Newsroom

Sokoman And Benton Confirm High-Grade Gold And Receipt Of Drill Permits For Grey River, Southern Newfoundland

Chip sampling with visible gold returns up to 134.46 g/t Au

St. John’s, NL, September 2, 2021 – Sokoman Minerals Corp. (TSXV: SIC) (OTCQB: SICNF) (“Sokoman”) and Benton Resources Inc. (TSXV: BEX) (“Benton”), members of a joint exploration alliance previously announced on May 27, 2021 (together, “the Alliance”), are pleased to announce they have received high-grade gold assays up to 134.46 g/t Au (visible gold noted in sample) at the Grey River Joint Venture located on the south coast of Newfoundland. The Alliance collected a series of grab and chip samples from outcrop and local float, and assays range from less than detection to 134.46 g/t Au (sampling details provided below). The sampling focused on an area roughly 500 m by 300 m immediately west of Gulch Cove where historical gold values of 225 g/t Au were reported by previous workers (see map).

The high-grade visible gold-bearing sample (480309) is located a few metres from tidewater and consisted of a 0.50 cm chip believed to be at the same location as the 225 g/t Au historical sample reported by previous workers. The sample also contained anomalous bismuth (>1000 ppm Bi), and silver (>6 ppm Ag), for which overlimit assaying is pending. A second sample (480310), contiguous with the aforementioned sample, returned 3.09 g/t Au from a 30 cm chip. In addition, a number of anomalous grab samples ranging from less than detection to 1.22 g/t Au were returned from the sampling over a 500 m strike length of the quartz zone that has been mapped by the government over an 8 kilometre E-W strike length and up to 300 m in width. Further sampling along this trend to the west has been completed in recent days and submitted for assay.

The Alliance has also completed sampling of five archived drill holes that were drilled for silica by the Newfoundland government in 1968. The drilling took place approximately 2 kilometres east of where the high-grade results are located. Examination of the old cores revealed up to 2% disseminated pyrite locally, and for which no records of gold assaying could be found. A total of 23 samples were taken that ranged from 0.25 m to 2.80 m in length with an average length of 1.21 m. Samples were sent to Eastern Analytical Ltd. in Springdale, NL for Au and ICP analysis.

The Alliance is also very pleased to announce that drilling permits have been received, and it intends to proceed immediately with sourcing a drill and crew, as well as addressing the logistical issues that will be faced. Drilling will most likely take place in October when conditions on the South Coast are more amenable to flying as it will be a helicopter-supported program. Total metres and number of holes will be refined once the geophysics has been modelled with the assay data and geology.

A recently completed Heliborne High Resolution Magnetic and Matrix Digital VLF-EM Survey flown by Terraquest Ltd. totaling 1099-line kilometres is currently being processed and will be used to further refine drill targets on the property.

The Grey River Project is targeting high-grade vein-hosted gold mineralization similar in style to the world class Pogo Mine in Alaska with past production of more than four million ounces of gold and current reserves of 5.9 Mt @ 8.0 g/t gold (1.5 million ounces gold) and resources of 23 Mt @ 9.8 g/t gold (6.9 million ounces gold). Source: Northern Star Resources Website – August 2021.

Mineralization hosted at the Pogo Mine in Alaska is not necessarily indicative of mineralization hosted on the Grey River property.

QP

This news release has been reviewed and approved by Timothy Froude, P.Geo., President and CEO of Sokoman Minerals Corp., and Nathan Sims, P.Geo., Senior Exploration Manager for Benton Resources Inc., both the ‘Qualified Person’ under National Instrument 43-101.

Sample Analysis

The samples were collected and delivered in sealed bags to Eastern Analytical Ltd. in Springdale, NL, by company personnel. Eastern Analytical Ltd. is an accredited assay lab that conforms to the requirements of ISO/IEC 17025. All samples were submitted for 34 element ICP analysis and gold by fire assay analysis. Two samples, 480309 and 480310, were submitted for total pulp metallics and gravimetric finish, based on the presence of visible gold in sample 480309. Analysis includes: the whole sample is crushed to -10 mesh; then pulverized to 95% -150 mesh. The total sample is weighed and screened 150 mesh; the +150 mesh fraction is fire assayed for Au, and a 30 g subsample of the -150 mesh fraction is fire assayed for Au; with a calculated weighted average of total Au in the sample reported as well. Duplicates of selected samples are analyzed in addition to the in-house standard and duplicate policies of Eastern Analytical Ltd. All reported assays are uncut.

COVID-19 Protocols

To ensure a working environment that protects the health and safety of the staff and contractors, Sokoman and Benton are operating under federally and provincially mandated and recommended guidelines during the current COVID-19 alert level.

About Sokoman Minerals Corp.

Sokoman Minerals Corp. is a discovery-oriented company with projects in Newfoundland and Labrador, Canada. The company’s primary focus is its portfolio of gold projects: flagship, 100%-owned Moosehead, Crippleback Lake (optioned to Trans Canada Gold Corp.) and East Alder (optioned to Canterra Minerals Corporation) along the Central Newfoundland Gold Belt, and the district-scale Fleur de Lys project in northwestern Newfoundland, that is targeting Dalradian-type orogenic gold mineralization similar to the Curraghinalt and Cavanacaw deposits in Northern Ireland, and Cononish in Scotland. The company also recently entered into a strategic alliance with Benton Resources Inc. through three large-scale joint-venture properties including Grey River Gold, Golden Hope and Kepenkeck in Newfoundland. Sokoman now controls independently and through the Benton alliance over 150,000 hectares (>6,000 claims – 1,500 sq. km), making it one of the largest landholders in Newfoundland, Canada’s newest and rapidly-emerging gold districts. The Company also retains an interest in an early-stage antimony/gold project (Startrek) in Newfoundland, optioned to White Metal Resources Inc., and in Labrador, the Company has a 100%-interest in the Iron Horse (Fe) project that has Direct Shipping Ore (DSO) potential.

About Benton Resources Inc.

Benton Resources Inc. is a well-funded mineral exploration company listed on the TSX Venture Exchange under the symbol BEX. Following a project generation business model, Benton has a diversified, highly-prospective property portfolio in Gold, Silver, Nickel, Copper, and Platinum Group Elements and currently holds large equity positions in other mining companies that are advancing high-quality assets. Whenever possible, BEX retains Net Smelter Return (NSR) royalties for potential long-term cash flow. Benton has also recently entered into a 50/50 strategic alliance with Sokoman Minerals Corp. (TSXV: SIC) through three large-scale joint venture properties including Grey River, Golden Hope and Kepenkeck in Newfoundland that are now being explored.

For further information, please contact:

CHF Capital Markets

Cathy Hume, CEO

Phone: 416-868-1079 x251

Email: cathy@chfir.com

Sokoman Minerals

Timothy Froude, P.Geo., President & CEO

Phone: 709-765-1726

Email: tim@sokomanmineralscorp.com

Benton Resources

Stephen Stares, President & CEO

Phone: 807-475-7474

Email: sstares@bentonresources.ca

Website: www.bentonresources.ca , www.sokomanmineralscorp.com

Twitter: @BentonResources , @SokomanMinerals

Facebook: @BentonResourcesBEX , @SokomanMinerals

THE TSX VENTURE EXCHANGE HAS NOT REVIEWED AND DOES NOT ACCEPT RESPONSIBILITY FOR THE ADEQUACY OR ACCURACY OF THIS RELEASE.

The information contained herein contains “forward-looking statements” within the meaning of applicable securities legislation. Forward-looking statements relate to information that is based on assumptions of management, forecasts of future results, and estimates of amounts not yet determinable. Any statements that express predictions, expectations, beliefs, plans, projections, objectives, assumptions or future events or performance are not statements of historical fact and may be “forward-looking statements.”

Forward-looking statements are subject to a variety of risks and uncertainties which could cause actual events or results to differ from those reflected in the forward-looking statements, including, without limitation: risks related to failure to obtain adequate financing on a timely basis and on acceptable terms; risks related to the outcome of legal proceedings; political and regulatory risks associated with mining and exploration; risks related to the maintenance of stock exchange listings; risks related to environmental regulation and liability; the potential for delays in exploration or development activities or the completion of feasibility studies; the uncertainty of profitability; risks and uncertainties relating to the interpretation of drill results, the geology, grade and continuity of mineral deposits; risks related to the inherent uncertainty of production and cost estimates and the potential for unexpected costs and expenses; results of prefeasibility and feasibility studies, and the possibility that future exploration, development or mining results will not be consistent with the Company’s expectations; risks related to gold price and other commodity price fluctuations; and other risks and uncertainties related to the Company’s prospects, properties and business detailed elsewhere in the Company’s disclosure record. Should one or more of these risks and uncertainties materialize, or should underlying assumptions prove incorrect, actual results may vary materially from those described in forward-looking statements. Investors are cautioned against attributing undue certainty to forward-looking statements. These forward-looking statements are made as of the date hereof and the Company does not assume any obligation to update or revise them to reflect new events or circumstances. Actual events or results could differ materially from the Company’s expectations or projections.

