities or the completion of feasibility studies; the uncertainty of profitability; risks and uncertainties relating to the interpretation of drill results, the geology, grade and continuity of mineral deposits; risks related to the inherent uncertainty of production and cost estimates and the potential for unexpected costs and expenses; results of prefeasibility and feasibility studies, and the possibility that future exploration, development or mining results will not be consistent with the Alliance’s expectations; risks related to gold price and other commodity price fluctuations; and other risks and uncertainties related to the Alliance’s prospects, properties and business detailed elsewhere in the Alliance’s disclosure record. Should one or more of these risks and uncertainties materialize, or should underlying assumptions prove incorrect, actual results may vary materially from those described in forward-looking statements. Investors are cautioned against attributing undue certainty to forward-looking statements. These forward-looking statements are made as of the date hereof and the Alliance does not assume any obligation to update or revise them to reflect new events or circumstances. Actual events or results could differ materially from the Alliance’s expectations or projections.

Benton And Sokoman Enter Into Mutual Participation Agreements Governing Cost Reimbursement Under Their Strategic Exploration Alliance

Thunder Bay, ON, October 15, 2021 – Benton Resources Inc. (“Benton”) (TSXV: BEX) and Sokoman Minerals Corp. (“Sokoman”) (TSXV: SIC) (OTCQB: SICNF) (jointly, ”the Companies” or singularly a “Joint Venture Party”) are pleased to announce that they have entered into mutual participation agreements (the “Participation Agreements”) that govern cost reimbursement between the Companies relating to certain option agreements entered into by each of Benton and Sokoman on behalf of their strategic exploration alliance announced on May 20, 2021. Pursuant to the strategic alliance the Companies agreed to share, on a 50/50 basis, exploration costs and costs associated with the exercise of property options entered into by either party on behalf of the strategic alliance. In cases where one of the Joint Venture Parties enters into an option agreement that requires shares to be issued to a third party optionor the other Joint Venture Party will contribute its 50% of the costs by reimbursing the first company for 50% of the option payments. Where common shares are required to be issued as part of the option payments in order to ensure that the costs are equally divided the monetary value of such shares will be calculated and the Joint Venture Party that did not enter into the option agreement will issue such number of shares to the Joint Venture Party that did enter into the option agreement that have a monetary value equal to 50% of the value of the shares issued by the Joint Venture Party that has entered into the option agreement.

Sokoman and Benton have on behalf of the strategic alliance, each entered into two property option agreements that have previously been announced that are being contributed to the strategic alliance and governed by the Participation Agreements. The Participation Agreements simply formalize and clarify what cash payments and share issuances are required to be made by the Joint Venture Party that did not directly enter into a particular option agreement in order to reimburse the Joint Venture Party that did enter into the option agreement.

Benton Participation Agreement

Sokoman entered into an option agreement that provides it with the right to acquire a 100% interest in a mineral license consisting of seven mineral claims (the “Lewis Option”) lying within the Grey River Gold Property. In order to exercise the Lewis Option Sokoman is required to make four cash payments of $10,000 each by June 15, 2024, and issue four tranches of shares of 50,000 each by June 15, 2024 (see Sokoman news release dated July 13, 2021). In accordance with the terms of the Benton Participation Agreement in order to contribute its 50% of the costs of the Lewis Option Benton will, to the extent that Sokoman continues to exercise the Lewis Option, reimburse Sokoman by: a) paying to Sokoman 50% of the cash payments made by Sokoman to exercise the Lewis Option ($20,000); and b) issuing to Sokoman such number of shares of Benton having a value equal to 50% of the value of each tranche of shares Sokoman issues to exercise the Lewis Option (292,208 Benton shares – 100,000 Sokoman shares at a floor price of $0.45 = $45,000 / $0.154 floor price for Benton shares).

Sokoman entered into an option agreement that provides it with the right to acquire a 100% interest (subject to a 1.5% NSR, two-thirds of which may be purchased for $1 million) in three licenses consisting of four mineral claims (the “G2B Option”) lying within the Grey River Gold Property. In order to exercise the G2B Option Sokoman is required to make three annual cash payments of $10,000 each and issue three tranches of shares of 50,000 each (see Sokoman news release dated July 13, 2021). In accordance with the terms of the Benton Participation Agreement in order to contribute its 50% of the costs of the G2B Option Benton will, to the extent that Sokoman continues to exercise the G2B Option, reimburse Sokoman by: a) paying to Sokoman 50% of the cash payments made by Sokoman to exercise the G2B Option ($15,000); and b) issuing to Sokoman such number of shares of Benton having a value equal to 50% of the value of each tranche of shares Sokoman issues to exercise the G2B Option (219,156 Benton shares – 75,000 Sokoman shares at a floor price of $0.45 = $33,750 / $0.154 floor price for Benton shares).

