Newsroom

Sokoman Closes Non-Brokered Flow-Through Private Placement

ST. JOHN’S, NL / ACCESSWIRE / December 28, 2022 / Sokoman Minerals Corp. (“Sokoman” or the “Company”) (TSXV:SIC)(OTCQB:SICNF) today announces that it has closed its previously announced (December 8, 2022 and December 22, 2022) flow-through private placement (the “Private Placement”) for aggregate gross proceeds of $4,142,752.

On receipt of TSX Venture Exchange (the “Exchange”) approval, the Company will issue 14,795,544 flow-through shares units (“FT Units”) at a price of $0.28 for gross proceeds of $4,142,752. Each FT Unit consists of one (1) common share of the Company and one half (1/2) of one common share purchase warrant (the “FT Warrant”), with each full FT Warrant entitling the holder to purchase one non-flow-through common share of the Company at a price of $0.36 for a period of 18 months after the closing of the Private Placement. The FT Units will entitle the holder to receive the tax benefits applicable to flow-through shares, in accordance with provisions of the Income Tax Act (Canada).

All securities issued pursuant to this financing will be subject to a four-month plus one-day hold, expiring April 24, 2023.

In connection with the Private Placement, the Company is paying finders’ fees as permitted by the policies of the TSX Venture Exchange.

The net proceeds of the flow-through will be used for project exploration work on the Company’s properties that it controls that will qualify for Canadian Exploration Expenses under the Income Tax Act (Canada). The Company intends to spend approximately 25% of the gross proceeds on the Golden Hope (Kraken Lithium Pegmatite Field) joint venture project, and the remaining balance on its flagship Moosehead Gold project.

About Sokoman Minerals Corp.

Sokoman Minerals Corp. is a discovery-oriented company with projects in the province of Newfoundland and Labrador, Canada. The Company’s primary focus is its portfolio of gold projects; the 100%-owned flagship, advanced-stage Moosehead, as well as Crippleback Lake; and East Alder (optioned to Canterra Minerals Corporation) along the Central Newfoundland Gold Belt, and the district-scale Fleur de Lys project near Baie Verte in northwestern Newfoundland, that is targeting Dalradian-type orogenic gold mineralization similar to the Curraghinalt and Cavanacaw deposits in Northern Ireland. The Company also recently entered into a strategic alliance with Benton Resources Inc. through three, large-scale, joint-venture properties including Grey River, Golden Hope, and Kepenkeck in Newfoundland.

Sokoman now controls, independently and through the Benton alliance, over 150,000 hectares (>6,000 claims – 1500 sq. km), making it one of the largest landholders in Newfoundland, in Canada’s newest and rapidly-emerging gold districts. The Company also retains an interest in an early-stage antimony/gold project (Startrek) in Newfoundland, optioned to White Metal Resources Inc., and in Labrador, the Company has a 100% interest in the Iron Horse (Fe) project which has Direct Shipping Ore (DSO) potential.

Mineralization hosted on adjacent and/or nearby properties is not necessarily indicative of mineralization hosted on the Company’s property.

The Company would like to thank the Government of Newfoundland and Labrador for past financial support of the Moosehead Gold project through the Junior Exploration Assistance Program.

For further information, please contact:

Sokoman Minerals

Timothy Froude, P.Geo., President & CEO

Phone: 709-765-1726

Email: tim@sokomanmineralscorp.com

CHF Capital Markets

Cathy Hume, VP Corporate Development, Director

Phone: 416-868-1079 x251

Email: cathy@chfir.com

CHF Capital Markets

Thomas Do, IR Manager

Phone: 416-868-1079 x 232

Email: thomas@chfir.com

Website: www.sokomanmineralscorp.com

Twitter: @SokomanMinerals

Facebook: @SokomanMinerals

LinkedIn: @SokomanMinerals

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accept responsibility for the adequacy or accuracy of this release.

Investors are cautioned that trading in the securities of the Corporation should be considered highly speculative. Except for historical information contained herein, this news release contains forward-looking statements that involve risks and uncertainties. Actual results may differ materially. Sokoman Minerals Corp. will not update these forward-looking statements to reflect events or circumstances after the date hereof. More detailed information about potential factors that could affect financial results is included in the documents filed from time to time with the Canadian securities regulatory authorities by Sokoman Minerals Corp.

Sokoman Announces Over-Subscription Of Non-Brokered Flow-Through Private Placement

ST. JOHN’S, NL / ACCESSWIRE / December 22, 2022 / Sokoman Minerals Corp. (“Sokoman” or the “Company”) (TSXV:SIC)(OTCQB:SICNF) today announces that, due to high demand, the Company is increasing the maximum amount for the flow-through private placement announced on December 8, 2022 (the “Private Placement”) from $3,000,000 to $4,142,752

On receipt of TSX Venture Exchange (the “Exchange”) approval, the Company will issue 14,795,544 flow-through shares units (“FT Units”) at a price of $0.28 for gross proceeds of $4,142,752. Each FT Unit consists of one (1) common share of the Company and one half (1/2) of one common share purchase warrant (the “FT Warrant”), with each full FT Warrant entitling the holder to purchase one non-flow-through common share of the Company at a price of $0.36 for a period of 18 months after the closing of the Private Placement. The FT Units will entitle the holder to receive the tax benefits applicable to flow-through shares, in accordance with provisions of the Income Tax Act (Canada).

All securities issued pursuant to this financing will be subject to a four-month plus one-day hold.

In connection with the Private Placement, the Company is paying finders’ fees as permitted by the policies of the TSX Venture Exchange.

The net proceeds of the flow-through will be used for project exploration work on the Company’s properties that it controls that will qualify for Canadian Exploration Expenses under the Income Tax Act (Canada). The Company intends to spend approximately 25% of the gross proceeds on the Golden Hope (Kraken Lithium Pegmatite Field) joint venture project, and the remaining balance on its flagship Moosehead Gold project.

Tim Froude, Sokoman’s President & CEO, commented: “We are very pleased to have received the overwhelming support and participation from new and existing shareholders alike.”

About Sokoman Minerals Corp.

Sokoman Minerals Corp. is a discovery-oriented company with projects in the province of Newfoundland and Labrador, Canada. The Company’s primary focus is its portfolio of gold projects; the 100%-owned flagship, advanced-stage Moosehead, as well as Crippleback Lake; and East Alder (optioned to Canterra Minerals Corporation) along the Central Newfoundland Gold Belt, and the district-scale Fleur de Lys project near Baie Verte in northwestern Newfoundland, that is targeting Dalradian-type orogenic gold mineralization similar to the Curraghinalt and Cavanacaw deposits in Northern Ireland. The Company also recently entered into a strategic alliance with Benton Resources Inc. through three, large-scale, joint-venture properties including Grey River, Golden Hope, and Kepenkeck in Newfoundland.

Sokoman now controls, independently and through the Benton alliance, over 150,000 hectares (>6,000 claims – 1500 sq. km), making it one of the largest landholders in Newfoundland, in Canada’s newest and rapidly-emerging gold districts. The Company also retains an interest in an early-stage antimony/gold project (Startrek) in Newfoundland, optioned to White Metal Resources Inc., and in Labrador, the Company has a 100% interest in the Iron Horse (Fe) project which has Direct Shipping Ore (DSO) potential.

Mineralization hosted on adjacent and/or nearby properties is not necessarily indicative of mineralization hosted on the Company’s property.

The Company would like to thank the Government of Newfoundland and Labrador for past financial support of the Moosehead Gold project through the Junior Exploration Assistance Program.

For further information, please contact:

Sokoman Minerals

Timothy Froude, P.Geo., President & CEO

Phone: 709-765-1726

Email: tim@sokomanmineralscorp.com

CHF Capital Markets

Cathy Hume, VP Corporate Development, Director

Phone: 416-868-1079 x251

Email: cathy@chfir.com

CHF Capital Markets

Thomas Do, IR Manager

Phone: 416-868-1079 x 232

Email: thomas@chfir.com

Website: www.sokomanmineralscorp.com

Twitter: @SokomanMinerals

Facebook: @SokomanMinerals

LinkedIn: @SokomanMinerals

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accept responsibility for the adequacy or accuracy of this release.

Investors are cautioned that trading in the securities of the Corporation should be considered highly speculative. Except for historical information contained herein, this news release contains forward-looking statements that involve risks and uncertainties. Actual results may differ materially. Sokoman Minerals Corp. will not update these forward-looking statements to reflect events or circumstances after the date hereof. More detailed information about potential factors that could affect financial results is included in the documents filed from time to time with the Canadian securities regulatory authorities by Sokoman Minerals Corp.

Sokoman Minerals Reports Final Till Sampling Results Fleur De Lys Project, North-Central Newfoundland

ST. JOHN’S, NL / ACCESSWIRE / December 21, 2022 / Sokoman MineralsCorp. (TSXV:SIC)(OTCQB:SICNF) (the “Company” or “Sokoman”) is pleased to provide the final results for all 1,260 C-Horizon tills taken on the Fleur de Lys project on the Baie Verte Peninsula, in north-central Newfoundland. The results confirm the potential of the Fleur de Lys Supergroup to host significant gold mineralization similar to deposits at advanced stages of development in both Northern Ireland and Scotland in the Dalradian Supergroup. The Fleur de Lys and the Dalradian Supergroups are believed to be equivalent sequences of metamorphic rocks spatially associated with major structural breaks.

The background level of gold grains in tills for the Fleur de Lys Project (the “Project”) has been determined to be 10 grains in a 10- to 12-kilogram sample of screened till. Ottawa-based Overburden Drilling Management (ODM), who is overseeing the Project, considers a sample to be anomalous if it contains two-times background or 20 gold grains. Results indicate that of the 1,260 samples, 328, or just over 25%, have at least 20 gold grains (to a maximum of 230 grains) and are considered anomalous. Fifty-five (55) samples contain at least 60 grains (six-times background) and a number with more than 50% pristine gold grains. Gold grains described as pristine are considered to be from a local bedrock source (less than 200 m transport).