Sokoman Receives Final Water Permit For Barge-Based Drilling At Moosehead Gold Project, Newfoundland

St. John’s, NL, August 18, 2021 – Sokoman Minerals Corp. (TSXV: SIC) (OTCQB: SICNF) (the “Company” or “Sokoman”) today announced that it has received the Water Resources Permit from the Government of Newfoundland and Labrador to begin barge-based drilling at the Company’s 100%-owned Moosehead Gold Project in central Newfoundland. The recently arrived third drill rig will be moved onto the barge once the drilling of a fence of holes at the 75 Zone is finished. The barge drill program will focus on the Upper Eastern Trend and Footwall Splay targets, estimated to constitute between 5,000 m and 10,000 m of drilling, with drill hole depths expected to be 100 m or less with a few reaching 215 m. The drill program is expected to run into the fall.

About the Moosehead Gold Project

The 100%-owned Moosehead Gold Project is located along the Trans-Canada Highway in north-central Newfoundland, Canada, on the same structural trend as the advanced Valentine Lake Project (Marathon Gold), and adjacent to New Found Gold’s Queensway Project. Both the Moosehead and Queensway projects are targeting high-grade, turbidite-hosted, Fosterville-type gold mineralization. At least five zones of significant gold-bearing mineralization have been identified at Moosehead with multiple high-priority targets, independent of the known zones, remaining to be tested. Drilling to date has constituted 23,378 m in 106 holes in Phases 1 to 5, and 24,500 m in 135 holes of a planned 50,000 m program in Phase 6.

QP

This news release has been reviewed and approved by Timothy Froude, P.Geo., a “Qualified Person” under National Instrument 43-101 and President and CEO of Sokoman Minerals Corp.

COVID-19 Protocols

To ensure a working environment that protects the health and safety of the staff and contractors, Sokoman is operating under federally and provincially mandated and recommended guidelines during the current COVID-19 alert level.

About Sokoman Minerals Corp.

Sokoman Minerals Corp. is a discovery-oriented company with gold projects in Newfoundland and Labrador, Canada. The Company’s primary focus is its portfolio of gold projects including the 100%-owned, high-grade, Fosterville-type Moosehead Gold, and the Crippleback Lake (optioned to Trans Canada Gold Corp.), and East Alder (optioned to Canterra Minerals Corporation) Projects, all of which lie along the Central Newfoundland Gold Belt, as well as the 100%-owned, district-scale Fleur de Lys project in north-western Newfoundland, which is targeting Dalradian-type gold mineralization similar to the Curraghinalt and Cavanacaw deposits in Northern Ireland. In addition, the Company recently entered into a strategic alliance with Benton Resources Inc. through three large-scale joint-venture properties for gold, with potential for other minerals, in Newfoundland – Grey River, Golden Hope and Kepenkeck.

Sokoman now controls independently, and through the Benton Alliance, over 150,000 hectares (>6,000 claims – 1500 sq. km), making it one of the largest landholders in Newfoundland, Canada’s newest and rapidly emerging gold district. The Company also retains an interest in an early-stage antimony/gold project (Startrek) in Newfoundland, optioned to White Metal Resources Inc., and in Labrador, the Company has a 100%-interest in the Iron Horse (Fe) project which has Direct Shipping Ore (DSO) potential.

Mineralization hosted on adjacent and/or nearby properties is not necessarily indicative of mineralization hosted on the Company’s property.

The Company would like to thank the Government of Newfoundland and Labrador for financial support of the Moosehead Project through the Junior Exploration Assistance Program.

For further information, please contact:

CHF Capital Markets

Cathy Hume, CEO

Phone: 416-868-1079 x251

Email: cathy@chfir.com

Sokoman Minerals

Timothy Froude, P.Geo., President & CEO

Phone: 709-765-1726

Email: tim@sokomanmineralscorp.com

Website: www.sokomanmineralscorp.com

Twitter: @SokomanMinerals

Facebook: @SokomanMinerals

LinkedIn: @SokomanMinerals

THE TSX VENTURE EXCHANGE HAS NOT REVIEWED AND DOES NOT ACCEPT RESPONSIBILITY FOR THE ADEQUACY OR ACCURACY OF THIS RELEASE.

The information contained herein contains “forward-looking statements” within the meaning of applicable securities legislation. Forward-looking statements relate to information that is based on assumptions of management, forecasts of future results, and estimates of amounts not yet determinable. Any statements that express predictions, expectations, beliefs, plans, projections, objectives, assumptions or future events or performance are not statements of historical fact and may be “forward-looking statements.”

Forward-looking statements are subject to a variety of risks and uncertainties which could cause actual events or results to differ from those reflected in the forward-looking statements, including, without limitation: risks related to failure to obtain adequate financing on a timely basis and on acceptable terms; risks related to the outcome of legal proceedings; political and regulatory risks associated with mining and exploration; risks related to the maintenance of stock exchange listings; risks related to environmental regulation and liability; the potential for delays in exploration or development activities or the completion of feasibility studies; the uncertainty of profitability; risks and uncertainties relating to the interpretation of drill results, the geology, grade and continuity of mineral deposits; risks related to the inherent uncertainty of production and cost estimates and the potential for unexpected costs and expenses; results of prefeasibility and feasibility studies, and the possibility that future exploration, development or mining results will not be consistent with the Company’s expectations; risks related to gold price and other commodity price fluctuations; and other risks and uncertainties related to the Company’s prospects, properties and business detailed elsewhere in the Company’s disclosure record. Should one or more of these risks and uncertainties materialize, or should underlying assumptions prove incorrect, actual results may vary materially from those described in forward-looking statements. Investors are cautioned against attributing undue certainty to forward-looking statements. These forward-looking statements are made as of the date hereof and the Company does not assume any obligation to update or revise them to reflect new events or circumstances. Actual events or results could differ materially from the Company’s expectations or projections.

Sokoman And Benton Announce Discovery Of High-Grade Lithium-Bearing Pegmatites At Golden Hope In Southwestern Newfoundland

Two samples, 110 m apart, return 1.95% and 0.49% Li2O respectively

St. John’s, NL, August 16, 2021 – Sokoman Minerals Corp. (TSXV: SIC) (OTCQB: SICNF) (“Sokoman”) and Benton Resources Inc. (TSXV: BEX) (“Benton”), which are 50/50 members of a joint exploration alliance previously announced on May 10, 2021 (together, “the Alliance”), are pleased to announce that they have discovered a swarm of lithium-bearing pegmatite dikes on the Golden Hope Joint Venture Project in southwestern Newfoundland, Canada. Benton’s President and CEO Stephen Stares and Director Michael Stares, along with Sokoman’s President and CEO Timothy Froude and consultant Sean O’Brien, identified the pegmatites on a recent field visit, collecting three grab samples over a 110-m-width across the dykes. Two of the samples returned 1.95% Li2O and 0.49% Li2O, believed to be the first discovery of significant lithium mineralization on the Island of Newfoundland. Lithium occurrences in the Appalachian belt are well known and include important deposits in the Carolinas in the eastern US, as well as in the geologically equivalent Caledonides of Ireland.

The lithium mineralization is situated in a so-far unknown-sized zone or swarm of pegmatite dykes with an apparent width of 110 m and as-yet unknown strike length. Random grab samples were collected near what is believed to be the northern and southern limits of the zone and submitted to Actlabs in Ancaster, Ontario for analysis by Sodium Peroxide Fusion ICPOES + ICPMS.

The focus of the Alliance remains the gold potential of the Golden Hope Project. However, the discovery of the lithium-bearing pegmatites is significant, therefore Sokoman and Benton will pursue this opportunity for the benefit of their respective shareholders. As a reference, Canaccord Genuity Group Inc., in an August 12, 2021 update report on lithium, forecasts lithium prices to continue climbing on growing demand from higher-than-expected global electric vehicle sales paired with supply shortfalls.

Sokoman’s President and CEO, Timothy Froude, P.Geo., states: “The discovery of what we believe to be the first lithium-rich pegmatites in Newfoundland could be very significant for shareholders of both Sokoman and Benton. A crew will be dispatched to the discovery site later this week for detailed sampling and documentation of the dykes. While the Alliance remains firmly committed to the evaluation of the gold potential of the property, we believe that the new discovery requires immediate follow-up sampling. This is a prime example of the enormous untapped resource potential that the Island has to offer.”

“To be part of the first ever lithium discovery in Newfoundland is simply extraordinary. Michael and I have previously been involved in several lithium discoveries in Ontario, so we understand the scale and grade of what it takes to make a deposit. These extremely early results at Golden Hope indicate that this new discovery could fit those criteria. We can hardly wait for the next sampling phase,” added Stephen Stares, President and CEO of Benton Resources.

The Alliance has completed the previously announced 5,709 line-km Heliborne High-Resolution Aeromagnetic & Matrix Digital VLF-EM Survey flown by Terraquest Ltd. with the data currently being processed. The survey will provide the structural / lithological setting and help identify gold-bearing structure extensions, as well as any unrecognized structures including those potentially related to the lithium pegmatites.

