Newsroom

Sokoman Minerals Announces Participation at the Prospectors & Developers Association of Canada (PDAC) 2025 Convention

St. John’s, NL, February 27, 2025, Sokoman Minerals Corp. (TSXV: SIC) (OTCQB: SICNF) (“Sokoman” or the “Company”) is pleased to announce its participation at the upcoming Prospectors & Developers Association of Canada (PDAC) Convention, taking place at the Metro Toronto Convention Centre (MTCC) from Sunday, March 2 to Wednesday, March 5, 2025.

Sokoman will be exhibiting at Booth No. 2432 at the Investors Exchange in the South Building.

President and CEO Timothy Froude, P.Geo., said, "We're excited to be back at PDAC, connecting with investors, industry professionals, and fellow explorers. This is a great opportunity to showcase Sokoman's progress and discuss the exciting potential of our projects in Newfoundland. We invite attendees to visit our booth and meet with our management team to learn more about what's ahead for Sokoman Minerals."

If you would like to book a one-on-one meeting, please email cathy@chfir.com.

About PDAC

The annual award-winning Prospectors & Developers Association of Canada Convention, held in Toronto, Canada, is the world's premier mineral exploration and mining convention for people, governments, companies, and organizations connected to mineral exploration. The PDAC brings together 27,000 attendees from more than 135 countries for its educational programming, networking events, business opportunities and fun. It has grown in size, stature, and influence since it began in 1932, and today, it is the event of choice for the world's mineral industry. For more information and/or to register for the conference, please visit: https://www.pdac.ca/convention.

About Sokoman Minerals Corp.

Sokoman Minerals Corp. is a discovery-oriented company and one of the largest landholders in the province of Newfoundland and Labrador, Canada’s emerging gold district. The Company's primary focus is its portfolio of gold projects; the 100%-owned flagship, advanced-stage Moosehead, Crippleback Lake, and the district-scale Fleur de Lys project near Baie Verte in northwestern Newfoundland, targeting Dalradian-type orogenic gold mineralization similar to the Curraghinalt and Cavanacaw deposits in Northern Ireland. The Company entered a strategic alliance with Benton Resources Inc. through three, large-scale, joint-venture properties including Grey River, Golden Hope, and Kepenkeck in Newfoundland.

In October 2023, Sokoman and Benton completed an agreement with Piedmont Lithium Inc., a major developer of lithium projects and processing plants in the USA, and exactly the right partner to have to advance the lithium project. For full details of the agreement please refer to the Company’s press release dated October 11, 2023.

Projects optioned with optionee fully vested are:

East Alder Project optioned to Canterra Minerals Inc. (SIC retains shares of CTM plus 1% NSR)

Startrek Project optioned to Thunder Gold (SIC retains shares of TGOL plus 1% NSR)

The Company would like to thank the Government of Newfoundland and Labrador for the financial support of the Moosehead and Fleur de Lys Projects through the Junior Exploration Assistance Program during the past few years.

For more information, please contact:

Timothy Froude, P.Geo., President & CEO

T: 709-765-1726

E: tim@sokomanmineralscorp.com

Cathy Hume, VP Corporate Development, Director

T: 416-868-1079 x 251

E: cathy@chfir.com

Website: www.sokomanmineralscorp.com

Twitter: @SokomanMinerals

Facebook: @SokomanMinerals

LinkedIn: @SokomanMineralsCorp

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Investors are cautioned that trading in the securities of the Corporation should be considered highly speculative. Except for historical information contained herein, this news release contains forward-looking statements that involve risks and uncertainties. Actual results may differ materially. Sokoman Minerals Corp. will not update these forward-looking statements to reflect events or circumstances after the date hereof. More detailed information about potential factors that could affect financial results is included in the documents filed from time to time with the Canadian securities regulatory authorities by Sokoman Minerals Corp.

Sokoman Provides Western Trend Update, Moosehead Gold Project, Central Newfoundland

Western Trend drilling continues to hit high-grade gold

St. John’s, NL, February 6, 2025, Sokoman Minerals Corp. (TSXV: SIC) (OTCQB: SICNF) (“Sokoman” or the “Company”) is pleased to provide, following the assay results press released on January 22, 2025, the remaining drill results from the Western Trend completed before Christmas 2024 at our 100%-owned Moosehead Project highlighted by the following:

MH-24-650: 23.83 g/t Au over 1.67 m incl. 59.38 g/t Au over 0.60 m from 43.65 m

MH-24-657: 335.98 g/t Au over 0.45 m from 104.55 m

MH-24-658: 25.50 g/t Au over 1.00 m from 92.95 m

(Assays are uncut, and drill lengths are shown. The estimated true thickness is believed to be 80 to 90% of the reported length. All assays were performed at Eastern Analytical in Springdale, Newfoundland. Reported assays are total pulp metallic assays.)

President and CEO Timothy Froude, P.Geo., states, “The Western Trend continues to deliver high-grade results, and the structure is holding up well and remains open to depth. The Western Trend drilling has resumed, and we have 18 holes proposed to expand the mineralization to depth and along strike to the south. The present drilling at the Western Trend will continue until the spring thaw. Drilling to date has defined the Western Trend mineralization to a depth of 165 m down plunge and 100 m vertically, and 145 m along strike to the south of the trench. This area is the proposed site for our conventional bulk sample, which we expect to be actively working on in late Q1 or early Q2 2025. We are working with Dr. David Coller to identify a drill test area northwest of the Western Trend trench. This area contains historical intersections that didn’t match previous geological models. With new structural insights from our successful trenching and mapping program in late 2024, we are revisiting these intersections to better understand their potential.

Table of Results - Western Trend Drill Program

Figure 1: Drill Hole Location Map - Plan View

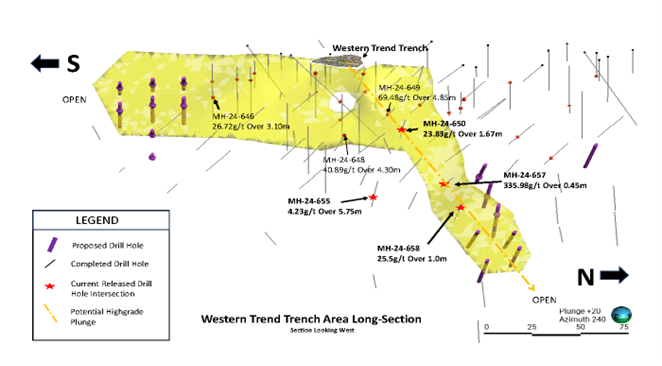

Figure 2: Western Trend Long Section - Looking Southwest

QP

This news release has been reviewed and approved by Timothy Froude, P.Geo., a "Qualified Person" under National Instrument 43-101 and President and CEO of Sokoman Minerals Corp.

Analytical Techniques / QA/QC

Samples, including duplicates, blanks, and standards, are submitted to Eastern Analytical Ltd. in Springdale, Newfoundland, for gold analysis. All core samples submitted for assay are saw cut by Sokoman personnel, with one-half submitted for assay and one-half retained for reference. Samples are delivered in sealed bags directly to the lab by Sokoman personnel. Eastern Analytical Ltd. is an accredited assay lab that conforms to the requirements of ISO/IEC 17025. Samples with visible gold are submitted for total pulp metallics with a gravimetric finish. All other samples are analyzed by standard fire assay methods. Total pulp metallic analysis includes the entire sample being crushed to -10 mesh and then pulverized to 95% -150 mesh. The total sample is weighed and screened to 150 mesh; the +150-mesh fraction is fire-assayed for Au, and a 30 g subsample of the -150-mesh fraction is fire-assayed for Au, with a calculated weighted average of total Au in the sample reported as well. One blank and one industry-approved standard for every twenty samples submitted is included in the sample stream. Random duplicates of selected samples are analyzed in addition to the in-house standard and duplicate policies of Eastern Analytical Ltd. All reported assays are uncut.

About Sokoman Minerals Corp.

Sokoman Minerals Corp. is a discovery-oriented company and one of the largest landholders in the province of Newfoundland and Labrador, Canada’s emerging gold district. The Company's primary focus is its portfolio of gold projects; the 100%-owned flagship, advanced-stage Moosehead, Crippleback Lake, and the district-scale Fleur de Lys project near Baie Verte in northwestern Newfoundland, targeting Dalradian-type orogenic gold mineralization similar to the Curraghinalt and Cavanacaw deposits in Northern Ireland. The Company entered a strategic alliance with Benton Resources Inc. through three, large-scale, joint-venture properties including Grey River, Golden Hope, and Kepenkeck in Newfoundland.

In October 2023, Sokoman and Benton completed an agreement with Piedmont Lithium Inc., a major developer of lithium projects and processing plants in the USA, and exactly the right partner to have to advance the lithium project. For full details of the agreement please refer to the Company’s press release dated October 11, 2023.

Projects optioned with optionee fully vested are:

East Alder Project optioned to Canterra Minerals Inc. (SIC retains shares of CTM plus 1% NSR)

Startrek Project optioned to Thunder Gold (SIC retains shares of TGOL plus 1% NSR)

The Company would like to thank the Government of Newfoundland and Labrador for the financial support of the Moosehead and Fleur de Lys Projects through the Junior Exploration Assistance Program during the past few years.

