Newsroom

Sokoman Provides Exploration Update at Moosehead Gold Project, Central Newfoundland

Drilling resumes with rigs at the South Pond and 463 Zone target areas

St. John’s, NL, July 10, 2023 – Sokoman Minerals Corp. (TSXV: SIC) (OTCQB: SICNF) ("Sokoman" or the "Company") today provides the following update on the Moosehead project, including the re-commencement of the 100,000 m+ Phase 6 diamond drilling program, proposed summer work plans, and an update on the structural model.

Tim Froude, President and CEO of Sokoman says: “Several programs were active during a recent pause in drilling including re-examining a large number of earlier holes to garner more structural and mineralization details; re-visiting the structural model with Dr. Coller (ongoing); and reconnaissance-level soil sampling over relatively unexplored areas of the property. We have also commenced a review of historical geophysical surveys to pull additional targeting information from, as well as consideration of possibly completing additional geophysics at Moosehead. We are truly excited by the ongoing work of Dr. Coller who has defined the footwall environment as a prime target area for high-grade vein zones similar to MH-22-463. This also explains several other historical “isolated” hits in the footwall that could never really be properly explained or fit in with the model at the time.”

The summer diamond drilling program started on June 12 with two drill rigs.

Targets for the first drill include testing a potential extension of a high-grade shoot that plunges north from the 75 Zone to where hole MH-21-263 intersected 4.80 m @12.86 g/t Au from 184.10 m. Three holes are planned for this section and then the rig will move to South Pond, following up on previously reported drilling including intersections in MH-20-123 (5.00 m @ 26.87 g/t Au) and MH-20-141 (4.20 m @ 64.00 g/t Au). The South Pond Zone remains open to depth. Recent re-modeling of mineralized zones at Moosehead suggests that the intersection in MH-21-344 (previously reported 2.27 g/t Au over 4.0 m including 9.70 g/t Au over 0.50 m), may be linked to the South Pond Zone at depth. The intersection in MH-21-344 is 200 m down plunge from the current modeled South Pond Zone. At least six holes totaling 1500 m -1800 m are proposed for the South Pond drilling.

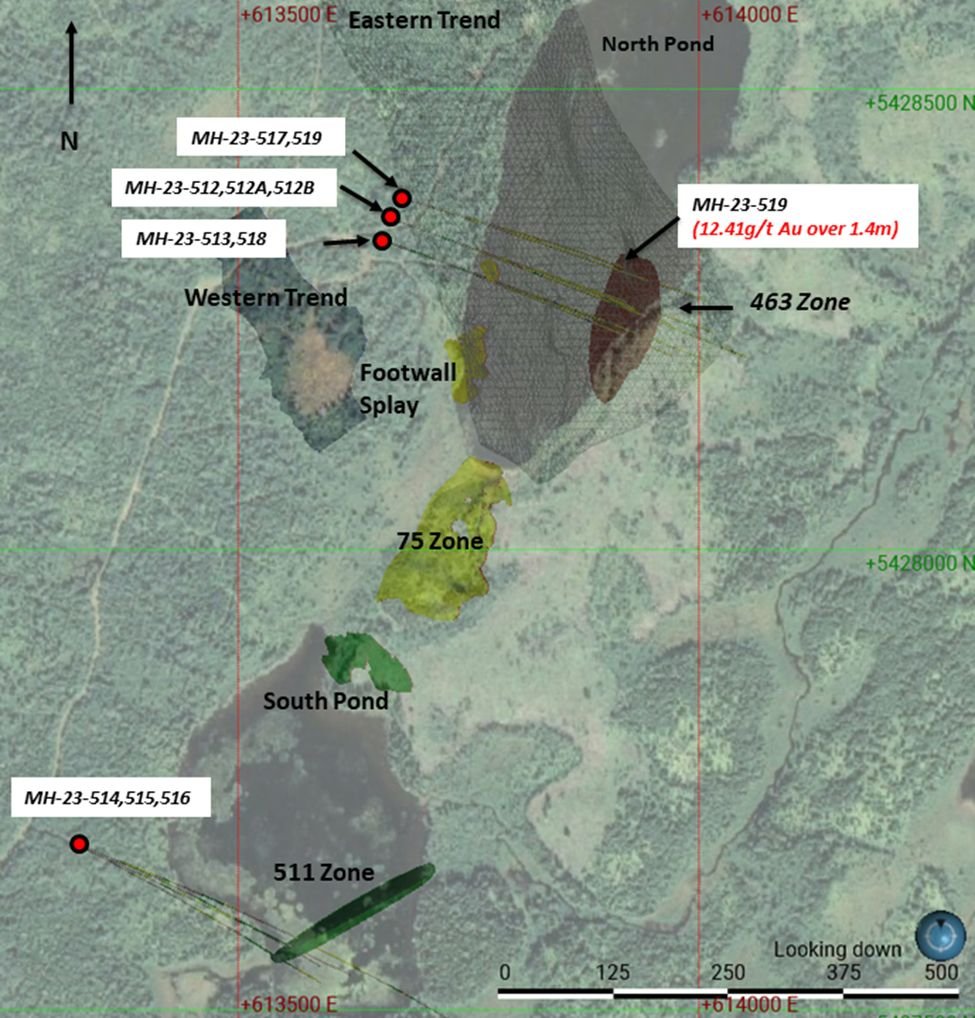

Targets for the second drill rig include testing the down plunge and northern extensions of mineralization in the 463 Zone area. This is where MH-22-463 returned 39.60 m @ 12.50 g/t Au including 10.5 m @ 41.97 g/t Au (see December 15, 2022 press release), and where MH-23-519 intersected a 1.4-metre wide zone of visible gold-bearing quartz veining that returned 12.41 g/t Au (from 409.75 m downhole) 56 m down plunge from hole MH-22-463 and which remains open to the south and to depth (see April 13, 2023 press release). The initial drilling will test 20 m - 50 m below MH-23-519 with four to five holes totaling 2,000 m proposed for the 463 Zone target area. Additional drilling in the general footwall environment will be proposed to the current 463 Zone depth of 450 m pending the results of the initial drilling.

Drill Plan Map

Diamond drilling and/or trenching (depending on overburden depth) will investigate other areas on the property testing soil geochemical anomalies in the southwestern and northern portions of the property, generated from winter sampling in proximity to the Valentine Lake Shear Zone which cuts through the entire property. Gold in soil values ranging from less than detection (<5 ppb) up to 912 ppb Au were returned three km southwest of the Eastern Trend where only sparse recon drilling has been completed, and from less than detection (<5 ppb) to 279 ppb Au 1.7 km northeast of the Eastern Trend where no previous drilling has taken place. For reference, the highest historical soil sample value found on the property was 425 ppb Au.

A revised structural interpretation has just been received from Dr. Coller who states, “The splitting out of the veins and shears/faults makes the primary and deformed vein pattern visually much clearer and there is an emerging significance of the vein trends in the footwall to the Eastern trend, which are highly oblique to main shears. These are the 463-type veins and a similar trending vein nearer surface. It was suggested that these veins may be linkages between two shear structures which may be duplicated. Several large areas with no drill testing relatively at shallow depths were identified.”

“On a larger scale, the gold mineralization at Moosehead appears to be associated with a NE-trending, regional tectonic contact that lays to the south of the currently outlined vein system. The geological interpretation of this contact is the Valentine Lake structure, a SE-dipping thrust/reverse fault (which could be the structural hanging wall to the south), and a SE-dipping gold vein system. This tectonic structure is somewhat obscure in the magnetics, is not well defined on surface, and the limit of mineralization and actual structural corridor requires further work to be defined.”

“It is believed that this type of structure, present at Moosehead, is similar to that seen at Newfound Gold’s Queensway property where the veins dip opposite to the main fault. The Newfound Gold model could be a useful structural template for the regional Moosehead system and a guide to regional drill spacing.”

QP

This news release has been reviewed and approved by Timothy Froude, P.Geo., a "Qualified Person" under National Instrument 43-101 and President and CEO of Sokoman Minerals Corp.

About Sokoman Minerals Corp.

Sokoman Minerals Corp. is a discovery-oriented company with projects in the province of Newfoundland and Labrador, Canada. The Company's primary focus is its portfolio of gold projects; the 100% flagship, advanced-stage Moosehead, as well as Crippleback Lake (available for option); and East Alder along the Central Newfoundland Gold Belt, and the district-scale Fleur de Lys project near Baie Verte in northwestern Newfoundland, that is targeting Dalradian-type orogenic gold mineralization similar to the Curraghinalt and Cavanacaw deposits in Northern Ireland. The Company also entered into a strategic alliance with Benton Resources Inc. through three, large-scale, joint-venture properties including Grey River, Golden Hope, and Kepenkeck in Newfoundland. Sokoman now controls, independently and through the Benton alliance, over 150,000 hectares (>6,000 claims – 1500 sq. km), making it one of the largest landholders in Newfoundland, in Canada’s newest and rapidly-emerging gold districts. The Company also retains a 1% NSR interest in an early-stage antimony/gold project (Startrek) in Newfoundland, optioned to Thunder Gold Corp (formerly White Metal Resources Inc.), and in Labrador, the Company has a 100% interest in the Iron Horse (Fe) project which has Direct Shipping Ore (DSO) potential.

Mineralization hosted on adjacent and/or nearby properties is not necessarily indicative of mineralization hosted on the Company's property.

The Company would like to thank the Government of Newfoundland and Labrador for past financial support of the Moosehead Project through the Junior Exploration Assistance Program.

For further information, please contact:

Timothy Froude, P.Geo., President & CEO

Phone: 709-765-1726

Email: tim@sokomanmineralscorp.com

Cathy Hume, VP Corporate Development, Director

Phone: 416-868-1079 x251

Email: cathy@chfir.com

Website: www.sokomanmineralscorp.com

Twitter: @SokomanMinerals

Facebook: @SokomanMinerals

LinkedIn: @SokomanMinerals

THE TSX VENTURE EXCHANGE HAS NOT REVIEWED AND DOES NOT ACCEPT RESPONSIBILITY FOR THE ADEQUACY OR ACCURACY OF THIS RELEASE.

Investors are cautioned that trading in the securities of the Corporation should be considered highly speculative. Except for historical information contained herein, this news release contains forward- looking statements that involve risks and uncertainties. Actual results may differ materially. Sokoman Minerals Corp. will not update these forward-looking statements to reflect events or circumstances after the date hereof. More detailed information about potential factors that could affect financial results is included in the documents filed from time to time with the Canadian securities regulatory authorities by Sokoman Minerals Corp.