In addition to the anomalous gold grains in tills, prospecting has also located anomalous gold in bedrock and float with 34 samples giving gold values >100 ppb Au (0.1 g/t Au), including 18 >500 ppb Au (0.5 g/t Au), and 10 >1000 ppb Au (>1.0 g/t Au) with a maximum of 4.6 g/t Au. The highest gold value was in outcrop in an area of strong gold-grain counts.

Tim Froude, President and CEO of Sokoman, commented: “We are extremely pleased with the success of the till program in outlining strongly-anomalous gold in tills overlying favourable rocks and structures that have given significant gold values in both float and bedrock. The property is ideally suited to cost-effective exploration with a supportive local population, operating mines, and support businesses. We are prioritizing the anomalies for continued follow-up prospecting, trenching, and or fast-tracking to the diamond drill stage. Planning will include a review of data by ODM with input from our field crews. A preliminary interpretation of the till results by ODM defines a target area of 30-km strike-length, within which better-defined anomalies are found.”

The Fleur de Lys Supergroup, which underlies the Project, are equivalent rocks to the Dalradian Supergroup in the UK, where three significant gold deposits, including the Curraghinalt and Cavanacaw deposits in Northern Ireland, and Cononish in Scotland are found. Dalradian-type gold deposits occur in moderate- to high-grade metamorphic terranes and are typically high grade (the Curraghinalt deposit has >6 million ounces of NI 43-101 compliant gold resources including 6.3 million tonnes at 14.95 grams per tonne (Measured and Indicated) for 3.06 million ounces; and 7.72 million tonnes at 12.24 grams per tonne gold (Inferred) for 3.03 million ounces {2018 Mineral Resource Statement, Curraghinalt Gold Project, Northern Ireland, SRK Consulting (Canada)}.

About the Fleur de Lys Gold Project

The 100%-owned Fleur de Lys Gold Project is located on the west side of the Baie Verte Peninsula in north-central Newfoundland. The Project is highly prospective for Dalradian-style (e.g., Curraghinalt) orogenic vein-hosted gold deposits and as such, represents a readily accessible yet underexplored, district-scale, gold target in the Newfoundland Appalachians. The property has seen little modern exploration, with some areas remaining completely unexplored although historical grab sample values of 3.3 g/t Au to 25.5 g/t Au are reported from several locations (note: historical assays have not been verified by the Company and should not be relied upon).

QP

This news release has been reviewed and approved by Timothy Froude, P.Geo., a “Qualified Person” under National Instrument 43-101 and President and CEO of Sokoman Minerals Corp.

Till Sampling QA/QC

The till samples were collected by Sokoman personnel using field collection techniques provided by ODM. All samples were hand dug to the desired depth (C-Horizon Till) with a 10- to 12-kg sieved sample (8 mesh) placed in a clear plastic sample bag and sealed. Samples were shipped in plastic pails by bonded courier to the ODM lab in Ottawa, Ontario. The till samples are processed using procedures designed to progressively concentrate the heavy minerals, expose the gold grains and prepare a split of the heavy mineral concentrate (“HMC”) suitable for geochemical analysis if requested. The sample is wet screened at 2 mm with a preliminary concentrate extracted from the -2 mm fraction by tabling. Geological observations on the character of the sample are made during both the screening and tabling operations. The table concentrate is purposely large (typically 300-400 g) and of low grade (10%-25% heavy minerals) in order to achieve a high, 80% to 90% recovery rate for all desired heavy minerals irrespective of their grain size or relative specific gravity. The gold grains, more than 95% of which are normally silt-sized (Averill 2001), are observed at this stage with the aid of micro-panning and are counted, measured and classified as to degree of wear (ie distance of glacial transport), then returned to the table concentrate. The pyrite content of the pan concentrate is estimated and the number of grains of heavier, visually distinctive indicator minerals such as arsenopyrite, galena, scheelite, cinnabar, etc. is recorded.

Quality Control and Quality Assurance Measures

In addition to using field duplicates to monitor the quality of the indicator mineral data obtained from specific projects, ODM performs blind tests to ensure that the recovery rates for all targeted minerals are consistently in the 80% to 90% range. Furthermore, both the quality of the mineral separation and the overall mineralogy of the concentrate are visible at every stage of the concentration process, minimizing the potential for sample mix-ups, indicator mineral carryover between samples, and other potential contamination issues. For example, gold grains, which are the most important indicator mineral on many surveys, are more susceptible to inter-sample carryover than any other indicator mineral due to their very small size, but these grains are physically observed during the first stage of mineral concentration, tabling, and, if anomalous concentrations are present, blank samples are tabled and carefully inspected for gold grains before the next project sample is processed.

Rock Sample Analysis

Rock sample analysis (gold by fire assay) completed at Eastern Analytical Ltd., in Springdale NL. Samples were delivered in sealed bags directly to the lab by Sokoman Minerals personnel. Eastern Analytical is an accredited assay lab that conforms to requirements of ISO/IEC 17025. Eastern routinely inserts industry accepted standards and blanks in all sample runs performed as well as completing random duplicate analysis.

About Sokoman Minerals Corp.

Sokoman Minerals Corp. is a discovery-oriented company with projects in the province of Newfoundland and Labrador, Canada. The Company’s primary focus is its portfolio of gold projects; the 100% flagship, advanced-stage Moosehead, as well as Crippleback Lake; and East Alder (optioned to Canterra Minerals Corporation) along the Central Newfoundland Gold Belt, and the district-scale Fleur de Lys project near Baie Verte in north-central Newfoundland, that is targeting Dalradian-type orogenic gold mineralization similar to the Curraghinalt and Cavanacaw deposits in Northern Ireland. The Company also entered into a strategic alliance with Benton Resources Inc. through three, large-scale, joint-venture properties including Grey River, Golden Hope, and Kepenkeck in Newfoundland.

Sokoman now controls, independently and through the Benton alliance, over 150,000 hectares (>6,000 claims – 1500 sq. km), making it one of the largest landholders in Newfoundland, in Canada’s newest and rapidly-emerging gold districts. The Company also retains an interest in an early-stage antimony/gold project (Startrek) in Newfoundland, optioned to White Metal Resources Inc., and in Labrador, the Company has a 100% interest in the Iron Horse (Fe) project which has Direct Shipping Ore (DSO) potential.

Mineralization hosted on adjacent and/or nearby and/or referenced properties is not necessarily indicative of mineralization hosted on the Company’s property.

The Company would like to thank the Government of Newfoundland and Labrador for financial support of the Fleur de Lys Project through the Junior Exploration Assistance Program.

For further information, please contact:

Sokoman Minerals

Timothy Froude, P.Geo., President & CEO

Phone: 709-765-1726

Email: tim@sokomanmineralscorp.com

CHF Capital Markets

Cathy Hume, VP Corporate Development, Director

Phone: 416-868-1079 x251

Email: cathy@chfir.com

CHF Capital Markets

Thomas Do, IR Manager

Phone: 416-868-1079 x 232

Email: thomas@chfir.com

Website: www.sokomanmineralscorp.com

Twitter: @SokomanMinerals

Facebook: @SokomanMinerals

LinkedIn: @SokomanMinerals

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Investors are cautioned that trading in the securities of the Corporation should be considered highly speculative. Except for historical information contained herein, this news release contains forward- looking statements that involve risks and uncertainties. Actual results may differ materially. Sokoman Minerals Corp. will not update these forward-looking statements to reflect events or circumstances after the date hereof. More detailed information about potential factors that could affect financial results is included in the documents filed from time to time with the Canadian securities regulatory authorities by Sokoman Minerals Corp.