For more information, please contact:

Timothy Froude, P.Geo., President & CEO

T: 709-765-1726

E: tim@sokomanmineralscorp.com

Cathy Hume, VP Corporate Development, Director

T: 416-868-1079 x 251

E: cathy@chfir.com

Website: www.sokomanmineralscorp.com

Twitter: @SokomanMinerals

Facebook: @SokomanMinerals

LinkedIn: @SokomanMineralsCorp

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Investors are cautioned that trading in the securities of the Corporation should be considered highly speculative. Except for historical information contained herein, this news release contains forward-looking statements that involve risks and uncertainties. Actual results may differ materially. Sokoman Minerals Corp. will not update these forward-looking statements to reflect events or circumstances after the date hereof. More detailed information about potential factors that could affect financial results is included in the documents filed from time to time with the Canadian securities regulatory authorities by Sokoman Minerals Corp.

Sokoman Minerals Corp. Closes Non-Brokered Flow-Through and Non-Flow-Through Private Placement Financing

St. John’s, NL, February 3, 2025, Sokoman Minerals Corp. (TSXV: SIC) (OTCQB: SICNF) (“Sokoman” or the “Company”) is pleased to announce that, further to its December 4, 2024, December 17, 2024, and December 31, 2024 news releases the Company has closed its non-brokered flow-through and non-flow-through private placement financing (the “Financing”) for aggregate gross proceeds of $1,706,250.

The Company has issued 36,412,500 $0.04 flow-through shares, with each flow-through common share of the Company entitling the holder to receive the tax benefits applicable to flow-through shares in accordance with provisions of the Income Tax Act (Canada), for aggregate gross proceeds of $1,456,500.

The Company has also issued a total of 7,135,714 $0.035 non-flow-through common shares, 6,285,714 non flow-through shares for $220,000 in this third and final tranche, for total aggregate gross proceeds of $249,750.

The FT Financing has been affected with one (1) insider subscribing for $10,000 or 250,000 FT Shares, that portion of the FT Financing a “related party transaction” as such term is defined under MI 61-101 – Protection of Minority Security Holders in Special Transactions. The Company is relying on exemptions from the formal valuation requirement of MI-61-101 under sections 5.5(a) and (b) of MI 61-101 in respect of the transaction as the fair market value of the transaction, insofar as it involves the interested party, is not more than 25% of the Company’s market capitalization.

The Company paid $12,180 in cash finders’ fees and issued 348,000 $0.06 non-transferable broker warrants in this third and final tranche. A total of CAD$57,200, 1,458,000 non-transferable broker warrants, exercisable at CAD$0.06 for one year, and 1,200,000 common shares has been paid to four finders.

All securities issued pursuant to the Financing are subject to a four-month and one-day hold period.

The Company will use an amount equal to the gross proceeds received by the Company from the sale of the FT shares, pursuant to the provisions in the Income Tax Act (Canada), to incur eligible “Canadian exploration expenses” that qualify as “flow-through mining expenditures” as both terms are defined in the Income Tax Act (Canada) (the “Qualifying Expenditures”) on or before December 31, 2025, and to renounce all of the Qualifying Expenditures in favour of the subscribers of the FT Units effective December 31, 2024.

The Company intends to spend CAD$1,000,000 of the flow-through proceeds on the Moosehead gold property, the balance on Fleur de Lys and Crippleback, and hard-dollar proceeds for working capital.

The Company further confirms that there are no proposed payments to non-arm’s length parties, no proposed payments to investor relations activities, and no specific use of 10% or more of the gross proceeds other than as disclosed for the flow-through portion, above.

About Sokoman Minerals Corp.

Sokoman Minerals Corp. is a discovery-oriented company and one of the largest landholders in the province of Newfoundland and Labrador, Canada’s emerging gold district. The Company's primary focus is its portfolio of gold projects; the 100%-owned flagship, advanced-stage Moosehead, Crippleback Lake, and the district-scale Fleur de Lys project near Baie Verte in northwestern Newfoundland, targeting Dalradian-type orogenic gold mineralization similar to the Curraghinalt and Cavanacaw deposits in Northern Ireland. The Company entered a strategic alliance with Benton Resources Inc. through three, large-scale, joint-venture properties including Grey River, Golden Hope, and Kepenkeck in Newfoundland.

In October 2023, Sokoman and Benton completed an agreement with Piedmont Lithium Inc., a major developer of lithium projects and processing plants in the USA, and exactly the right partner to have to advance the lithium project. For full details of the agreement please refer to the Company’s press release dated October 11, 2023.

Projects optioned with optionee fully vested are:

East Alder Project optioned to Canterra Minerals Inc. (SIC retains shares of CTM plus 1% NSR)

Startrek Project optioned to Thunder Gold (SIC retains shares of TGOL plus 1% NSR)

The Company would like to thank the Government of Newfoundland and Labrador for the financial support of the Moosehead and Fleur de Lys Projects through the Junior Exploration Assistance Program during the past few years.

For more information, please contact:

Timothy Froude, P.Geo., President & CEO

T: 709-765-1726

E: tim@sokomanmineralscorp.com

Cathy Hume, VP Corporate Development, Director

T: 416-868-1079 x 251

E: cathy@chfir.com

Website: www.sokomanmineralscorp.com

Twitter: @SokomanMinerals

Facebook: @SokomanMinerals

LinkedIn: @SokomanMineralsCorp

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Investors are cautioned that trading in the securities of the Corporation should be considered highly speculative. Except for historical information contained herein, this news release contains forward-looking statements that involve risks and uncertainties. Actual results may differ materially. Sokoman Minerals Corp. will not update these forward-looking statements to reflect events or circumstances after the date hereof. More detailed information about potential factors that could affect financial results is included in the documents filed from time to time with the Canadian securities regulatory authorities by Sokoman Minerals Corp.

Sokoman Drilling Resumes at Western Trend, Moosehead Project, Central Newfoundland

Program to begin with 18 holes to extend gold zone to depth and along strike

St. John’s, NL, January 30, 2025, Sokoman Minerals Corp. (TSXV: SIC) (OTCQB: SICNF) (“Sokoman” or the “Company”) is pleased to announce that diamond drilling has resumed at the Western Trend gold zone, the site of the conventional bulk sample planned for extraction late in Q1 or early Q2, 2025. The drill program is following up on the recently announced high-grade results highlighted by intersections of 69.48 g/t Au over 4.85 m (MH-24-649), 40.89 g/t Au over 4.30 m (MH-24-648) and 26.72 g/t Au over 3.10 m (MH-24-646) (please see January 22, 2025 news release here), from the trench area.

The plan and long section show the previous drilling on the Western Trend and the location of the planned drill holes. A high-grade shoot dipping East and down-plunge is outlined in the accompanying long section with the proposed drilling designed to extend it to depth and to the south.

Timothy Froude, P.Geo., President and CEO, states, "We are very pleased to announce the resumption of drilling at the Western Trend and are confident that additional high-grade values will be found in the holes yet to report, as well as in the planned 2025 program. The information from the drilling will help in planning the location of the conventional bulk sample planned for late Q1 or early Q2, as soon as conditions allow. Discussions for processing the sample offsite are in progress. We are expecting the final batch of assays, from drilling prior to Christmas, shortly with several holes noted to have visible gold in quartz."

Drilling to date at the Western Trend has tested 100 m of the strike to 165 m down plunge with the zone remaining open. The deeper holes are targeting the potential high-grade plunge of the intersection point between the east-west trending splay and the main north-trending vein system.

Figure 1: Drill Hole Location Map (proposed holes (pDH) in purple highlight)

Figure 2: Long Section of Western Trend (looking Southwest)

QP

This news release has been reviewed and approved by Timothy Froude, P.Geo., a "Qualified Person" under National Instrument 43-101 and President and CEO of Sokoman Minerals Corp.

Analytical Techniques / QA/QC

Samples, including duplicates, blanks, and standards, are submitted to Eastern Analytical Ltd. in Springdale, Newfoundland, for gold analysis. All core samples submitted for assay are saw cut by Sokoman personnel, with one-half submitted for assay and one-half retained for reference. Samples are delivered in sealed bags directly to the lab by Sokoman personnel. Eastern Analytical Ltd. is an accredited assay lab that conforms to the requirements of ISO/IEC 17025. Samples with visible gold are submitted for total pulp metallics with a gravimetric finish. All other samples are analyzed by standard fire assay methods. Total pulp metallic analysis includes the entire sample being crushed to -10 mesh and then pulverized to 95% -150 mesh. The total sample is weighed and screened to 150 mesh; the +150-mesh fraction is fire-assayed for Au, and a 30 g subsample of the -150-mesh fraction is fire-assayed for Au, with a calculated weighted average of total Au in the sample reported as well. One blank and one industry-approved standard for every twenty samples submitted is included in the sample stream. Random duplicates of selected samples are analyzed in addition to the in-house standard and duplicate policies of Eastern Analytical Ltd. All reported assays are uncut.