Sokoman Minerals Provides Update on Fleur de Lys Gold Project North-Central Newfoundland

Detailed prospecting to begin in August ahead of trenching/drilling

St. John’s, NL, July 7, 2023 – Sokoman Minerals Corp. (TSXV: SIC) (OTCQB: SICNF) ("Sokoman" or the "Company") is pleased to provide an update on the planned exploration of the Fleur de Lys gold project on the Baie Verte Peninsula, in north-central Newfoundland. Company geologists and prospectors recently toured gold systems in Dalradian / Caledonian rocks in Northern Ireland which are equivalent to the Appalachian, Fleur de Lys Supergroup rocks, including mineralization in and around the world-class Curraghinalt gold deposit. Curraghinalt is host to >6 million ounces of NI 43-101 compliant* gold resources in 20+, discrete quartz veins ranging from tens of centimeters to more than 1.5 m in thickness. The veins have strike lengths in excess of 1.8 km and have been intersected in drill holes to 1,000 m vertically with the resources calculated by SRK Consulting (Canada) in 2018 to a 400 m depth. Curraghinalt, which remains open at depth, is the largest gold deposit in the Appalachian-Caledonian Orogen.

Tim Froude, President and CEO of Sokoman, commented: "We are extremely thankful for the opportunity to visit Northern Ireland and examine the geological setting of gold in Dalradian rocks of the Sperrin Mountains and adjacent terranes to aid in our broader assessment of Sokoman's Fleur de Lys gold project. A week in the field and underground, viewing core from the deposits, and meetings with the British Geological Survey (BGS), industry geologists, and local prospectors, has been invaluable in helping our team understand i) the controls on gold deposition in the very familiar-looking Dalradian rocks, and ii) gold exploration strategies that have proven successful in this segment of Irish/UK Caledonides. Several crucial elements pertaining to the distribution of gold in Dalradian rocks are directly applicable to evaluating Sokoman's gold in till anomalies at Fleur de Lys including 1) the regional structural setting; 2) the absolute ages and relative timing of gold mineralizing events and poly-phase tectonism; 3) vein styles, and proximity to the Clew-Bay/Omagh crustal-scale terrane boundary - the Baie Verte Line equivalent; 4) local, specific, lithological controls; 5) the proximity to gold-rich VMS in adjacent terranes; and 6) the physical nature and distribution of the gold at Curraghinalt.

This data highlighted the critical commonalities, vis-à-vis gold, between the Sperrin Mountains (e.g., Curraghinalt) and the Fleur de Lys belt at regional, property, and outcrop scales. Our mission in Northern Ireland was to learn about gold in this part of the world and apply it to exploration plans in the Fleur de Lys belt in Newfoundland. Given what we learned, we left even more confident about the potential of our Fleur de Lys gold project. The Company, with input from Overburden Drilling Management, is prioritizing the anomalies for a detailed follow-up prospecting program beginning in August, with significant results to be further explored by trenching or diamond drilling."

Gold-bearing quartz float; Curraghinalt gold deposit underlies the field in the foreground

Exposure of gold-bearing quartz vein in graphitic schist and psammite near Curraghinalt

Narrow high-grade quartz-pyrite (gold bearing) vein near Curraghinalt

About the Fleur de Lys Gold Project

The 100%-owned project is located on the west side of the Baie Verte Peninsula in north-central Newfoundland. The area has a long history of base metal and gold production dating back to the 1860s. The project is highly prospective for Dalradian-style (e.g., Curraghinalt) orogenic, vein-hosted, gold deposits and as such, represents a readily accessible, yet underexplored, district-scale, gold target in the Newfoundland Appalachians. The Fleur de Lys Supergroup, which underlies the project, includes equivalent rocks to the Dalradian Supergroup in the UK, where three significant gold deposits, including the Curraghinalt and Cavanacaw deposits in Northern Ireland, and Cononish in Scotland are found. The Dalradian, vein-hosted, gold deposits occur in moderate to high-grade metamorphic terranes and are typically high grade.

Prior to Sokoman’s exploration, the Fleur de Lys belt had seen little modern exploration with some areas completely unexplored, even though historical grab sample values of 3.3 g/t Au to 25.5 g/t Au were reported from several locations (note: historical assays have not been verified by the Company and should not be relied upon). Sokoman’s Fleur de Lys property is ideally suited to cost-effective exploration with excellent access and infrastructure, a supportive local population, a long history of mining, and support businesses.

To date, the Company has completed a property scale C-horizon till sampling program (1,260 samples) implemented and overseen by Overburden Drilling Management (ODM), which has outlined strongly anomalous gold in tills overlying favourable rocks and structures with significant gold values in both float and bedrock. The background level of gold grains in tills for the project has been determined to be 10 grains in a 10- to 12-kilogram sample of screened till. ODM considers a Fleur de Lys sample to be anomalous if it contains two-times background or 20 gold grains. Results indicate that of the 1,260 samples collected, 328 samples, or just over 25%, have at least 20 gold grains (to a maximum of 230 grains) and are considered anomalous. Fifty-five (55) samples contain at least 60 grains (six-times background) with multiple samples containing more than 50% pristine gold grains. Gold grains described as pristine are considered to be from a local bedrock source. Of note - most gold grains at Fleur de Lys are small (<1 mm) as is most of the gold at Curraghinalt, where gold is intimately associated with pyrite mineralization in quartz veins.

In addition, limited prospecting has located anomalous gold in bedrock and float with 34 samples giving gold values >100 ppb Au (0.1 g/t Au), including 18 samples >500 ppb Au (0.5 g/t Au), and 10 samples >1000 ppb Au (>1.0 g/t Au) with a maximum of 6.2 g/t Au. The highest gold value was in an outcrop (a grab sample) in an area of strong gold-grain counts. A regional airborne magnetic survey (Geological Survey of Canada (GSC) - 2015) over the Baie Verte Peninsula suggests that multiple crosscutting structures occur in the vicinity of several strong gold in till anomalies and in multiple rock (grab and float) gold-bearing samples, all within a 5-8 km corridor adjacent to the Baie Verte Line. Interpretation of the till results by ODM defines a target area of 30 km strike-length, with better-defined anomalies located within this 30 km long area.

Panned, fine gold grains from surface vein exposure at Curraghinalt

QP

This news release has been reviewed and approved by Timothy Froude, P. Geo., a "Qualified Person" under National Instrument 43-101 and President and CEO of Sokoman Minerals Corp.

Till Sampling QA/QC

The till samples were collected by Sokoman personnel using field collection techniques provided by ODM. All samples were hand dug to the desired depth (C-Horizon Till) with a 10- to 12-kg sieved sample (8 mesh) placed in a clear plastic sample bag and sealed. Samples were shipped in plastic pails by bonded courier to the ODM lab in Ottawa, Ontario. The till samples are processed using procedures designed to progressively concentrate the heavy minerals, expose the gold grains and prepare a split of the heavy mineral concentrate (“HMC”) suitable for geochemical analysis if requested. The sample is wet screened at 2 mm with a preliminary concentrate extracted from the -2 mm fraction by tabling. Geological observations on the character of the sample are made during both the screening and tabling operations. The table concentrate is purposely large (typically 300-400 g) and of low grade (10%-25% heavy minerals) in order to achieve a high, 80% to 90% recovery rate for all desired heavy minerals irrespective of their grain size or relative specific gravity. The gold grains, more than 95% of which are normally silt-sized (Averill 2001), are observed at this stage with the aid of micro-panning and are counted, measured, and classified as to degree of wear (ie distance of glacial transport), then returned to the table concentrate. The pyrite content of the pan concentrate is estimated and the number of grains of heavier, visually distinctive indicator minerals such as arsenopyrite, galena, scheelite, cinnabar, etc. is recorded.

Quality Control and Quality Assurance Measures

In addition to using field duplicates to monitor the quality of the indicator mineral data obtained from specific projects, ODM performs blind tests to ensure that the recovery rates for all targeted minerals are consistently in the 80% to 90% range. Furthermore, both the quality of the mineral separation and the overall mineralogy of the concentrate are visible at every stage of the concentration process, minimizing the potential for sample mix-ups, indicator mineral carryover between samples, and other potential contamination issues. For example, gold grains, which are the most important indicator mineral on many surveys, are more susceptible to inter-sample carryover than any other indicator mineral due to their very small size, but these grains are physically observed during the first stage of mineral concentration, tabling, and if anomalous concentrations are present, blank samples are tabled and carefully inspected for gold grains before the next project sample is processed.

Rock Sample Analysis

Rock sample analysis (gold by fire assay) completed at Eastern Analytical Ltd., in Springdale NL. Samples were delivered in sealed bags directly to the lab by Sokoman Minerals’ personnel. Eastern Analytical is an accredited assay lab that conforms to the requirements of ISO/IEC 17025. Eastern routinely inserts industry-accepted standards and blanks in all sample runs performed as well as completing random duplicate analysis.

About Sokoman Minerals Corp.

Sokoman Minerals Corp. is a discovery-oriented company with projects in the province of Newfoundland and Labrador, Canada. The Company's primary focus is its portfolio of gold projects; the 100%-owned flagship, advanced-stage Moosehead, as well as Crippleback Lake (available for option); and East Alder along the Central Newfoundland Gold Belt, and the district-scale Fleur de Lys project near Baie Verte in north-central Newfoundland, that is targeting Dalradian-type orogenic gold mineralization similar to the Curraghinalt and Cavanacaw deposits in Northern Ireland. The Company also entered into a strategic alliance with Benton Resources Inc. through three, large-scale, joint-venture properties including Grey River, Golden Hope, and Kepenkeck in Newfoundland.

Sokoman now controls, independently and through the Benton Alliance, over 150,000 hectares (>6,000 claims – 1500 sq. km), making it one of the largest landholders in Newfoundland, in Canada’s newest and rapidly-emerging gold districts. The Company also retains an interest in an early-stage antimony/gold project (Startrek) in Newfoundland, optioned to Thunder Gold Corp (formerly White Metal Resources Inc.), and in Labrador, the Company has a 100% interest in the Iron Horse (Fe) project which has Direct Shipping Ore (DSO) potential.

Mineralization hosted on adjacent and/or nearby and/or referenced properties is not necessarily indicative of mineralization hosted on the Company's property.