Sokoman Provides Drilling Update – Moosehead Gold Project, Central Newfoundland

MH-22-505 Completed to 559 m Depth; Top of 463 Zone Intersected; Assays Pending

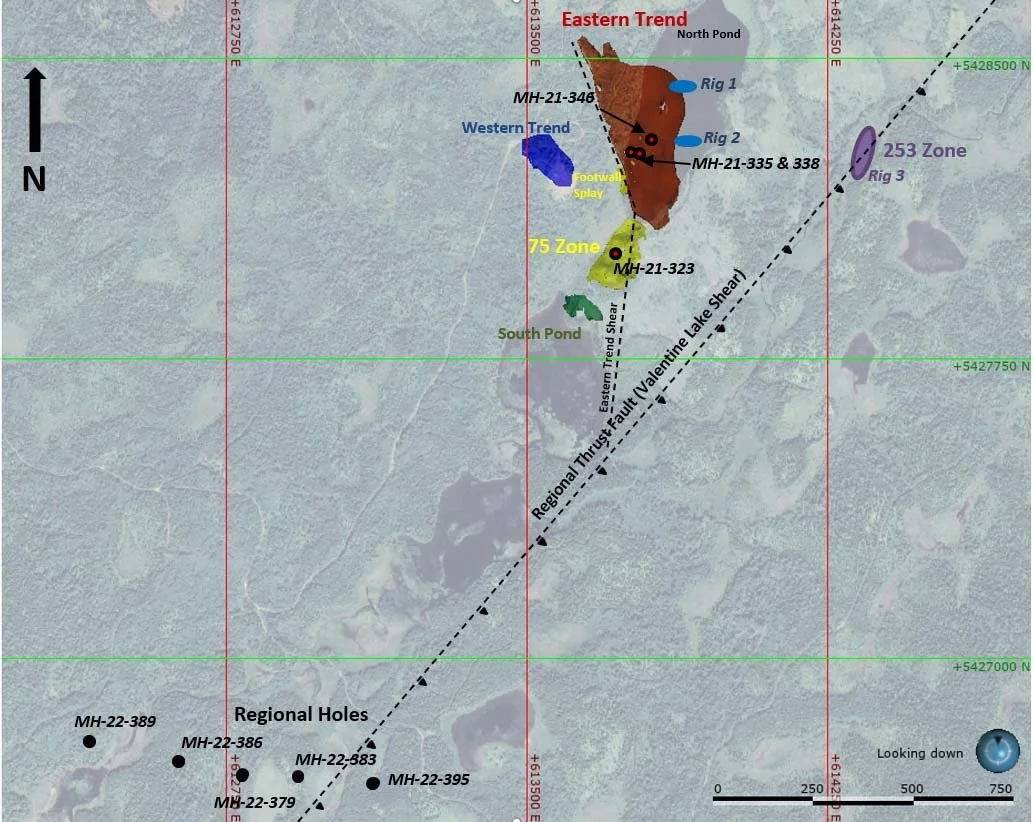

St. John’s, NL, December 15, 2022 – Sokoman Minerals Corp. (TSXV: SIC) (OTCQB: SICNF) (“Sokoman” or the “Company”) is pleased to provide an update on the structural analysis of hole MH-22-463 as well as an update on diamond drilling in the immediate area. MH-22-463 (see press release September 6, 2022) intersected a 39.60 m intercept (core length) of 12.50 g/t Au (from 295.30 m downhole) including a higher-grade interval of 10.25 m grading 41.97 g/t Au (from 312.35 m downhole) from what is now termed the “463 Zone”.

MH-22-505 was collared on the western shore of North Pond to provide the proper angle to test the geometry of the 463 Zone as it was designed to intersect the mid-point of the 463 Zone at depths from 390 m to 410 m. The hole flattened slightly and cut through the top portion of the inferred location of the 463 Zone and intersected three (< 1 m-wide) visible gold (VG) bearing veins, with characteristics similar to veins intersected in MH-22-463, at depths between 393 m and 414 m downhole. The upper part of the hole was projected to cut through a portion of the main Eastern Trend Fault system and significant quartz veining was intersected from 189 m to 194 m and 199 m to 210 m with VG specks noted in both intervals. Other veining with one (1) speck of VG was intersected in a breccia zone from 275 m to 277 m. The mineralized breccia occurs in a similar orientation to the breccia in the 463 Zone and is interpreted to represent another splay or offset in the footwall of the Eastern Trend.

The deepest mineralized zone with 1%-5% stringer/disseminated pyrite +/- arsenopyrite associated with massive (1 m) quartz veins and irregular narrow veins and stringers was intersected from 480 m to 520 m. Significant quartz veining (10%-30%) noted in other parts of the hole will also be assayed. Final assay results are not expected before the end of the year.

463 Zone

The 463 Zone is a significant departure in vein style/geometry from one suggested by earlier drill intersections in the vicinity. The “463” intercept is thicker than any other to date and includes the “typical” high-grade vuggy-type veins with abundant VG with 5%-7% accessory boulangerite and sphalerite, as well as brecciated veining with occasional specks of VG with minor boulangerite and sphalerite. The Company re-engaged Ireland-based structural geology consultant, Dr. David Coller, to review/update existing structural models for the Moosehead mineralization. Dr. Coller’s preliminary conclusions are that the 463 Zone is the hinge zone of a folded footwall splay vein off the lower Eastern Trend with the geometry inferred to be a flat structure with a north-south trend.

Tim Froude, President, and CEO of Sokoman says: “Drill hole MH-22-505 is the first of a series of holes planned to test the 463 Zone. The hole flattened a few degrees more than expected and cut through the upper portion of the 463 Zone with the units and veining intersected, comparing well with hole 463. The next hole will be drilled at a steeper angle to target the middle of the 463 Zone approximately 15 m – 20 m deeper than hole 505.

It is encouraging to see the gold mineralization continuing to depths beyond our previous drilling and confirms the Eastern Trend area is a good hunting ground for additional high-grade mineralization. Drilling will pause for the holiday break with a planned startup in mid – January 2023. Approximately 20,000 m remain in Phase 6 but the program will continue beyond that figure and for the foreseeable future.”

The Moosehead Project has five open-ended zones of gold mineralization focused around the Eastern Trend in the central portion of the property with mineralization defined over a 600-m strike length and over 370 m down dip. The Company is well funded with more than $7 million in the treasury.

QP

This news release has been reviewed and approved by Timothy Froude, P.Geo., a “Qualified Person” under National Instrument 43-101 and President and CEO of Sokoman Minerals Corp.

Analytical Techniques / QA/QC

Samples, including duplicates, blanks, and standards, were submitted to Eastern Analytical Ltd. in Springdale, Newfoundland for gold analysis. All core samples submitted for assay were saw cut by Sokoman personnel with one-half submitted for assay and one-half retained for reference. Samples were delivered in sealed bags directly to the lab by Sokoman personnel. Eastern Analytical Ltd. is an accredited assay lab that conforms to the requirements of ISO/IEC 17025. Samples with visible gold were submitted for total pulp metallics and gravimetric finish. All other samples were analyzed by standard fire assay methods. Total pulp metallic analysis includes: the whole sample is crushed to -10 mesh; then pulverized to 95% -150 mesh. The total sample is weighed and screened to 150 mesh; the +150 mesh fraction is fire assayed for Au, and a 30 g subsample of the -150 mesh fraction is fire assayed for Au; with a calculated weighted average of total Au in the sample reported as well. One blank and one industry-approved standard for every twenty samples submitted is included in the sample stream. Random duplicates of selected samples are analyzed in addition to the in-house standard and duplicate policies of Eastern Analytical Ltd. All reported assays are uncut.

About Sokoman Minerals Corp.

Sokoman Minerals Corp. is a discovery-oriented company with projects in the province of Newfoundland and Labrador, Canada. The Company’s primary focus is its portfolio of gold projects; the 100% flagship, advanced-stage Moosehead, as well as the Crippleback Lake; and East Alder (optioned to Canterra Minerals Corporation) along the Central Newfoundland Gold Belt, and the district-scale Fleur de Lys project Near Baie Verte in northwestern Newfoundland, that is targeting Dalradian-type orogenic gold mineralization similar to the Curraghinalt and Cavanacaw deposits in Northern Ireland. The Company also recently entered into a strategic alliance with Benton Resources Inc. through three, large-scale, joint-venture properties including Grey River, Golden Hope, and Kepenkeck in Newfoundland. Sokoman now controls, independently and through the Benton alliance, over 150,000 hectares (>6,000 claims – 1500 sq. km), making it one of the largest landholders in Newfoundland, in Canada’s newest and rapidly-emerging gold districts. The Company also retains a 1% Net Smelter Return (NSR) interest in an early-stage antimony/gold project (Startrek) in Newfoundland, optioned to Thunder Gold Corp (formerly White Metal Resources Inc.), and in Labrador, the Company has a 100% interest in the Iron Horse (Fe) project which has Direct Shipping Ore (DSO) potential.

Mineralization hosted on adjacent and/or nearby properties is not necessarily indicative of mineralization hosted on the Company’s property.

The Company would like to thank the Government of Newfoundland and Labrador for past financial support of the Moosehead Project through the Junior Exploration Assistance Program.

For further information, please contact:

Sokoman Minerals

Timothy Froude, P.Geo., President & CEO

Phone: 709-765-1726

Email: tim@sokomanmineralscorp.com

CHF Capital Markets

Cathy Hume, VP Corporate Development, Director

Phone: 416-868-1079 x251

Email: cathy@chfir.com

CHF Capital Markets

Thomas Do, IR Manager

Phone: 416-868-1079 x 232

Email: thomas@chfir.com

Website: www.sokomanmineralscorp.com

Twitter: @SokomanMinerals

Facebook: @SokomanMinerals

LinkedIn: @SokomanMinerals

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accept responsibility for the adequacy or accuracy of this release.

Investors are cautioned that trading in the securities of the Corporation should be considered highly speculative. Except for historical information contained herein, this news release contains forward- looking statements that involve risks and uncertainties. Actual results may differ materially. Sokoman Minerals Corp. will not update these forward-looking statements to reflect events or circumstances after the date hereof. More detailed information about potential factors that could affect financial results is included in the documents filed from time to time with the Canadian securities regulatory authorities by Sokoman Minerals Corp.

Sokoman Announces Non-Brokered Flow-Through Private Placement For Gross Proceeds Of Up To $3m

ST. JOHN’S, NL / ACCESSWIRE / December 8, 2022 / Sokoman Minerals Corp.(TSXV:SIC)(OTCQB:SICNF) (“Sokoman” or the “Company”) today announced the non-brokered private placement of flow-through (“FT”) units (the “Private Placement”) for gross proceeds of up to $3,000,000. The Private Placement is expected to close on or before December 28, 2022.

The Private Placement is priced at $0.28 per FT Unit. Each FT Unit consists of one common share of the Company and one-half of one common share purchase warrant (a “Warrant”), each full Warrant being exercisable for one additional common share of the Company, each of which will not qualify as a flow-through share, at an exercise price of $0.36 for 18 months from the date of issue. The FT Units will entitle the holder to receive the tax benefits applicable to flow-through shares, in accordance with provisions of the Income Tax Act (Canada).

All securities issued pursuant to the Private Placement will be subject to a four-month and one-day hold period.

In connection with the Private Placement, the Company may pay finders’ fees in cash as permitted by the policies of the TSX Venture Exchange. The Private Placement is subject to approval by the TSX Venture Exchange.

The Company will use an amount equal to the gross proceeds received by the Company from the sale of the FT Units, pursuant to the provisions in the Income Tax Act (Canada), to incur eligible “Canadian exploration expenses” that qualify as “flow-through mining expenditures” as both terms are defined in the Income Tax Act (Canada) (the “Qualifying Expenditures”) on or before December 31, 2023, and to renounce all of the Qualifying Expenditures in favour of the subscribers of the FT Units effective December 31, 2022.