Sokoman Participation Agreement

Benton entered into an option agreement that provides it with the right to acquire a 100% interest (subject to a 2% NSR, half of which may be purchased for $1 million) in eleven mineral claims (the “Keats Option”) at the Kepenkeck gold project. In order to exercise the Keats Option Benton is required to make the following cash payments and issue the following shares: (i) an initial $10,000 and issue 200,000 shares; (ii) on the first anniversary $20,000 and issue 200,000 shares; (iii) on the second anniversary $20,000 and issue 200,000 shares; and (iv) on the third anniversary $40,000 and issue 400,000 shares (see Benton news release dated May 6, 2021). In accordance with the terms of the Sokoman Participation Agreement in order to contribute its 50% of the costs of the Keats Option Sokoman will, to the extent that Benton continues to exercise the Keats Option, reimburse Benton by: a) paying to Benton 50% of the cash payments made by Benton to exercise the Keats Option ($45,000); and b) issuing to Benton such number of shares of Sokoman having a value equal to 50% of the value of each tranche of shares Benton issues to exercise the Keats Option (171,111 Sokoman shares – 500,000 Benton shares at a floor price of $0.154 = $77,000 / $0.45 floor price for Sokoman shares).

Benton entered into an option agreement that provides it with the right to acquire a 100% interest (subject to a 2% NSR, one-half of which may be purchased for $1 million) in two licenses consisting of thirty mineral claims at Larry’s Pond (the “Rogers Option”). In order to exercise the Rogers Option Benton is required to make the following cash payments and issue the following shares: (i) an initial $10,000 and issue 50,000 shares; (ii) on the first anniversary $10,000 and issue 50,000 shares; (iii) on the second anniversary $10,000 and issue 50,000 shares; and (iv) on the third anniversary $30,000 and issue 50,000 shares (see Benton news release dated June 29, 2021). In accordance with the terms of the Sokoman Participation Agreement in order to contribute its 50% of the costs of the Rogers Option Sokoman will, to the extent that Benton continues to exercise the Rogers Option, reimburse Benton by: a) paying to Benton 50% of the cash payments made by Benton to exercise the Rogers Option ($30,000); and b) issuing to Benton such number of shares of Sokoman having a value equal to 50% of the value of each tranche of shares Benton issues to exercise the Rogers Option (34,222 Sokoman shares – 100,000 Benton shares at floor price of $0.154 = $15,400 / $0.45 floor price for Sokoman shares).

For the purposes of paragraph 1 and 2 above: a) the value of Sokoman shares issued or to be issued to exercise the Lewis Option, the G2B Option or shares to be issued under the Sokoman Participation Agreement shall be the share price that is the greater of $0.45 and the 20-day volume weighted average price (the “VWAP”) of Sokoman shares prior to the day the Sokoman shares are issued, and b) the value of Benton shares to be issued to exercise the Keats Option, the Rogers Option or shares to be issued under the Benton Participation Agreement shall be the share price that is the greater of $0.154 and the 20-day VWAP of Benton shares prior to the day that Benton shares are issued.

About Benton Resources Inc.

Benton Resources is a well-funded Canadian-based project generator with a diversified property portfolio in Gold, Silver, Nickel, Copper, and Platinum group elements. Benton holds multiple high-grade projects available for option that can be viewed on the company’s website. Parties interested in seeking more information about properties available for option can contact Mr. Stares directly.

About Sokoman Minerals Corp.

Sokoman Minerals Corp. is a discovery-oriented company with projects in the province of Newfoundland and Labrador, Canada. The company’s primary focus is its portfolio of gold projects: Moosehead, Crippleback Lake (optioned to Trans Canada Gold Corp.) and East Alder (optioned to Canterra Minerals Corporation) along the Central Newfoundland Gold Belt, and the recently acquired district-scale Fleur de Lys project in northwestern Newfoundland, that is targeting Dalradian-type orogenic gold mineralization similar to the Curraghinalt and Cavanacaw deposits in Northern Ireland, and Cononish in Scotland. The company also recently entered into a strategic alliance with Benton Resources Inc. through three large-scale joint-venture properties including Grey River, Golden Hope and Kepenkeck in Newfoundland. Sokoman now controls independently and through the Benton alliance over 150,000 hectares (>6,000 claims) of land, making the company one of the largest landholders in Newfoundland, Canada’s newest and rapidly emerging gold districts. The company also retains an interest in an early-stage antimony/gold project (Startrek) in Newfoundland, optioned to White Metal Resources Inc., and in Labrador, the company has a 100% interest in the Iron Horse (Fe) project that has Direct Shipping Ore (DSO) potential.

For further information, please contact:

CHF Capital Markets

Cathy Hume, CEO

Phone: 416-868-1079 x251

Email: cathy@chfir.com

Benton Resources

Stephen Stares, President & CEO

Phone: 807-475-7474

Email: sstares@bentonresources.ca

Sokoman Minerals

Timothy Froude, P.Geo., President & CEO

Phone: 709-765-1726

Email: tim@sokomanmineralscorp.com

Website: www.sokomanmineralscorp.com , www.bentonresources.ca

Twitter: @SokomanMinerals , @BentonResources

Facebook: @SokomanMinerals , @BentonResourcesBEX

Sokoman And Benton Expand The Kraken Lithium Pegmatite Swarm In Newfoundland

Dyke system expanded: 2.2 km-long by 0.85 km-wide

Fine-grained spodumene identified in several new areas

Dyke system is wide open for expansion

St. John’s, NL, October 14, 2021 – Sokoman Minerals Corp. (“Sokoman”) (TSXV: SIC) (OTCQB: SICNF) and Benton Resources Inc. (“Benton”) (TSXV: BEX) (jointly “the Alliance”) are pleased to announce that prospecting has expanded the area containing lithium-bearing pegmatite dykes, now known as “The Kraken Pegmatite Swarm”, to an area measuring approximately 2.2 km-long by 0.85 km-wide. In the past two weeks, the Alliance has focused their prospecting to the east of the original discovery and now have identified multiple areas of spodumene-bearing pegmatites dykes ranging from 0.5 m to 10.0 m in thickness from possible stacked swarms striking approximately 50 degrees and dipping 45-65 degrees east with unknown strike length. A total of 55 samples were collected over the eastern-half of the swarm area and assay results are expected within the next few weeks. All samples were submitted to Actlabs in Ancaster, Ontario for analysis by Sodium Peroxide Fusion ICPOES + ICPMS.