*The Curraghinalt deposit has >6 million ounces of NI 43-101 compliant gold resources including 6.34 million tonnes at 15.01 grams per tonne (Measured and Indicated) for 3.06 million ounces; and 7.72 million tonnes at 12.24 grams per tonne gold (Inferred) for 3.03 million ounces {2018 Mineral Resource Statement, Curraghinalt Gold Project, Northern Ireland, SRK Consulting (Canada)}.

The Company would like to thank the Government of Newfoundland and Labrador for past financial support of the Fleur de Lys project through the Junior Exploration Assistance Program.

For further information, please contact:

Timothy Froude, P.Geo., President & CEO

Phone: 709-765-1726

Email: tim@sokomanmineralscorp.com

Cathy Hume, VP Corporate Development, Director

Phone: 416-868-1079 x251

Email: cathy@chfir.com

Website: www.sokomanmineralscorp.com

Twitter: @SokomanMinerals

Facebook: @SokomanMinerals

LinkedIn: @SokomanMinerals

THE TSX VENTURE EXCHANGE HAS NOT REVIEWED AND DOES NOT ACCEPT RESPONSIBILITY FOR THE ADEQUACY OR ACCURACY OF THIS RELEASE.

Investors are cautioned that trading in the securities of the Corporation should be considered highly speculative. Except for historical information contained herein, this news release contains forward- looking statements that involve risks and uncertainties. Actual results may differ materially. Sokoman Minerals Corp. will not update these forward-looking statements to reflect events or circumstances after the date hereof. More detailed information about potential factors that could affect financial results is included in the documents filed from time to time with the Canadian securities regulatory authorities by Sokoman Minerals Corp.

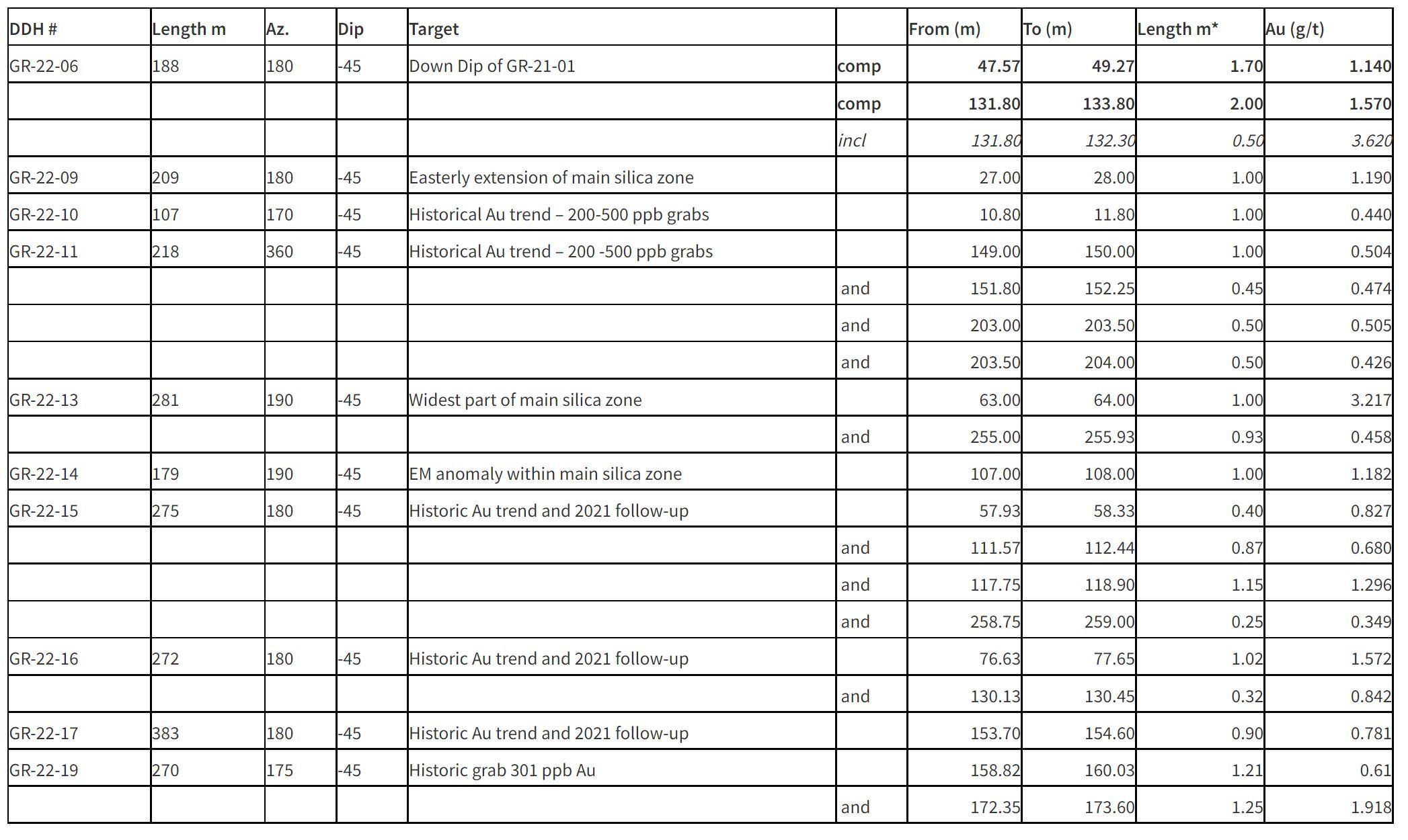

Sokoman Provides Recent Drilling Results at Moosehead Gold Project

St. John’s, NL, June 30, 2023 – Sokoman Minerals Corp. (TSXV: SIC) (OTCQB: SICNF) ("Sokoman" or the "Company") today provides an update on drill results at the Moosehead Gold Project completed prior to spring break-up. The delay in commencing the current diamond drilling program was to facilitate a review of the structural and vein models at Moosehead and to include input from Dr. David Coller, Ph.D., who has been assisting with the structural interpretation at Moosehead since 2019.

Tim Froude, President and CEO of Sokoman, says: "It has been an extremely busy spring at Moosehead. The summer diamond drilling program recommenced on June 12 with two rigs that are active at present. A total of 87,280 m of drilling has now been completed in the Phase 6 program and we plan to continue drilling beyond the originally scheduled 100,000 m. Diamond drilling and/or trenching (depending on overburden depth) will test other areas on the property with a view to discovering high grades in extensions of known zones and new drill targets."

Results from eight exploration drill holes completed prior to the spring break-up have been received and are reported in the following table. Six of the holes (MH-23-521 to 526) were in fences of reconnaissance holes (grassroots exploration) aimed at testing geophysical and/or soil/till geochemical anomalies to the north of North Pond along the interpreted trend of the main Eastern Trend and Upper North Pond shears. Most holes intersected weakly mineralized structures with minor quartz-carbonate veining and variable amounts of disseminated sulphides. The strongest results were from the western-most hole drilled (MH-23-525 (2.02 m @3.96 g/t Au), suggesting additional drilling is required west and down plunge of this hole.

Identifying structure and alteration was the primary purpose of drilling these holes. Given the narrow and nuggety high-grade style and nature of the Moosehead veins it is not unreasonable to encounter poorly mineralized intervals when stepping farther out from the bulk of the identified mineralized zone. Further work in these areas could be conducted in the future once the stratigraphic, survey, and analytic information has been incorporated into the property database and geology model, and fully interpreted.

Table of Results

Holes MH-23-517A and 520, while intersecting veining, did not intersect visible gold-bearing veining, suggesting the holes veered off of the 463 Zone trend. The zone is still open and additional holes are planned for this area. The 463 Zone is a prime target to intersect additional high-grade vein zones similar to MH-22-463.

A comprehensive exploration program at Moosehead is being finalized and will be provided in due course.

Drill Plan Map

QP

This news release has been reviewed and approved by Timothy Froude, P.Geo., a "Qualified Person" under National Instrument 43-101 and President and CEO of Sokoman Minerals Corp.

Analytical Techniques / QA/QC

Samples, including duplicates, blanks, and standards, were submitted to Eastern Analytical Ltd. in Springdale, Newfoundland for gold analysis. All core samples submitted for assay were saw cut by Sokoman personnel with one-half submitted for assay and one-half retained for reference. Samples were delivered in sealed bags directly to the lab by Sokoman personnel. Eastern Analytical Ltd. is an accredited assay lab that conforms to the requirements of ISO/IEC 17025. Samples with visible gold were submitted for total pulp metallics and gravimetric finish. All other samples were analyzed by standard fire assay methods. Total pulp metallic analysis includes: the whole sample is crushed to -10 mesh; then pulverized to 95% -150 mesh. The total sample is weighed and screened to 150 mesh; the +150 mesh fraction is fire assayed for Au, and a 30 g subsample of the -150 mesh fraction is fire assayed for Au; with a calculated weighted average of total Au in the sample reported as well. One blank and one industry-approved standard for every twenty samples submitted is included in the sample stream. Random duplicates of selected samples are analyzed in addition to the in-house standard and duplicate policies of Eastern Analytical Ltd. All reported assays are uncut.

About Sokoman Minerals Corp.

Sokoman Minerals Corp. is a discovery-oriented company with projects in Newfoundland and Labrador, Canada. The company's primary focus is its portfolio of gold projects: flagship, 100%-owned Moosehead, Crippleback Lake (available for option) and East Alder along the Central Newfoundland Gold Belt, and the district-scale Fleur de Lys project near Baie Verte in northwestern Newfoundland, that is targeting Dalradian-type orogenic gold mineralization similar to the Curraghinalt and Cavanacaw deposits in Northern Ireland, and Cononish in Scotland. The company also entered into a strategic alliance with Benton Resources Inc. through three large-scale joint-venture properties including Grey River Gold, Golden Hope, and Kepenkeck in Newfoundland. Sokoman now controls independently and through the Benton alliance over 150,000 hectares (>6,000 claims - 1,500 sq. km), making it one of the largest landholders in Newfoundland, Canada's newest and rapidly-emerging gold districts. The company also retains an interest in an early-stage antimony/gold project (Startrek) in Newfoundland, optioned to Thunder Gold Corp (formerly White Metal Resources Inc.), and in Labrador, the Company has a 100% interest in the Iron Horse (Fe) project that has Direct Shipping Ore (DSO) potential.

Mineralization hosted on adjacent and/or nearby properties is not necessarily indicative of mineralization hosted on the Company's property.

The Company would like to thank the Government of Newfoundland and Labrador for past financial support of the Moosehead Project through the Junior Exploration Assistance Program.