The Company intends to spend approximately 25% of the gross proceeds on the Golden Hope (Kraken Lithium Pegmatite Field) joint venture project, and the remaining balance on its flagship Moosehead Gold project.

The Company is well-funded to cover corporate and working capital needs for 2023 with $4.7M in the treasury.

About Sokoman Minerals Corp.

Sokoman Minerals Corp. is a discovery-oriented company with projects in Newfoundland and Labrador, Canada. The company’s primary focus is its portfolio of gold projects: flagship, 100%-owned Moosehead and Crippleback Lake Projects, and East Alder (optioned to Canterra Minerals Corporation) along the Central Newfoundland Gold Belt, and the district-scale Fleur de Lys project in northwestern Newfoundland, that is targeting Dalradian-type orogenic gold mineralization similar to the Curraghinalt and Cavanacaw deposits in Northern Ireland, and Cononish in Scotland. The Company has also entered into a strategic alliance (the Alliance) with Benton Resources Inc. through three large-scale joint-venture properties including Grey River Gold, Golden Hope, and Kepenkeck on the Island of Newfoundland. Sokoman now controls independently and through the Alliance over 150,000 hectares (>6,000 claims – 1,500 sq km), making it one of the largest landholders in Newfoundland, Canada’s newest and rapidly-emerging gold district. Sokoman also retains a 1% Net Smelter Return (NSR) royalty in an early-stage antimony/gold project (Startrek) in Newfoundland, and in Labrador, the company has a 100% interest in the Iron Horse (Fe) project that has Direct Shipping Ore (DSO) potential.

Mineralization hosted on adjacent and/or nearby properties is not necessarily indicative of mineralization hosted on the Company’s property.

The Company would like to thank the government of Newfoundland and Labrador for past financial support of the Moosehead Project through the Junior Exploration Assistance Program.

For further information, please contact:

Sokoman Minerals

Timothy Froude, P.Geo., President & CEO

Phone: 709-765-1726

Email: tim@sokomanmineralscorp.com

CHF Capital Markets

Thomas Do, IR Manager

Phone: 416-868-1079 x 232

Email: thomas@chfir.com

Website: www.sokomanmineralscorp.com

Twitter: @SokomanMinerals

Facebook: @SokomanMinerals

LinkedIn: @SokomanMinerals

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accept responsibility for the adequacy or accuracy of this release.

Investors are cautioned that trading in the securities of the Corporation should be considered highly speculative. Except for historical information contained herein, this news release contains forward-looking statements that involve risks and uncertainties. Actual results may differ materially. Sokoman Minerals Corp. will not update these forward-looking statements to reflect events or circumstances after the date hereof. More detailed information about potential factors that could affect financial results is included in the documents filed from time to time with the Canadian securities regulatory authorities by Sokoman Minerals Corp.

Sokoman And Benton Channel Samples Up To 13.57% Cs2o And Confirm High-Grade Cesium Discovery At The Golden Hope Joint Venture, Southwestern Newfoundland

Channel sampling at the Hydra Zone returns up to 13.57% Cs2O

St. John’s, NL – December 1, 2022 – Sokoman Minerals Corp. (TSXV: SIC) (OTCQB: SICNF) (“Sokoman”) and Benton Resources Inc. (TSXV: BEX) (“Benton”) together, (the “Alliance”) are pleased to announce that recent channel sampling at the cesium dyke prospect has confirmed a potentially significant high-grade cesium discovery dubbed the Hydra Zone, on the Golden Hope Project in southwestern Newfoundland.

Results (rush service) from saw-cut channel samples ranging from 0.4 m to 0.7 m long, and two bulk grab samples, confirm that the outcropping pegmatite dyke is strongly enriched in several critical minerals. Samples 758224, 758225, and 758226 (see table below) are consecutive 0.4 m-long channel cuts that averaged 8.75% Cs2O, 0.41% Li2O (lithium oxide), 0.025% Ta2O5 (tantalum oxide), and 0.33% Rb2O (rubidium oxide) over a combined total of 1.2 m. An additional 17 saw-cut samples are still pending which were sent to SGS laboratories in Grand Falls-Windsor, Newfoundland. The sampling reported today was completed over a 20 m-long section of the pegmatite dyke in the same area as the previously reported (November 17, 2022 news release) grab sampling that returned up to 1.56% Cs2O. This is the first high-grade cesium mineralization recorded on the Island of Newfoundland.

The cesium-rich dyke is approximately 5 m – 6 m wide and has been traced for approximately 100 m along strike to where it disappears under overburden in both directions. The dyke is located approximately 12 km east northeast of the initial Kraken Pegmatite discovery. It is distinctly different from the main Kraken Pegmatite dykes as it contains very coarse, as well as fine-grained phases. A suite of samples is currently being worked on at Vancouver Petrographics to identify the full suite of minerals in the dyke with a report due in 4-6 weeks.

The onset of winter has hampered the Alliance’s efforts to follow up on these results and it hopes to get a weather window in the coming weeks to complete mapping, detailed sampling, and regional soil sampling.

About Cesium

Cesium is rare globally. The United States and Canada have included cesium, lithium, and tantalum (among others) in their lists of Critical Minerals / Elements since each of them has been identified as being essential to the economy and national security.

Here are some facts and figures about cesium:

Currently only produced at one locality, the Tanco Mine in Manitoba (Sinomine Resources Group)

Very dense metal and its primary use is in deep drilling applications in the oil and gas sector

Many industrial as well as medical uses including:

Cesium hydroxide/carbonate is used in petrochemical catalysts; cesium iodide is used in fluoroscopy equipment; as the input phosphor of x-ray imaging equipment; cesium bromide is used in infrared detectors, optics, photoelectric cells, scintillation counters, and spectrophotometers

Important component of atomic clocks which are the most accurate time and frequency monitors which play a vital role in aircraft guidance systems, global positioning satellites and internet and cellular telephone transmissions

Global market for cesium forecast to double in the next five years

Global leader in terms of production, market share, revenue, etc. is China’s Sinomine Resource Group; Albermarle Corp of the USA is second

Forecast prices (2023) for cesium salt (the most common product produced from cesium ore) is USD$188/kg and USD$291/kg for pure cesium metal

The Alliance also announced yesterday that Phase 3 drilling has started at the Kraken Lithium Prospect, 12 km to the southwest and that the initial three drill holes have made a new discovery of spodumene-rich dykes. (November 30, 2022 news release). Approximately 20 holes are planned.

The Alliance is extremely pleased with the continued success on the Golden Hope Project and the new discovery of cesium along with lithium, tantalum, and rubidium 12 km from the original Kraken Pegmatite discovery. Given the results to date, the Alliance is confident that ongoing prospecting and soil geochemistry surveys will make more discoveries along the 100% owned, 60 km-long, structural trend hosting the Kraken and cesium-rich dykes.

Timothy Froude, P.Geo., President and CEO of Sokoman stated: “The cesium results reported today are quite impressive and once again demonstrate the potential of the Golden Hope JV to host potentially significant deposits of several critical metals (Lithium-Cesium-Tantalum). Grades of this magnitude are rare. The results include a 1.2 m channel located near the southern margin of the exposed dyke dominated by a coarser-grained phase and where overburden prevented further sampling at the time. The lowest values reported today are from a finer-grained section of the dyke so we have already learned quite a bit about the nature of the mineralization in the dyke. Once able, we intend to clean off as much of the dyke as we can, and the terrain should allow for sufficient stripping to occur. The samples still pending include a mixture of coarse-grained, and fine-grained phases and those results will further our understanding of the zone. Winter has arrived, so we have to wait for a weather window to get back onsite. We are learning as much as possible as quickly as possible about the critical metals markets and we recently received a paid-for, in-depth report on the cesium market and have incorporated some of those details into today’s news. We are also now applying for drilling permits for this area and those should be in hand by Q1, 2023.”

“We are also pleased to resume drilling in the main Kraken Pegmatite field, in particular to the west of the discovery area where no drilling has taken place to date and where strong soil geochemistry, as well as multiple >1% Li2O samples, were collected. In the meantime, soil sampling along the 60 km trend controlled by the Alliance will continue until the closure of the camp for the holiday break.”

Stephen Stares, President and CEO of Benton stated: “This new high-grade cesium zone compliments the Kraken Lithium zone very well and the results compare to most deposits known worldwide. Although it’s very early days for this exciting new discovery, it’s a continued testament to the promising strategic metal endowment within the large project. I’m confident we will make more discoveries as we continue with our aggressive exploration plans in this new LCT-type pegmatite belt.”

QP

This news release has been reviewed and approved by Timothy Froude, P.Geo., President and CEO of Sokoman Minerals Corp., and Stephen House, P.Geo., VP Exploration of Benton Resources Inc., both a “Qualified Person” under National Instrument 43-101.

Mineralization hosted on adjacent and/or nearby properties is not necessarily indicative of mineralization hosted on the Golden Hope property. Samples were submitted to SGS Canada Inc. in Grand Falls-Windsor, Newfoundland for prep and then sent to SGS Canada Inc. analytical laboratory in Burnaby, British Colombia. All samples submitted for assay were taken or saw-cut by Benton personnel and submitted for assay. Samples were delivered in sealed bags directly to the Grand Falls-Windsor prep lab by Benton personnel or contractor. SGS Canada Inc. (SGS) is an accredited assay lab that conforms to the requirements of ISO/IEC 17025. Samples are analyzed using SGS’s GS_IMS91A50 method that delivers a 56-element package utilizing sodium peroxide fusion, ICP-AES, and ICP-MS analytical techniques. All reported assays are uncut.

