Newsroom

Sokoman Minerals Restructures A Portion Of Its Non-Brokered Private Placement Led By Eric Sprott

St. John’s, NL, March 30, 2021 – Sokoman Minerals Corp. (“Sokoman” or “the Company”) (TSX.V: SIC) (OTCQB: SICNF) today announces that it is partially restructuring its non-brokered private placement of units (the “Private Placement”) for gross proceeds of $6,500,000 announced on March 19, 2021.

Eric Sprott, the Company’s largest shareholder to date, proposed to subscribe for $5,000,000 worth of units, which, together with his previous investments into Sokoman, would have taken his position above 20% of the Company’s stock ownership. Pursuant to its policies, the TSX Venture Exchange (“the Exchange”) requires shareholder approval for Mr. Sprott to exceed the 20% threshold. Accordingly, the Company will divide Mr. Sprott’s investment into two tranches: a) $4,919,647 will be taken down as part of the Private Placement, and b) $980,353 of his investment will be held in trust pursuant to a separate financing via subscription receipts which will convert into units with the same terms as that of the Private Placement upon the Company receiving shareholder approval for Mr. Sprott to go over the 20% threshold (the “Subscription Receipts Financing”). The Company has scheduled an Extraordinary General Meeting (“EGM”) for May 18, 2021 for the purposes of obtaining the required shareholder approval.

Pursuant to the Subscription Receipts Financing, each subscription receipt will be issued at a price of $0.26 and after obtaining shareholder approval for Mr. Sprott to exceed the 20% threshold, each subscription receipt will be converted automatically into units having the same terms as the Private Placement with each unit consisting of one (1) common share in the capital of the Company and one half (½) of a common share purchase warrant. Each full warrant will be transferable in accordance with applicable Securities Laws and will entitle the holder to purchase one (1) additional share for $0.40 at any time prior to 4:30 p.m. (Vancouver time) twenty-four (24) months after the closing date.

About Sokoman Minerals Corp.

Sokoman Minerals Corp. is a discovery-oriented company with projects in Newfoundland & Labrador, Canada. The Company’s primary focus is its portfolio of gold projects (Moosehead, Crippleback Lake and East Alder) in central Newfoundland on the structural corridor hosting Marathon Gold’s advanced stage Valentine Lake gold project. The 100%-owned Moosehead Gold Project is located along the Trans-Canada Highway in north-central Newfoundland, and adjacent to New Found Gold’s Queensway Project. Both the Moosehead and Queensway projects are targeting high-grade, turbidite-hosted, Fosterville-type gold mineralization. The gold mineralization in the Eastern Trend at Moosehead has been defined over a 500 m strike length and a 200 m vertical height and remains open, with high-grade drill results including 5.10 m of 124.20 g/t Au (MH-18-39). The Company is currently in the midst of the Phase 6 drill program.

The Company also retains an interest in an early-stage antimony/gold project in Newfoundland optioned to White Metal Resources Inc. In Labrador, the Company has a 100% interest in the Iron Horse (Fe) project which has Direct Shipping Ore (DSO) potential.

Mineralization hosted on adjacent and/or nearby properties is not necessarily indicative of mineralization hosted on the Company’s property.

To learn more, please contact:

Timothy Froude, P. Geo.,

President & CEO

709-765-1726

tim@sokomanmineralscorp.com

Cathy Hume, Director,

Investor Relations

416-868-1079 x251

cathy@chfir.com

Website: www.sokomanmineralscorp.com

Twitter: @SokomanMinerals

Facebook: @SokomanMinerals

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Investors are cautioned that trading in the securities of the Corporation should be considered highly speculative. Except for historical information contained herein, this news release contains forward- looking statements that involve risks and uncertainties. Actual results may differ materially. Sokoman Minerals Corp. will not update these forward-looking statements to reflect events or circumstances after the date hereof. More detailed information about potential factors that could affect financial results is included in the documents filed from time to time with the Canadian securities regulatory authorities by Sokoman Minerals Corp.

Sokoman Minerals Announces Non-Brokered Private Placement Led By Eric Sprott

St. John’s, NL, March 19, 2021 – Sokoman Minerals Corp. (‘Sokoman’ or ‘the Company’) (TSX.V: SIC) (OTCQB: SICNF) today announces that, subject to all regulatory approvals, the Company intends to complete a non-brokered private placement of units (the “Private Placement”) for gross proceeds of $6,500,000 with a lead order of $5,000,000 from Eric Sprott. The Company expects to file documents for approval with the TSX Venture Exchange (the “Exchange”) next week.