QP

This news release has been reviewed and approved by Timothy Froude, P.Geo., President and CEO of Sokoman Minerals Corp., and Nathan Sims, P.Geo, Senior Exploration Manager for Benton Resources Inc., both the ‘Qualified Person’ under National Instrument 43-101.

COVID-19 Protocols

To ensure a working environment that protects the health and safety of the staff and contractors, Sokoman and Benton are operating under federally and provincially mandated and recommended guidelines during the current COVID-19 alert level.

About Sokoman Minerals Corp.

Sokoman Minerals Corp. is a discovery-oriented company with projects in Newfoundland and Labrador, Canada. The Company’s primary focus is its portfolio of gold projects: flagship, 100%-owned Moosehead, Crippleback Lake (optioned to Trans Canada Gold Corp.) and East Alder (optioned to Canterra Minerals Corporation) along the Central Newfoundland Gold Belt, and the district-scale Fleur de Lys project in northwestern Newfoundland, which is targeting Dalradian-type orogenic gold mineralization similar to the Curraghinalt and Cavanacaw deposits in Northern Ireland, and Cononish in Scotland. The Company also recently entered into a strategic alliance with Benton Resources Inc. through three large-scale joint venture properties including Grey River Gold, Golden Hope and Kepenkeck in Newfoundland. Sokoman now controls independently and through the Benton alliance over 150,000 hectares (>6,000 claims – 1,500 sq. km), making it one of the largest landholders in Newfoundland, Canada’s newest and rapidly-emerging gold districts. The Company also retains an interest in an early-stage antimony/gold project (Startrek) in Newfoundland, optioned to White Metal Resources Inc., and in Labrador, the Company has a 100% interest in the Iron Horse (Fe) project that has Direct Shipping Ore (DSO) potential.

Mineralization hosted on adjacent and/or nearby properties is not necessarily indicative of mineralization hosted on the Company’s property.

About Benton Resources Inc.

Benton Resources Inc. is a well-funded mineral exploration company listed on the TSX Venture Exchange under the symbol BEX. Following a project generation business model, Benton has a diversified, highly-prospective property portfolio in Gold, Silver, Nickel, Copper, and Platinum Group Elements and currently holds large equity positions in other mining companies that are advancing high-quality assets. Whenever possible, BEX retains Net Smelter Return (NSR) royalties for potential long-term cash flow. Benton has also recently entered into a 50/50 strategic alliance with Sokoman Minerals (TSXV: SIC) through three large-scale joint venture properties including Grey River, Golden Hope and Kepenkeck in Newfoundland that are now being explored.

For further information, please contact:

CHF Capital Markets

Cathy Hume, CEO

Phone: 416-868-1079 x251

Email: cathy@chfir.com

Sokoman Minerals

Timothy Froude, P.Geo., President & CEO

Phone: 709-765-1726

Email: tim@sokomanmineralscorp.com

Benton Resources

Stephen Stares, President & CEO

Phone: 807-475-7474

Email: sstares@bentonresources.ca

Website: www.bentonresources.ca , www.sokomanmineralscorp.com

Twitter: @BentonResources , @SokomanMinerals

Facebook: @BentonResourcesBEX , @SokomanMinerals

THE TSX VENTURE EXCHANGE HAS NOT REVIEWED AND DOES NOT ACCEPT RESPONSIBILITY FOR THE ADEQUACY OR ACCURACY OF THIS RELEASE.

The information contained herein contains “forward-looking statements” within the meaning of applicable securities legislation. Forward-looking statements relate to information that is based on assumptions of management, forecasts of future results, and estimates of amounts not yet determinable. Any statements that express predictions, expectations, beliefs, plans, projections, objectives, assumptions or future events or performance are not statements of historical fact and may be “forward-looking statements.”

Forward-looking statements are subject to a variety of risks and uncertainties which could cause actual events or results to differ from those reflected in the forward-looking statements, including, without limitation: risks related to failure to obtain adequate financing on a timely basis and on acceptable terms; risks related to the outcome of legal proceedings; political and regulatory risks associated with mining and exploration; risks related to the maintenance of stock exchange listings; risks related to environmental regulation and liability; the potential for delays in exploration or development activities or the completion of feasibility studies; the uncertainty of profitability; risks and uncertainties relating to the interpretation of drill results, the geology, grade and continuity of mineral deposits; risks related to the inherent uncertainty of production and cost estimates and the potential for unexpected costs and expenses; results of prefeasibility and feasibility studies, and the possibility that future exploration, development or mining results will not be consistent with the Company’s expectations; risks related to gold price and other commodity price fluctuations; and other risks and uncertainties related to the Company’s prospects, properties and business detailed elsewhere in the Company’s disclosure record. Should one or more of these risks and uncertainties materialize, or should underlying assumptions prove incorrect, actual results may vary materially from those described in forward-looking statements. Investors are cautioned against attributing undue certainty to forward-looking statements. These forward-looking statements are made as of the date hereof and the Company does not assume any obligation to update or revise them to reflect new events or circumstances. Actual events or results could differ materially from the Company’s expectations or projections.

Sokoman Minerals Mobilizes Third Drill Rig At Moosehead Gold Project, Newfoundland

St. John’s, NL, August 10, 2021 – Sokoman Minerals Corp. (TSXV:SIC) (OTCQB:SICNF) (the “Company” or “Sokoman”) today announced that the third drill rig has arrived at the Company’s 100%-owned flagship Moosehead Gold Project in north-central Newfoundland and will be deployed immediately to test high-priority targets in the 75 Zone and Eastern Trend areas where up to 15,000 metres of the remaining 27,000 metres remain to be drilled in the current phase. Once the Water Resources Permit has been received, the drill rig will be relocated to drill from the barge that is ready to be mobilized to the property. The barge program alone could entail as much as 5,000 to 10,000 m, depending on success and depths, to target the Footwall Splay and as much of the Eastern Trend that can be accessed. The contractor is also in the process of securing the fourth drill rig and crew for deployment as soon as practicable.

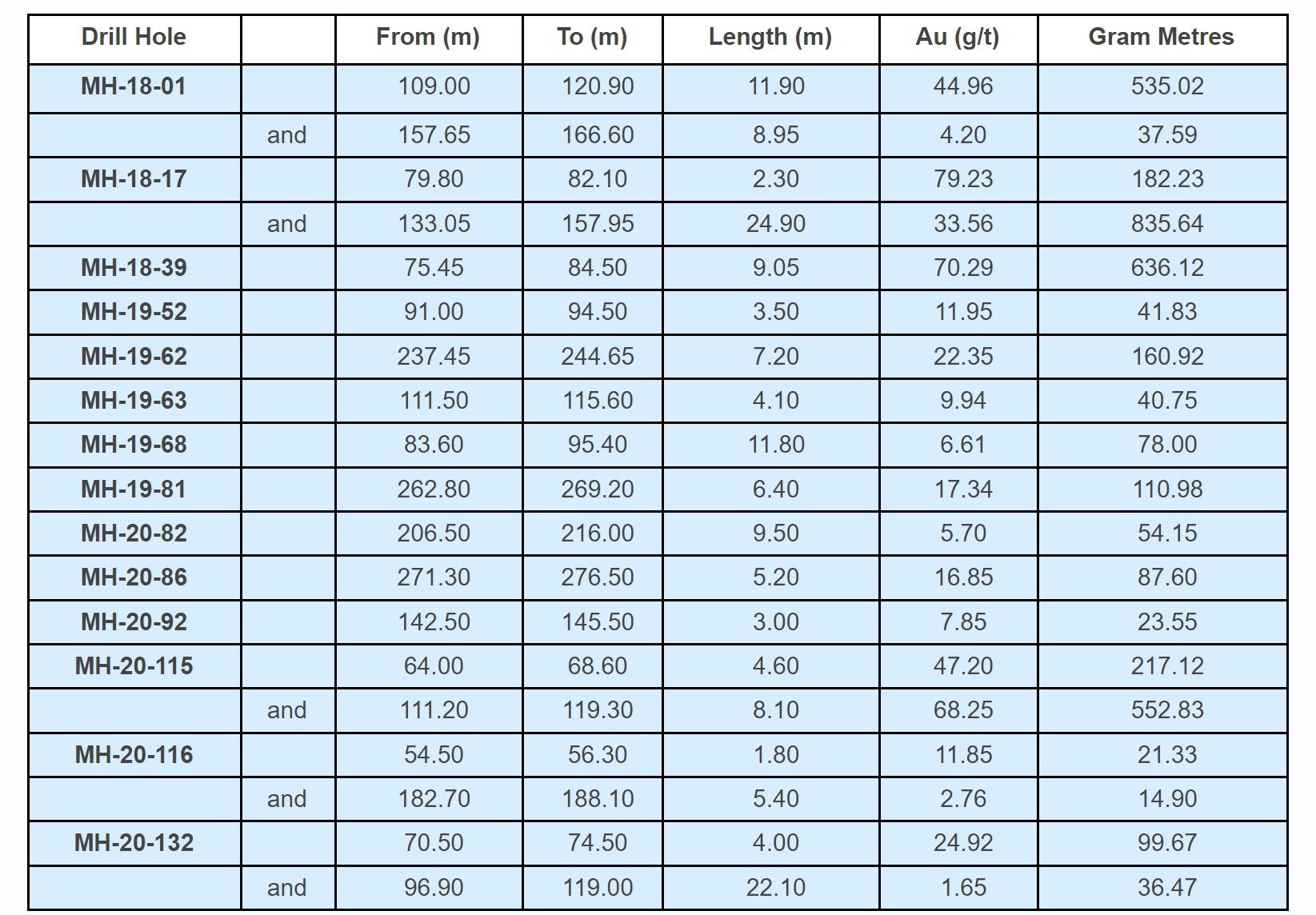

Just under 23,000 m of the proposed 50,000 m Phase 6 program has been completed to date and multiple strong intersections have been reported from this phase including the holes summarized as follows:

MH-21-115 (Footwall Splay – Eastern Trend) – 4.60 m @ 47.20 g/t Au; and 8.10 m @ 68.25 g/t Au

MH-21-163 (Footwall Splay – Eastern Trend) – 18.90 m @ 13.09 g/t Au

MH-21-141 (South Pond Zone 1) – 4.20 m @ 64.00 g/t Au

MH-21-123 (South Pond Zone 1) – 5.00 m @ 26.87 g/t Au

MH-21-203 (75 Zone) – 2.85 m @ 13.67 g/t Au

*Reported lengths are core lengths and are believed to be 70% to 85% of true thickness

About the Flagship Moosehead Gold Project

The 100%-owned Moosehead Gold Project is located along the Trans-Canada Highway in north-central Newfoundland, on the same structural trend as the advanced Valentine Lake Project (Marathon Gold), and adjacent to New Found Gold’s Queensway Project. Both the Moosehead and Queensway projects are targeting high-grade, turbidite-hosted, Fosterville-type gold mineralization. At least five zones of significant gold bearing mineralization have been identified to date at Moosehead and multiple high-priority targets independent of the known zones remain to be tested. In Phases 1 to 5, the Company completed 23,378 m (106 holes). The Company has to date completed just under 23,000 m of a current 50,000 m Phase 6 drill program at Moosehead.

QP

This news release has been reviewed and approved by Timothy Froude, P. Geo., a “Qualified Person” under National Instrument 43-101 and President and CEO of Sokoman Minerals Corp.

COVID-19 Protocols

To ensure a working environment that protects the health and safety of the staff and contractors, Sokoman is operating under federally and provincially mandated and recommended guidelines during the current COVID-19 alert level.

About Sokoman Minerals Corp.

Sokoman Minerals Corp. is a discovery-oriented company with gold projects in Newfoundland & Labrador, Canada. The Company’s primary focus is its portfolio of gold projects including the 100%-owned, high-grade, Fosterville-style Moosehead Project, and the Crippleback Lake (optioned to Trans Canada Gold Corp.), and East Alder (optioned to Canterra Minerals Corporation) Projects, all of which lie along the Central Newfoundland Gold Belt, as well as the 100%-owned, district-scale Fleur de Lys project in northwestern Newfoundland, which is targeting Dalradian-type gold mineralization similar to the Curraghinalt and Cavanacaw deposits in Northern Ireland. The Company also recently entered into a strategic alliance with Benton Resources Inc. through three large scale joint venture properties including Grey River, Golden Hope and Kepenkeck in Newfoundland.

Sokoman now controls independently, and through the Benton Alliance, over 150,000 hectares (>6,000 claims – 1500 sq. km), making it one of the largest landholders in Newfoundland, Canada’s newest and rapidly emerging gold districts. The Company also retains an interest in an early-stage antimony/gold project (Startrek) in Newfoundland, optioned to White Metal Resources Inc., and in Labrador, the Company has a 100% interest in the Iron Horse (Fe) project which has Direct Shipping Ore (DSO) potential.

Mineralization hosted on adjacent and/or nearby properties is not necessarily indicative of mineralization hosted on the Company’s property.

The Company would like to thank the Government of Newfoundland and Labrador for financial support of the Moosehead Project through the Junior Exploration Assistance Program.

To learn more, please contact:

Timothy Froude, P. Geo.,

President & CEO

709-765-1726

tim@sokomanmineralscorp.com

Cathy Hume, Director,

Investor Relations

416-868-1079 x251

cathy@chfir.com

Website: www.sokomanmineralscorp.com

Twitter: @SokomanMinerals

Facebook: @SokomanMinerals

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Investors are cautioned that trading in the securities of the Corporation should be considered highly speculative. Except for historical information contained herein, this news release contains forward- looking statements that involve risks and uncertainties. Actual results may differ materially. Sokoman Minerals Corp. will not update these forward-looking statements to reflect events or circumstances after the date hereof. More detailed information about potential factors that could affect financial results is included in the documents filed from time to time with the Canadian securities regulatory authorities by Sokoman Minerals Corp.

Sokoman Announces High-Grade Results Demonstrating Continuity Of Eastern Trend Mineralization At The Moosehead Project, Central Newfoundland

St. John’s, NL, July 29, 2021 – Sokoman Minerals Corp. (TSXV:SIC) (OTCQB:SICNF) (the “Company” or “Sokoman”) is pleased to announce that ongoing Phase 6 drilling at the 100% owned Moosehead Property in central Newfoundland has intersected additional high-grade gold with multiple holes reporting visible gold mineralization.

Tim Froude, President and CEO of Sokoman, says: “Drilling continues to confirm high-grade gold at Moosehead and provide insights into the complex geological controls on the high-grade mineralization. Our methodical approach is paying off as we continue to intersect and extend the interpreted high-grade shoots that lie within the larger envelope of gold mineralization. With high-grade gold existing in all known zones within an area at least 700 m in strike, up to 200 m in width, and at least 250 m vertical, the potential to link these zones as well as expand the footprint of the Moosehead system is high. Drilling will continue with two rigs and arrival of the barge rig on the property is expected to be two – three weeks. The barge is ready and will be mobilized immediately on receipt of the Water Resources permit, which is the only permit outstanding. We will be posting all Phase 6 drill hole summaries on our website as soon as compilation and updating of sections and plans are complete.”

75 Zone

While waiting on assays for South Pond the drill was relocated to the 75 Zone to assess the southern extension of the Eastern Trend. Borehole MH-19-75 was originally drilled in the fall of 2019 and returned a 5.80 m intersection (core length) grading 6.93 g/t Au starting at 87.50 m downhole, including two visible gold-bearing veins that assayed 30.42 g/t Au over 0.30 m (from 88.95 m), and 32.99 g/t Au over 0.80 m (from 92.50 m). The initial follow-up program around MH-19-75 was based on 25 m step outs which the Company has determined to be less than ideal for evaluating these complex shear systems. MH-21-203 returned 13.67 g/t Au over 2.85 m from 98.15 m downhole – a 10 m step out to the south from MH-19-75. MH-21-205 – a 15 m step out from MH-19-75 (and up-dip from MH-21-203) intersected four veins with visible gold, returning 2.88 g/t Au over 4.25 m including 7.89 g/t Au over 1.25 m. Given these results the drill will continue at the 75 Zone.

South Pond

At South Pond, ongoing drilling has defined a steeply-plunging, high-grade core within the moderately to steeply east-northeast dipping mineralized zone. Modeling of the area suggests that South Pond is possibly a splay off the Eastern Trend structure to the east, with many similar characteristics to the original Footwall Splay at North Pond. This interpretation bodes well for continued exploration between South Pond and Western Trend (approximately 250 m corridor) not only for gold mineralization on the main structures but for repeating splays as well.

Eastern Trend

Drill holes MH-21-193, 198 and 200 all focused on the Lower Eastern Trend between vertical depths of 150 to 200 m and were follow-up to previous drilled holes MH-19-62 (7.20 m @ 22.35 g/t Au and MH-19-81 (6.40 m @ 17.34 g/t Au). The results have confirmed continuity of gold mineralization in the Lower Eastern Trend and drilling will continue in this area for the foreseeable future.

Previous drilling in the Eastern Trend intersected gold mineralization on structures both above and below the main mineralized envelope. Ongoing close-spaced drilling of the Lower Eastern Trend indicates that there is more regularity and predictability to these intersections. The upcoming barge-based program will be key to assessing the up-plunge potential and whether these structures prove to be additional high-grade splays and or parallel structures.

About the Moosehead Gold Project

The 100%-owned Moosehead Gold Project is located along the Trans-Canada Highway in north central Newfoundland, on the same structural trend as the advanced Valentine Lake Project (Marathon Gold), and adjacent to New Found Gold’s Queensway Project. Both the Moosehead and Queensway projects are targeting high-grade, turbidite-hosted, Fosterville-type gold mineralization. At least five zones of significant gold bearing mineralization have been identified to date at Moosehead and multiple high-priority targets independent of the known zones remain to be tested. In Phases 1 to 5 the Company completed 23,378 m (106 holes). In Phase 6 the Company has completed 22,326 m to-date to hole MH-21-228 (120 holes in this Phase) of the 50,000 m drill program at Moosehead.