About Sokoman Minerals Corp.

Sokoman Minerals Corp. is a discovery-oriented company and one of the largest landholders in the province of Newfoundland and Labrador, Canada’s emerging gold district. The Company's primary focus is its portfolio of gold projects; the 100%-owned flagship, advanced-stage Moosehead, Crippleback Lake, and the district-scale Fleur de Lys project near Baie Verte in northwestern Newfoundland, targeting Dalradian-type orogenic gold mineralization similar to the Curraghinalt and Cavanacaw deposits in Northern Ireland. The Company entered a strategic alliance with Benton Resources Inc. through three, large-scale, joint-venture properties including Grey River, Golden Hope, and Kepenkeck in Newfoundland.

In October 2023, Sokoman and Benton completed an agreement with Piedmont Lithium Inc., a major developer of lithium projects and processing plants in the USA, and exactly the right partner to have to advance the lithium project. For full details of the agreement please refer to the Company’s press release dated October 11, 2023.

Projects optioned with optionee fully vested are:

East Alder Project optioned to Canterra Minerals Inc. (SIC retains shares of CTM plus 1% NSR)

Startrek Project optioned to Thunder Gold (SIC retains shares of TGOL plus 1% NSR)

The Company would like to thank the Government of Newfoundland and Labrador for the financial support of the Moosehead and Fleur de Lys Projects through the Junior Exploration Assistance Program during the past few years.

For more information, please contact:

Timothy Froude, P.Geo., President & CEO

T: 709-765-1726

E: tim@sokomanmineralscorp.com

Cathy Hume, VP Corporate Development, Director

T: 416-868-1079 x 251

E: cathy@chfir.com

Website: www.sokomanmineralscorp.com

Twitter: @SokomanMinerals

Facebook: @SokomanMinerals

LinkedIn: @SokomanMineralsCorp

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Investors are cautioned that trading in the securities of the Corporation should be considered highly speculative. Except for historical information contained herein, this news release contains forward-looking statements that involve risks and uncertainties. Actual results may differ materially. Sokoman Minerals Corp. will not update these forward-looking statements to reflect events or circumstances after the date hereof. More detailed information about potential factors that could affect financial results is included in the documents filed from time to time with the Canadian securities regulatory authorities by Sokoman Minerals Corp.

Sokoman Hits 69.48 g/t Gold over 4.85 m at Moosehead Gold Project in Central Newfoundland

Western Trend Orogenic Gold Mineralization Exhibits High Grades and Strong Continuity

St. John’s, NL, January 22, 2025, Sokoman Minerals Corp. (TSXV: SIC) (OTCQB: SICNF) (“Sokoman” or the “Company”) is pleased to provide the following results from the ongoing Western Trend diamond drilling program at the 100%-owned Moosehead Project. A total of 19 holes (1,325 m) were completed immediately before the Christmas break, with this release including assays for 13 holes, highlighted by the following:

MH-24-649 69.48 g/t Au over 4.85m incl. 176.47 g/t Au over 1.90 m from 41.60 m

MH-24-648 40.89 g/t Au over 4.30m incl. 74.08 g/t Au over 2.35 m from 47.20 m

MH-24-646 26.72 g/t Au over 3.10m incl. 40.56 g/t Au over 1.90 m from 28.30 m

Assays are uncut with core lengths shown; the estimated true thickness is believed to be 80 to 90% of the reported length. Assays are total pulp metallics from Eastern Analytical in Springdale, Newfoundland.

Timothy Froude, P.Geo., President and CEO, states, "This is a great way to start the year! We are incredibly pleased with the high grades, with visible gold (including abundant visible gold) in 9 of 13 holes from the Western Trend (Photo 1). The success of the drilling was the result of using what we learned from the Western Trend trenching program last November, which included input from structural consultant Dr. David Coller, who mapped the trench. The Western Trend drilling is scheduled to resume on January 27 with a minimum 10-hole program to further expand the high-grade mineralization in the trench (Figure 1), the site of the planned conventional (drill and blast) bulk sample. We are also in discussions with Novamera to finalize an agreement for a surgical bulk sample at the adjacent Footwall Splay utilizing their proprietary technology in Q3 2025, so it will be a pivotal and very busy 2025 at Moosehead."

The recent Western Trend drilling has tested 100 m of strike to 80 m down dip, with the zone remaining open. The remaining assays are expected in 3-4 weeks. The next phase of drilling will be mainly deeper holes targeting the high-grade plunge of the intersection point between the east-west trending splay and the main north-trending vein system (down plunge from MH-24-648 and 649) to a depth of 165 m down plunge and 100 m vertically. This area is a key target as it is a location where rock preparation is ideal for gold deposition with the potential to be where there is dilation zone. We will also be testing to the south of the trench (south of MH-24-646) to extend the strike to 145 m.

Table of Results - Western Trend Drill Program

Photo 1: Visible gold in quartz - DDH MH-24-649 Western Trend Trench area

69.48 g/t Au over 4.85 m (41.60 - 46.45 m)

Figure 1: Drill Hole Location Map

About Sokoman Minerals Corp.

Sokoman Minerals Corp. is a discovery-oriented company and one of the largest landholders in the province of Newfoundland and Labrador, Canada’s emerging gold district. The Company's primary focus is its portfolio of gold projects; the 100%-owned flagship, advanced-stage Moosehead, Crippleback Lake, and the district-scale Fleur de Lys project near Baie Verte in northwestern Newfoundland, targeting Dalradian-type orogenic gold mineralization similar to the Curraghinalt and Cavanacaw deposits in Northern Ireland. The Company entered a strategic alliance with Benton Resources Inc. through three, large-scale, joint-venture properties including Grey River, Golden Hope, and Kepenkeck in Newfoundland.

In October 2023, Sokoman and Benton completed an agreement with Piedmont Lithium Inc., a major developer of lithium projects and processing plants in the USA, and exactly the right partner to have to advance the lithium project. For full details of the agreement please refer to the Company’s press release dated October 11, 2023.

Projects optioned with optionee fully vested are:

East Alder Project optioned to Canterra Minerals Inc. (SIC retains shares of CTM plus 1% NSR)

Startrek Project optioned to Thunder Gold (SIC retains shares of TGOL plus 1% NSR)

The Company would like to thank the Government of Newfoundland and Labrador for the financial support of the Moosehead and Fleur de Lys Projects through the Junior Exploration Assistance Program during the past few years.

For more information, please contact:

Timothy Froude, P.Geo., President & CEO

T: 709-765-1726

E: tim@sokomanmineralscorp.com

Cathy Hume, VP Corporate Development, Director

T: 416-868-1079 x 251

E: cathy@chfir.com

Website: www.sokomanmineralscorp.com

Twitter: @SokomanMinerals

Facebook: @SokomanMinerals

LinkedIn: @SokomanMineralsCorp

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Investors are cautioned that trading in the securities of the Corporation should be considered highly speculative. Except for historical information contained herein, this news release contains forward-looking statements that involve risks and uncertainties. Actual results may differ materially. Sokoman Minerals Corp. will not update these forward-looking statements to reflect events or circumstances after the date hereof. More detailed information about potential factors that could affect financial results is included in the documents filed from time to time with the Canadian securities regulatory authorities by Sokoman Minerals Corp.

Sokoman Minerals Closes Non-Brokered Flow-Through Private Placement Financing and Second Tranche of Non-Flow-Through Private Placement Financing

St. John’s, NL, December 31, 2024, Sokoman Minerals Corp. (TSXV: SIC) (OTCQB: SICNF) (“Sokoman” or the “Company”) is pleased to announce that further to its December 4, 2024 and December 17, 2024 news releases the Company has closed the flow-through portion of its non-brokered flow-through financing (the “FT Financing”) for aggregate gross proceeds of CAD$1,456,500.

The Company has issued 36,412,500 CAD$0.04 flow-through shares (the “FT Shares”), with each flow-through common share of the Company entitling the holder to receive the tax benefits applicable to flow-through shares in accordance with the provisions of the Income Tax Act (Canada).

The Company is also closing the second tranche of its non-flow-through financing (the “NFT Financing”) and has issued an additional 700,000 non-flow-through common shares for an aggregate total of 850,000 non-flow-through common shares for CAD$29,750.

The FT Financing has been effected with one (1) insider subscribing for CAD$10,000 or 250,000 FT Shares, that portion of the FT Financing a “related-party transaction” as such term is defined under MI 61-101 – Protection of Minority Security Holders in Special Transactions. The Company is relying on exemptions from the formal valuation requirement of MI-61-101 under sections 5.5(a) and (b) of MI 61-101 in respect of the transaction as the fair market value of the transaction, insofar as it involves the interested party, is not more than 25% of the Company’s market capitalization.

In connection with the FT Financing, the Company has paid cash finders’ fees totalling CAD$44,400, issued 1,110,000 non-transferable broker warrants, exercisable at CAD$0.06 for one year, and issued 1,200,000 common shares to three finders, as permitted by the policies of the TSX Venture Exchange (the “Exchange”).