For further information, please contact:

Timothy Froude, P.Geo., President & CEO

Phone: 709-765-1726

Email: tim@sokomanmineralscorp.com

Cathy Hume, VP Corporate Development, Director

Phone: 416-868-1079 x251

Email: cathy@chfir.com

Website: www.sokomanmineralscorp.com

Twitter: @SokomanMinerals

Facebook: @SokomanMinerals

LinkedIn: @SokomanMinerals

THE TSX VENTURE EXCHANGE HAS NOT REVIEWED AND DOES NOT ACCEPT RESPONSIBILITY FOR THE ADEQUACY OR ACCURACY OF THIS RELEASE.

Investors are cautioned that trading in the securities of the Corporation should be considered highly speculative. Except for historical information contained herein, this news release contains forward- looking statements that involve risks and uncertainties. Actual results may differ materially. Sokoman Minerals Corp. will not update these forward-looking statements to reflect events or circumstances after the date hereof. More detailed information about potential factors that could affect financial results is included in the documents filed from time to time with the Canadian securities regulatory authorities by Sokoman Minerals Corp.

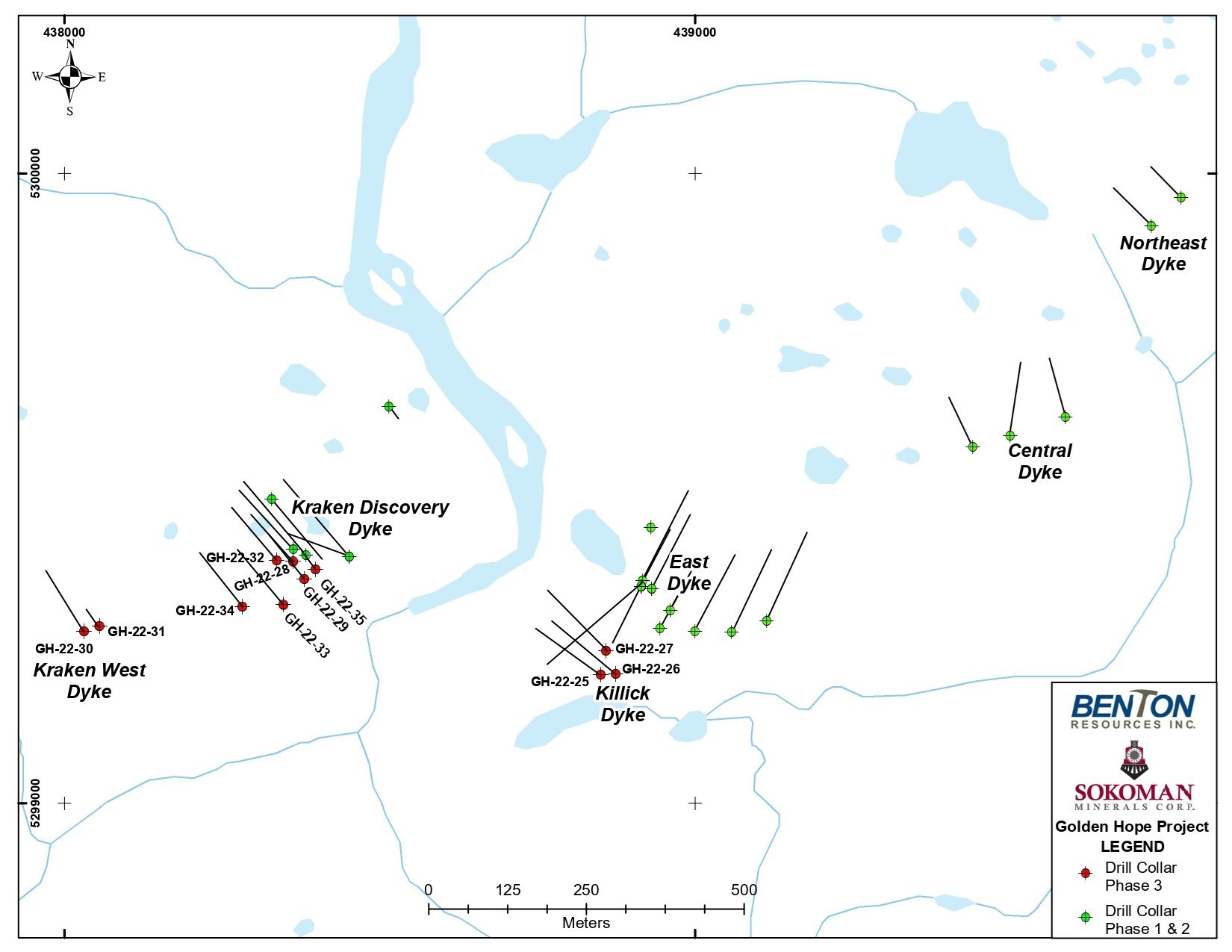

Sokoman and Benton Intersect 1.22% Li2O over 13.37 m at the Killick Zone and Mobilize Second Drill to Golden Hope JV - Southwest Newfoundland

19 holes completed at Killick Zone – Rig 2 testing the Hydra Cesium Dyke

St. John’s, NL, June 20, 2023 – Sokoman Minerals Corp. (TSXV: SIC) (OTCQB: SICNF) (“Sokoman”) and Benton Resources Inc. (TSXV: BEX) (“Benton”) together, (the “Alliance”) are pleased to announce that approximately 3,500 m in 19 holes have been completed on the 50-50 Golden Hope Joint Venture (GHJV) targeting lithium and other associated critical metals. Drilling has focused on the Killick zone, where 2022 drilling returned up to 1.04% Li2O over 15.23 m, including 4.18 m of 1.48% Li2O, and 2.98 m of 1.23% Li2O in GH-22-27 and, 9.50 m of 1.08% Li2O in GH-22-26. Drilling continues to intersect spodumene-bearing dykes ranging from less than a metre to >20m thick.

The Alliance is pleased to report that assays have been received for 11 of the 19 drill holes completed at the Killick Zone with results up to 1.22% Li2O over 13.37 m in GH-23-45 and separate intervals of 0.81% Li2O over 21.00 m and 0.99% Li2O over 10.16 m in GH-23-46. Holes 45 and 46 were drilled 30 m south along strike of holes 25 and 26 where multiple spodumene-bearing dykes were intersected (see February 16, 2023 news release). The Killick Zone remains open along strike in both directions and to depth. A summary of results received to date is presented below:

Table 1 – Summary of Drill Results – Phase 4 Drilling

Figure 1 – Drill Core GH-23-45

Drilling will continue to test the Killick dyke area plus any new dykes discovered in the ongoing soil geochemical/trenching program 4 km along strike to the east of the Kraken Pegmatite Field, where lithium-in-soil geochemical anomalies of similar strength to the Kraken Discovery Dyke area are located.

The Alliance is also pleased to announce that it has mobilized a second diamond drill to test the Hydra (cesium/lithium/tantalum) target 10 km northeast of the Killick zone. Trenching is ongoing to expose the dyke and help plan the drilling. The Hydra dyke is host to high-grade cesium mineralization in pollucite, as well as significant lithium, tantalum, and rubidium values with a 1.2 m channel sample from 2022 grading 8.76% Cs2O, 0.41% Li2O, 0.025% Ta2O5, and 0.33% Rb2O (see news release December 1, 2022).

Figure 2 – Drill at Hydra

The Alliance is also continuing with its regional-scale prospecting/sampling program using 200 m to 500 m spaced lines over the favourable dyke-bearing corridor, covering the 10 km gap between the Killick and Hydra dyke fields, and also extending the survey 20 km to the NE. 1,430 B-Horizon soil samples have been collected in 2023 and submitted to Eastern Analytical Ltd. in Springdale NL for lithium analysis.

QA/QC Protocols

Rock and core samples are submitted to SGS Canada Inc. in Grand Falls-Windsor, NL for preparation and then sent to the SGS Canada Inc. analytical laboratory in Burnaby, BC for analysis. All samples were acquired by hand (rocks) or saw-cut (channels/drill core) and delivered, by Benton/Sokoman personnel, in sealed bags, to the Grand Falls-Windsor prep lab of SGS, which is an accredited assay lab conforming to the requirements of ISO/IEC 17025. Samples are analyzed using SGS’s GS_IMS91A50 method that delivers a 56-element package utilizing sodium peroxide fusion, ICP-AES, and ICP-MS analytical techniques. All reported assays are uncut.

Soil samples were collected by Benton/Sokoman personnel utilizing a Dutch-auger, collecting B-Horizon soil, where possible or if B was not present, the soil horizon type was noted. The samples were sent to Eastern Analytical Ltd., in Springdale, NL, for Li, Ta, Sn, and Nb analyses by four-acid digestion, then analyzed by ICP-OES. Eastern Analytical Ltd. achieved ISO 17025 accreditation in February 2014 (for more details on the scope of accreditation visit the CALA website).

QP

This news release has been reviewed and approved by, Timothy Froude, P.Geo., President and CEO of Sokoman Minerals Corp., and Stephen House, P.Geo., VP Exploration for Benton Resources Inc., both 'Qualified Persons' under National Instrument 43-101.

About Sokoman Minerals Corp.

Sokoman Minerals Corp. is a discovery-oriented company with projects in Newfoundland and Labrador, Canada. The company’s primary focus is its portfolio of gold projects: flagship, 100%-owned Moosehead, Crippleback Lake (available for option) and East Alder (optioned to Canterra Minerals Corporation) along the Central Newfoundland Gold Belt, and the district-scale Fleur de Lys project near Baie Verte in northwestern Newfoundland, that is targeting Dalradian-type orogenic gold mineralization similar to the Curraghinalt and Cavanacaw deposits in Northern Ireland, and Cononish in Scotland. The company also entered into a strategic alliance with Benton Resources Inc. through three large-scale joint-venture properties including Grey River Gold, Golden Hope, and Kepenkeck in Newfoundland. Sokoman now controls independently and through the Benton alliance over 150,000 hectares (>6,000 claims – 1,500 sq. km), making it one of the largest landholders in Newfoundland, Canada’s newest and rapidly-emerging gold districts. The company also retains an interest in an early-stage antimony/gold project (Startrek) in Newfoundland, optioned to Thunder Gold Corp (formerly White Metal Resources Inc.), and in Labrador, the Company has a 100% interest in the Iron Horse (Fe) project that has Direct Shipping Ore (DSO) potential.

About Benton Resources Inc.

Benton Resources Inc. is a well-funded mineral exploration company listed on the TSX Venture Exchange under the symbol BEX. Following a project generation business model, Benton has a diversified, highly-prospective property portfolio of Gold, Silver, Nickel, Copper, Platinum Group Elements, and most recently Lithium and Cesium assets. In addition, it currently holds large equity positions in other mining companies that are advancing high-quality assets. Whenever possible, BEX retains net smelter return (NSR) royalties with potential long-term cash flow.