The Alliance also received further assays from a second phase of sampling collected from a till covered area, west of the original discovery, with samples of sub-crops and large local boulders returning anomalous results of rubidium, tantalum and lithium. One sample of a large, angular, purple pegmatite boulder located 600 m west of the original lithium zone graded 1.04% Li2O. The sampling has demonstrated that the dyke system contains economic grades of lithium, is widespread, and open along strike.

The Alliance is planning detailed geological mapping and a high-resolution drone survey that will include imagery, lidar and magnetic datasets to assist in the mapping and targeting the dyke system for drilling which will commence shortly. The companies have already completed a 5,709 line-km Heliborne High-Resolution Aeromagnetic & Matrix Digital VLF-EM Survey flown by Terraquest Ltd. with the final data currently being processed. The survey will provide the structural / lithological setting and help identify gold-bearing structure extensions, as well as any unrecognized structures including those potentially related to the lithium-bearing pegmatites.

Benton’s President and CEO, Stephen Stares, states: “The Alliance has discovered and released high-grade results up to 2.37% Li2O which is the first of its kind in Newfoundland. As the Alliance continues to advance the lithium potential, it’s quickly becoming evident that the Kraken dyke system is a large, highly-evolved, pegmatite field similar to the geological environment and setting of other large systems in the Appalachian belt, including the important deposits held by Piedmont Lithium Inc in the Carolinas, eastern US, as well as in the geologically equivalent Avalonia Project being advanced by Ganfeng Lithium in the Caledonides of Ireland.”

QP

This news release has been reviewed and approved by Timothy Froude, P.Geo., President and CEO of Sokoman Minerals Corp., and Nathan Sims, P.Geo., Senior Exploration Manager for Benton Resources Inc., both the ‘Qualified Person’ under National Instrument 43-101.

COVID-19 Protocols

To ensure a working environment that protects the health and safety of the staff and contractors, Sokoman and Benton are operating under federally and provincially mandated and recommended guidelines during the current COVID-19 alert level.

About Sokoman Minerals Corp.

Sokoman Minerals Corp. is a discovery-oriented company with projects in Newfoundland and Labrador, Canada. The company’s primary focus is its portfolio of gold projects: flagship, 100%-owned Moosehead, Crippleback Lake (optioned to Trans Canada Gold Corp.) and East Alder (optioned to Canterra Minerals Corporation) along the Central Newfoundland Gold Belt, and the district-scale Fleur de Lys project in northwestern Newfoundland, which is targeting Dalradian-type orogenic gold mineralization similar to the Curraghinalt and Cavanacaw deposits in Northern Ireland, and Cononish in Scotland. The company also recently entered into a strategic alliance with Benton Resources Inc. through three large-scale joint venture properties including Grey River, Golden Hope and Kepenkeck in Newfoundland. Sokoman now controls independently and through the Benton alliance over 150,000 hectares (>6,000 claims – 1,500 sq. km), making it one of the largest landholders in Newfoundland, Canada’s newest and rapidly-emerging gold districts. The company also retains an interest in an early-stage antimony / gold project (Startrek) in Newfoundland, optioned to White Metal Resources Inc., and in Labrador, the company has a 100% interest in the Iron Horse (Fe) project that has Direct Shipping Ore (DSO) potential.

Mineralization hosted on adjacent and/or nearby properties is not necessarily indicative of mineralization hosted on the company’s property.

About Benton Resources Inc.

Benton Resources Inc. is a well-funded mineral exploration company listed on the TSX Venture Exchange under the symbol BEX. Following a project generation business model, Benton has a diversified, highly-prospective property portfolio in Gold, Silver, Nickel, Copper, and Platinum Group Elements and currently holds large equity positions in other mining companies that are advancing high-quality assets. Whenever possible, BEX retains Net Smelter Return (NSR) royalties for potential long-term cash flow. Benton has also recently entered into a 50/50 strategic alliance with Sokoman Minerals Corp. (TSXV: SIC) through three large-scale joint venture properties including Grey River, Golden Hope and Kepenkeck in Newfoundland that are now being explored.

Golden Hope Project: Kracken Pegmatite Swarm Sampling and Proposed Drone Survey

For further information, please contact:

CHF Capital Markets

Cathy Hume, CEO

Phone: 416-868-1079 x251

Email: cathy@chfir.com

Sokoman Minerals

Timothy Froude, P.Geo., President & CEO

Phone: 709-765-1726

Email: tim@sokomanmineralscorp.com

Benton Resources

Stephen Stares, President & CEO

Phone: 807-475-7474

Email: sstares@bentonresources.ca

Website: www.sokomanmineralscorp.com , www.bentonresources.ca

Twitter: @SokomanMinerals , @BentonResources

Facebook: @SokomanMinerals , @BentonResourcesBEX

THE TSX VENTURE EXCHANGE HAS NOT REVIEWED AND DOES NOT ACCEPT RESPONSIBILITY FOR THE ADEQUACY OR ACCURACY OF THIS RELEASE.