QP

This news release has been reviewed and approved by Timothy Froude, P.Geo., a “Qualified Person” under National Instrument 43-101 and President and CEO of Sokoman Minerals Corp.

COVID-19 Protocols

To ensure a working environment that protects the health and safety of the staff and contractors, Sokoman is operating under federally and provincially mandated and recommended guidelines during the current COVID-19 alert level.

Analytical Techniques / QA/QC

All core samples submitted for assay were saw cut by Sokoman personnel with one-half submitted for assay and one-half retained for reference. Samples were delivered in sealed bags directly to the lab by Sokoman personnel. Samples, including duplicates, blanks and standards, were submitted to Eastern Analytical Ltd. in Springdale, Newfoundland for gold analysis. Eastern Analytical Ltd. is an accredited assay lab that conforms to the requirements of ISO/IEC 17025. Samples with possible visible gold were submitted for total pulp metallics and gravimetric finish. All other samples were analyzed by standard fire assay methods. Total pulp metallic analysis includes: the whole sample is crushed to -10 mesh; then pulverized to 95% -150 mesh. The total sample is weighed and screened 150 mesh; the +150 mesh fraction is fire assayed for Au, and a 30 g subsample of the -150 mesh fraction is fire assayed for Au; with a calculated weighted average of total Au in the sample reported as well. One blank and one industry approved standard for every twenty samples submitted, is included in the sample stream. Random duplicates of selected samples are analyzed in addition to the in-house standard and duplicate policies of Eastern Analytical. All reported assays are uncut.

About Sokoman Minerals Corp.

Sokoman Minerals Corp. is a discovery-oriented company with gold projects in Newfoundland & Labrador, Canada. The Company’s primary focus is its portfolio of gold projects including the 100%-owned, high-grade, Fosterville-style Moosehead Project, and the Crippleback Lake (optioned to Trans Canada Gold Corp.), and East Alder (optioned to Canterra Minerals Corporation) Projects, all of which lie along the Central Newfoundland Gold Belt, as well as the 100%-owned, district-scale Fleur de Lys project in northwestern Newfoundland, which is targeting Dalradian-type gold mineralization similar to the Curraghinalt and Cavanacaw deposits in Northern Ireland. The Company also recently entered into a strategic alliance with Benton Resources Inc. through three large scale joint venture properties including Grey River, Golden Hope and Kepenkeck in Newfoundland.

Sokoman now controls independently, and through the Benton Alliance, over 150,000 hectares (>6,000 claims – 1500 sq. km), making it one of the largest landholders in Newfoundland, Canada’s newest and rapidly emerging gold districts. The Company also retains an interest in an early-stage antimony/gold project (Startrek) in Newfoundland, optioned to White Metal Resources Inc., and in Labrador, the Company has a 100% interest in the Iron Horse (Fe) project which has Direct Shipping Ore (DSO) potential.

Mineralization hosted on adjacent and/or nearby properties is not necessarily indicative of mineralization hosted on the Company’s property.

The Company would like to thank the Government of Newfoundland and Labrador for financial support of the Moosehead Project through the Junior Exploration Assistance Program.

Moosehead Project – South Pond & 75 Zone

Moosehead Project – East Trend

To learn more, please contact:

Timothy Froude, P. Geo.,

President & CEO

709-765-1726

tim@sokomanmineralscorp.com

Cathy Hume, Director,

Investor Relations

416-868-1079 x251

cathy@chfir.com

Website: www.sokomanmineralscorp.com

Twitter: @SokomanMinerals

Facebook: @SokomanMinerals

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Investors are cautioned that trading in the securities of the Corporation should be considered highly speculative. Except for historical information contained herein, this news release contains forward- looking statements that involve risks and uncertainties. Actual results may differ materially. Sokoman Minerals Corp. will not update these forward-looking statements to reflect events or circumstances after the date hereof. More detailed information about potential factors that could affect financial results is included in the documents filed from time to time with the Canadian securities regulatory authorities by Sokoman Minerals Corp.

Sokoman Minerals Provides Exploration Update For Its Portfolio Of Gold Projects In Newfoundland, Canada

Ongoing drilling at Moosehead; field work at Fleur de Lys and Benton-Sokoman JV projects; visible gold found at Grey River

St. John’s, NL, July 20, 2021 – Sokoman Minerals Corp. (TSXV: SIC) (OTCQB: SICNF) (the “Company” or “Sokoman”) is pleased to provide the following exploration update on its 100%-owned projects as well as Joint Venture Projects with Benton Resources Inc. (TSXV: BEX) in Newfoundland.

Highlights:

Moosehead: close to 20,000 m completed with two drill rigs; third drill rig expected in 2-3 weeks for the barge-based program; testing Footwall Splay/ Eastern Trend, South Pond and the new 75 Zone.

Fleur de Lys: ongoing till sampling program; multiple samples submitted for gold grain and heavy mineral analysis with initial results expected in 2-3 weeks.

Grey River JV: sampling in the vicinity of the historical 225 g/t Au sample site resulted in the identification of visible gold in a portion of the mineralized zone; samples submitted for assays; high-resolution airborne geophysical survey to begin shortly.

Golden Hope JV: initial reconnaissance mission completed; rock samples, stream sediment and C-horizon till samples submitted for assays; in the process of completing high-resolution airborne geophysical survey.

Kepenkeck JV: completed a high-resolution airborne geophysical survey; a prospecting program has begun; a detailed soil sampling program to commence shortly; first assay results from sampling deemed very encouraging.

Moosehead Project

Phase 6 drilling program is ongoing at Moosehead with two rigs. While there has been a delay in getting a third drill rig on-site due to the current shortage of the drill crew experienced by Sokoman’s preferred drilling contractor who knows the property area well, Sokoman has recently been advised that the third rig is expected to join the program in 2-3 weeks. The third rig will now be designated for the barge-based program which is awaiting final approval from the Department of Environment. The Company is looking at adding a fourth drill rig as soon as possible and will keep investors posted on the progress made in that regard.

Once the third rig is on site, Sokoman plans to be alternating the initial two drills in order to test regional targets that could easily lead to other discoveries in addition to extending currently known zones.

Just under 20,000 m of the proposed 50,000 m Phase 6 program has been completed and multiple strong intersections have been reported from this phase including the holes summarized as follows:

MH-21-115 (Footwall Splay – Eastern Trend) – 4.60 m @ 47.20 g/t Au; and 8.10 m @ 68.25 g/t Au

MH-21-163 (Footwall Splay – Eastern Trend) – 18.90 m @ 13.09 g/t Au

MH-21-141 (South Pond Zone 1) – 4.20 m @ 64.00 g/t Au

MH-21-123 (South Pond Zone 1) – 5.00 m @ 26.87 g/t Au

*Reported lengths are core lengths and are believed to be 70% to 85% of true thickness

The barge program could entail as much as 5,000 to 10,000 m, depending on success and depths, to target the Footwall Splay and as much of the Eastern Trend that can be accessed.

Drilling will continue at the South Pond target as well as on the nearby 75 Zone, which is an open-ended mineralized block lying 100 m northeast of the South Pond target, approximately halfway to the Eastern Trend, and which delivered MH-19-75 (5.80 m of 6.93 g/t Au, including a VG bearing vein grading 32.99 g/t Au over 0.80 m) and remains open. The 75 Zone drilling will help determine whether it is linked to any known zone or is a new splay. Currently a four-to-six-hole program is focused on this area. Once completed, the drill will be assigned to test some of the high-priority geochemical and geophysical targets elsewhere on the property while awaiting assays.

Fleur de Lys Project

The property-scale till sampling program is approximately 40% complete with 357 samples submitted for gold grain and heavy mineral analysis at Overburden Drilling Management (ODM) in Ottawa. The sample collection is being supervised by ODM utilizing contract crews. Results from the early sampling are expected in the next 2-3 weeks. Prospecting has been ongoing concurrent with the till sampling, and approximately 40 rock samples have been submitted for assay, many with disseminated pyrite and chalcopyrite, minerals linked to several gold-enriched deposits in the UK, including the six-million-ounce Curraghinalt deposit in Northern Ireland, with which the Fleur de Lys project shares many characteristics.

Grey River Sokoman/ Benton JV Project

Airborne geophysical surveying totalling 1,099 line-kilometres is about to begin at the 324-claim (8,100 hectares – 81 sq km) Grey River JV in southern Newfoundland and will consist of a Heliborne High-Resolution Magnetic and Matrix Digital VLF-EM Survey flown by Terraquest Ltd. The results of the survey will help define structural targets that may be associated with the gold mineralization at Grey River. The property is targeting high-grade gold mineralization similar to that currently being mined at Pogo, Alaska with published reserves of 6.9 million ounces at 9.4 g/t Au (Northern Star Resources website March 31, 2021), as well as other styles of gold mineralization including shear zone and intrusion-related gold.