About Sokoman Minerals Corp.

Sokoman Minerals Corp. is a discovery-oriented company with projects in Newfoundland and Labrador, Canada. The company’s primary focus is its portfolio of gold projects: flagship, 100%-owned Moosehead, Crippleback Lake, and East Alder (optioned to Canterra Minerals Corporation) along the Central Newfoundland Gold Belt, and the district-scale Fleur de Lys project in northwestern Newfoundland, which is targeting Dalradian-type orogenic gold mineralization similar to the Curraghinalt and Cavanacaw deposits in Northern Ireland, and Cononish in Scotland. The company is also a 50/50 partner in a strategic alliance with Benton Resources Inc. through three large-scale joint-venture properties including Grey River Gold, Golden Hope, and Kepenkeck in Newfoundland. Sokoman now controls independently and through the Benton alliance over 150,000 hectares (>6,000 claims – 1,500 sq. km), making it one of the largest landholders in Newfoundland, Canada’s newest and rapidly-emerging gold districts. The company also retains an interest in an early-stage antimony/gold project (Startrek) in Newfoundland, optioned to White Metal Resources Inc., and in Labrador, the company has a 100% interest in the Iron Horse (Fe) project that has Direct Shipping Ore (DSO) potential.

About Benton Resources Inc.

Benton Resources Inc. is a well-funded mineral exploration company listed on the TSX Venture Exchange under the symbol BEX. Following a project generation business model, Benton has a diversified, highly-prospective property portfolio of Gold, Silver, Nickel, Copper, Platinum Group Elements and most-recently Lithium and Cesium assets. In addition, it currently holds large equity positions in other mining companies that are advancing high-quality assets. Whenever possible, BEX retains Net Smelter Return (NSR) royalties with potential long-term cash flow.

Benton also is a 50/50 partner in a strategic alliance with Sokoman Minerals Corp. (TSXV:SIC) through three large-scale joint venture properties including Grey River Gold, Golden Hope, and Kepenkeck in Newfoundland.

For further information, please contact:

CHF Capital Markets

Thomas Do, IR Manager

Phone: 416-868-1079 x 232

Email: thomas@chfir.com

Sokoman Minerals

Timothy Froude, P.Geo., President & CEO

Phone: 709-765-1726

Email: tim@sokomanmineralscorp.com

Benton Resources

Stephen Stares, President & CEO

Phone: 807-475-7474

Email: sstares@bentonresources.ca

Website: www.sokomanmineralscorp.com , www.bentonresources.ca

Twitter: @SokomanMinerals , @BentonResources

Facebook: @SokomanMinerals , @BentonResourcesBEX

LinkedIn: @SokomanMinerals, @BentonResources

THE TSX VENTURE EXCHANGE HAS NOT REVIEWED AND DOES NOT ACCEPT RESPONSIBILITY FOR THE ADEQUACY OR ACCURACY OF THIS RELEASE.

The information contained herein contains “forward-looking statements” within the meaning of applicable securities legislation. Forward-looking statements relate to information that is based on assumptions of management, forecasts of future results, and estimates of amounts not yet determinable. Any statements that express predictions, expectations, beliefs, plans, projections, objectives, assumptions or future events or performance are not statements of historical fact and may be “forward-looking statements.”

Forward-looking statements are subject to a variety of risks and uncertainties which could cause actual events or results to differ from those reflected in the forward-looking statements, including, without limitation: risks related to failure to obtain adequate financing on a timely basis and on acceptable terms; risks related to the outcome of legal proceedings; political and regulatory risks associated with mining and exploration; risks related to the maintenance of stock exchange listings; risks related to environmental regulation and liability; the potential for delays in exploration or development activities or the completion of feasibility studies; the uncertainty of profitability; risks and uncertainties relating to the interpretation of drill results, the geology, grade and continuity of mineral deposits; risks related to the inherent uncertainty of production and cost estimates and the potential for unexpected costs and expenses; results of prefeasibility and feasibility studies, and the possibility that future exploration, development or mining results will not be consistent with the Alliance’s expectations; risks related to gold price and other commodity price fluctuations; and other risks and uncertainties related to the Alliance’s prospects, properties and business detailed elsewhere in the Alliances’s disclosure record. Should one or more of these risks and uncertainties materialize, or should underlying assumptions prove incorrect, actual results may vary materially from those described in forward-looking statements. Investors are cautioned against attributing undue certainty to forward-looking statements. These forward-looking statements are made as of the date hereof and the Alliance does not assume any obligation to update or revise them to reflect new events or circumstances. Actual events or results could differ materially from the Alliance’s expectations or projections.

Sokoman Minerals And Benton Resources Report Kraken Lithium Prospect Phase 3 Drilling Program Underway; First Three Holes Cut Spodumene-Rich Dykes Up To 14 M Thick

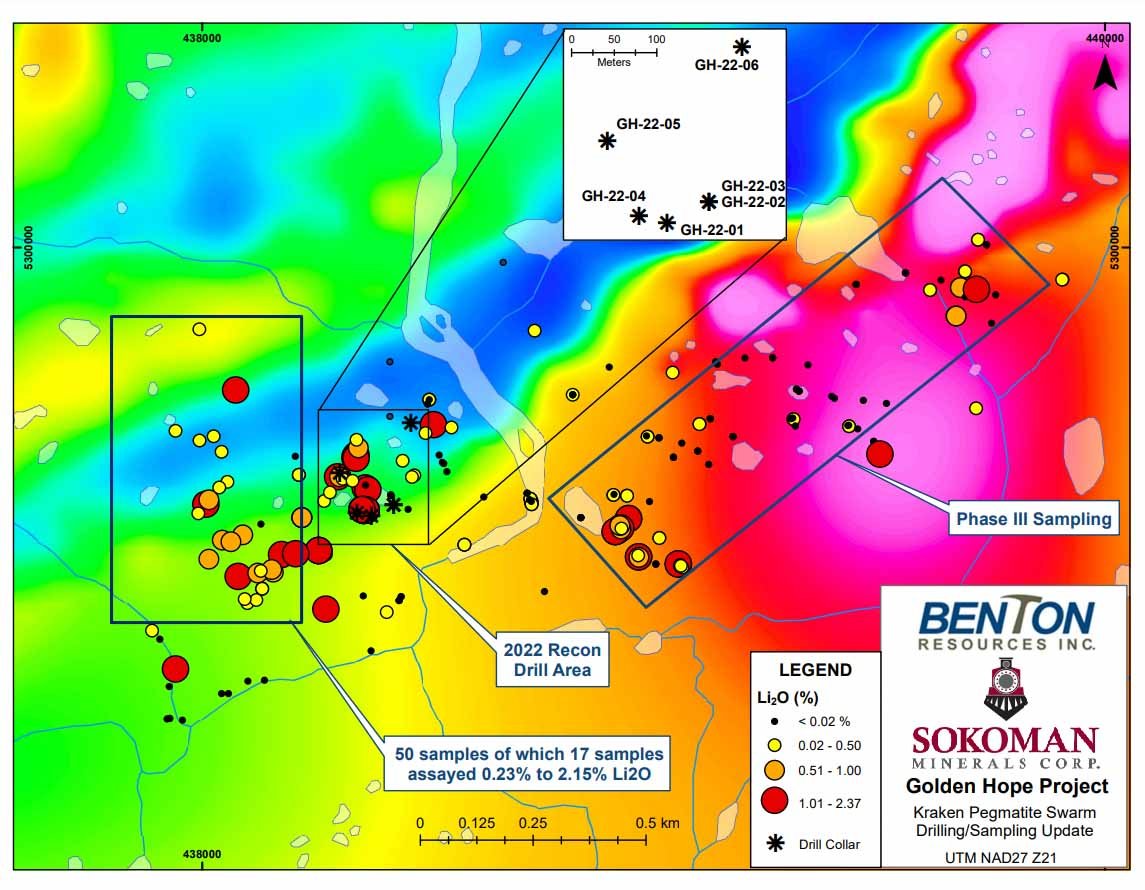

St. John’s, NL, November 30, 2022 – Sokoman Minerals Corp. (TSXV:SIC) (OTCQB:SICNF) (“Sokoman”) and Benton Resources Inc. (TSXV:BEX) (“Benton”), together (the “Alliance”) are happy to report the commencement of the third phase of drilling at the Kraken Lithium Prospect. The Alliance is also extremely pleased to announce a new discovery, the Killick Zone, where surface grab samples graded up to 1.12% Li2O, located 200 m south of the East Dyke Zone (see press release October 18, 2022).

Currently, the Alliance has completed three holes GH-22-25, GH-22-26, and GH-22-27 on the new discovery, intersecting multiple, near-surface, spodumene-bearing dykes. Hole GH-22-25 cut eight pegmatite dykes ranging from 0.8 m to 11.2 m thick (drilled thickness, true thickness uncertain at this time), including an 8.8 m interval with visible spodumene in the 11.2 m dyke. Hole GH-22-26, drilled 35 m behind GH-22-25, also cut multiple spodumene-bearing dykes with drilled thicknesses ranging from 0.8 m to 10.5 m. The 10.5 m-thick dyke carried visible spodumene over its entire width. Hole GH-22-27 was drilled 30 m north of holes 25 and 26 along strike and cut two pegmatite dyke zones of 14.2 m and 2.95 m thick. Visual spodumene is present over 12.83 m of the 14.2 m interval and the entire length of the 2.95 m interval.

The planned drill program will consist of a minimum of 2,000 m targeting the new Killick Zone, and well as the main Kraken Discovery Dyke area located 0.6 km to 1.2 km to the west of the Killick and East Dyke area. The current drill program is expected to continue until the start of the holiday break in mid-December. The core has been logged and is currently being prioritized to facilitate faster sampling of the mineralized sections. The Alliance continues to be impressed with the rate of discovery in this new lithium district and looks forward to the future exploration success of this exciting lithium project located in the mining-friendly province of Newfoundland and Labrador.