The information contained herein contains “forward-looking statements” within the meaning of applicable securities legislation. Forward-looking statements relate to information t

Benton Resources And Sokoman Minerals Commence Diamond Drilling Grey River Jv Project, Southern Newfoundland

Phase 1 Program Approximately 2,000 metres

Thunder Bay, ON, October 12, 2021 – Benton Resources Inc. (“Benton”) (TSXV: BEX) and Sokoman Minerals Corp. (“Sokoman”) (TSXV: SIC) (OTCQB: SICNF) (jointly “the Alliance”) are pleased to announce that Phase 1 diamond drilling has commenced at the Grey River JV gold project (the ”Project”) on the south coast of Newfoundland. The Project is targeting high-grade gold mineralization similar in style to the Pogo gold deposit in the Tintina Belt of Alaska.

The Project is centered on the community of Grey River, a deep-water, ice-free harbour on the south coast of the Island of Newfoundland, 32 km to the east of the town of Burgeo, and 38 km southeast of the Golden Hope JV gold project. The Alliance’s claims straddle a deep-seated, east-west trending, ductile shear zone that separates a large enclave of Late Precambrian amphibolite, gabbro, metasediments, felsic metavolcanics and mafic orthogneisses from a batholith-scale, syn-kinematic suite of Siluro-Devonian granitoid rocks. The east-west shear zone at Grey River, and parallel structures immediately offshore, are fundamental crustal breaks along which metal-rich, mid- to late-Devonian granites were emplaced, along the southern coast of the Island.

Rocks in this area of southwestern Newfoundland are unusually enriched in Au, Mo, Cu, W, F and Bi. A 5 km- by 10 km-long area within, and adjoining the property, is particularly metal-rich, hosting:

multiple mesothermal/intrusion-related Au-rich (+/- Bi-Ag-Sb-Pb-Zn) quartz veins

a porphyry Mo-Cu deposit (Moly Brook)

a vein-type wolframite-rich W deposit (Grey River #10)

a diffusely bounded, high-purity, locally auriferous, silica deposit (Gulch Cove)

Each appears to be associated with features in the regional aero magnetics and are also reflected in regional Government lake-sediment geochemistry coverage. The primary focus of the Alliance’s exploration is quartz-vein-hosted, structurally controlled / intrusion-related, high-grade Au (+/- Ag, Bi, Sb) in both the granitic and adjacent metamorphic terrains.

Previous exploration at Grey River has identified gold mineralization in several settings:

in base-metal-rich and sulphide-poor, quartz veins and veinlets in the gneisses and related metamorphic rocks, including regional-scale silica bodies

in quartz veins with coarse-grained sulphides in granite

in sulphide-poor, quartz stock-works in sericitized granite

in stockwork-style quartz and quartz-sulphide veinlets with or without pervasive silica replacement in granite

Gold grades reported from historic grab and channel samples range from less than 1 g/t to more than 225 g/t Au, locally with 200-300 g/t Ag, with or without anomalous Bi, Sb and W. The 225 g/t Au chip sample is from a 20-30 cm-wide zone of pyritic alteration immediately adjacent to an 8 km-long, diffusely-bounded, quartz-rich zone. The highly anomalous value coincides with the large, elongated, high-purity silica body (12M tonnes >95% SiO) which was drilled by the Newfoundland Government in 1967, as part of an Island-wide, silica-assessment program. The silica body lies in mica schists, along the boundary with amphibolite gneisses and mica-schists, and along the flank of a prominent aeromagnetic high. Its origin is unclear with past workers proposing different origins including meta-quartzite, quartz vein, silica replacement. The style, grades, setting and Au-Ag-Bi-W-Sb geochemical signature of the gold mineralization, have drawn comparisons with the high-grade Pogo gold mine in the Tintina Gold Belt of Alaska and Yukon which is gold in diffusely bounded quartz bodies in amphibolite grade gneisses. The Pogo mine has produced 3.9 million oz gold at 13.6 g/t gold (to end of 2019), with Mineral Reserves of more than 7 million oz gold.

Tim Froude, President and CEO of Sokoman, says: “We are very pleased to begin this program at Grey River, which will be the first drilling program directed at the gold potential of the large quartz zones or bodies in the eastern portion of the property. Historical sampling results include chip/channel samples of 225 g/t Au, and widespread grab-sample values from less than detection to 3.8 g/t Au. None of the gold enriched areas, which occur over an 8 km strike length of the silica body, have been drill tested. We are focusing on areas of anomalous gold with 8 to 10 reconnaissance holes using data from the recently-completed, high-resolution, magnetic/electromagnetic airborne survey that identified potential structures correlating with the gold enriched areas.”

Steve Stares, President and CEO of Benton, says: “With the rapid pace in which the Alliance has advanced the Grey River project to its inaugural drill program, I’m very excited to see what this large silica system might hold as we carry out this first phase of drilling.”

QP

This news release has been reviewed and approved by Timothy Froude, P. Geo., a “Qualified Person” under National Instrument 43-101 and President and CEO of Sokoman Minerals Corp.

COVID-19 Protocols

To ensure a working environment that protects the health and safety of the staff and contractors, Sokoman is operating under federally and provincially mandated and recommended guidelines during the current COVID-19 alert level.