Management of Sokoman and Benton have visited the Grey River and the Golden Hope properties to establish priorities and to engage in sampling as many areas of known mineralization. The visit to Grey River was extremely successful in that sampling in the vicinity of the historical 225 g/t Au sample site resulted in the identification of visible gold in a portion of the mineralized zone. In addition, prospecting in the immediate area identified several other mineralized horizons that did not appear to be previously sampled. Assays are pending from a suite of samples collected from several locations on the property. The historical “Quartz Zone” reported by previous workers is impressive and extends for several kilometres in an east west direction (photos can be viewed on Sokoman’s website under the Grey River Project tab) and is up to 200-300 metres in width locally. Multiple gold showings are known along most of its length ranging from 100-200 ppb Au to 225 g/t Au, but no drilling has been carried out at any of the known gold occurrences. The companies have applied for drilling permits which will target these zones.

Golden Hope Sokoman/ Benton JV Project

Exploration has also commenced on the 3,176-claim (79,400 hectares – 794 sq km) Golden Hope Property in southwestern Newfoundland, including a 5,709-line-kilometre Heliborne High-Resolution Aeromagnetic & Matrix Digital VLF-EM Survey being flown by Terraquest Ltd. The survey will help provide an overall structural picture of the property and identify extensions of known gold-bearing structures as well as any previously unrecognized structures on the property. An initial reconnaissance mission at Golden Hope was completed earlier this month by management of Sokoman and Benton in order to get a firsthand look at the ground and to obtain samples in as many areas as possible (photos can be viewed on Sokoman’s website under the Golden Hope Project tab). Mineralization observed included multiple occurrences of structurally controlled quartz veins with variable amounts of pyrite, as well as a previously unknown zone of locally significant arsenopyrite and pyrite (as stringers and veinlets comprising up to 10% of rock volume), that was noted to be several dozen metres in thickness and of unknown strike length. Overall, approximately 50 rock samples as well as seven stream sediment and four C-horizon till samples were collected and submitted for assaying/processing.

Kepenkeck Sokoman/ Benton Resources JV Project

The Company has been informed by Joint Venture partner Benton that a Heliborne High-Resolution Aeromagnetic & Matrix Digital VLF-EM Survey totaling 1,984 line-kilometres has been flown by Terraquest Ltd. A prospecting program has begun, and a detailed soil sampling program will commence shortly. The Kepenkeck property lies in east-central Newfoundland, along trend from Canstar Resources’ Golden Baie project and immediately east of New Found Gold’s Queensway project. The target is high grade and quartz veining, hosted in graphitic shales similar to that of the New Found Gold property.

The companies have received the first assay results from 24 samples submitted. Gold grading from >5 ppb to 5,340 ppb have been obtained from localized float and outcrops. The companies are very encouraged by these early results, and follow-up has been planned to further these discoveries.

About the Flagship Moosehead Gold Project

The 100%-owned Moosehead Gold Project is located along the Trans-Canada Highway in north central Newfoundland, on the same structural trend as the advanced Valentine Lake Project (Marathon Gold), and adjacent to New Found Gold’s Queensway Project. Both the Moosehead and Queensway projects are targeting high-grade, turbidite-hosted, Fosterville-type gold mineralization. At least five zones of significant gold bearing mineralization have been identified to date at Moosehead and multiple high-priority targets independent of the known zones remain to be tested. The Company has completed approximately 20,000 m of a current 50,000 m drill program at Moosehead.

Highlighted Results from Footwall Splay/Eastern Trend Main Zone at Moosehead

QP

This news release has been reviewed and approved by Timothy Froude, P. Geo., a “Qualified Person” under National Instrument 43-101 and President and CEO of Sokoman Minerals Corp.

COVID-19 Protocols

To ensure a working environment that protects the health and safety of the staff and contractors, Sokoman is operating under federally and provincially mandated and recommended guidelines during the current COVID-19 alert level.

Analytical Techniques / QA/QC

All core samples submitted for assay were saw cut by Sokoman personnel with one half submitted for assay and one half retained for reference. Samples were delivered in sealed bags directly to the lab by Sokoman Minerals personnel. Samples, including duplicates, blanks and standards, were submitted to Eastern Analytical Ltd. in Springdale, Newfoundland for gold analysis. Eastern Analytical is an accredited assay lab that conforms to requirements of ISO/IEC 17025. Samples with possible visible gold were submitted for total pulp metallics and gravimetric finish. All other samples were analyzed by standard fire assay methods. Total pulp metallic analysis includes: the whole sample is crushed to -10 mesh; then pulverized to 95% -150 mesh; the total sample is weighed and screened 150 mesh; the +150 mesh fraction is fire assayed for Au, and a 30 g subsample of the -150 mesh fraction is fire assayed for Au; with a calculated weighted average of total Au in the sample reported as well. One blank and one industry approved standard for every twenty samples submitted, is included in the sample stream. In addition, random duplicates of selected samples are analyzed in addition to the in-house standard and duplicate policies of Eastern Analytical.

About Sokoman Minerals Corp.

Sokoman Minerals Corp. is a discovery-oriented company with gold projects in Newfoundland & Labrador, Canada. The Company’s primary focus is its portfolio of gold projects including the 100%-owned, high-grade, Fosterville-style Moosehead Project, and the Crippleback Lake (optioned to Trans Canada Gold Corp.), and East Alder (optioned to Canterra Minerals Corporation) Projects, all of which lie along the Central Newfoundland Gold Belt, as well as the 100%-owned, district-scale Fleur de Lys project in northwestern Newfoundland, which is targeting Dalradian-type gold mineralization similar to the Curraghinalt and Cavanacaw deposits in Northern Ireland. The Company also recently entered into a strategic alliance with Benton Resources Inc. through three large scale joint venture properties including Grey River, Golden Hope and Kepenkeck in Newfoundland.

Sokoman now controls independently, and through the Benton Alliance, over 150,000 hectares (>6,000 claims – 1500 sq. km), making it one of the largest landholders in Newfoundland, Canada’s newest and rapidly emerging gold districts. The Company also retains an interest in an early-stage antimony/gold project (Startrek) in Newfoundland, optioned to White Metal Resources Inc., and in Labrador, the Company has a 100% interest in the Iron Horse (Fe) project which has Direct Shipping Ore (DSO) potential.

Mineralization hosted on adjacent and/or nearby properties is not necessarily indicative of mineralization hosted on the Company’s property.

The Company would like to thank the Government of Newfoundland and Labrador for financial support of the Moosehead Project through the Junior Exploration Assistance Program.

To learn more, please contact:

Timothy Froude, P. Geo.,

President & CEO

709-765-1726

tim@sokomanmineralscorp.com

Cathy Hume, Director,

Investor Relations

416-868-1079 x251

cathy@chfir.com

Website: www.sokomanmineralscorp.com

Twitter: @SokomanMinerals

Facebook: @SokomanMinerals

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Investors are cautioned that trading in the securities of the Corporation should be considered highly speculative. Except for historical information contained herein, this news release contains forward- looking statements that involve risks and uncertainties. Actual results may differ materially. Sokoman Minerals Corp. will not update these forward-looking statements to reflect events or circumstances after the date hereof. More detailed information about potential factors that could affect financial results is included in the documents filed from time to time with the Canadian securities regulatory authorities by Sokoman Minerals Corp.

Sokoman Minerals And Benton Resources Option Two Properties Lying Within The Grey River Gold Property, Newfoundland

St. John’s, NL, July 13, 2021 – Sokoman Minerals Corp. (TSXV: SIC) (OTCQB: SICNF) (the “Company” or “Sokoman”) today announced the execution of two (2) property option agreements on behalf of the strategic alliance between the Company and Benton Resources Inc. (“Benton”) (see news release dated May 20, 2021) to add additional mineral claims to the Grey River Gold Property in the province of Newfoundland and Labrador, Canada.

Pursuant to an option agreement (the “Lewis Option Agreement”), Gary Lewis (“Lewis”) has granted Sokoman the option to acquire a 100% interest in a property license consisting of seven claims (the “Lewis Property”) subject to a 1.5% net smelter return royalty (the “Lewis NSR”) in favour of Lewis (the “Lewis Option”). One percent of the Lewis NSR may be purchased by the Company for $1 million at any time. The Lewis Option Agreement will terminate if Sokoman fails to complete any of the following terms, and each cash payment and share issuance is to be made equally among Gary Lewis, Aubrey Budgell and Paul Delaney:

the payment of $10,000 cash;

the issuance of 50,000 shares of Sokoman upon TSX Venture Exchange (the “Exchange”) approval;

the payment of a further $10,000 and the issuance of a further 50,000 shares on or before the first anniversary of the Lewis Option Agreement;

the payment of a further $10,000 and the issuance of a further 50,000 shares on or before the second anniversary of the Lewis Option Agreement; and

the payment of a further $10,000 and issuance of a further 50,000 shares on or before the third anniversary of the Lewis Option Agreement.