In 2022 Benton entered into a 50/50 strategic alliance with Sokoman Minerals Inc. (TSXV: SIC) through three large-scale joint-venture properties including Grey River Gold, Golden Hope, and Kepenkeck in Newfoundland that are being explored.

For further information, please contact:

Sokoman Minerals Corp.

Timothy Froude, P.Geo., President & CEO

Phone: 709-765-1726

Email: tim@sokomanmineralscorp.com

Benton Resources Inc.

Stephen Stares, President & CEO

Phone: 807-475-7474

Email: sstares@bentonresources.ca

CHF Capital Markets

Cathy Hume, CEO

Phone: 416-868-1079 x 251

Email: cathy@chfir.com

Website: www.sokomanmineralscorp.com , www.bentonresources.ca

Twitter: @SokomanMinerals , @BentonResources

Facebook: @SokomanMinerals , @BentonResourcesBEX

LinkedIn: @SokomanMinerals, @BentonResources

THE TSX VENTURE EXCHANGE HAS NOT REVIEWED AND DOES NOT ACCEPT RESPONSIBILITY FOR THE ADEQUACY OR ACCURACY OF THIS RELEASE.

The information contained herein contains “forward-looking statements” within the meaning of applicable securities legislation. Forward-looking statements relate to information that is based on assumptions of management, forecasts of future results, and estimates of amounts not yet determinable. Any statements that express predictions, expectations, beliefs, plans, projections, objectives, assumptions or future events or performance are not statements of historical fact and may be “forward-looking statements.”

Forward-looking statements are subject to a variety of risks and uncertainties which could cause actual events or results to differ from those reflected in the forward-looking statements, including, without limitation: risks related to failure to obtain adequate financing on a timely basis and on acceptable terms; risks related to the outcome of legal proceedings; political and regulatory risks associated with mining and exploration; risks related to the maintenance of stock exchange listings; risks related to environmental regulation and liability; the potential for delays in exploration or development activities or the completion of feasibility studies; the uncertainty of profitability; risks and uncertainties relating to the interpretation of drill results, the geology, grade and continuity of mineral deposits; risks related to the inherent uncertainty of production and cost estimates and the potential for unexpected costs and expenses; results of prefeasibility and feasibility studies, and the possibility that future exploration, development or mining results will not be consistent with the Alliance’s expectations; risks related to gold price and other commodity price fluctuations; and other risks and uncertainties related to the Alliance’s prospects, properties and business detailed elsewhere in the Alliance’s disclosure record. Should one or more of these risks and uncertainties materialize, or should underlying assumptions prove incorrect, actual results may vary materially from those described in forward-looking statements. Investors are cautioned against attributing undue certainty to forward-looking statements. These forward-looking statements are made as of the date hereof and the Alliance does not assume any obligation to update or revise them to reflect new events or circumstances. Actual events or results could differ materially from the Alliance’s expectations or projections.

Sokoman And Benton Provide Exploration Update On Li / Cs Exploration Golden Hope JV – Southwestern Newfoundland

Ten holes completed at Killick target – second drill to begin testing the Hydra Dyke

St. John’s, NL, MAY 18, 2023 – Sokoman Minerals Corp. (TSXV: SIC) (OTCQB: SICNF) (“Sokoman”) and Benton Resources Inc. (TSXV: BEX) (“Benton”) together, (the “Alliance”) are pleased to announce that 1,400 m in ten holes have been completed on the 50/50 Golden Hope Joint Venture (GHJV) targeting lithium and other critical metals. Drilling has focused on the Killick Dyke zone, where 2022 drilling returned up to 1.04% Li2O over 15.23 m, including 4.18 m of 1.48% Li2O, and 2.98 m of 1.23% Li2O in GH-22-27 and 9.50 m of 1.08% Li2O in GH-22-26. All ten holes have intersected spodumene-bearing dykes ranging from less than a metre to over 20 m thick.

Drilling will continue to test the Killick Dyke area plus any new dyke discovered in the ongoing soil geochemical and trenching program along strike to the east of the Kraken Pegmatite Field, where lithium-in-soil geochemical anomalies of similar strength to the Kraken Discovery Dyke area were found, 4 km along strike to the east of any known dykes.

The Alliance is also pleased to announce that it plans to mobilize a second diamond drill to test the Hydra (cesium/lithium/tantalum) target 10 km northeast of the Killick Dyke. Trenching is ongoing here to expose the dyke and help plan for the drilling. The Hydra Dyke is host to high-grade cesium mineralization as pollucite, as well as significant lithium, tantalum, and rubidium values with a 1.2 m channel sample from 2022 grading 8.76% Cs2O, 0.41% Li2O, 0.025% Ta2O5, and 0.33% Rb2O (news release December 1, 2022).

The Alliance has received the first batch of soil sampling results from the Hydra area which shows a significant lithium/tantalum anomaly (5 to 996 ppm Li; 5 to 141 ppm Ta) in the vicinity of the Hydra Dyke. The soil survey is continuing, using 500 m spaced lines to cover the 10 km gap between the Killick and Hydra fields crossing the favourable dyke-bearing corridor.

Figure 1: Close up of coarse-grained spodumene in GH-23-44

Figure 2: Close up of medium-grained spodumene in GH-23-45

Figure 3: Camp photo showing the drill setup testing the Killick Dyke (both can be seen on the left-center side of the image)

Figure 4: Golden Hope Project drill plan map

Tim Froude, President and CEO of Sokoman, says: “We are off to a great start at Golden Hope, and we expect the 5,000 m drill program to be completed before the end of summer giving us plenty of time to build on significant results and plan for additional drilling. Coupled with the ongoing soil sampling and prospecting programs, this will be a defining year for the project.”

Stephen Stares, President and CEO of Benton, says: “We continue to be excited about the potential of the Kraken Dyke system and the new Killick Dyke zone. The rate of success in expanding the lithium zones in drilling continues to show that we are truly in a new lithium-cesium-tantalum (LCT) belt. We look forward to our continued success as we move the project along.”

QA/QC Protocols

Rock and core samples are submitted to SGS Canada Inc. in Grand Falls-Windsor, Newfoundland for preparation and then sent to the SGS Canada Inc. analytical laboratory in Burnaby, British Colombia for analysis. All samples were acquired by hand (rocks) or saw-cut (channels/drill core) and delivered, by Sokoman/Benton personnel, in sealed bags, to the Grand Falls-Windsor prep lab of SGS, which is an accredited assay lab that conforms to the requirements of ISO/IEC 17025. Samples are analyzed using SGS’s GS_IMS91A50 method that delivers a 56-element package utilizing sodium peroxide fusion, ICP-AES, and ICP-MS analytical techniques. All reported assays are uncut. Soil samples were collected by Sokoman/Benton personnel utilizing a standard Dutch-auger, collecting B Horizon soil, where possible. Where B was not present, the soil horizon or type was noted. Soil samples were sent to Eastern Analytical Ltd., in Springdale, NL, for Li, Ta, Sn, and Nb analyses by four-acid digestion, analyzed by ICP-OES. Eastern Analytical Ltd. achieved ISO 17025 accreditation in February 2014 (for more details on the scope of accreditation visit the CALA website).

QP

This news release has been reviewed and approved by Timothy Froude, P. Geo., President and CEO of Sokoman Minerals Corp., and Stephen House, P. Geo., VP Exploration for Benton Resources Inc., both ‘Qualified Persons’ under National Instrument 43-101.

About Sokoman Minerals Corp.

Sokoman Minerals Corp. is a discovery-oriented company with projects in Newfoundland and Labrador, Canada. The company’s primary focus is its portfolio of gold projects: flagship, 100%-owned Moosehead, Crippleback Lake (available for option) and East Alder (optioned to Canterra Minerals Corporation) along the Central Newfoundland Gold Belt, and the district-scale Fleur de Lys project near Baie Verte in northwestern Newfoundland, that is targeting Dalradian-type orogenic gold mineralization similar to the Curraghinalt and Cavanacaw deposits in Northern Ireland, and Cononish in Scotland. The company also recently entered into a strategic alliance with Benton Resources Inc. through three large-scale joint-venture properties including Grey River Gold, Golden Hope, and Kepenkeck in Newfoundland. Sokoman now controls independently and through the Benton alliance over 150,000 hectares (>6,000 claims – 1,500 sq. km), making it one of the largest landholders in Newfoundland, Canada’s newest and rapidly-emerging gold districts. The company also retains an interest in an early-stage antimony/gold project (Startrek) in Newfoundland, optioned to Thunder Gold Corp (formerly White Metal Resources Inc.), and in Labrador, the Company has a 100% interest in the Iron Horse (Fe) project that has Direct Shipping Ore (DSO) potential.

About Benton Resources Inc.

Benton Resources Inc. is a well-funded mineral exploration company listed on the TSX Venture Exchange under the symbol BEX. Following a project generation business model, Benton has a diversified, highly-prospective property portfolio of Gold, Silver, Nickel, Copper, Platinum Group Elements, and most recently Lithium and Cesium assets. In addition, it currently holds large equity positions in other mining companies that are advancing high-quality assets. Whenever possible, BEX retains net smelter return (NSR) royalties with potential long-term cash flow.

Benton also entered into a 50/50 strategic alliance with Sokoman Minerals Inc. (TSXV: SIC) through three large-scale joint-venture properties including Grey River Gold, Golden Hope, and Kepenkeck in Newfoundland that are being explored.

For further information, please contact:

Sokoman Minerals Corp.

Timothy Froude, P.Geo., President & CEO

Phone: 709-765-1726

Email: tim@sokomanmineralscorp.com

Benton Resources Inc.

Stephen Stares, President & CEO

Phone: 807-475-7474

Email: sstares@bentonresources.ca

CHF Capital Markets

Cathy Hume, CEO

Phone: 416-868-1079 x 251

Email: cathy@chfir.com

Website: www.sokomanmineralscorp.com , www.bentonresources.ca

Twitter: @SokomanMinerals , @BentonResources

Facebook: @SokomanMinerals , @BentonResourcesBEX

LinkedIn: @SokomanMinerals, @BentonResources

THE TSX VENTURE EXCHANGE HAS NOT REVIEWED AND DOES NOT ACCEPT RESPONSIBILITY FOR THE ADEQUACY OR ACCURACY OF THIS RELEASE.