About Sokoman Minerals Corp.

Sokoman Minerals Corp. is a discovery-oriented company with projects in the province of Newfoundland and Labrador, Canada. Sokoman’s primary focus is its portfolio of gold projects; flagship, advanced-stage Moosehead, Crippleback Lake (optioned to Trans Canada Gold Corp.) and East Alder (optioned to Canterra Minerals Corporation) along the Central Newfoundland Gold Belt, and the district-scale Fleur de Lys project in northwestern Newfoundland, that is targeting Dalradian-type orogenic gold mineralization similar to the Curraghinalt and Cavanacaw deposits in Northern Ireland. Sokoman also recently entered into a strategic alliance with Benton Resources Inc. through three, large-scale joint-venture properties including Grey River, Golden Hope and Kepenkeck in Newfoundland.

Sokoman now controls, independently and through the Benton alliance, over 150,000 hectares (>6,000 claims – 1500 sq. km), making it one of the largest landholders in Newfoundland, in Canada’s newest and rapidly-emerging gold districts. The Company also retains an interest in an early-stage antimony/gold project (Startrek) in Newfoundland, optioned to White Metal Resources Inc., and in Labrador, the Company has a 100% interest in the Iron Horse (Fe) project which has Direct Shipping Ore (DSO) potential.

About Benton Resources Inc.

Benton Resources Inc. is a well-funded mineral exploration company listed on the TSX Venture Exchange under the symbol BEX. Following a project generation business model, Benton has a diversified, highly-prospective property portfolio in Gold, Silver, Nickel, Copper, and Platinum Group Elements and currently holds large equity positions in other mining companies that are advancing high-quality assets. Whenever possible, BEX retains Net Smelter Return (NSR) royalties for potential long-term cash flow. Benton has also recently entered into a 50/50 strategic alliance with Sokoman Minerals Corp. (TSXV: SIC) through three large-scale joint venture properties including Grey River, Golden Hope and Kepenkeck in Newfoundland that are now being explored.

Mineralization hosted on adjacent and/or nearby properties is not necessarily indicative of mineralization hosted on Sokoman’s property.

Sokoman would like to thank the Government of Newfoundland and Labrador for financial support of the Fleur de Lys Project through the Junior Exploration Assistance Program.

For further information, please contact:

Sokoman Minerals

Timothy Froude, P.Geo., President & CEO

Phone: 709-765-1726

Email: tim@sokomanmineralscorp.com

CHF Capital Markets

Cathy Hume, CEO

Phone: 416-868-1079 x251

Email: cathy@chfir.com

Benton Resources

Stephen Stares, President & CEO

Phone: 807-475-7474

Email: sstares@bentonresources.ca

Website: www.sokomanmineralscorp.com , www.bentonresources.ca

Twitter: @SokomanMinerals , @BentonResources

Facebook: @SokomanMinerals , @BentonResourcesBEX

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Investors are cautioned that trading in the securities of the Corporation should be considered highly speculative. Except for historical information contained herein, this news release contains forward- looking statements that involve risks and uncertainties. Actual results may differ materially. Sokoman Minerals Corp. will not update these forward-looking statements to reflect events or circumstances after the date hereof. More detailed information about potential factors that could affect financial results is included in the documents filed from time to time with the Canadian securities regulatory authorities by Sokoman Minerals Corp.

Sokoman Reports Strong Gold Grain Counts In Till At Fleur De Lys Project North-Central Newfoundland

Multiple targets outlined in Phase 1 Program from 50% of Results

St. John’s, NL, October 06, 2021 – Sokoman Minerals Corp. (TSXV: SIC) (OTCQB: SICNF) (the “Company” or “Sokoman”) is pleased to announce that the Phase 1, C-Horizon till sampling program, at the Fleur de Lys Gold Project has been completed with preliminary results outlining multiple anomalous areas. A total of 823 samples were collected in Phase 1 on lines 1.5 km to 2 km apart with sample spacing along the lines at 250 m. To date, gold grain counts have been received for 400 samples with multiple anomalies identified. The table below outlines the number of samples reporting anomalous results.

Based on discussions with Ottawa-based Overburden Drilling Management (ODM), the company overseeing the project, background gold grain counts have been determined to be 10 grains per sample with an anomalous sample having 2X background or 20 gold grains. Of the 400 results received to date, 109 contain at least 20 gold grains and are considered anomalous with the two highest gold grain counts, 111 and 116 grains, carrying 90 and 84 pristine grains respectively, suggesting a very local source (less than 200 metres) on the Fleur de Lys property. A follow-up program of infill tills, based on the results to date, will commence immediately.

The field crews have also collected 60-plus rock samples with all samples pending assays. Most samples submitted for assay have in excess of 1% pyrite (iron sulphide), chalcopyrite (copper sulphide), or galena (lead sulphide).

It is expected that follow-up till sampling and prospecting will continue until late fall.

Tim Froude, President and CEO of Sokoman, said: “We are extremely pleased with the results to date at the Fleur de Lys Gold Project where our exploration has defined multiple areas where gold in till is strongly suggesting a source area in Fleur de Lys units. The Fleur de Lys Supergroup that underlies the area are equivalent rocks to the Dalradian Supergroup in the UK, where three significant gold deposits are known to occur, including the Curraghinalt and Cavanacaw deposits in Northern Ireland, and Cononish in Scotland. These gold deposits occur in moderate- to high-grade metamorphic terrains, like the Fleur de Lys, and involve significant gold resources. For example, the Curraghinalt deposit has more than 6 million ounces of NI 43-101 compliant gold resources, including 6.3 M tonnes at 15 g/t (M+I) and 7.2 M tonnes at 12.24 g/t (Inferred).”