All securities issued pursuant to the FT Financing and the NFT Financing (together the “Financings”) are subject to a four-month and one-day hold period.

Final approval of the Financings is subject to Exchange approval.

The Company will use an amount equal to the gross proceeds received by the Company from the sale of the FT Shares, pursuant to the provisions in the Income Tax Act (Canada), to incur eligible “Canadian exploration expenses” that qualify as “flow-through mining expenditures” as both terms are defined in the Income Tax Act (Canada) (the “Qualifying Expenditures”) on or before December 31, 2025, and to renounce all of the Qualifying Expenditures in favour of the subscribers of the FT Shares effective December 31, 2024.

The Company intends to spend CAD$1,000,000 of the flow-through proceeds on the Moosehead gold property, the balance on the Fleur de Lys and Crippleback projects, and hard-dollar proceeds for working capital.

About Sokoman Minerals Corp.

Sokoman Minerals Corp. is a discovery-oriented company and one of the largest landholders in the province of Newfoundland and Labrador, Canada’s emerging gold district. The Company's primary focus is its portfolio of gold projects; the 100%-owned flagship, advanced-stage Moosehead, Crippleback Lake, and the district-scale Fleur de Lys project near Baie Verte in northwestern Newfoundland, targeting Dalradian-type orogenic gold mineralization similar to the Curraghinalt and Cavanacaw deposits in Northern Ireland. The Company entered a strategic alliance with Benton Resources Inc. through three, large-scale, joint-venture properties including Grey River, Golden Hope, and Kepenkeck in Newfoundland.

In October 2023, Sokoman and Benton completed an agreement with Piedmont Lithium Inc., a major developer of lithium projects and processing plants in the USA, and exactly the right partner to have to advance the lithium project. For full details of the agreement please refer to the Company’s press release dated October 11, 2023.

Projects optioned with optionee fully vested are:

East Alder Project optioned to Canterra Minerals Inc. (SIC retains shares of CTM plus 1% NSR)

Startrek Project optioned to Thunder Gold (SIC retains shares of TGOL plus 1% NSR)

The Company would like to thank the Government of Newfoundland and Labrador for the financial support of the Moosehead and Fleur de Lys Projects through the Junior Exploration Assistance Program during the past few years.

For more information, please contact:

Timothy Froude, P.Geo., President & CEO

T: 709-765-1726

E: tim@sokomanmineralscorp.com

Cathy Hume, VP Corporate Development, Director

T: 416-868-1079 x 251

E: cathy@chfir.com

Website: www.sokomanmineralscorp.com

Twitter: @SokomanMinerals

Facebook: @SokomanMinerals

LinkedIn: @SokomanMineralsCorp

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Investors are cautioned that trading in the securities of the Corporation should be considered highly speculative. Except for historical information contained herein, this news release contains forward-looking statements that involve risks and uncertainties. Actual results may differ materially. Sokoman Minerals Corp. will not update these forward-looking statements to reflect events or circumstances after the date hereof. More detailed information about potential factors that could affect financial results is included in the documents filed from time to time with the Canadian securities regulatory authorities by Sokoman Minerals Corp.

Sokoman Minerals Completes Phase 1 Diamond Drilling Program Fleur de Lys Gold Project, NW Newfoundland

More than 50% of the holes intersected mineralized structures

St. John’s, NL, December 24, 2024, Sokoman Minerals Corp. (TSXV: SIC) (OTCQB: SICNF) (“Sokoman” or the “Company”) reports that the Phase 1 drill program at the 100%-owned Fleur de Lys Project, has been completed in 23 drill holes. Twenty reconnaissance drill holes evaluated high-priority geochemical and/or geophysical targets, including seven holes in the immediate vicinity of the gold-bearing Golden Bull boulders. Three others (FDL-24-9,10, and 17) tested showings discovered by Noranda in the late 1980s.

All preliminary* assays have been received and compiled. See the table below. Twelve drill holes, including the three holes on the Noranda targets, intersected gold mineralization (>200 ppb). Exploration, including prospecting, mapping, geophysics, trenching, and a Phase 2 drilling program, is planned for 2025 to locate the source of the large, mineralized boulders.

*Some samples require metallics assaying based on >1000 ppb Au initial assay. The additional analysis will not affect the reported highlight results.

Timothy Froude, P. Geo., President and CEO of Sokoman Minerals, states, “Our inaugural drill program was conducted on an 8 km2 section of the 329 km2 Fleur de Lys Project. It returned many promising results, with 50% of the drill holes intersecting gold-bearing structures. The final and most northerly hole (FDL-24-23) intersected five separate gold-bearing veins, which indicates a new direction for further exploration.

We are highly encouraged by our progress, even though we have yet to pinpoint the source of the high-grade Golden Bull gold-mineralized boulder field. We will be interpreting the information collected to date as well as future geophysical surveys to further define the mineralized structures before planning a Phase 2 drill program.”

Map 1: Drilling Overview

QP

This news release has been reviewed and approved by Timothy Froude, P.Geo., a "Qualified Person" under National Instrument 43-101 and President and CEO of Sokoman Minerals Corp.

Analytical Techniques / QA/QC

Samples, including duplicates, blanks, and standards, are submitted to Eastern Analytical Ltd. in Springdale, Newfoundland for gold analysis. Eastern Analytical Ltd. is an accredited assay lab that conforms to the requirements of ISO/IEC 17025. Samples are delivered in sealed bags directly to the lab by Sokoman personnel. All samples of quartz vein material were submitted for total pulp metallics and gravimetric finish. Total pulp metallic analysis includes: the whole sample is crushed to -10 mesh; and then pulverized to 95% -150 mesh. The total sample is weighed and screened to 150 mesh; the +150 mesh fraction is fire-assayed for Au, and a 30 g subsample of the -150 mesh fraction is fire-assayed for Au; with a calculated weighted average of total Au in the sample reported as well. One blank and one industry-approved standard for every twenty samples submitted is included in the sample stream. Random duplicates of selected samples are analyzed in addition to the in-house standard and duplicate policies of Eastern Analytical Ltd. All reported assays are uncut.

About Sokoman Minerals Corp.

Sokoman Minerals Corp. is a discovery-oriented company and one of the largest landholders in the province of Newfoundland and Labrador, Canada’s emerging gold district. The Company's primary focus is its portfolio of gold projects; the 100%-owned flagship, advanced-stage Moosehead, Crippleback Lake, and the district-scale Fleur de Lys project near Baie Verte in northwestern Newfoundland, targeting Dalradian-type orogenic gold mineralization similar to the Curraghinalt and Cavanacaw deposits in Northern Ireland. The Company entered a strategic alliance with Benton Resources Inc. through three, large-scale, joint-venture properties including Grey River, Golden Hope, and Kepenkeck in Newfoundland.

In October 2023, Sokoman and Benton completed an agreement with Piedmont Lithium Inc., a major developer of lithium projects and processing plants in the USA, and exactly the right partner to have to advance the lithium project. For full details of the agreement please refer to the Company’s press release dated October 11, 2023.

Projects optioned with optionee fully vested are:

East Alder Project optioned to Canterra Minerals Inc. (SIC retains shares of CTM plus 1% NSR)

Startrek Project optioned to Thunder Gold (SIC retains shares of TGOL plus 1% NSR)

The Company would like to thank the Government of Newfoundland and Labrador for the financial support of the Moosehead and Fleur de Lys Projects through the Junior Exploration Assistance Program during the past few years.

For more information, please contact:

Timothy Froude, P.Geo., President & CEO

T: 709-765-1726

E: tim@sokomanmineralscorp.com

Cathy Hume, VP Corporate Development, Director

T: 416-868-1079 x 251

E: cathy@chfir.com

Website: www.sokomanmineralscorp.com

Twitter: @SokomanMinerals

Facebook: @SokomanMinerals

LinkedIn: @SokomanMineralsCorp

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Investors are cautioned that trading in the securities of the Corporation should be considered highly speculative. Except for historical information contained herein, this news release contains forward-looking statements that involve risks and uncertainties. Actual results may differ materially. Sokoman Minerals Corp. will not update these forward-looking statements to reflect events or circumstances after the date hereof. More detailed information about potential factors that could affect financial results is included in the documents filed from time to time with the Canadian securities regulatory authorities by Sokoman Minerals Corp.

Sokoman Minerals Corp. Closes First Tranche of Non-Brokered Flow-Through and Hard-Dollar Private Placement Financing

ST.John’s, NL, December 17, 2024, Sokoman Minerals Corp. (TSXV: SIC) (OTCQB: SICNF) (“Sokoman” or the “Company”) is pleased to announce that further to its December 4, 2024 news release, the Company has received conditional approval from the TSX Venture Exchange (the "Exchange") for its non-brokered flow-through and hard-dollar financing (the "Financing") and will be closing the first tranche of the Financing for aggregate gross proceeds of CAD$1,421,250.

The Company will now issue 35,400,000 CAD$0.04 flow-through shares, with each flow-through common share of the Company entitling the holder to receive the tax benefits applicable to flow-through shares in accordance with provisions of the Income Tax Act (Canada).