Kraken Project Highlights:

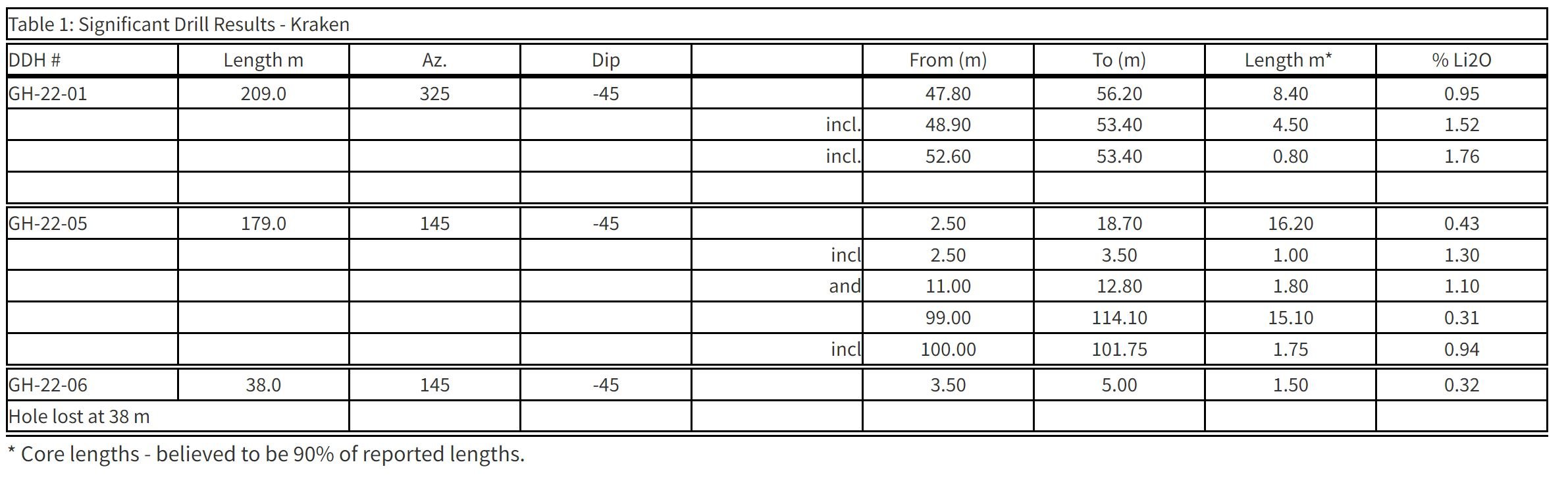

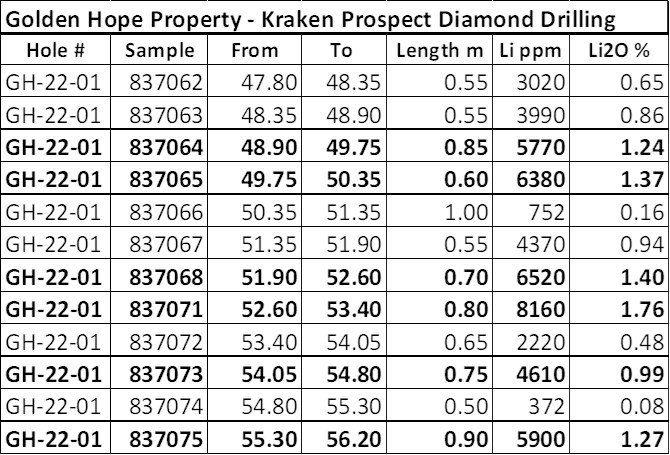

First significant lithium discovery on the Island of Newfoundland in July 2021; select grab samples returned values from trace up to 2.37% Li2O over a 2.2 km strike length, the discovery remains open with the Alliance controlling an additional 60 km of potential strike extensions. A reconnaissance drill campaign in early 2022 intersected 0.94% Li2O over 8.40 m on the Kraken Discovery Dyke.

Second drill campaign in summer 2022 (3,073 m / 18 holes) focused on the East Dyke area 600 m to the east of the Kraken Discovery Dyke, intercepted multiple stacked dykes including 0.60% Li2O over 20.82 m (46.00 m to 66.82 m), including 1.16% Li2O over 5.50 m, including 1.43% Li2O over 2.68 m.

Discovery of the new high-grade Cesium Zone 12 km to the east northeast of Kraken with grab samples assaying up to 1.56% Cs2O (cesium oxide), 0.4% Li2O (lithium oxide), 0.022% Ta2O5 (tantalum oxide), and 0.30% Rb2O (rubidium oxide), released November 17, 2022.

Third phase drill program currently underway with the first three holes intersecting visual spodumene over significant thicknesses up to 11.2 m in the new Killick Zone 200 m south of East Dyke.

The third phase drilling will also target a 600 m to 700 m strike extension immediately west of the Kraken Discovery Dyke which has multiple untested surface samples and dyke occurrences grading in excess of 1% Li2O, as well as strong soil geochemistry.

Lithium soil geochemistry over areas of spodumene-bearing dykes outlines the mineralization. Subsequent soil sampling along trend and to the north of the known zones has identified multiple strong lithium-in-soil anomalies, now prioritized for prospecting. Given its effectiveness, the Alliance has launched an extensive and systematic lithium soil survey at Golden Hope.

The Alliance believes the extensive (~800 sq km) Golden Hope project has excellent potential for additional discoveries. Exploration is still in its infancy and the Alliance has control over a district-scale lithium play similar in scale to the large systems in the Appalachians, including the important deposits held by Piedmont Lithium Inc. in the Carolinas, USA, as well as the Avalonia Project of International Lithium in a joint venture with GFL International Co. Ltd., a subsidiary of Ganfeng Lithium Co. Ltd. in the Caledonides of Ireland. Golden Hope lies along the prolific Appalachian-Caledonian Lithium Belt extending from the UK to the Eastern US.

Sokoman’s President and CEO Tim Froude, comments: “We have stated in the past that the true size of the lithium-rich system on the Golden Hope Property is still unknown, today’s announcement further emphasizes that fact. The Killick Zone discovery is yet another example of just how well mineralized this corridor is, and with several rock and soil anomalies as yet untested, we feel numerous more discoveries are yet to be made. At this time, it is not possible to determine if the dykes at the Killick Zone are the western extension of the East Dyke, or if they represent a new, subparallel trend. Drilling to test the western extension of the Kraken Discovery Dyke will focus on the 2 km long lithium-in-soil anomaly, as well as numerous outcrops and float of spodumene mineralization that are known.”

Benton’s President and CEO Stephen Stares, states: “This project continues to surprise us with more lithium-rich pegmatites, and I have no doubt we are onto a very important discovery of much-needed strategic metals on the Island of Newfoundland. We continue to show the robust extent of these highly-evolved pegmatite fields from multiple zones of high-grade Lithium at the Kraken, to the discovery of high-grade Cesium 12 km to the East. We are very pleased with our continued success and look forward to receiving assay results from our ongoing exploration efforts.”

QP

This news release has been reviewed and approved by Timothy Froude, P.Geo., President and CEO of Sokoman Minerals Corp., and a Director of Benton Resources Inc. Mr. Froude is a ‘Qualified Person’ under National Instrument 43-101.

Analytical Techniques / QA/QC

Samples, including duplicates, blanks, and standards, were submitted to SGS Canada Inc. in Grand Falls-Windsor, Newfoundland for prep and then sent to SGS Canada Inc. analytical laboratory in Burnaby, British Colombia. All core samples submitted for assay were saw cut by Benton personnel with one-half submitted for assay and one-half retained for reference. Samples were delivered in sealed bags directly to the Grand Falls-Windsor prep lab by Benton personnel or contractor. SGS Canada Inc. (“SGS”) is an accredited assay lab that conforms to the requirements of ISO/IEC 17025. Samples are analyzed using SGS’s GS_IMS91A50 method that delivers a 56-element package utilizing sodium peroxide fusion, ICP-AES, and ICP-MS analytical techniques. One blank and one industry-approved standard for every twenty samples submitted is included in the sample stream. Random duplicates of selected samples are analyzed in addition to the in-house standard and duplicate policies of SGS Canada Inc. All reported assays are uncut.

All soil samples were analyzed for lithium at Eastern Analytical in Springdale, NL. Lithium package includes Lithium, Lithium Oxide, Tantalum, Niobium, and Tin. One (1) gram of sample is digested to dryness in three acids (Nitric, Perchloric, and Hydrofluoric). After which HCl is added and brought to a boil on a hotplate. It is then topped to volume (200 ml) with distilled water and read on the ICP-OES.

About Sokoman Minerals Corp.

Sokoman Minerals Corp. is a discovery-oriented company with projects in Newfoundland and Labrador, Canada. The company’s primary focus is its portfolio of gold projects: flagship, 100%-owned Moosehead and Crippleback Lake Projects, and East Alder (optioned to Canterra Minerals Corporation) along the Central Newfoundland Gold Belt, and the district-scale Fleur de Lys project in northwestern Newfoundland, that is targeting Dalradian-type orogenic gold mineralization similar to the Curraghinalt and Cavanacaw deposits in Northern Ireland, and Cononish in Scotland. The company has also entered into a strategic alliance (the Alliance) with Benton Resources Inc. through three large-scale joint-venture properties including Grey River Gold, Golden Hope, and Kepenkeck on the Island of Newfoundland. Sokoman now controls independently and through the Alliance over 150,000 hectares (>6,000 claims – 1,500 sq km), making it one of the largest landholders in Newfoundland, Canada’s newest and rapidly-emerging gold district. Sokoman also retains an interest in an early-stage antimony/gold project (Startrek) in Newfoundland, optioned to White Metal Resources Inc., and in Labrador, the company has a 100% interest in the Iron Horse (Fe) project that has Direct Shipping Ore (DSO) potential.