About the Fleur de Lys Gold Project

The 100%-owned Fleur de Lys Gold Project is located on the Baie Verte Peninsula in north-central Newfoundland. The area is highly prospective for Dalradian-style (e.g., Curraghinalt) orogenic vein-hosted gold deposits and as such, represents a readily accessible yet underexplored, district-scale, gold target in the Newfoundland Appalachians. The property has seen little modern exploration, with some areas remaining completely unexplored. Historical grab sample grades of 3.3 g/t Au to 25.5 g/t Au are reported from several separate locations (Note: historical assays have not been verified by the Company and should not be relied upon.)

Reconnaissance till sampling by Sokoman in 2019/2020 in the Fleur de Lys belt defined multiple gold targets, in 129 C-horizon till samples, was sent to Overburden Drilling Management (ODM) in Ottawa for gold grain analysis. Results gave 38 samples with >20 grains, 14 >40 grains and a maximum of 122 grains with many with high gold grain counts having a high percentage (30-80%) of pristine grains, suggesting a local (< 1 km) source for the gold. The 2021 exploration has continued this early work and has already defined targets for follow-up in 2021 and more advanced exploration in 2022.

QP

This news release has been reviewed and approved by Timothy Froude, P.Geo., a “Qualified Person” under National Instrument 43-101 and President and CEO of Sokoman Minerals Corp.

COVID-19 Protocols

To ensure a working environment that protects the health and safety of the staff and contractors, Sokoman is operating under federally and provincially mandated and recommended guidelines during the current COVID-19 alert level.

Till Sampling QA/QC

The till samples were collected by Sokoman personnel using field collection techniques provided by ODM. All samples were hand dug to the desired depth (C- Horizon Till) with a 10 kg -12 kg sieved sample (8 mesh) placed in a clear-plastic sample bag and sealed. Samples were shipped in plastic pails by bonded courier to the ODM lab in Ottawa, Ontario. The till samples were processed using procedures designed to progressively concentrate the heavy minerals, expose the gold grains, and prepare a split of the heavy mineral concentrate (“HMC”), suitable for geochemical analysis if requested. The sample is wet screened at 2 mm with a preliminary concentrate extracted from the -2 mm fraction by tabling. Geological observations on the character of the sample are made during both the screening and tabling operations. The table concentrate is purposely large (typically 300 g – 400 g) and of low grade (10% – 25% heavy minerals) to achieve a high, 80% to 90% recovery rate for all desired heavy minerals irrespective of their grain size or relative specific gravity. The gold grains, more than 95% of which are normally silt-sized (Averill 2001), are observed at this stage with the aid of micro-panning and are counted, measured, and classified as to degree of wear (i.e. distance of glacial transport), then returned to the table concentrate. The pyrite content of the pan concentrate is estimated and the number of grains of heavier, visually distinctive indicator minerals such as arsenopyrite, galena, scheelite, cinnabar etc. is recorded.

Quality Control and Quality Assurance Measures

In addition to using field duplicates to monitor the quality of the indicator mineral data obtained from specific projects, ODM performs blind tests to ensure that the recovery rates for all targeted minerals are consistently in the 80 to 90% range. Furthermore, both the quality of the mineral separation and the overall mineralogy of the concentrate are visible at every stage of the concentration process, minimizing the potential for sample mix-ups, indicator mineral carryover between samples and other potential contamination issues. For example, gold grains, which are the most important indicator mineral on many surveys, are more susceptible to inter-sample carryover than any other indicator mineral due to their very small size, but these grains are physically observed during the first stage of mineral concentration, tabling, and, if anomalous concentrations are present, blank samples are tabled and carefully inspected for gold grains before the next project sample is processed.

About Sokoman Minerals Corp.

Sokoman Minerals Corp. is a discovery-oriented company with projects in the province of Newfoundland and Labrador, Canada. The Company’s primary focus is its portfolio of gold projects; flagship, advanced-stage Moosehead, Crippleback Lake (optioned to Trans Canada Gold Corp.) and East Alder (optioned to Canterra Minerals Corporation) along the Central Newfoundland Gold Belt, and the district-scale Fleur de Lys Gold Project in northwestern Newfoundland, that is targeting Dalradian-type orogenic gold mineralization similar to the Curraghinalt and Cavanacaw deposits in Northern Ireland. The Company also recently entered into a strategic alliance with Benton Resources Inc. through three, large-scale joint-venture properties including Grey River, Golden Hope and Kepenkeck in Newfoundland.

Sokoman now controls, independently and through the Benton alliance, over 150,000 hectares (>6,000 claims – 1500 sq. km), making it one of the largest landholders in Newfoundland, in Canada’s newest and rapidly-emerging gold districts. The Company also retains an interest in an early-stage antimony/gold project (Startrek) in Newfoundland, optioned to White Metal Resources Inc., and in Labrador, the Company has a 100% interest in the Iron Horse (Fe) project which has Direct Shipping Ore (DSO) potential.