The information contained herein contains “forward-looking statements” within the meaning of applicable securities legislation. Forward-looking statements relate to information that is based on assumptions of management, forecasts of future results, and estimates of amounts not yet determinable. Any statements that express predictions, expectations, beliefs, plans, projections, objectives, assumptions or future events or performance are not statements of historical fact and may be “forward-looking statements.”

Forward-looking statements are subject to a variety of risks and uncertainties which could cause actual events or results to differ from those reflected in the forward-looking statements, including, without limitation: risks related to failure to obtain adequate financing on a timely basis and on acceptable terms; risks related to the outcome of legal proceedings; political and regulatory risks associated with mining and exploration; risks related to the maintenance of stock exchange listings; risks related to environmental regulation and liability; the potential for delays in exploration or development activities or the completion of feasibility studies; the uncertainty of profitability; risks and uncertainties relating to the interpretation of drill results, the geology, grade and continuity of mineral deposits; risks related to the inherent uncertainty of production and cost estimates and the potential for unexpected costs and expenses; results of prefeasibility and feasibility studies, and the possibility that future exploration, development or mining results will not be consistent with the Alliance’s expectations; risks related to gold price and other commodity price fluctuations; and other risks and uncertainties related to the Alliance’s prospects, properties and business detailed elsewhere in the Alliance’s disclosure record. Should one or more of these risks and uncertainties materialize, or should underlying assumptions prove incorrect, actual results may vary materially from those described in forward-looking statements. Investors are cautioned against attributing undue certainty to forward-looking statements. These forward-looking statements are made as of the date hereof and the Alliance does not assume any obligation to update or revise them to reflect new events or circumstances. Actual events or results could differ materially from the Alliance’s expectations or projections.

Sokoman And Benton Announce Start Of 2023 Drilling Program At The Kraken Lithium And Hydra Cesium Discoveries In Southwestern Newfoundland

ST. JOHN’S, NL / ACCESSWIRE / May 2, 2023 / Sokoman Minerals Corp. (TSXV: SIC)(OTCQB:SICNF) (“Sokoman”) and Benton Resources Inc. (TSXV:BEX) (“Benton”) together, (the “Alliance“) are pleased to announce the start of the 2023 drilling program which will see a minimum of 5,000 meters drilled on the 50-50 Golden Hope Joint Venture (“GHJV“). The GHJV was formed by the Alliance in 2021 to explore the mineral potential of an underexplored structural belt of rocks in southwestern Newfoundland hosting past-producing gold operations. Within the first week of exploration, the Alliance had discovered the very first hard rock lithium dyke on the Island, and in the fall of 2022, the Alliance discovered the very first cesium-rich dyke. These two areas of mineralization are now known as the Kraken Lithium Pegmatite Field and the Hydra Dyke. Drilling will commence at the Killick Zone, part of the Kraken Lithium Pegmatite Field, where holes completed in late 2022 all returned significant lithium mineralization highlighted by the following.

Killick Dyke Drilling

1.04% Li2O over 15.23 m, including 4.18 m of 1.48% Li2O, and 2.98 m of 1.23% Li2O in GH-22-27 and, 9.50 m of 1.08% Li2O from GH-22-26

Other dykes tested include:

0.95% Li2O over 8.40 m, including 1.76% Li2O over 0.80 m in GH-22-01 on the Kraken Main Dyke

5.50 m at 1.16% Li2O within a wider intersection of 20.82 m averaging 0.60% Li2O in drill hole GH-22-15 on the East Dyke

Drilling will also test any new dykes uncovered during the ongoing soil geochemical and trenching program along strike to the east of the Kraken Lithium Pegmatite Field where in 2022, lithium-in-soil geochemical anomalies of similar strength to the discovery-dyke area lie four km along strike to the east of known dykes. A select number of holes will also be completed at the high-grade Hydra Dyke 12 km northeast of the Kraken Lithium Pegmatite Field once trenching and sampling have been completed. A 1.2 m-long channel sample collected at Hydra in late 2022 returned 8.76% Cs2O, 0.41% Li2O, 0.025% Ta2O5, and 0.33% Rb2O (see news release dated December 1, 2022). The dyke is only partially exposed (5 – 6 meters wide) and additional sampling is required to determine width of mineralization. All proposed work is fully permitted and funded with a $3 to $4 million budget for the entire lithium and cesium programs.

Tim Froude, President and CEO of Sokoman, says: “We are very pleased to be starting the 2023 drilling program and along with our JV partner Benton Resources, anticipate a successful program. The initial holes will target extending the Killick Dyke mineralization which has returned our best drill results to date, and once trenching has been completed at Hydra, testing the high-grade cesium mineralization defined in late 2022.”

Stephen Stares, President and CEO of Benton says: “We are extremely excited to kick off the field season at the GHJV and I’m confident that we’ll have another successful year on this newly discovered Lithium-Cesium belt. With our large land position, high demand for these much-needed critical metals and rapidly growing concerns to cut harmful emissions, Benton and Sokoman are truly in a rare position to unlock Newfoundland’s potential for LTC-type pegmatite discoveries while increasing shareholder value.”

QA/QC Protocols

Rock and core samples were submitted to SGS Canada Inc. in Grand Falls-Windsor, Newfoundland for preparation and then sent to the SGS Canada Inc. analytical laboratory in Burnaby, British Colombia. All samples submitted were taken or saw-cut by Sokoman/Benton personnel and delivered in sealed bags directly to the Grand Falls-Windsor prep lab by Sokoman/Benton personnel. SGS Canada Inc. (SGS) is an accredited assay lab that conforms to the requirements of ISO/IEC 17025. Samples are analyzed using SGS’s GS_IMS91A50 method that delivers a 56-element package utilizing sodium peroxide fusion, ICP-AES, and ICP-MS analytical techniques. All reported assays are uncut. Soil samples were collected by Sokoman/Benton personnel utilizing a standard Dutch-auger collecting B Horizon soil where possible. Where B was not present, the material collected was noted. The soil samples were sent to Eastern Analytical Ltd., in Springdale, NL, for Li, Ta, Sn, and Nb assaying by four-acid digestion and analyzed by ICP-OES. Eastern Analytical Ltd. achieved ISO 17025 accreditation in February 2014 (for more details on the scope of accreditation visit the CALA website).

QP

This news release has been reviewed and approved by Timothy Froude, P. Geo., President and CEO of Sokoman Minerals Corp., and Stephen House, P. Geo., VP Exploration for Benton Resources Inc., both the ‘Qualified Person’ under National Instrument 43-101.

About Sokoman Minerals Corp.

Sokoman Minerals Corp. is a discovery-oriented company with projects in Newfoundland and Labrador, Canada. The company’s primary focus is its portfolio of gold projects: flagship, 100%-owned Moosehead, Crippleback Lake (available for option) and East Alder (optioned to Canterra Minerals Corporation) along the Central Newfoundland Gold Belt, and the district-scale Fleur de Lys project near Baie Verte in northwestern Newfoundland, that is targeting Dalradian-type orogenic gold mineralization similar to the Curraghinalt and Cavanacaw deposits in Northern Ireland, and Cononish in Scotland. The company entered a strategic alliance with Benton Resources Inc. through three large-scale joint-venture properties including Grey River Gold, Golden Hope, and Kepenkeck in Newfoundland. Sokoman now controls independently and through the Benton alliance more than 150,000 hectares (>6,000 claims – 1,500 sq. km), making it one of the largest landholders in Newfoundland, Canada’s newest and rapidly-emerging gold districts. The company also retains an interest in an early-stage antimony/gold project (Startrek) in Newfoundland, optioned to Thunder Gold Corp (formerly White Metal Resources Inc.), and in Labrador, the Company has a 100% interest in the Iron Horse (Fe) project that has Direct Shipping Ore (DSO) potential.

About Benton Resources Inc.

Benton Resources Inc. is a well-funded mineral exploration company listed on the TSX Venture Exchange under the symbol BEX. Following a project generation business model, Benton has a diversified, highly-prospective property portfolio of Gold, Silver, Nickel, Copper, Platinum Group Elements, and most recently Lithium and Cesium assets. In addition, it currently holds large equity positions in other mining companies that are advancing high-quality assets. Whenever possible, BEX retains net smelter return (NSR) royalties with potential long-term cash flow.

Benton entered a 50/50 strategic alliance with Sokoman Minerals Inc. (TSXV: SIC) through three large-scale joint-venture properties including Grey River Gold, Golden Hope, and Kepenkeck in Newfoundland that are now being explored.

For further information, please contact:

Sokoman Minerals

Timothy Froude, P.Geo., President & CEO

Phone: 709-765-1726

Email: tim@sokomanmineralscorp.com

Benton Resources

Stephen Stares, President & CEO

Phone: 807-475-7474

Email: sstares@bentonresources.ca

CHF Capital Markets

Thomas Do, IR Manager

Phone: 416-868-1079 x 232

Email: thomas@chfir.com

Website: www.sokomanmineralscorp.com , www.bentonresources.ca

Twitter: @SokomanMinerals , @BentonResources

Facebook: @SokomanMinerals , @BentonResourcesBEX

LinkedIn: @SokomanMinerals, @BentonResources

THE TSX VENTURE EXCHANGE HAS NOT REVIEWED AND DOES NOT ACCEPT RESPONSIBILITY FOR THE ADEQUACY OR ACCURACY OF THIS RELEASE.

The information contained herein contains “forward-looking statements” within the meaning of applicable securities legislation. Forward-looking statements relate to information that is based on assumptions of management, forecasts of future results, and estimates of amounts not yet determinable. Any statements that express predictions, expectations, beliefs, plans, projections, objectives, assumptions or future events or performance are not statements of historical fact and may be “forward-looking statements.”

Forward-looking statements are subject to a variety of risks and uncertainties which could cause actual events or results to differ from those reflected in the forward-looking statements, including, without limitation: risks related to failure to obtain adequate financing on a timely basis and on acceptable terms; risks related to the outcome of legal proceedings; political and regulatory risks associated with mining and exploration; risks related to the maintenance of stock exchange listings; risks related to environmental regulation and liability; the potential for delays in exploration or development activities or the completion of feasibility studies; the uncertainty of profitability; risks and uncertainties relating to the interpretation of drill results, the geology, grade and continuity of mineral deposits; risks related to the inherent uncertainty of production and cost estimates and the potential for unexpected costs and expenses; results of prefeasibility and feasibility studies, and the possibility that future exploration, development or mining results will not be consistent with the Alliance’s expectations; risks related to gold price and other commodity price fluctuations; and other risks and uncertainties related to the Alliance’s prospects, properties and business detailed elsewhere in the Alliance’s disclosure record. Should one or more of these risks and uncertainties materialize, or should underlying assumptions prove incorrect, actual results may vary materially from those described in forward-looking statements. Investors are cautioned against attributing undue certainty to forward-looking statements. These forward-looking statements are made as of the date hereof and the Alliance does not assume any obligation to update or revise them to reflect new events or circumstances. Actual events or results could differ materially from the Alliance’s expectations or projections.