About Benton Resources Inc.

Benton Resources Inc. is a well-funded mineral exploration company listed on the TSX Venture Exchange under the symbol BEX. Following a project generation business model, Benton has a diversified, highly-prospective property portfolio of Gold, Silver, Nickel, Copper, Platinum Group Elements, and most-recently Lithium and Cesium assets. In addition, it currently holds large equity positions in other mining companies that are advancing high-quality assets. Whenever possible, BEX retains Net Smelter Return (NSR) royalties with potential long-term cash flow.

Benton also is a 50/50 partner in a strategic alliance with Sokoman Minerals Corp. (TSXV: SIC) through three large-scale joint venture properties including Grey River Gold, Golden Hope, and Kepenkeck in Newfoundland.

For further information, please contact:

CHF Capital Markets

Thomas Do, IR Manager

Phone: 416-868-1079 x 232

Email: thomas@chfir.com

Sokoman Minerals

Timothy Froude, P.Geo., President & CEO

Phone: 709-765-1726

Email: tim@sokomanmineralscorp.com

Benton Resources

Stephen Stares, President & CEO

Phone: 807-475-7474

Email: sstares@bentonresources.ca

Website: www.sokomanmineralscorp.com , www.bentonresources.ca

Twitter: @SokomanMinerals , @BentonResources

Facebook: @SokomanMinerals , @BentonResourcesBEX

LinkedIn: @SokomanMinerals, @BentonResources

THE TSX VENTURE EXCHANGE HAS NOT REVIEWED AND DOES NOT ACCEPT RESPONSIBILITY FOR THE ADEQUACY OR ACCURACY OF THIS RELEASE.

The information contained herein contains “forward-looking statements” within the meaning of applicable securities legislation. Forward-looking statements relate to information that is based on assumptions of management, forecasts of future results, and estimates of amounts not yet determinable. Any statements that express predictions, expectations, beliefs, plans, projections, objectives, assumptions or future events or performance are not statements of historical fact and may be “forward-looking statements.”

Forward-looking statements are subject to a variety of risks and uncertainties which could cause actual events or results to differ from those reflected in the forward-looking statements, including, without limitation: risks related to failure to obtain adequate financing on a timely basis and on acceptable terms; risks related to the outcome of legal proceedings; political and regulatory risks associated with mining and exploration; risks related to the maintenance of stock exchange listings; risks related to environmental regulation and liability; the potential for delays in exploration or development activities or the completion of feasibility studies; the uncertainty of profitability; risks and uncertainties relating to the interpretation of drill results, the geology, grade and continuity of mineral deposits; risks related to the inherent uncertainty of production and cost estimates and the potential for unexpected costs and expenses; results of prefeasibility and feasibility studies, and the possibility that future exploration, development or mining results will not be consistent with the Alliance’s expectations; risks related to gold price and other commodity price fluctuations; and other risks and uncertainties related to the Alliance’s prospects, properties and business detailed elsewhere in the Alliance’s disclosure record. Should one or more of these risks and uncertainties materialize, or should underlying assumptions prove incorrect, actual results may vary materially from those described in forward-looking statements. Investors are cautioned against attributing undue certainty to forward-looking statements. These forward-looking statements are made as of the date hereof and the Alliance does not assume any obligation to update or revise them to reflect new events or circumstances. Actual events or results could differ materially from the Alliance’s expectations or projections.

Sokoman Reports Additional Eastern Trend Mineralization And Provides Update On Mh-22-463; Moosehead Gold Project, Central Newfoundland

Structural update suggests MH-22-463 is opening up a new structural orientation at the lower levels of the currently defined Moosehead gold system

St. John’s, NL, November 24, 2022 – Sokoman Minerals Corp. (TSXV: SIC) (OTCQB: SICNF) is pleased to report the following assay results from the ongoing 100,000 m Phase 6 program at Moosehead, as well as update on exploration in the vicinity of MH-22-463 which returned a 39.6 m intercept (core length) grading 12.50 g/t Au, including a higher-grade interval of 10.25 m grading 41.97 g/t Au from the Lower Eastern Trend. The mineralized zone in MH-22-463 is located approximately 100 m below the currently modeled mineralized shell for the Eastern Trend. Also released are 14 holes drilled along the northern perimeter of the Western Trend where geophysics (magnetics and historical IP) indicated the potential to expand the zone in that direction.

Drilling highlights from the Eastern Trend include:

MH-22-489: three zones of mineralization were intersected; from 106.35 m to 108.10 m (1.75 m @ 2.69 g/t Au); and, from 210.40 m to 212.22 m (1.82 m @ 3.78 g/t Au); and, from 244.19 m to 245.20 m (1.01 m @ 56.67 g/t Au)

MH-22-485: two zones of mineralization were intersected; from 203.00 m to 209.45 m (6.45 m @ 4.01 g/t Au); and, from 227.45 m to 232.95 m (5.50 m @ 1.27 g/t Au)

Other holes reported today (full assay summary appended) confirm the continuation of the Eastern Trend to the north and down dip and drilling will continue in those directions. The drilling includes holes designed to extend the Eastern Trend to depth, as well as testing areas inferred to be within the Eastern Trend but where previously drilled holes are too widely spaced to confirm. The onset of freezing temperatures has forced an end to the barge-based program for 2022 but will resume in 2023. While the main focus of the barge program was the Eastern Trend and splays linked to it, it now appears that the recent intersection in MH-22-463 may be partially tested by holes drilled from the barge. Meanwhile, drilling to test the MH-22-463 area will commence next week with holes being collared from the western side of North Pond. Drilling at Moosehead will continue with two drills until the holiday break period which starts December 15, 2022.

MH-22-463

Drill hole MH-22-463 reported (see September 6, 2022 news release) one of the best intersections on the Moosehead Property to date, returning 39.60 m of 12.50 g/t Au including a 10.25 m section averaging 41.97 g/t Au. This represents the deepest, high-grade intersection to date at approximately 370 m down dip (300 m vertically). The Company has been reviewing all available information from the immediate area including televiewer data from the hole, combined with a visit from structural consultant, Dr. David Coller, who spent five days at Moosehead reviewing the core. Following his rigorous assessment of core and 3D modeling, Dr. Coller corroborates that the intersection in MH-22-463 represents a new and previously unrecognized gold occurrence in the footwall to the Eastern Trend. The intersection in MH-22-463 is complex with the borehole intersecting at an oblique angle and crossing several gold-bearing intact veins and extensive mineralized vein breccia intervals. The interpreted westerly dip of this deeper level zone is new and opposite to the gold structures established at higher level and is interpreted as either a high-grade linking structure or fold core-controlled breccia-vein zone.

Borehole MH-22-418, located 80 m to the northwest and also in the footwall of the Eastern Trend, intersected similar intact veins and vein breccia as MH-22-463, grading 4.14 g/t Au over 5.92 m from 388.84 m downhole including 1.31 m of 15.60 g/t Au. One scenario links these intersections with a shallow rake within a northwest-dipping plane that is best tested by drilling towards it from the west shore of North Pond. A second possible scenario (based on the current televiewer data) is for these similar high-grade intersections to be two of a series of new NE trending NW dipping zones link zones. New televiewer data being acquired is aimed at improving the estimation of the strike trend to plan and optimize the drill test of the extent and continuity of this high-grade occurrence. True thickness and extent of the mineralization in MH-22-463 will require multiple drill holes from potentially different orientations. Up to this point, the Company has been targeting east-dipping structures like the Eastern Trend. This opens up a new structural orientation at the lower levels of the gold system that have not been targeted except for the early drilling in 2018/2019. These holes will also be completed using HQ-size core to provide a larger diameter hole for better televiewer accessibility and maximize sample size should visible gold be intersected.

Western Trend

A total of 14 holes were drilled around the northern limits of currently defined Western Trend. While intersecting favourable structures, most holes returned low values (see table), however, the structures remain open to the north where till and soil Geochem anomalies remain unexplained. The Western Trend is also open along strike to the south and down dip. The area will be reassessed over the holiday break for additional testing in 2023. The Western Trend, like all of the mineralized zones at Moosehead, hosts near-surface, high-grade gold such as previously reported in hole MH-18-08 that cut two zones, including; 1.05 m @ 207.5 g/t Au from 8.5 m downhole, and 2.28 m @ 42.36 g/t Au from 33.07 m downhole.

Tim Froude, President and CEO of Sokoman, says: “We will soon be testing the area surrounding the intersection reported in hole MH-22-463. Dr. Coller’s visit was timely and critical, and we now have the start of a new model that we feel strongly will deliver additional intersections. Drilling will commence next week once drill crews return from break and we hope to have news before the holiday break in mid-December. The number of holes to be placed into the 463 area will be determined by the results we get as we drill them.

The barge-based program was not finished before year-end due to an earlier-than-expected freeze-up, therefore the program will be continued as early as possible in 2023. We have also just received a new magnetic interpretation for the project and combined with the deep seeking Alpha IP survey which will also commence next week, will ensure we have the best, and most up-to-date package of data to work with moving forward. To date, we have completed 77,500 m in Phase 6 with approximately 1,050 samples outstanding at the lab representing all or parts of about 15 holes.”

Drilling on the Moosehead Project to date has discovered five zones of gold mineralization, most containing visible gold, focused mainly on the Eastern Trend in the central portion of the property. Gold mineralization has been defined over a 600-m strike length and to 370-m down dip. The Company is well funded with more than $4.5 million in the treasury.

QP

This news release has been reviewed and approved by Timothy Froude, P.Geo., a “Qualified Person” under National Instrument 43-101 and President and CEO of Sokoman Minerals Corp.