Mineralization hosted on adjacent and/or nearby properties is not necessarily indicative of mineralization hosted on the Company’s property.

The Company would like to thank the Government of Newfoundland and Labrador for financial support of the Fleur de Lys Gold Project through the Junior Exploration Assistance Program.

For further information, please contact:

Sokoman Minerals

Timothy Froude, P.Geo., President & CEO

Phone: 709-765-1726

Email: tim@sokomanmineralscorp.com

CHF Capital Markets

Cathy Hume, CEO

Phone: 416-868-1079 x251

Email: cathy@chfir.com

Website: www.sokomanmineralscorp.com

Twitter: @SokomanMinerals

Facebook: @SokomanMinerals

LinkedIn: @SokomanMinerals

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Investors are cautioned that trading in the securities of the Corporation should be considered highly speculative. Except for historical information contained herein, this news release contains forward- looking statements that involve risks and uncertainties. Actual results may differ materially. Sokoman Minerals Corp. will not update these forward-looking statements to reflect events or circumstances after the date hereof. More detailed information about potential factors that could affect financial results is included in the documents filed from time to time with the Canadian securities regulatory authorities by Sokoman Minerals Corp.

Sokoman Expands 75 Zone And Releases Additional Results From Eastern Trend, Moosehead Gold Project, Central Newfoundland

New Structure Intersected 300 m East of Eastern Trend;

Barge-Based Drilling on North Pond Underway at Footwall Splay and Upper Eastern Trend

St. John’s, NL, September 28, 2021 – Sokoman Minerals Corp. (TSXV: SIC) (OTCQB: SICNF) (the “Company” or “Sokoman”) is pleased to announce that ongoing Phase 6 drilling at the 100%-owned Moosehead Property in central Newfoundland has intersected additional high-grade gold mineralization at both the Lower Eastern Trend and in the 75 Zone, located approximately 100 m along strike south of the main Eastern Trend. (Note: see full table of results, plan map and long section for the 75 Zone and the Eastern Trend further in this release. Not all previous intersections appear on section.)

Highlights of the recently-received rush assays (including total pulp metallics) include:

MH-21-234: 30.59 g/t Au over 2.75 m (within 4.80 m of 17.56 g/t Au)

from the 75 ZoneMH-21-243: 32.72 g/t Au over 1.70 m (within 9.20 m of 6.70 g/t Au)

from the 75 ZoneMH-21-215: 36.15 g/t Au over 0.35 m (within 2.35 m of 20.39 g/t Au)

from the Eastern TrendMH-21-229: 18.41 g/t Au over 2.10 m (within 5.10 m of 7.64 g/t Au)

from the Eastern Trend

The Company is also pleased to announce that reconnaissance drilling testing for the source of gold-bearing boulders, discovered earlier this year 300 m to the east of North Pond (see July 6, 2021 news release), has intersected a significant structure (named the 253 Zone), featuring strong quartz veining and variable sulphide mineralization, mainly pyrite and arsenopyrite. Assays are pending and additional drilling is planned.

Tim Froude, President and CEO of Sokoman, says: “We are extremely pleased with the progress of Phase 6 with approximately 19,000 m remaining to be drilled this year. Today’s results give strong support to the growth potential of the 75 Zone with the drilling suggesting that the 75 Zone is linked to the larger Eastern Trend to the north. Our goal is to verify this connection by drilling step-out holes to the north and also down-plunge to test the zone at depth.

“The barge-based component of Phase 6 has started, and the first hole has been completed without any issues with drilling to continue until freeze-up, expected to be in late November / early December. At least 5,000 m of drilling is planned to test the Upper Eastern Trend and Footwall Splay targets where previous drilling has given some of our best holes to date including earlier Phase 6 hole MH-21-115 that gave 4.6 m of 47 g/t Au (Footwall Splay) and 8 m of 68 g/t Au (Upper Eastern Trend).

“We are also pleased to report that drilling which tested the area of the VG boulders, located earlier this summer (July 6, 2021, News Release), has intersected a previously unknown structure, parallel to the main Eastern Trend. The new structure (the 253 Zone), which carries significant veining with associated sulphides, is potentially several kilometres in strike extent based on geophysics, is open both to the northeast and southwest and will be subject to further drilling this fall. Assays are pending and further details will be provided once additional holes have been completed and assays have been received.

“We currently have four drills at Moosehead, including the recently arrived barge rig. Our intention is to temporarily relocate one of the land-based rigs for a month to carry out a Phase 1 drill program (2,000 m) at our Grey River JV with Benton Resources Inc. to test high-priority targets before winter sets in. This will take place shortly with the rig returning to Moosehead to continue testing regional targets, including the newly discovered 253 Zone until year-end.”

75 Zone

Drilling at the 75 Zone continues on 10 m – 15 m step-outs from MH-19-75, originally drilled in the fall of 2019 that had a 5.80 m intersection of 6.93 g/t Au from 87.50 m downhole, including two visible gold-bearing veins that gave 30.42 g/t Au over 0.30 m, and 32.99 g/t Au over 0.80 m. MH-21-234, collared 60 m northwest of MH-19-75, gave 30.59 g/t Au over 2.75 m (within 4.80 m of 17.56 g/t Au). MH-21-243, collared 80 m south-southwest of MH-19-75, gave 32.72 g/t Au over 1.70 m (within 9.20 m of 6.70 g/t Au). These results give the 75 Zone a minimum 100 m north-south strike extent and open to depth from surface. Drilling will continue in the area until the end of the season.