Sokoman Reports Additional Assay Results From Moosehead Gold Project, Central Newfoundland

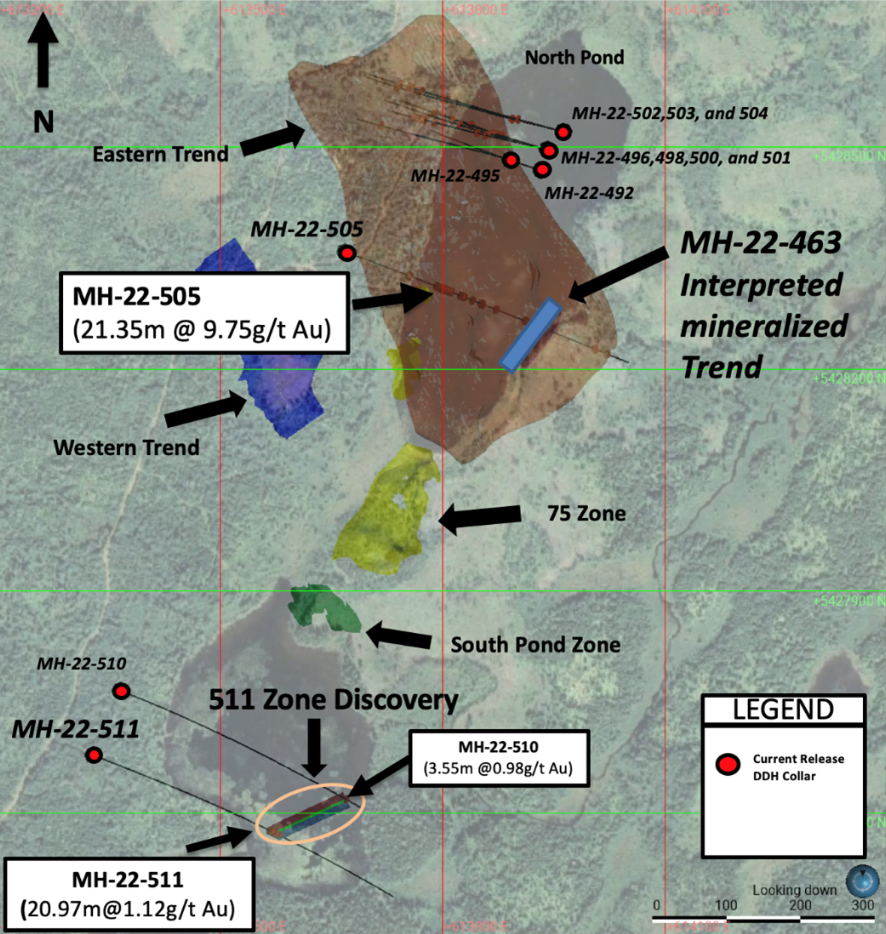

Drilling at 463 Zone expands footprint; MH-23-519 extends 463 Zone 68 m down-plunge

St. John’s, NL, April 13, 2023 – Sokoman Minerals Corp. (TSXV:SIC) (OTCQB:SICNF) (the “Company” or “Sokoman”) is pleased to report that diamond drilling at the new 463 Zone has expanded the footprint of the zone and indicates a different plumbing system may be responsible for emplacing gold mineralization in some or perhaps most of the mineralized zones known on the property. Results are highlighted by MH-23-519, which intersected a 1.4 metre-wide zone of visible gold-bearing quartz veining that returned 12.41 g/t Au (from 409.75 m downhole) 68 m down-plunge from hole 463 and remains open to the south and to depth. The company has made a video giving a visual explanation of the results. Investors are encouraged to watch the video HERE.

Tim Froude, President and CEO of Sokoman, says: “We are very pleased with the results from the 463 Zone drilling as it has not only opened up a large new target area, but the possibility that the vein system at Moosehead may predate the Eastern Trend shear zone is a significant development. In the past year or so we have had many intersections that looked “out of place”, that we couldn’t seem to fit anywhere, now it makes sense that they occur in a perpendicular structure in the footwall below the main Eastern Trend and that the Eastern Trend while remaining a significant trap for gold, it may not be the primary target for additional gold mineralization. We are also optimistic that eventually we will encounter high-grade gold in the vicinity or associated with the 511 Zone; there is still only limited drilling in that area. We anticipate the annual spring breakup to coincide with the crew rotation in about two weeks with drilling recommencing in late May or earlier, if possible, and we are well funded, with over $6 million in the treasury.”

Drill Plan – April 13, 2023

In late 2022, drill hole MH-22-463 cut a significant thickness of gold mineralization (39.60 m @12.50 g/t Au including 10.5 m @41.97 g/t Au (see press release December 15, 2022) that appeared unique in several aspects to many previous intersections reported on the property. Located in the footwall to the main Eastern Trend, the intersection suggested a different structure and/or plumbing system existed in this underexplored area. Drill holes MH-22-505, 512, 517, 519 (and others), designed to test the 463 Zone, all intersected multiple, narrow, locally high-grade veins in the footwall and perpendicular to the main Eastern Trend.

In conjunction with discussions with structural consultant Dr. David Coller, it now appears clear that the 463 Zone is part of a system of less-deformed veins at right angles to the main Eastern Trend and consequently, parallel to most of the drilling completed over the previous two years. This also strongly suggests that the Eastern Trend may not be the feature controlling gold mineralization, but rather it has crosscut and incorporated a pre-existing vein system as we now see similar-looking gold bearing veins in deformed, as well as largely-pristine rocks. It also opens up the entire footwall environment as a host to high-grade veins.

At the 511 Zone, located under South Pond, drilling continued to intersect gold mineralization (MH-23-514 to 516) and the zone remains open and will be further tested in 2023. The recent drilling also confirms that the 511 Zone consists of multiple subparallel structures.

QP

This news release has been reviewed and approved by Timothy Froude, P.Geo., a “Qualified Person” under National Instrument 43-101 and President and CEO of Sokoman Minerals Corp.

Analytical Techniques / QA/QC

Samples, including duplicates, blanks, and standards, were submitted to Eastern Analytical Ltd. in Springdale, Newfoundland for gold analysis. All core samples submitted for assay were saw cut by Sokoman personnel with one-half submitted for assay and one-half retained for reference. Samples were delivered in sealed bags directly to the lab by Sokoman personnel. Eastern Analytical Ltd. is an accredited assay lab that conforms to the requirements of ISO/IEC 17025. Samples with visible gold were submitted for total pulp metallics and gravimetric finish. All other samples were analyzed by standard fire assay methods. Total pulp metallic analysis includes: the whole sample is crushed to -10 mesh; then pulverized to 95% -150 mesh. The total sample is weighed and screened to 150 mesh; the +150 mesh fraction is fire assayed for Au, and a 30 g subsample of the -150 mesh fraction is fire assayed for Au; with a calculated weighted average of total Au in the sample reported as well. One blank and one industry-approved standard for every twenty samples submitted are included in the sample stream. Random duplicates of selected samples are analyzed in addition to the in-house standard and duplicate policies of Eastern Analytical Ltd. All reported assays are uncut.

Table of Results – April 13, 2023

About Sokoman Minerals Corp.

Sokoman Minerals Corp. is a discovery-oriented company with projects in the province of Newfoundland and Labrador, Canada. The Company’s primary focus is its portfolio of gold projects; the 100% flagship, advanced-stage Moosehead, as well as Crippleback Lake (available for option); and East Alder (optioned to Canterra Minerals Corporation) along the Central Newfoundland Gold Belt, and the district-scale Fleur de Lys project near Baie Verte in northwestern Newfoundland, that is targeting Dalradian-type, orogenic gold mineralization similar to the Curraghinalt and Cavanacaw deposits in Northern Ireland. The Company also entered into a strategic alliance with Benton Resources Inc. through three, large-scale, joint-venture properties including Grey River, Golden Hope, and Kepenkeck in Newfoundland. Sokoman now controls, independently and through the Benton alliance, over 150,000 hectares (>6,000 claims – 1500 sq. km), making it one of the largest landholders in Newfoundland, in Canada’s newest and rapidly-emerging gold districts. The Company also retains a 1% NSR interest in an early-stage antimony/gold project (Startrek) in Newfoundland, optioned to Thunder Gold Corp (formerly White Metal Resources Inc.), and in Labrador, the Company has a 100% interest in the Iron Horse (Fe) project which has Direct Shipping Ore (DSO) potential.

Mineralization hosted on adjacent and/or nearby properties is not necessarily indicative of mineralization hosted on the Company’s property.

The Company would like to thank the Government of Newfoundland and Labrador for past financial support of the Moosehead Project through the Junior Exploration Assistance Program.

For further information, please contact:

Sokoman Minerals

Timothy Froude, P.Geo., President & CEO

Phone: 709-765-1726

Email: tim@sokomanmineralscorp.com

CHF Capital Markets

Cathy Hume, VP Corporate Development, Director

Phone: 416-868-1079 x251

Email: cathy@chfir.com

CHF Capital Markets

Thomas Do, IR Manager

Phone: 416-868-1079 x 232

Email: thomas@chfir.com

Website: www.sokomanmineralscorp.com

Twitter: @SokomanMinerals

Facebook: @SokomanMinerals

LinkedIn: @SokomanMinerals

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Investors are cautioned that trading in the securities of the Corporation should be considered highly speculative. Except for historical information contained herein, this news release contains forward- looking statements that involve risks and uncertainties. Actual results may differ materially. Sokoman Minerals Corp. will not update these forward-looking statements to reflect events or circumstances after the date hereof. More detailed information about potential factors that could affect financial results is included in the documents filed from time to time with the Canadian securities regulatory authorities by Sokoman Minerals Corp.