Analytical Techniques / QA/QC

Samples, including duplicates, blanks, and standards, were submitted to Eastern Analytical Ltd. in Springdale, Newfoundland for gold analysis. All core samples submitted for assay were saw cut by Sokoman personnel with one-half submitted for assay and one-half retained for reference. Samples were delivered in sealed bags directly to the lab by Sokoman personnel. Eastern Analytical Ltd. is an accredited assay lab that conforms to the requirements of ISO/IEC 17025. Samples with possible visible gold were submitted for total pulp metallics and gravimetric finish. All other samples were analyzed by standard fire assay methods. Total pulp metallic analysis includes: the whole sample is crushed to -10 mesh; then pulverized to 95% -150 mesh. The total sample is weighed and screened to 150 mesh; the +150 mesh fraction is fire assayed for Au, and a 30 g subsample of the -150 mesh fraction is fire assayed for Au; with a calculated weighted average of total Au in the sample reported as well. One blank and one industry-approved standard for every twenty samples submitted is included in the sample stream. Random duplicates of selected samples are analyzed in addition to the in-house standard and duplicate policies of Eastern Analytical Ltd. All reported assays are uncut.

About Sokoman Minerals Corp.

Sokoman Minerals Corp. is a discovery-oriented company with projects in the province of Newfoundland and Labrador, Canada. The Company’s primary focus is its portfolio of gold projects; flagship, advanced-stage Moosehead, Crippleback Lake (optioned to Trans Canada Gold Corp.) and East Alder (optioned to Canterra Minerals Corporation) along the Central Newfoundland Gold Belt, and the district-scale Fleur de Lys project in northwestern Newfoundland, that is targeting Dalradian-type orogenic gold mineralization similar to the Curraghinalt and Cavanacaw deposits in Northern Ireland. The Company also entered into a strategic alliance with Benton Resources Inc. through three, large-scale, joint-venture properties including Grey River, Golden Hope, and Kepenkeck in Newfoundland.

Sokoman now controls, independently and through the Benton alliance, over 150,000 hectares (>6,000 claims – 1500 sq. km), making it one of the largest landholders in Newfoundland, in Canada’s newest and rapidly-emerging gold districts. The Company also retains an interest in an early-stage antimony/gold project (Startrek) in Newfoundland, optioned to White Metal Resources Inc., and in Labrador, the Company has a 100% interest in the Iron Horse (Fe) project which has Direct Shipping Ore (DSO) potential.

Mineralization hosted on adjacent and/or nearby properties is not necessarily indicative of mineralization hosted on the Company’s property.

The Company would like to thank the Government of Newfoundland and Labrador for past financial support of the Moosehead Project through the Junior Exploration Assistance Program.

For further information, please contact:

Sokoman Minerals

Timothy Froude, P.Geo., President & CEO

Phone: 709-765-1726

Email: tim@sokomanmineralscorp.com

CHF Capital Markets

Cathy Hume, VP Corporate Development, Director

Phone: 416-868-1079 x251

Email: cathy@chfir.com

CHF Capital Markets

Thomas Do, IR Manager

Phone: 416-868-1079 x 232

Email: thomas@chfir.com

Website: www.sokomanmineralscorp.com

Twitter: @SokomanMinerals

Facebook: @SokomanMinerals

LinkedIn: @SokomanMinerals

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Investors are cautioned that trading in the securities of the Corporation should be considered highly speculative. Except for historical information contained herein, this news release contains forward- looking statements that involve risks and uncertainties. Actual results may differ materially. Sokoman Minerals Corp. will not update these forward-looking statements to reflect events or circumstances after the date hereof. More detailed information about potential factors that could affect financial results is included in the documents filed from time to time with the Canadian securities regulatory authorities by Sokoman Minerals Corp.

Sokoman And Benton Discover High-Grade Cesium Mineralization In Outcrop 12 Km Ne Of The Kraken Lithium Pegmatite Swarm In Southwestern Newfoundland

Drilling to Re-start at Kraken Immediately

St. John’s, NL – November 17, 2022 – Sokoman Minerals Corp. (TSXV: SIC) (OTCQB: SICNF) (“Sokoman”) and Benton Resources Inc. (TSXV: BEX) (“Benton”) together, (the “Alliance”) are pleased to announce the discovery of a high-grade cesium-rich dyke with grab samples assaying up to 1.56% Cs2O (cesium oxide), 0.4% Li2O (lithium oxide), 0.022% Ta2O5 (tantalum oxide), and 0.30% Rb2O (rubidium oxide). This is the first high-grade cesium mineralization recorded on the Island of Newfoundland.

The cesium-rich dyke is approximately 5 m – 6 m wide and has been traced for approximately 100 m along strike to where it disappears under overburden in both directions. The dyke is located approximately 12 km northeast of the Kraken lithium discovery. The Alliance has completed first-pass channel sampling across the dyke with results pending.

The cesium-rich dyke is distinctly different from the main Kraken field containing very coarse, as well as fine-grained phases, with the coarse phase a dark grey quartz (+/- pollucite*), coarse green mica, and large (20 cm – 30 cm) grey/white blocky plagioclase crystals. Minor black to green tourmaline or tantalite as well as fine-grained pinkish garnet and other minerals, including lepidolite, a lithium-rich mica, may be present, but until petrographic work is completed, the full suite of minerals in the dyke is uncertain. Samples have been shipped to Vancouver Petrographics for thin sectioning and mineral identification.

Detailed mapping, as well as additional sampling, will be conducted once the channel results are received. The results below are values for random grab samples taken along a 15 m portion of the cesium-rich dyke, the only results to date. Results of the petrographic examination and the channel sample values will be released as they are received.

* pollucite – believed to be the mineral containing the cesium mineralization reported above.

Table 1: Reconnaissance Sampling Results – Cesium Discovery – Golden Hope Joint Venture

Cesium is rare globally. The United States and Canada have included cesium, lithium, and tantalum (among others) in their lists of Critical Minerals / Elements since each of them has been identified as being essential to the economy and national security. At this point in time there are only two pegmatite mines globally that produce cesium:

Bitika, Zimbawe (currently not producing)

Sinclair, Australia

The Alliance also announces that Phase 3 drilling will start in the next few days on the Kraken main dyke and the western extension areas where prospecting samples have given values >1% Li2O. Approximately 20 holes are planned.

The Alliance is extremely pleased with the continued success on the Golden Hope Project and the new discovery of cesium along with lithium, tantalum, and rubidium in an area far removed from the original Kraken discovery. Given the results to date, the Alliance is confident that ongoing prospecting and soil geochemistry surveys will make more discoveries along the 100% owned, 60 km long, structural trend hosting the Kraken and cesium-rich dykes.

The Kraken Pegmatites are highly evolved pegmatite swarms, similar to the geological environment and setting of other large systems in the Appalachian belt, including the important deposits held by Piedmont Lithium Inc. in the Carolinas, eastern US, as well as in the geologically equivalent Avalonia Project of International Lithium in a joint venture with GFL International Co. Ltd., a subsidiary of Ganfeng Lithium Co. Ltd. in the Caledonides of Ireland. All samples were submitted to Actlabs in Ancaster, Ontario for analysis by Sodium Peroxide Fusion ICPOES + ICPMS.

Timothy Froude, P. Geo., President and CEO of Sokoman stated: “The LCT (Lithium-Cesium-Tantalum) potential of the Golden Hope Project continues to prove itself. With this news of the discovery of significant cesium as well as anomalous values of other critical metals, Golden Hope has evolved into a potentially significant host to many metals in high demand to power and build the new economy. We are also pleased to resume drilling in the main Kraken field, in particular to the west of the discovery area where no drilling has taken place to date and where strong soil geochemistry as well as multiple >1% Li2O samples were collected. In the meantime, soil sampling along the 60 km trend controlled by the Alliance will continue until the closure of the camp for the holiday break.”

Stephen Stares, President and CEO of Benton stated: “The Golden Hope Project continues to deliver exceptional new discoveries and results. I’m extremely excited and encouraged that we have located further new high-grade LCT-type pegmatites and I’m confident we will make more new discoveries as we continue with our aggressive exploration plans.”

QP

This news release has been reviewed and approved by Timothy Froude, P.Geo., President and CEO of Sokoman Minerals Corp., and Stephen House, P.Geo., VP Exploration of Benton Resources Inc., both the “Qualified Person” under National Instrument 43-101.

About Sokoman Minerals Corp.

Sokoman Minerals Corp. is a discovery-oriented company with projects in Newfoundland and Labrador, Canada. The company’s primary focus is its portfolio of gold projects: flagship, 100%-owned Moosehead, Crippleback Lake, and East Alder (optioned to Canterra Minerals Corporation) along the Central Newfoundland Gold Belt, and the district-scale Fleur de Lys project in northwestern Newfoundland, which is targeting Dalradian-type orogenic gold mineralization similar to the Curraghinalt and Cavanacaw deposits in Northern Ireland, and Cononish in Scotland. The company is also a 50/50 partner in a strategic alliance with Benton Resources Inc. through three large-scale joint venture properties including Grey River Gold, Golden Hope and Kepenkeck in Newfoundland. Sokoman now controls independently and through the Benton alliance over 150,000 hectares (>6,000 claims – 1,500 sq. km), making it one of the largest landholders in Newfoundland, Canada’s newest and rapidly-emerging gold districts. The company also retains an interest in an early-stage antimony/gold project (Startrek) in Newfoundland, optioned to White Metal Resources Inc., and in Labrador, the company has a 100% interest in the Iron Horse (Fe) project that has Direct Shipping Ore (DSO) potential.

Mineralization hosted on adjacent and/or nearby properties is not necessarily indicative of mineralization hosted on Sokoman’s property.

About Benton Resources Inc.