Pursuant to a second option agreement (the “G2B Gold Option Agreement”), G2B Gold Inc. (“G2B Gold”) has granted Sokoman the option to acquire a 100% interest in a property consisting of three licenses comprised of four claims (the “G2B Property”) subject to a 1.5% net smelter return royalty (the “G2B NSR”) in favour of G2B Gold (the “G2B Gold Option”). One percent of the G2B NSR may be purchased by the Company for $1 million at any time. The G2B Option Agreement will terminate if Sokoman fails to complete any of the following terms, and each cash payment and share issuance is to be made equally among G2B Gold, United Gold Inc. and Grassroots Prospecting & Prospect Generation Inc.:

the payment of 10,000 cash;

the issuance of 50,000 shares of Sokoman upon Exchange approval;

the payment of a further $10,000 and the issuance of a further 50,000 shares on or before the first anniversary date of the G2B Gold Option Agreement;

the payment of a further $10,000 and the issuance of a further 50,000 shares on or before the second anniversary date of the G2B Gold Option Agreement.

About Sokoman Minerals Corp.

Sokoman Minerals Corp. is a discovery-oriented company with projects in Newfoundland and Labrador, Canada. The Company’s primary focus is its portfolio of gold projects: flagship Moosehead, Crippleback Lake (optioned to Trans Canada Gold Corp.) and East Alder (optioned to Canterra Minerals Corporation) along the Central Newfoundland Gold Belt, and the district-scale Fleur de Lys project in northwestern Newfoundland, which is targeting Dalradian-type orogenic gold mineralization similar to the Curraghinalt and Cavanacaw deposits in Northern Ireland, and Cononish in Scotland. The Company also recently entered into a strategic alliance with Benton Resources Inc. through three large-scale joint venture properties including Grey River Gold, Golden Hope and Kepenkeck in Newfoundland. Sokoman now controls independently and through the Benton alliance over 150,000 hectares (>6,000 claims – 1,500 sq. km), making it one of the largest landholders in Newfoundland, Canada’s newest and rapidly-emerging gold districts. The Company also retains an interest in an early-stage antimony/gold project (Startrek) in Newfoundland, optioned to White Metal Resources Inc., and in Labrador, the Company has a 100% interest in the Iron Horse (Fe) project that has Direct Shipping Ore (DSO) potential.

About Benton Resources Inc.

Benton Resources is a well-funded Canadian-based project generator with a diversified property portfolio in Gold, Silver, Nickel, Copper, and Platinum group elements. Benton holds multiple high-grade projects available for option which can be viewed on the Company’s website. Parties interested in seeking more information about properties available for option can contact Mr. Stares directly.

To learn more, please contact:

CHF Capital Markets

Cathy Hume, CEO

Phone: 416-868-1079 x251

Email: cathy@chfir.com

Benton Resources

Stephen Stares, President & CEO

Phone: 807-475-7474

Email: sstares@bentonresources.ca

Sokoman Minerals

Timothy Froude, P.Geo., President & CEO

Phone: 709-765-1726

Email: tim@sokomanmineralscorp.com

Website: www.bentonresources.ca , www.sokomanmineralscorp.com

Twitter: @BentonResources , @SokomanMinerals

Facebook: @BentonResourcesBEX , @SokomanMinerals

LinkedIn: @BentonResources, @SokomanMinerals

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Investors are cautioned that trading in the securities of the Corporation should be considered highly speculative. Except for historical information contained herein, this news release contains forward- looking statements that involve risks and uncertainties. Actual results may differ materially. Sokoman Minerals Corp. will not update these forward-looking statements to reflect events or circumstances after the date hereof. More detailed information about potential factors that could affect financial results is included in the documents filed from time to time with the Canadian securities regulatory authorities by Sokoman Minerals Corp.

Sokoman Announces Additional High-Grade Results From The Moosehead Project, Central Newfoundland

New Visible-Gold-Bearing Boulders Discovered with Values up to 14 g/t Au

St. John’s, NL, July 6, 2021 – Sokoman Minerals Corp. (TSXV:SIC) (OTCQB:SICNF) (the “Company” or “Sokoman”) is pleased to announce that ongoing Phase 6 drilling at the 100%-owned Moosehead Property in central Newfoundland has intersected additional high-grade gold mineralization at both the Eastern Trend and South Pond Zones. In addition, prospecting in an area 300 m to the east of North Pond, an area with minimal drilling, has located visible-gold-bearing quartz float returning 9.2 and 14.3 g/t Au from total pulp metallics assays with additional assays pending.

Tim Froude, President and CEO of Sokoman, says: “We are extremely pleased with the results from the early stages of this summer exploration program at Moosehead. The discovery of a new high-grade boulder train at the limits of our drilling suggests that other mineralized zones are likely to be found at Moosehead. Our experience to-date with boulders is that they are generally close to the source, given the average thickness of overburden. Drilling will continue and we are expecting the barge to arrive on the property in four-five weeks, permits are pending. Our drill results at the Lower Eastern Trend demonstrate good continuity and grade, and our most recent success in MH-21-191 at 165 m vertical is a great beginning as we infill the down-dip portion of the Eastern Trend. At South Pond, we have extended the near-surface, high-grade mineralization and are working our way to the north towards the Western Trend where this 250 m corridor has had minimal drilling, and we look forward to connecting these zones. Field work has also begun on all three JV projects with Benton Resources, and updates on all of them will be provided in the coming weeks.”

The table highlights results to date from the ongoing Phase 6 drilling program.

Core lengths – believed to be 70% to 90% of reported lengths.

** Follow-up logging and sampling was completed after priority core was logged and sampled.

Italicized text and figures denote new assays, all others are previously released.

South Pond

The recent drilling has extended the mineralized zones up and down dip. DDH MH-21-190 extended the “high-grade” intersection in MH-21-123 (5 m of 26.87 g/t Au) 11 m up dip, while DDH MH-21-184 extended the new near-surface mineralized zone, discovered in MH-21-152 (3.0 m of 1.82 g/t) 15 m down dip. The style of veining and mineral assemblage (boulangerite, arsenopyrite and sphalerite) in these holes is similar to the “high-grade” zones in MH-21-190. To date, the South Pond Zone has been traced 65 m along strike and from surface to 95 m down dip, remaining open both along strike and down dip.

Footwall Splay / Eastern Trend

Drilling of the Footwall Splay and Upper Eastern Trend reflects infill and step-out results. MH-21-167 collared in a visible-gold-bearing vein returning 2.94 g/t Au over 1.2 m, extending the Footwall Splay 27 m to the south from MH-21-157, which returned 12.39 g/t Au over 3.5 m including 28.57 g/t Au over 1.50 m from 36.3 m downhole. The Footwall Splay currently has a 175 m N-S strike length over a minimum width of 25 m. MH-21-178 tested the Upper Eastern Trend returning 4.72 g/t Au over 1.10 m from 30.20 m downhole, 25 m vertically below surface. Additional drilling will be carried out using a barge-based program on North Pond with the drill contractor modifying the barge to accommodate the drill. Sokoman anticipates starting this program in 4-6 weeks.

The Lower Eastern Trend was tested by MH-21-191, which returned 21.86 g/t Au over 3.60 m including 43.47 g/t Au over 1.80 m at a downhole depth of 244 m, a 9 m step-out from MH-16-62, which returned 22.35 g/t Au over 7.20 m including 33.59 g/t Au over 4.80 m.

Holes MH-21-163 and 165 both report shoulder and infill sampling, which enhances previously released results, including additional zones of mineralization.

High-Grade Boulders

Prospecting in the fall of 2020 discovered a cluster of angular quartz boulders 300 m to the east of North Pond with trace pyrite and arsenopyrite assaying <1 g/t Au. Recent follow-up prospecting, taking advantage of low water levels, located quartz boulders 20 m ESE of the original cluster. The new boulders carry arsenopyrite and lesser boulangerite and sphalerite, with multiple sights of fine visible gold. Two samples submitted for total pulp metallics and gravimetric finish analysis gave 14.81 g/t Au and 9.36 g/t Au. Prospecting along nearby brooks has located similar mineralized boulders with visible gold 250 m to the northeast, assays are pending. The boulders occur along a prominent northeast-trending structural lineament in the east-central portion of the property coinciding with strong linear magnetic and possibly associated VLF-EM anomalies. Three widely-spaced drill holes, completed earlier this year in the general area, did not adequately test this near-surface target. Additional drilling is planned.

Footwall Splay/Eastern Trend Main Zone

Previously released uncut drilling results. Lengths are core lengths and believed to be 70-90% true thickness.

About the Moosehead Gold Project

The 100%-owned Moosehead Gold Project is located along the Trans-Canada Highway in north-central Newfoundland, on the same structural trend as the advanced Valentine Lake Project (Marathon Gold) and adjacent to New Found Gold’s Queensway Project. Both the Moosehead and Queensway projects are targeting high-grade, turbidite-hosted, Fosterville-type gold mineralization. At least five zones of significant gold-bearing mineralization have been identified to-date at Moosehead and multiple high-priority targets independent of the known zones remain to be tested. The Company has completed approximately 18,000 m of a 50,000 m drill program at Moosehead.

QP

This news release has been reviewed and approved by Timothy Froude, P. Geo., a “Qualified Person” under National Instrument 43-101, and President and CEO of Sokoman Minerals Corp.