The Company is also issuing 150,000 CAD$0.035 non-flow-through common shares.

In connection with the Financings, the Company is paying cash finders' fees totaling CAD$42,000, issuing 1,050,000 non-transferable broker warrants, exercisable at CAD$0.06 for one year. And issuing 1,200,000 common shares to two finders, as permitted by the policies of the Exchange.

All securities issued pursuant to the Financing are subject to a four-month and one-day hold period.

Final approval of the Financing is subject to Exchange approval.

The Company will use an amount equal to the gross proceeds received by the Company from the sale of the FT shares, pursuant to the provisions in the Income Tax Act (Canada), to incur eligible "Canadian exploration expenses" that qualify as "flow-through mining expenditures" as both terms are defined in the Income Tax Act (Canada) (the "Qualifying Expenditures") on or before December 31, 2025, and to renounce all of the Qualifying Expenditures in favour of the subscribers of the FT Units effective December 31, 2024.

The Company intends to spend CAD$1,000,000 of the flow-through proceeds on the Moosehead gold property, the balance on Fleur de Lys and Crippleback, and hard-dollar proceeds for working capital.

About Sokoman Minerals Corp.

Sokoman Minerals Corp. is a discovery-oriented company and one of the largest landholders in the province of Newfoundland and Labrador, Canada's emerging gold district. The Company's primary focus is its portfolio of gold projects; the 100%-owned flagship, advanced-stage Moosehead, Crippleback Lake, and the district-scale Fleur de Lys project near Baie Verte in northwestern Newfoundland, targeting Dalradian-type orogenic gold mineralization similar to the Curraghinalt and Cavanacaw deposits in Northern Ireland. The Company entered a strategic alliance with Benton Resources Inc. through three, large-scale, joint-venture properties including Grey River, Golden Hope, and Kepenkeck in Newfoundland.

In October 2023, Sokoman and Benton completed an agreement with Piedmont Lithium Inc., a major developer of lithium projects and processing plants in the USA, and exactly the right partner to have to advance the lithium project. For full details of the agreement please refer to the Company's press release dated October 11, 2023.

Projects optioned with optionee fully vested are:

East Alder Project optioned to Canterra Minerals Inc. (SIC retains shares of CTM plus 1% NSR)

Startrek Project optioned to Thunder Gold (SIC retains shares of TGOL plus 1% NSR)

The Company would like to thank the Government of Newfoundland and Labrador for the financial support of the Moosehead and Fleur de Lys Projects through the Junior Exploration Assistance Program during the past few years.

For more information, please contact:

Timothy Froude, P.Geo., President & CEO

T: 709-765-1726

E: tim@sokomanmineralscorp.com

Cathy Hume, VP Corporate Development, Director

T: 416-868-1079 x 251

E: cathy@chfir.com

Website: www.sokomanmineralscorp.com

Twitter: @SokomanMinerals

Facebook: @SokomanMinerals

LinkedIn: @SokomanMineralsCorp

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Investors are cautioned that trading in the securities of the Corporation should be considered highly speculative. Except for historical information contained herein, this news release contains forward-looking statements that involve risks and uncertainties. Actual results may differ materially. Sokoman Minerals Corp. will not update these forward-looking statements to reflect events or circumstances after the date hereof. More detailed information about potential factors that could affect financial results is included in the documents filed from time to time with the Canadian securities regulatory authorities by Sokoman Minerals Corp.

Sokoman Provides Project Update, Moosehead Gold Project, Central Newfoundland

13 of 19 holes at the Western Trend intersect gold-bearing quartz veins

St. John’s, NL, December 12, 2024 – Sokoman Minerals Corp. (TSXV: SIC) (OTCQB: SICNF) (“Sokoman” or the “Company”) is pleased to provide an update on the Moosehead Project. The previously announced (see press release dated November 27, 2024) Western Trend diamond-drill program is progressing well, with 1,325 m in 19 holes completed. The drilling is testing the area of the recently completed Western Trend Trench (Figure 1) which is the future site of the planned conventional (drill and blast) bulk sample. Thirteen (13) of the holes intersected visible gold-bearing quartz veins and vein swarms (Photos 1 and 2), similar to the exposures in the trench. All assays are pending and expected early in Q1 2025. Drilling will continue until the Christmas break (December 19, 2024, to mid-January 2025).

The drilling program is testing the strike/dip extents of the newly discovered, east-west trending, gold-bearing vein network, which is a splay off the main north-trending vein system in the trench. Drilling to date has tested 100 m of the strike to 80 m down dip with the zone remaining open. The deeper holes target the potential high-grade plunge of the intersection point between the east-west trending splay and the main north-trending vein system. The new vein system setting is similar to the high-grade Footwall Splay trending off the main Eastern Trend approximately 200 m to the east. The trenching was initiated for a conventional (drill and blast) bulk sample from the Western Trend, with final permits expected soon, and bulk-sample collection is planned for Q2 2025.

The Company is also pleased to report additional Phase 1 metallurgical results from Base Met Labs in Kamloops, B.C., for scoping-level, metallurgical tests of the Western Trend gold mineralization. Gold recoveries from the bulk gravity testing of the quartz vein sample returned 82.0% to 83.0% of the gold, with leaching of the gravity tailings giving a 95.0% to 96.6% gold recovery. Additional testing is ongoing, and the final results are expected in Q1 2025.

Timothy Froude, P.Geo., President and CEO, states, "With the drilling program largely complete at the Western Trend, we expect to have a sample plan in hand early in Q1 2025 with collection of the bulk sample following once all permits have been received. We are evaluating several options for the sample processing, with the aim of deciding by mid-to-late Q1 2025. We also look forward to continued good gold intersections in the Western Trend drilling program, where we have had excellent success. The metallurgical work on the quartz vein portion of the planned bulk sample has yielded excellent recoveries. We are expecting a formal proposal from Novamera on the planned Footwall Splay Zone bulk sample to be taken later in 2025 using its proprietary technology. It looks like 2025 will be a great year for the Moosehead Project and indeed for Sokoman as a whole."

Photo 1: Visible gold in quartz - DDH MH-24-649 Western Trend Trench area

Photo 2: Mineralized vein swarm in MH-24-655 - Western Trend Trench area

Figure 1: Drill Hole Location Map

QP

This news release has been reviewed and approved by Timothy Froude, P.Geo., a "Qualified Person" under National Instrument 43-101 and President and CEO of Sokoman Minerals Corp.

Analytical Techniques / QA/QC

Samples, including duplicates, blanks, and standards, are submitted to Eastern Analytical Ltd. in Springdale, Newfoundland, for gold analysis. All core samples submitted for assay are saw cut by Sokoman personnel, with one-half submitted for assay and one-half retained for reference. Samples are delivered in sealed bags directly to the lab by Sokoman personnel. Eastern Analytical Ltd. is an accredited assay lab that conforms to the requirements of ISO/IEC 17025. Samples with visible gold are submitted for total pulp metallics with a gravimetric finish. All other samples are analyzed by standard fire assay methods. Total pulp metallic analysis includes the entire sample being crushed to -10 mesh and then pulverized to 95% -150 mesh. The total sample is weighed and screened to 150 mesh; the +150-mesh fraction is fire-assayed for Au, and a 30 g subsample of the -150-mesh fraction is fire-assayed for Au, with a calculated weighted average of total Au in the sample reported as well. One blank and one industry-approved standard for every twenty samples submitted is included in the sample stream. Random duplicates of selected samples are analyzed in addition to the in-house standard and duplicate policies of Eastern Analytical Ltd. All reported assays are uncut.

About Sokoman Minerals Corp.

Sokoman Minerals Corp. is a discovery-oriented company with projects in the province of Newfoundland and Labrador, Canada. The Company's primary focus is its portfolio of gold projects: the 100%-owned flagship, advanced-stage Moosehead, Crippleback Lake, and the district-scale Fleur de Lys project near Baie Verte in northwestern Newfoundland, which is targeting Dalradian-type orogenic gold mineralization similar to the Curraghinalt and Cavanacaw deposits in Northern Ireland. The Company entered into a strategic alliance with Benton Resources Inc. through three large-scale, joint-venture properties, including Grey River, Golden Hope, and Kepenkeck in Newfoundland. Sokoman is one of the largest landholders in Newfoundland, in Canada's newest and rapidly emerging gold districts.

In October 2023, Sokoman and Benton completed an agreement with Piedmont Lithium Inc., a major developer of lithium projects and processing plants in the USA, and exactly the right partner to have to advance the lithium project. The agreement provides for Piedmont to earn up to 62.5% of the Killick Lithium Project (formerly Golden Hope project) by funding up to $12 million in exploration expenses and issuing $10 million common shares in three stages. The Killick Lithium Project has been transferred to Killick Lithium Inc. (Killick), a 100%-owned subsidiary of Vinland Lithium Inc. (Vinland). Newly created Vinland has received $2 million in financing from Piedmont for a 19.9% interest, with the balance of ownership between Sokoman and Benton. Sokoman and Benton will continue to operate the exploration efforts at Killick through the earn-in stages. Sokoman and Benton will retain a royalty of 2% NSR on future production. Piedmont will have exclusive marketing rights for the promotion and sale of any lithium products produced from the project on a life-of-mine basis, and the right of first refusal on 100% offtake rights to the lithium concentrates.