Subject to receipt of all regulatory approvals, Sokoman intends to issue units at a price of $0.26 per unit for gross proceeds of $6,500,000, with each unit consisting of one (1) common share in the capital of the Company and one half (½) of a common share purchase warrant. Each full warrant will be transferable in accordance with applicable Securities Laws and will entitle the holder to purchase one (1) additional share for $0.40 at any time prior to 4:30 p.m. (Vancouver time) on that date which is twenty-four (24) months after the closing date.

In connection with the Private Placement, the Company may pay finders’ fees of 5% cash to certain finders, in accordance with Exchange policies. All securities issued pursuant to the Private Placement will be subject to a four month and one day hold period.

The proceeds of this financing will be directed towards advancing the Company’s flagship Moosehead Gold Project, which includes increasing the current drill program from 20,000m to 50,000m total with four drill rigs.

About Sokoman Minerals Corp.

Sokoman Minerals Corp. is a discovery-oriented company with projects in Newfoundland & Labrador, Canada. The Company’s primary focus is its portfolio of gold projects (Moosehead, Crippleback Lake and East Alder) in central Newfoundland on the structural corridor hosting Marathon Gold’s advanced stage Valentine Lake gold project. The 100%-owned Moosehead Gold Project is located along the Trans-Canada Highway in north-central Newfoundland, and adjacent to New Found Gold’s Queensway Project. Both the Moosehead and Queensway projects are targeting high-grade, turbidite-hosted, Fosterville-type gold mineralization. The gold mineralization in the Eastern Trend at Moosehead has been defined over a 500 m strike length and a 200 m vertical height and remains open, with high-grade drill results including 5.10 m of 124.20 g/t Au (MH-18-39). The Company is currently in the midst of the Phase 6 drill program.

The Company also retains an interest in an early-stage antimony/gold project in Newfoundland optioned to White Metal Resources Inc. In Labrador, the Company has a 100% interest in the Iron Horse (Fe) project which has Direct Shipping Ore (DSO) potential.

Mineralization hosted on adjacent and/or nearby properties is not necessarily indicative of mineralization hosted on the Company’s property.

To learn more, please contact:

Timothy Froude, P. Geo.,

President & CEO

709-765-1726

tim@sokomanmineralscorp.com

Cathy Hume, Director,

Investor Relations

416-868-1079 x251

cathy@chfir.com

Website: www.sokomanmineralscorp.com

Twitter: @SokomanMinerals

Facebook: @SokomanMinerals

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Investors are cautioned that trading in the securities of the Corporation should be considered highly speculative. Except for historical information contained herein, this news release contains forward- looking statements that involve risks and uncertainties. Actual results may differ materially. Sokoman Minerals Corp. will not update these forward-looking statements to reflect events or circumstances after the date hereof. More detailed information about potential factors that could affect financial results is included in the documents filed from time to time with the Canadian securities regulatory authorities by Sokoman Minerals Corp.

The Northern Miner Article Featuring Sokoman Minerals (Tsx.V: Sic) (Otcqb: Sicnf)

Dear Investor,

The Moosehead Gold Project has been written up by a top mining publication, The Northern Miner. With the most recent high-grade results reported at the property, Moosehead is entering what appears to be the most prosperous stages of exploration to date.

Read about the exciting developments at the project and what President and CEO Tim Froude had to say about it in the article here: JV Article: Sokoman seeks success at Moosehead in Central Newfoundland – MINING.COM

To learn more, please contact:

Timothy Froude, P. Geo.,

President & CEO

709-765-1726

tim@sokomanmineralscorp.com

Cathy Hume, Director,

Investor Relations

416-868-1079 x251

cathy@chfir.com

Website: www.sokomanmineralscorp.com

Twitter: @SokomanMinerals

Facebook: @SokomanMinerals

Sokoman Acquires District-Scale Property In Nw Newfoundland: Fleur De Lys Project Targets Dalradian-Style Orogenic Gold

St. John’s, NL, March 4, 2021 – Sokoman Minerals Corp. (TSX-V: SIC) (OTCQB: SICNF) (the “Company” or “Sokoman”) is pleased to announce that it has acquired, through staking and option agreements, a total of 1,891 claims (47,275 hectares), the Fleur de Lys Project, on the Baie Verte Peninsula of northwestern Newfoundland.