COVID-19 Protocols

To ensure a working environment that protects the health and safety of the staff and contractors, Sokoman is operating under federally and provincially mandated and recommended guidelines during the current COVID-19 alert level.

Analytical Techniques / QA/QC

All core samples submitted for assay were saw cut by Sokoman personnel with one-half submitted for assay and one-half retained for reference. Samples were delivered in sealed bags directly to the lab by Sokoman Minerals personnel. Samples, including duplicates, blanks and standards, were submitted to Eastern Analytical Ltd. in Springdale, Newfoundland and Labrador for gold analysis. Eastern Analytical is an accredited assay lab that conforms to requirements of ISO/IEC 17025. Samples with possible visible gold were submitted for total pulp metallics and gravimetric finish. All other samples were analyzed by standard fire-assay methods. Total pulp metallic analysis includes: the whole sample being crushed to -10 mesh; then pulverized to 95% -150 mesh. The total sample is weighed and screened 150 mesh; the +150 mesh fraction is fire assayed for Au, and a 30 g subsample of the -150 mesh fraction is fire assayed for Au; with a calculated weighted average of total Au in the sample reported as well. One blank and one industry-approved standard for every twenty samples submitted, is included in the sample stream. Random duplicates of selected samples are analyzed in addition to the in-house standard and duplicate policies of Eastern Analytical Ltd. All reported assays are uncut.

About Sokoman Minerals Corp.

Sokoman Minerals Corp. is a discovery-oriented company with projects in Newfoundland and Labrador, Canada. The Company’s primary focus is its portfolio of gold projects: flagship Moosehead, Crippleback Lake (optioned to Trans Canada Gold Corp.) and East Alder (optioned to Canterra Minerals Corporation) along the Central Newfoundland Gold Belt, and the district-scale Fleur de Lys project in northwestern Newfoundland, which is targeting Dalradian-type orogenic gold mineralization similar to the Curraghinalt and Cavanacaw deposits in Northern Ireland, and Cononish in Scotland. The Company also recently entered into a strategic alliance with Benton Resources Inc. through three large-scale joint venture properties including Grey River, Golden Hope and Kepenkeck in Newfoundland. Sokoman now controls independently and through the Benton alliance over 150,000 hectares (>6,000 claims – 1,500 sq. km), making it one of the largest landholders in Newfoundland, Canada’s newest and rapidly-emerging gold districts. The Company also retains an interest in an early-stage antimony/gold project (Startrek) in Newfoundland, optioned to White Metal Resources Inc., and in Labrador, the Company has a 100% interest in the Iron Horse (Fe) project that has Direct Shipping Ore (DSO) potential.

Mineralization hosted on adjacent and/or nearby properties is not necessarily indicative of mineralization hosted on the Company’s property.

The Company would like to thank the Government of Newfoundland and Labrador for financial support of the Moosehead Project through the Junior Exploration Assistance Program.

Moosehead Phase 6

Moosehead Plan Map Phase 6 as of 29 Jun 2021

To learn more, please contact:

Timothy Froude, P. Geo.,

President & CEO

709-765-1726

tim@sokomanmineralscorp.com

Cathy Hume, Director,

Investor Relations

416-868-1079 x251

cathy@chfir.com

Website: www.sokomanmineralscorp.com

Twitter: @SokomanMinerals

Facebook: @SokomanMinerals

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Investors are cautioned that trading in the securities of the Corporation should be considered highly speculative. Except for historical information contained herein, this news release contains forward- looking statements that involve risks and uncertainties. Actual results may differ materially. Sokoman Minerals Corp. will not update these forward-looking statements to reflect events or circumstances after the date hereof. More detailed information about potential factors that could affect financial results is included in the documents filed from time to time with the Canadian securities regulatory authorities by Sokoman Minerals Corp.

Sokoman And Benton Option Claims Adjacent To The Joint Kepenkeck Gold Property In Newfoundland

June 29, 2021 – Sokoman Minerals Corp. (‘Sokoman’) (TSXV: SIC) (OTCQB: SICNF) and Benton Resources Inc. (‘Benton’) (TSXV: BEX) (jointly, ‘the Companies’) are pleased to announce that on behalf of their strategic alliance (see news release dated May 20, 2021) Benton has entered into an option agreement to acquire the Larry’s Pond project which lies along the western boundary of the Kepenkeck Gold JV claims (the “Option Agreement”). Larry’s Pond consists of two licenses totalling 30 claim units (the “Property”). The optionors of the Larry’s Pond project (the “Optionors”) have discovered and sampled multiple quartz veins and silicified zones containing sulfides (chalcopyrite and galena) for which results are pending. Under the Option Agreement and upon approval from the TSX Venture Exchange (the “Exchange”), Benton, on behalf of the Joint Venture, will issue 200,000 common shares and make cash payments to the Optionors of $60,000 as per below:

paying to the Optionors in the aggregate $10,000 cash on execution of the Option Agreement;

issuing to the Optionors in the aggregate 50,000 common shares of Benton upon receipt of Exchange approval for the Option Agreement;

paying to the Optionors in the aggregate a further $10,000 cash and issuing to the Optionors in the aggregate a further 50,000 common shares of Benton by the first anniversary of the effective date of the Option Agreement (the “Effective Date”);

paying to the Optionors in the aggregate a further $10,000 cash and issuing to the Optionors in the aggregate a further 50,000 common shares of Benton by the second anniversary of the Effective Date; and

paying to the Optionors in the aggregate a further $30,000 cash and issuing to the Optionors in the aggregate a further 50,000 common shares of Benton by the third anniversary of the Effective Date.

The Optionors will retain a 2% Net Smelter Royalty, half of which Benton, on behalf of the Joint Venture, can purchase for CAD$1M at any time. Under the terms of the Joint Venture, Sokoman will reimburse Benton for 50% of the Option payments made by Benton pursuant to the Option Agreement.

Personnel have begun prospecting and mapping on the Property, and the imminent, detailed, 100m-spaced Airborne Mag-VFL survey that will encompass approximately 1,600 line-km in the area will include the optioned Property. Benton and Sokoman anticipate that these initial activities will generate gold targets for further exploration. Results will be released as they are received and compiled.

QP

Nathan Sims, P.Geo., Senior Exploration Manager for Benton Resources Inc., and Timothy Froude, P.Geo., President & CEO of Sokoman Minerals Corp., “Qualified Persons” under National Instrument 43-101, have approved the scientific and technical disclosure in this news release and prepared or supervised its preparation.

About Benton Resources Inc.

Benton Resources is a well-funded Canadian-based project generator with a diversified property portfolio in Gold, Silver, Nickel, Copper, and Platinum group elements. Benton holds multiple high-grade projects available for option which can be viewed on the Company’s website. Parties interested in seeking more information about properties available for option can contact Mr. Stares directly.

About Sokoman Minerals Corp.

Sokoman Minerals Corp. is a discovery-oriented company with projects in Newfoundland & Labrador, Canada. The Company’s primary focus is its portfolio of gold projects: Moosehead, Crippleback Lake (optioned to Trans Canada Gold Corp.) and East Alder (optioned to Canterra Minerals Corporation) along the Central Newfoundland Gold Belt, and the recently acquired district-scale Fleur de Lys project in northwestern Newfoundland, which is targeting Dalradian-type orogenic gold mineralization similar to the Curraghinalt and Cavanacaw deposits in Northern Ireland, and Cononish in Scotland. The Company also recently entered into a strategic alliance with Benton Resources Inc. through three large-scale joint venture properties including Grey River, Golden Hope and Kepenkeck in Newfoundland. Sokoman now controls independently and through the Benton alliance over 150,000 hectares (>6,000 claims) of land, making the Company one of the largest landholders in Newfoundland, Canada’s newest and rapidly emerging gold districts. The Company also retains an interest in an early-stage antimony/gold project (Startrek) in Newfoundland, optioned to White Metal Resources Inc., and in Labrador, the Company has a 100% interest in the Iron Horse (Fe) project that has Direct Shipping Ore (DSO) potential.

For further information, please contact:

Cathy Hume, CHF Capital Markets

Phone: 416-868-1079 x251

Email: cathy@chfir.com

Benton Resources

Stephen Stares, President & CEO

Phone: 807-475-7474

Email: sstares@bentonresources.ca

Sokoman Minerals

Timothy Froude, P.Geo., President & CEO

Phone: 709-765-1726

Email: tim@sokomanmineralscorp.com

Website: www.bentonresources.ca , www.sokomanmineralscorp.com

Twitter: @BentonResources , @SokomanMinerals

Facebook: @BentonResourcesBEX , @SokomanMinerals

THE TSX VENTURE EXCHANGE HAS NOT REVIEWED AND DOES NOT ACCEPT RESPONSIBILITY FOR THE ADEQUACY OR ACCURACY OF THIS RELEASE.

The information contained herein contains “forward-looking statements” within the meaning of applicable securities legislation. Forward-looking statements relate to information that is based on assumptions of management, forecasts of future results, and estimates of amounts not yet determinable. Any statements that express predictions, expectations, beliefs, plans, projections, objectives, assumptions or future events or performance are not statements of historical fact and may be “forward-looking statements.”