Projects optioned with optionee fully vested are:

East Alder Project optioned to Canterra Minerals Inc. (SIC retains shares of CTM plus 1% NSR)

Startrek Project optioned to Thunder Gold (SIC retains shares of TGOL plus 1% NSR)

The Company would like to thank the Government of Newfoundland and Labrador for the financial support of the Moosehead and Fleur de Lys Projects through the Junior Exploration Assistance Program during the past few years.

For more information, please contact:

Timothy Froude, P.Geo., President & CEO

T: 709-765-1726

E: tim@sokomanmineralscorp.com

Cathy Hume, VP Corporate Development, Director

T: 416-868-1079 x 251

E: cathy@chfir.com

Website: www.sokomanmineralscorp.com

Twitter: @SokomanMinerals

Facebook: @SokomanMinerals

LinkedIn: @SokomanMineralsCorp

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Investors are cautioned that trading in the securities of the Corporation should be considered highly speculative. Except for historical information contained herein, this news release contains forward-looking statements that involve risks and uncertainties. Actual results may differ materially. Sokoman Minerals Corp. will not update these forward-looking statements to reflect events or circumstances after the date hereof. More detailed information about potential factors that could affect financial results is included in the documents filed from time to time with the Canadian securities regulatory authorities by Sokoman Minerals Corp.

Sokoman Minerals Corp. Postpones Annual General and Special Meeting

St. John’s, NL, December 11, 2024 – Sokoman Minerals Corp. (TSXV: SIC) (OTCQB: SICNF) (“Sokoman” or the “Company”) today announces that due to the ongoing Canada Post strike, it has postponed its Annual General Meeting (the “Meeting”) set for January 8, 2025. The Meeting will be rescheduled after the Canada Post strike has concluded.

About Sokoman Minerals Corp.

Sokoman Minerals Corp. is a discovery-oriented company with projects in the province of Newfoundland and Labrador, Canada. The Company's primary focus is its portfolio of gold projects: the 100%-owned flagship, advanced-stage Moosehead, Crippleback Lake, and the district-scale Fleur de Lys project near Baie Verte in northwestern Newfoundland, which is targeting Dalradian-type orogenic gold mineralization similar to the Curraghinalt and Cavanacaw deposits in Northern Ireland. The Company entered into a strategic alliance with Benton Resources Inc. through three large-scale, joint-venture properties, including Grey River, Golden Hope, and Kepenkeck in Newfoundland. Sokoman is one of the largest landholders in Newfoundland, in Canada's newest and rapidly emerging gold districts.

In October 2023, Sokoman and Benton completed an agreement with Piedmont Lithium Inc., a major developer of lithium projects and processing plants in the USA, and exactly the right partner to have to advance the lithium project. The agreement provides for Piedmont to earn up to 62.5% of the Killick Lithium Project (formerly Golden Hope project) by funding up to $12 million in exploration expenses and issuing $10 million common shares in three stages. The Killick Lithium Project has been transferred to Killick Lithium Inc. (Killick), a 100%-owned subsidiary of Vinland Lithium Inc. (Vinland). Newly created Vinland has received $2 million in financing from Piedmont for a 19.9% interest, with the balance of ownership between Sokoman and Benton. Sokoman and Benton will continue to operate the exploration efforts at Killick through the earn-in stages. Sokoman and Benton will retain a royalty of 2% NSR on future production. Piedmont will have exclusive marketing rights for the promotion and sale of any lithium products produced from the project on a life-of-mine basis, and the right of first refusal on 100% offtake rights to the lithium concentrates.

Projects optioned with optionee fully vested are:

East Alder Project optioned to Canterra Minerals Inc. (SIC retains shares of CTM plus 1% NSR)

Startrek Project optioned to Thunder Gold (SIC retains shares of TGOL plus 1% NSR)

The Company would like to thank the Government of Newfoundland and Labrador for the financial support of the Moosehead and Fleur de Lys Projects through the Junior Exploration Assistance Program during the past few years.

For more information, please contact:

Timothy Froude, P.Geo., President & CEO

T: 709-765-1726

E: tim@sokomanmineralscorp.com

Cathy Hume, VP Corporate Development, Director

T: 416-868-1079 x 251

E: cathy@chfir.com

Website: www.sokomanmineralscorp.com

Twitter: @SokomanMinerals

Facebook: @SokomanMinerals

LinkedIn: @SokomanMineralsCorp

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Investors are cautioned that trading in the securities of the Corporation should be considered highly speculative. Except for historical information contained herein, this news release contains forward-looking statements that involve risks and uncertainties. Actual results may differ materially. Sokoman Minerals Corp. will not update these forward-looking statements to reflect events or circumstances after the date hereof. More detailed information about potential factors that could affect financial results is included in the documents filed from time to time with the Canadian securities regulatory authorities by Sokoman Minerals Corp.

Sokoman Minerals Corp. Announces Non-Brokered Flow-through Private Placement and Hard-Dollar Financing

ST. JOHN'S, NL, December 4, 2024, Sokoman Minerals Corp. (TSXV: SIC) (OTCQB: SICNF) (“Sokoman” or the “Company”) today announces a non-brokered private placement of flow-through ("FT") shares (the "Private Placement") for gross proceeds of up to CAD$1,500,000. The Private Placement is expected to close on or before December 16, 2024.

The Private Placement is priced at CAD$0.04 per FT share, with each flow-through common share of the Company entitling the holder to receive the tax benefits applicable to flow-through shares in accordance with provisions of the Income Tax Act (Canada).

The Company also announces a non-flow-through CAD$0.035 share financing (the "NFT Financing") for aggregate gross proceeds of up to CAD$250,000.

All securities issued pursuant to the FT Financing and the NFT Financing (together the "Financings") will be subject to a four-month and one-day hold period.

In connection with the Financings, the Company may pay finders' fees in cash and broker warrants as permitted by the policies of the TSX Venture Exchange (the "Exchange"). The Financings are subject to Exchange approval.

The Company will use an amount equal to the gross proceeds received by the Company from the sale of the FT shares, pursuant to the provisions in the Income Tax Act (Canada), to incur eligible "Canadian exploration expenses" that qualify as "flow-through mining expenditures" as both terms are defined in the Income Tax Act (Canada) (the "Qualifying Expenditures") on or before December 31, 2025, and to renounce all of the Qualifying Expenditures in favour of the subscribers of the FT Units effective December 31, 2024.

The Company intends to spend CAD$1,000,000 of the flow-through proceeds on the Moosehead gold property, the balance on Fleur de Lys and Crippleback, and hard-dollar proceeds for working capital.

About Sokoman Minerals Corp.

Sokoman Minerals Corp. is a discovery-oriented company with projects in the province of Newfoundland and Labrador, Canada. The Company's primary focus is its portfolio of gold projects: the 100%-owned flagship, advanced-stage Moosehead, Crippleback Lake, and the district-scale Fleur de Lys project near Baie Verte in northwestern Newfoundland, which is targeting Dalradian-type orogenic gold mineralization similar to the Curraghinalt and Cavanacaw deposits in Northern Ireland. The Company entered into a strategic alliance with Benton Resources Inc. through three large-scale, joint-venture properties, including Grey River, Golden Hope, and Kepenkeck in Newfoundland. Sokoman is one of the largest landholders in Newfoundland, in Canada's newest and rapidly emerging gold districts.

In October 2023, Sokoman and Benton completed an agreement with Piedmont Lithium Inc., a major developer of lithium projects and processing plants in the USA, and exactly the right partner to have to advance the lithium project. The agreement provides for Piedmont to earn up to 62.5% of the Killick Lithium Project (formerly Golden Hope project) by funding up to $12 million in exploration expenses and issuing $10 million common shares in three stages. The Killick Lithium Project has been transferred to Killick Lithium Inc. (Killick), a 100%-owned subsidiary of Vinland Lithium Inc. (Vinland). Newly created Vinland has received $2 million in financing from Piedmont for a 19.9% interest, with the balance of ownership between Sokoman and Benton. Sokoman and Benton will continue to operate the exploration efforts at Killick through the earn-in stages. Sokoman and Benton will retain a royalty of 2% NSR on future production. Piedmont will have exclusive marketing rights for the promotion and sale of any lithium products produced from the project on a life-of-mine basis, and the right of first refusal on 100% offtake rights to the lithium concentrates.

Projects optioned with optionee fully vested are:

East Alder Project optioned to Canterra Minerals Inc. (SIC retains shares of CTM plus 1% NSR)

Startrek Project optioned to Thunder Gold (SIC retains shares of TGOL plus 1% NSR)

The Company would like to thank the Government of Newfoundland and Labrador for the financial support of the Moosehead and Fleur de Lys Projects through the Junior Exploration Assistance Program during the past few years.