Sokoman And Benton Announce Exploration Update For Kraken Lithium And Hydra Cesium Discoveries In Southwestern Newfoundland

St. Johns, NL, March 28, 2023 – Sokoman Minerals Corp. (TSXV: SIC) (OTCQB: SICNF) (“Sokoman”) and, Benton Resources Inc. (TSXV: BEX) (“Benton”), together (the “Alliance“) are pleased to provide an exploration update and outline immediate plans for the 50-50 Golden Hope Joint Venture (GHJV). The GHJV was formed by the Alliance in 2021 to explore the mineral potential of an underexplored structural belt of rocks in southwestern Newfoundland hosting past-producing gold operations. Within the first week of exploration, the Alliance had discovered the very first hard rock lithium dyke on the Island, and in the fall of 2022, the Alliance discovered the very first cesium-rich dyke. These two areas of high-grade mineralization are now known as the Kraken Lithium Pegmatite Field and the Hydra Dyke. Prospecting, trenching, mapping, soil geochemistry, and three (3) phases of diamond drilling during the 2021 and 2022 field seasons, have resulted in multiple new discoveries which remain wide open for expansion.

Golden Hope JV Project – Kraken Lithium Pegmatite Field to Hydra Dyke

The Alliance would like to report that it has also renewed and received approval for its camp permits along with continued exploration permits for the entire GHJV land position. These permits allow for a fourth phase diamond drilling program consisting of a minimum of 5,000 metres along with prospecting, soil sampling, and geological mapping along the highly-favourable trend.

The fourth phase, 5,000-metre drill program is anticipated to start within the next few weeks and camp preparation will start as soon as next week. Highlights from earlier phases of drilling at the Kraken Lithium Pegmatite Field have returned very promising results including:

1.04% Li2O over 15.23 m, including 4.18 m of 1.48% Li2O and 2.98 m of 1.23% Li2O in GH-22-27 on the newly discovered Killick Zone

0.95% Li2O over 8.40 m from 47.8 m to 56.2 m, including 1.76% Li2O over 0.80 m in GH-22-01 on the Kraken Main Dyke

5.50 m at 1.16% Li2O within a wider intersection of 20.82 m averaging 0.60% Li2O in drill hole GH-22-15 on the East Dyke

Lithium-in-soil geochemical anomalies of similar strength to the discovery dyke area lie 4 km along strike to the east of known dykes and are top priority trenching targets

The Alliance is also pleased to report that it has received drilling permits for the newly discovered cesium-tantalum-rubidium and lithium-rich Hydra Dyke, which is 12 km northeast of the Kraken Lithium Pegmatite Field. Initial channel sampling last fall at the Hydra Dyke returned results as high as 8.76% Cs2O, 0.41% Li2O, 0.025% Ta2O5, and 0.33% Rb2O over 1.20 m in channel sampling (see news release dated December 1, 2022). The Alliance is planning trenching to be followed by drilling as soon as the snow has melted.

Tim Froude, President and CEO of Sokoman, says: “The 2023 exploration program at the GHJV is arguably one of the most important programs we will undertake. The results to date, from an area with no previous critical metal history, have already demonstrated the district-scale potential of the project. The 4 km long untested soil geochemical anomaly, directly on trend from our known dykes, will be one of the first areas targeted, and I will be very surprised if more dykes are not discovered. This still represents only 10% of the strike length of the system that we have under our control.”

Stephen Stares, President and CEO of Benton, says: “We are extremely excited to kick off the field season at the GHJV and I’m confident that we’ll have another successful year on this newly discovered Lithium-Cesium belt. With our large land position, high demand for these much-needed critical metals and rapidly growing concerns to cut harmful emissions, Benton and Sokoman are truly in a rare position to unlock Newfoundland’s potential for LTC-type pegmatite discoveries while increasing shareholder value.”

QA/QC Protocols

Rock and core samples were submitted to SGS Canada Inc. in Grand Falls-Windsor, Newfoundland for preparation and then sent to the SGS Canada Inc. analytical laboratory in Burnaby, British Colombia. All samples submitted were taken or saw-cut by Benton/Sokoman personnel and delivered in sealed bags directly to the Grand Falls-Windsor prep lab by Benton/Sokoman personnel. SGS Canada Inc. (SGS) is an accredited assay lab that conforms to the requirements of ISO/IEC 17025. Samples are analyzed using SGS’s GS_IMS91A50 method that delivers a 56-element package utilizing sodium peroxide fusion, ICP-AES, and ICP-MS analytical techniques. All reported assays are uncut. Soil samples were collected by Sokoman/Benton personnel utilizing a standard Dutch-auger collecting B Horizon soil where possible. Where B was not present, the material collected was noted. The soil samples were sent to Eastern Analytical Ltd., in Springdale, NL, for Li, Ta, Sn, and Nb assaying by four-acid digestion and analyzed by ICP-OES. Eastern Analytical Ltd. achieved ISO 17025 accreditation in February 2014 (for more details on the scope of accreditation visit the CALA website).

QP

This news release has been reviewed and approved by Timothy Froude, P. Geo., President and CEO of Sokoman Minerals Corp., and Stephen House, P. Geo., VP Exploration for Benton Resources Inc., both the ‘Qualified Person’ under National Instrument 43-101.

Benton also recently entered into a 50/50 strategic alliance with Sokoman Minerals Inc. (TSXV: SIC) through three large-scale joint-venture properties including Grey River Gold, Golden Hope, and Kepenkeck in Newfoundland that are now being explored.

About Sokoman Minerals Corp.

Sokoman Minerals Corp. is a discovery-oriented company with projects in Newfoundland and Labrador, Canada. The company’s primary focus is its portfolio of gold projects: flagship, 100%-owned Moosehead, Crippleback Lake (available for option) and East Alder (optioned to Canterra Minerals Corporation) along the Central Newfoundland Gold Belt, and the district-scale Fleur de Lys project near Baie Verte in northwestern Newfoundland, that is targeting Dalradian-type orogenic gold mineralization similar to the Curraghinalt and Cavanacaw deposits in Northern Ireland, and Cononish in Scotland. The company also recently entered into a strategic alliance with Benton Resources Inc. through three large-scale joint-venture properties including Grey River Gold, Golden Hope, and Kepenkeck in Newfoundland. Sokoman now controls independently and through the Benton alliance over 150,000 hectares (>6,000 claims – 1,500 sq. km), making it one of the largest landholders in Newfoundland, Canada’s newest and rapidly-emerging gold districts. The company also retains an interest in an early-stage antimony/gold project (Startrek) in Newfoundland, optioned to Thunder Gold Corp (formerly White Metal Resources Inc.), and in Labrador, the Company has a 100% interest in the Iron Horse (Fe) project that has Direct Shipping Ore (DSO) potential.

About Benton Resources Inc.

Benton Resources Inc. is a well-funded mineral exploration company listed on the TSX Venture Exchange under the symbol BEX. Following a project generation business model, Benton has a diversified, highly-prospective property portfolio of Gold, Silver, Nickel, Copper, Platinum Group Elements, and most recently Lithium and Cesium assets. In addition, it currently holds large equity positions in other mining companies that are advancing high-quality assets. Whenever possible, BEX retains net smelter return (NSR) royalties with potential long-term cash flow.

For further information, please contact:

Sokoman Minerals

Timothy Froude, P.Geo., President & CEO

Phone: 709-765-1726

Email: tim@sokomanmineralscorp.com

Benton Resources

Stephen Stares, President & CEO

Phone: 807-475-7474

Email: sstares@bentonresources.ca

CHF Capital Markets

Thomas Do, IR Manager

Phone: 416-868-1079 x 232

Email: thomas@chfir.com

Website: www.sokomanmineralscorp.com , www.bentonresources.ca

Twitter: @SokomanMinerals , @BentonResources

Facebook: @SokomanMinerals , @BentonResourcesBEX

LinkedIn: @SokomanMinerals, @BentonResources

THE TSX VENTURE EXCHANGE HAS NOT REVIEWED AND DOES NOT ACCEPT RESPONSIBILITY FOR THE ADEQUACY OR ACCURACY OF THIS RELEASE.

The information contained herein contains “forward-looking statements” within the meaning of applicable securities legislation. Forward-looking statements relate to information that is based on assumptions of management, forecasts of future results, and estimates of amounts not yet determinable. Any statements that express predictions, expectations, beliefs, plans, projections, objectives, assumptions or future events or performance are not statements of historical fact and may be “forward-looking statements.”

Forward-looking statements are subject to a variety of risks and uncertainties which could cause actual events or results to differ from those reflected in the forward-looking statements, including, without limitation: risks related to failure to obtain adequate financing on a timely basis and on acceptable terms; risks related to the outcome of legal proceedings; political and regulatory risks associated with mining and exploration; risks related to the maintenance of stock exchange listings; risks related to environmental regulation and liability; the potential for delays in exploration or development activities or the completion of feasibility studies; the uncertainty of profitability; risks and uncertainties relating to the interpretation of drill results, the geology, grade and continuity of mineral deposits; risks related to the inherent uncertainty of production and cost estimates and the potential for unexpected costs and expenses; results of prefeasibility and feasibility studies, and the possibility that future exploration, development or mining results will not be consistent with the Alliance’s expectations; risks related to gold price and other commodity price fluctuations; and other risks and uncertainties related to the Alliance’s prospects, properties and business detailed elsewhere in the Alliance’s disclosure record. Should one or more of these risks and uncertainties materialize, or should underlying assumptions prove incorrect, actual results may vary materially from those described in forward-looking statements. Investors are cautioned against attributing undue certainty to forward-looking statements. These forward-looking statements are made as of the date hereof and the Alliance does not assume any obligation to update or revise them to reflect new events or circumstances. Actual events or results could differ materially from the Alliance’s expectations or projections.

Sokoman Minerals To Present At The Emerging Growth Conference On Wednesday, March 22, 2023

ST. JOHN’S, NL / ACCESSWIRE / March 20, 2023 / Sokoman Minerals Corp. (TSXV:SIC)(OTCQB:SICNF) (“Sokoman” or the “Company”) is pleased to announce that it has been invited to present at the Emerging Growth Conference on Wednesday, March 22, 2023 at 10:15am EST.

This live, interactive online event will give existing shareholders and the investment community the opportunity to interact with the Company’s President and CEO, Tim Froude in real-time. Mr. Froude will provide the latest updates on Sokoman’s projects including flagship, 100%-owned Moosehead Gold in Central Newfoundland, and the Kraken Lithium Pegmatite project in Southwestern Newfoundland, followed by a Q&A session. Please submit your questions in advance to Questions@EmergingGrowth.com.

Please register HERE to ensure you are able to attend the conference and receive any updates that are released: https://goto.webcasts.com/starthere.jsp?ei=1595544&tp_key=e1808cf5bc&sti=sicnf