Eastern Trend

One drill continues to infill / extend gold mineralization in the Lower Eastern Trend, and the barge-based drilling has commenced in the Upper Eastern Trend / Footwall Splay targets. Results from the Eastern Trend and the 75 Zone, up to September 28, 2021, are shown in the table below.

Results to-date indicate good continuity with high-grade intersections in the Lower Eastern Trend, including holes MH-21-215 and 229. MH-21-229, designed to test the up-dip continuity of an interpreted high-grade ore shoot 20 m above MH-20-98. MH-20-98 intersected 4.16 g/t Au / 5.65 m including 8.21 g/t Au / 2.50 m at a downhole depth of 296 m. MH-21-229 intersected 18.41 g/t Au over 2.10 m (within 5.10 m of 7.64 g/t Au), showing good continuity in the area that has received limited drilling. MH-21-215 cut two zones of mineralization including a high-grade zone of 36.15 g/t Au over 0.35 m (within 2.35 m of 20.39 g/t Au), and a lower zone of 2.01 g/t Au over 2.70 m with considerable up-plunge potential. At least 5,000 m remain to be completed in this area this year.

About the Moosehead Gold Project

The 100%-owned Moosehead Gold Project is located along the Trans-Canada Highway in north-central Newfoundland, on the same structural trend as the advanced Valentine Lake Project (Marathon Gold), and adjacent to New Found Gold’s Queensway Project. Both the Moosehead and Queensway projects are targeting high-grade, turbidite-hosted, Fosterville-type gold mineralization. At least five zones of significant gold bearing mineralization have been identified to date at Moosehead with multiple high-priority targets, independent of the known zones, remaining to be tested. In Phases 1 to 5, the Company completed 23,378 m (106 holes). In Phase 6, the Company has completed 31,000 m in 170 holes (up to MH-21-280) of the 50,000 m drill program.

QP

This news release has been reviewed and approved by Timothy Froude, P.Geo., a “Qualified Person” under National Instrument 43-101 and President and CEO of Sokoman Minerals Corp.

COVID-19 Protocols

To ensure a working environment that protects the health and safety of the staff and contractors, Sokoman is operating under federally and provincially mandated and recommended guidelines during the current COVID-19 alert level.

Analytical Techniques / QA/QC

All core samples submitted for assay were saw cut by Sokoman personnel with one-half submitted for assay and one-half retained for reference. Samples were delivered in sealed bags directly to the lab by Sokoman personnel. Samples, including duplicates, blanks and standards, were submitted to Eastern Analytical Ltd. in Springdale, Newfoundland for gold analysis. Eastern Analytical Ltd. is an accredited assay lab that conforms to the requirements of ISO/IEC 17025. Samples with possible visible gold were submitted for total pulp metallics and gravimetric finish. All other samples were analyzed by standard fire assay methods. Total pulp metallic analysis includes: the whole sample is crushed to -10 mesh; then pulverized to 95% -150 mesh. The total sample is weighed and screened to 150 mesh; the +150 mesh fraction is fire assayed for Au, and a 30 g subsample of the -150 mesh fraction is fire assayed for Au; with a calculated weighted average of total Au in the sample reported as well. One blank and one industry approved standard for every twenty samples submitted, is included in the sample stream. Random duplicates of selected samples are analyzed in addition to the in-house standard and duplicate policies of Eastern Analytical Ltd. All reported assays are uncut.

About Sokoman Minerals Corp.

Sokoman Minerals Corp. is a discovery-oriented company with projects in the province of Newfoundland and Labrador, Canada. The Company’s primary focus is its portfolio of gold projects; flagship, advanced-stage Moosehead, Crippleback Lake (optioned to Trans Canada Gold Corp.) and East Alder (optioned to Canterra Minerals Corporation) along the Central Newfoundland Gold Belt, and the district-scale Fleur de Lys project in northwestern Newfoundland, that is targeting Dalradian-type orogenic gold mineralization similar to the Curraghinalt and Cavanacaw deposits in Northern Ireland. The Company also recently entered into a strategic alliance with Benton Resources Inc. through three, large-scale joint-venture properties including Grey River, Golden Hope and Kepenkeck in Newfoundland.

Sokoman now controls, independently and through the Benton alliance, over 150,000 hectares (>6,000 claims – 1500 sq. km), making it one of the largest landholders in Newfoundland, in Canada’s newest and rapidly-emerging gold districts. The Company also retains an interest in an early-stage antimony/gold project (Startrek) in Newfoundland, optioned to White Metal Resources Inc., and in Labrador, the Company has a 100% interest in the Iron Horse (Fe) project which has Direct Shipping Ore (DSO) potential.

Mineralization hosted on adjacent and/or nearby properties is not necessarily indicative of mineralization hosted on the Company’s property.

The Company would like to thank the Government of Newfoundland and Labrador for financial support of the Moosehead Project through the Junior Exploration Assistance Program.

Plan Map Moosehead

Moosehead Eastern Trend – 75 Zone, Inclined Long Section

For further information, please contact:

Sokoman Minerals

Timothy Froude, P.Geo., President & CEO

Phone: 709-765-1726

Email: tim@sokomanmineralscorp.com

CHF Capital Markets

Cathy Hume, CEO

Phone: 416-868-1079 x251

Email: cathy@chfir.com