For more information, please contact:

Timothy Froude, P.Geo., President & CEO

T: 709-765-1726

E: tim@sokomanmineralscorp.com

Cathy Hume, VP Corporate Development, Director

T: 416-868-1079 x 251

E: cathy@chfir.com

Website: www.sokomanmineralscorp.com

Twitter: @SokomanMinerals

Facebook: @SokomanMinerals

LinkedIn: @SokomanMineralsCorp

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Investors are cautioned that trading in the securities of the Corporation should be considered highly speculative. Except for historical information contained herein, this news release contains forward-looking statements that involve risks and uncertainties. Actual results may differ materially. Sokoman Minerals Corp. will not update these forward-looking statements to reflect events or circumstances after the date hereof. More detailed information about potential factors that could affect financial results is included in the documents filed from time to time with the Canadian securities regulatory authorities by Sokoman Minerals Corp.

Sokoman Provides Project Update, Moosehead Gold Project, Central Newfoundland

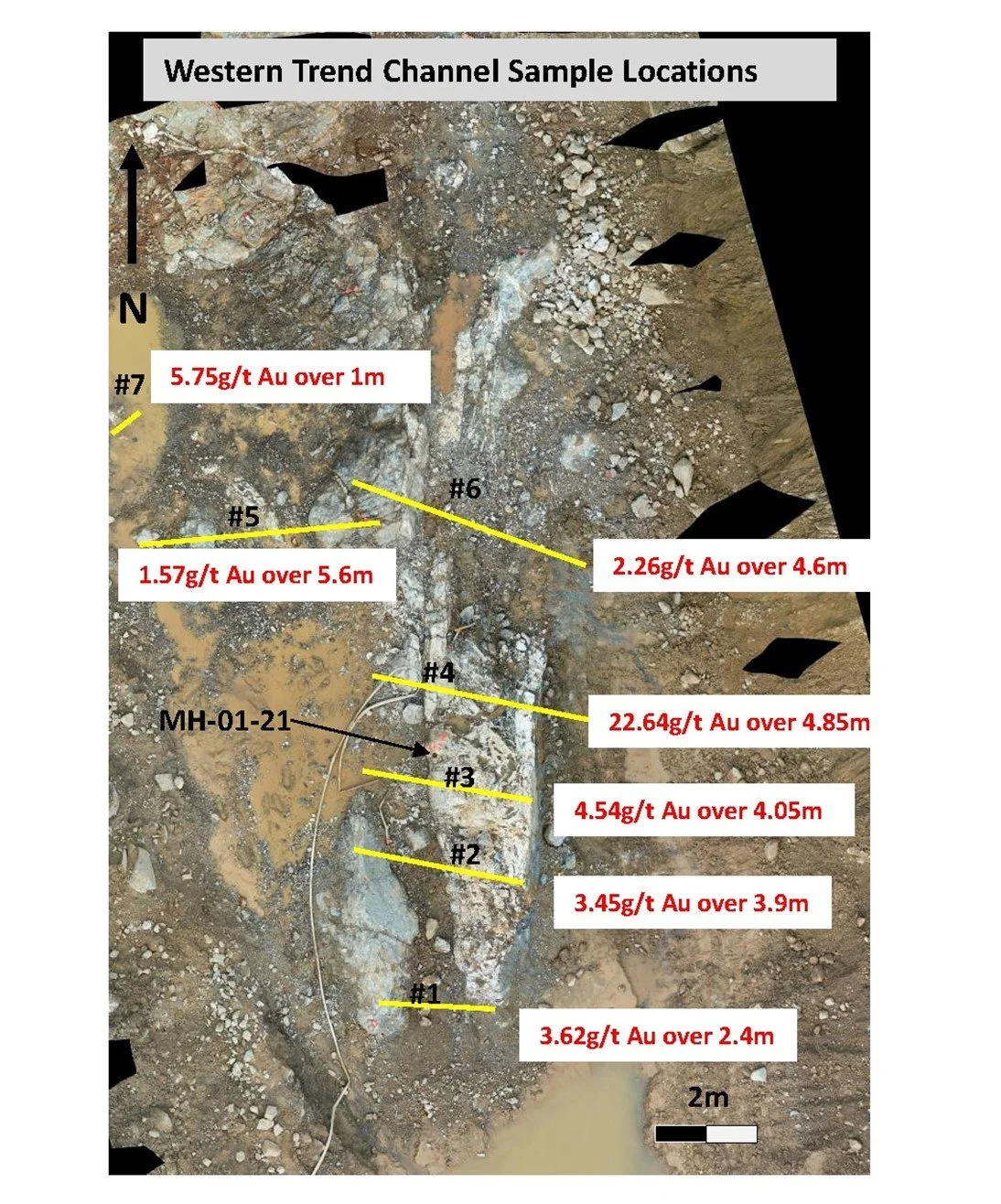

Channel sample results received / 1,500 m drilling program initiated at the Western Trend.

ST. JOHN'S, NL, November 27, 2024, Sokoman Minerals Corp. (TSXV: SIC) (OTCQB: SICNF) (“Sokoman” or the “Company”) is pleased to announce that a minimum 1,500 m diamond drill program has begun to test the Western Trend gold zone based on information gained in the trenching program. Drilling will consist of 20 to 30 diamond drill holes testing along strike / down dip of the newly discovered, east-west trending, gold-bearing vein network exposed in the Western Trend trench, a splay off of the main, north-trending vein system similar to the Footwall Splay trend off of the main Eastern Trend. The trenching was initiated as a first step towards a conventional (drill and blast) bulk sample from the Western Trend.

The Company also reports the results for the remaining channel samples from the Western Trend trench and preliminary results for the metallurgical samples from Base Met Labs in Kamloops, B.C., for scoping-level, metallurgical testing of the Western Trend gold mineralization.

Timothy Froude, P.Geo., President and CEO, states, "We are excited about the next few months at Moosehead, as we will not only be receiving the first metallurgical test results for the property, we are also beginning a drilling program based on the results of the trenching program at the Western Trend, the first step towards a bulk sample at Moosehead. All three programs are intertwined since the drilling will influence the bulk sample extraction, and the metallurgical work will strongly influence how and possibly where the sample is processed. The final assay results for channel samples in the Western Trend trench confirm the significance of the newly recognized East-West trend of high-grade mineralization, justifying the 1,500 m drill program. Dr. Coller's recent visit to the property, focused on the Western Trend trench exposure, will help him determine the structural setting at Moosehead and ultimately lead to recommendations for deep drilling at Moosehead."

Western Trend Channel Sample Results

The remaining channel sample results, 21 samples from channels 8 to 15, from the Western Trend trench (see channel sample location map) confirm that an east-west trending, high-grade vein system (the East-West Splay) occurs in the Western Trend. It is highlighted by channel #8, which returned 8.10 m of 7.09 g/t Au, including 3.20 m of 14.29 g/t Au. A total of 41.2 m, representing 57 separate samples, ranging from 0.15 to 1.10 m (with a median length of 0.73 m), returned an average weighted grade of 5.79 g/t Au with all samples analyzed by total pulp metallic assaying at Eastern Analytical Ltd. in Springdale, NL.

Channel Sample Location Map

Western Trend Diamond Drilling

Based on observations from the Western Trend trench, a minimum 1,500 m diamond drill program is planned to extend the main vein trend and the newly recognized East-West Splay by up to 200 m along strike and 80 m vertically. To date, four drill holes have been completed with all intersecting visible gold-bearing quartz vein zones. The program is expected to continue to the Christmas Break, on or about December 19, 2024. All analyses are pending.

Bulk Sampling

The proposed 1,000 m3 (approximately 2,700 tonnes) conventional bulk sample from the Western Trend trench area is in the permitting stage. It will await the metallurgical testing results on the 242 kg sample (split between the three types of mineralization) at Base Met Labs in Kamloops, B.C., and the results of the diamond drill program. The Company is in discussion with several groups regarding bulk sample processing. Also, the Company expects a report on progress on the Footwall Splay bulk sample from Novamera Inc. later this quarter, including plans for the next stage of the bulk sample program.

Metallurgical Testing

The 242 kg metallurgical sample (split between the three types of mineralization) is being tested at Base Met Labs in Kamloops, B.C. The first stage work involved establishing the head grade for all three samples, with the results summarized below:

· Quartz veins - 58.8 g/t Au grade

· Wallrock (sediment) - 0.84 g/t Au grade

· Wallrock (altered dyke) - 2.46 g/t Au grade

Other studies, including gravity recoveries, leaching, etc., are ongoing and expected before year end.

QP

This news release has been reviewed and approved by Timothy Froude, P.Geo., a "Qualified Person" under National Instrument 43-101 and President and CEO of Sokoman Minerals Corp.

Analytical Techniques / QA/QC

Samples, including duplicates, blanks, and standards, are submitted to Eastern Analytical Ltd. in Springdale, Newfoundland, for gold analysis. All core samples submitted for assay are saw cut by Sokoman personnel, with one-half submitted for assay and one-half retained for reference. Samples are delivered in sealed bags directly to the lab by Sokoman personnel. Eastern Analytical Ltd. is an accredited assay lab that conforms to the requirements of ISO/IEC 17025. Samples with visible gold are submitted for total pulp metallics with a gravimetric finish. All other samples are analyzed by standard fire assay methods. Total pulp metallic analysis includes: the entire sample being crushed to -10 mesh; and then pulverized to 95% -150 mesh. The total sample is weighed and screened to 150 mesh; the +150-mesh fraction is fire-assayed for Au, and a 30 g subsample of the -150-mesh fraction is fire-assayed for Au, with a calculated weighted average of total Au in the sample reported as well. One blank and one industry-approved standard for every twenty samples submitted is included in the sample stream. Random duplicates of selected samples are analyzed in addition to the in-house standard and duplicate policies of Eastern Analytical Ltd. All reported assays are uncut.

About Sokoman Minerals Corp.

Sokoman Minerals Corp. is a discovery-oriented company with projects in the province of Newfoundland and Labrador, Canada. The Company's primary focus is its portfolio of gold projects: the 100%-owned flagship, advanced-stage Moosehead, Crippleback Lake, and the district-scale Fleur de Lys project near Baie Verte in northwestern Newfoundland, which is targeting Dalradian-type orogenic gold mineralization similar to the Curraghinalt and Cavanacaw deposits in Northern Ireland. The Company entered into a strategic alliance with Benton Resources Inc. through three large-scale, joint-venture properties, including Grey River, Golden Hope, and Kepenkeck in Newfoundland. Sokoman is one of the largest landholders in Newfoundland, in Canada's newest and rapidly emerging gold districts.

In October 2023, Sokoman and Benton completed an agreement with Piedmont Lithium Inc., a major developer of lithium projects and processing plants in the USA, and exactly the right partner to have to advance the lithium project. The agreement provides for Piedmont to earn up to 62.5% of the Killick Lithium Project (formerly Golden Hope project) by funding up to $12 million in exploration expenses and issuing $10 million common shares in three stages. The Killick Lithium Project has been transferred to Killick Lithium Inc. (Killick), a 100%-owned subsidiary of Vinland Lithium Inc. (Vinland). Newly created Vinland has received $2 million in financing from Piedmont for a 19.9% interest, with the balance of ownership between Sokoman and Benton. Sokoman and Benton will continue to operate the exploration efforts at Killick through the earn-in stages. Sokoman and Benton will retain a royalty of 2% NSR on future production. Piedmont will have exclusive marketing rights for the promotion and sale of any lithium products produced from the project on a life-of-mine basis, and the right of first refusal on 100% offtake rights to the lithium concentrates.

Projects optioned with optionee fully vested:

East Alder Project optioned to Canterra Minerals Inc (SIC retains 850,000 shares of CTM plus 1% NSR)

Startrek Project optioned to Thunder Gold (SIC retains 1,750,000 shares of TGOL plus 1% NSR)

The Company would like to thank the Government of Newfoundland and Labrador for the financial support of the Moosehead and Fleur de Lys Projects through the Junior Exploration Assistance Program over the past few years.

About Sokoman Minerals Corp.

Sokoman Minerals Corp., based in Newfoundland and Labrador, Canada, focuses primarily on its gold projects, including the wholly-owned Moosehead, Crippleback Lake, and the extensive Fleur de Lys project near Baie Verte. This latter project aims to discover Dalradian-type orogenic gold mineralization like the Curraghinalt and Cavanacaw deposits in Northern Ireland. The company has also partnered with Benton Resources Inc. on three large-scale joint ventures: Grey River, Killick Lithium, formerly Golden Hope, and Kepenkeck, positioning Sokoman as one of the largest landholders in Canada’s emerging gold districts.

In October 2023, Sokoman and Benton entered into an agreement with Piedmont Lithium Inc. to advance the Killick Lithium Project. Under this deal, Piedmont can acquire up to 62.5% of the project by investing up to $12 million in exploration and issuing $10 million shares over three phases. The project, previously known as Golden Hope, is now part of Killick Lithium Inc., a subsidiary of Vinland Lithium Inc., in which Piedmont has acquired a 19.9% stake for $2 million. Sokoman and Benton maintain operational control during the earn-in phases and retain a 2% NSR royalty on future production. Additionally, Piedmont holds exclusive marketing and first-refusal rights on the lithium concentrates for the life of the mine.

Projects optioned with optionee fully vested:

East Alder Project optioned to Canterra Minerals Inc (SIC retains 850,000 shares of CTM plus 1% NSR)

Startrek Project optioned to Thunder Gold (SIC retains 1,750,000 shares of TGOL plus 1% NSR)

The Company would like to thank the Government of Newfoundland and Labrador for the financial support of the Moosehead and Fleur de Lys Projects through the Junior Exploration Assistance Program during the past few years.

For more information, please contact:

Timothy Froude, P.Geo., President & CEO

T: 709-765-1726

E: tim@sokomanmineralscorp.com

Cathy Hume, VP Corporate Development, Director

T: 416-868-1079 x 251

E: cathy@chfir.com

Website: www.sokomanmineralscorp.com

Twitter: @SokomanMinerals

Facebook: @SokomanMinerals

LinkedIn: @SokomanMineralsCorp

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Investors are cautioned that trading in the securities of the Corporation should be considered highly speculative. Except for historical information contained herein, this news release contains forward-looking statements that involve risks and uncertainties. Actual results may differ materially. Sokoman Minerals Corp. will not update these forward-looking statements to reflect events or circumstances after the date hereof. More detailed information about potential factors that could affect financial results is included in the documents filed from time to time with the Canadian securities regulatory authorities by Sokoman Minerals Corp.

Sokoman Minerals Corp. to Seek Shareholders Approval to Spin-out Shares of Vinland Lithium Inc.

ST. JOHN'S, NL, November 25, 2024, Sokoman Minerals Corp. (TSXV: SIC) (OTCQB: SICNF) (“Sokoman” or the “Company”) announces that it has filed Management Proxy Materials under its profile on sedarplus.ca for its annual and special general meeting of shareholders (the “Meeting”). The Meeting is currently set to be held on January 8, 2025, in Vancouver, BC, although the actual date is likely to change as a result of the Canadian postal strike. At the Meeting, Sokoman shareholders will be asked to approve a special resolution (two-thirds of votes cast) to reorganize Sokoman’s share capital to facilitate a spin-out to shareholders of approximately 2 million of Sokoman’s 4 million shares of Vinland Lithium Inc. (“Vinland”). Vinland holds the Killick Lithium Project and is currently owned by Sokoman (40%), Benton Resources Inc. (“Benton”) (40%) and Piedmont Lithium Newfoundland Holdings LLC (“Piedmont”), a wholly-owned subsidiary of NASDAQ-listed Piedmont Lithium Inc. (20%). Benton will concurrently seek the approval of its shareholders for a similar 2 million share spin-out. Subject to the two spin-outs being completed, the TSX Venture Exchange has conditionally agreed to list the approximately 10 million issued shares of Vinland, of which approximately 40% will be in the hands of Sokoman and Benton shareholders.

The spin-outs will be substantially pro rata to Sokoman and Benton shareholders; however, the exact ratio of Vinland share per Sokoman share will be determined prior to completion in January 2025. The exchange ratio is dependent on the number of Sokoman shares issued at the time of completion. The ratio is expected to be approximately 50 Vinland shares per 8,000 Sokoman shares. Accounts holding less than 8,000 Sokoman shares (having an approximate $320 market value) will not receive Vinland shares as the immediate and ongoing administration and compliance costs for very small odd-lot Vinland shareholders would be prohibitive.

Some of the key points for shareholders are as follows:

The Killick Lithium Project holds excellent discovery potential in a newly discovered lithium belt

Piedmont, a wholly-owned subsidiary of NASDAQ-listed Piedmont Lithium Inc., completed a 2023 financing in Vinland of CAD$2.0M @ CAD$1.00 per share to hold 19.9%

Piedmont Lithium Inc. is one of North America’s leading lithium companies

Newfoundland is ranked as one of the top jurisdictions to explore and develop mineral potential

Piedmont Lithium Inc. has vast technical and geological knowledge in similar geology to that of the Kraken pegmatites

Vinland holds indirectly, through its subsidiary Killick Lithium Inc., a 100% interest in the Killick Lithium Project

Piedmont will have the option to earn up to a 62.5% direct interest in Killick Lithium Inc. by spending CAD$12.0M in exploration and development during the period of the option

Upon Piedmont completing all earn-in options, Piedmont/Piedmont Lithium Inc. will have paid Sokoman and Benton a total of CAD$10.0M in Piedmont Lithium Inc. shares in addition to having funded all the Vinland exploration and development costs

Sokoman and Benton to collectively retain a 2% NSR on the Killick Lithium Project

In addition to the spin-out resolution, Sokoman shareholders who attend the Meeting will attend to annual matters, including consideration of Sokoman’s June 30, 2024, audited financial statements, the election of directors, appointment of auditors, and approval of Sokoman’s stock option plan.