Fleur de Lys Project Highlights:

Geological equivalent to the Dalradian belt in the Northern UK Caledonides (host to 6 million oz Curraghinalt Deposit)

2019/20 Sokoman tills returned up to 122 gold grains with more than 35% pristine

Unexplained gold anomalies in lake sediments and tills

98% of property is 100% owned with no royalties or required payments

Historic exploration:

limited – virtually none since late 1990s

only 1 drill hole for gold

gold in bedrock values from 3.3 to 25.5 g/t gold** – not drilled

Adjacent to all of Newfoundland’s current gold production

Recent Federal/Provincial studies include mapping, geophysics, satellite imagery

Excellent infrastructure including ready access via hundreds of kilometres of paved secondary highways and forest-access roads

Mining-friendly jurisdiction – one of the Fraser Institutes (2020) top-ten global mining jurisdictions

Tim Froude, President & CEO of Sokoman, says: “The staking of the Fleur de Lys project is the result of two years of research and recce exploration. This exciting project will not distract us from our flagship Moosehead Project but will become a great addition to our portfolio. We are excited and proud to have seized the opportunity to acquire, largely for staking costs only, a district-scale project in one of the hottest gold exploration jurisdictions in the world. Historic exploration has been minimal with only 1 recorded drill hole testing for gold on the 475 sq. km property. An analogous geological setting, at multiple levels, to a multi-million-ounce gold deposit in the UK (Curraghinalt); anomalous gold in government lake-sediment and till geochemical surveys; gold in till samples taken by Sokoman with many pristine gold grains indicating closeness to source; and rock samples with significant gold values – all of this is found on our new Fleur de Lys property.”

The Fleur de Lys Project is highly prospective for Dalradian-style (e.g., Curraghinalt) orogenic vein-hosted gold deposits and as such, represents a readily accessible yet underexplored, district-scale, gold target in the Newfoundland Appalachians. The property is underlain primarily by Late Precambrian-Early Cambrian metasedimentary rocks of the Fleur de Lys Supergroup, locally cut by a regional suite of Silurian intrusions. The Fleur de Lys metamorphic terrane lies immediately west of the Baie Verte – Brompton Line (BVBL), a major Appalachian-Caledonian crustal-scale structure, marked by ultramafic remnants of ophiolite complexes. The structure and adjoining continental margin/volcanic arc rocks extend NW from Newfoundland into the Caledonian orogen in Northern Ireland and Scotland (UK). Similar metamorphosed and deformed continental margin sediments, equivalent to parts of the Fleur de Lys Supergroup, occur in the same tectonic position relative to the BVBL in northern UK, and contain structurally controlled, vein-hosted orogenic gold deposits. The largest of these are Curraghinalt in Northern Ireland and Cononish in Scotland. The Curraghinalt Gold Project (Dalradian Gold/Orion Mine Finance) is a high-grade, 6-million-ounce deposit*, the largest gold deposit in the Appalachian-Caledonian orogen.

Currently, all of Newfoundland’s gold production comes from the Baie Verte Peninsula; the largest of these is Anaconda Mining Inc.’s Point Rousse operation, which lies less than 8 kilometres from the property boundary. There are more than 100 gold prospects and showings on the Baie Verte Peninsula, many of which are orogenic-style, related to major splays and related second-order structures linked to the BVBL. Similar second- and third order structures, farther west and likewise linked to the BVBL, represent potential targets within Sokoman’s Fleur de Lys property.

The property has seen little modern exploration, with some areas remaining completely unexplored. Historic work by Noranda, other smaller companies, and individual prospectors documented polymetallic (Cu, Pb, Mo) quartz veins with high silver values, gold (including visible gold), pyrite and arsenic-rich alteration, in structurally controlled quartz veinlets, veins and vein-breccias, that cut psammitic, pelitic and graphitic Fleur de Lys metasediments, just west of the Baie Verte – Brompton Line. Historical grab sample grades of 3.3 g/t Au to 25.5 g/t Au are reported from several separate locations (Jacobs,1991; Basha,1999). (Note: historical assays have not been verified by the Company and should not be relied upon).

Reconnaissance till sampling by Sokoman in 2019/20 over the “then” Crown Land in the Fleur de Lys belt has defined multiple gold targets, defined by 129 C-horizon till samples sent to Overburden Drilling Management (ODM) in Ottawa for gold grain analysis. Results gave 38 samples with >20 grains, 14 >40 grains with a maximum of 122 grains. Many samples with high gold grain counts have a high percentage (30-80%) of pristine grains, suggesting a local, probably less than a 1 km, source for the gold.

Sokoman is pleased to have Sean O’Brien, P. Geo., of Far Eastern Geo-Consult, joining the Company as a Technical Advisor on the Project. Sean is a highly respected mapper and researcher, a former Senior Geologist with the Geological Survey of Newfoundland and Labrador with 40 years’ experience in the Appalachian-Caledonian orogen. Part of his most recent work, via his consultancy, includes research and project generation related to orogenic, and hydrothermal, intrusion-related gold on the metamorphosed margins of the Northern Appalachian-Caledonian belt.

Sokoman is using the services of Overburden Drilling Management (ODM) to propose and oversee a Phase 1 till program over the entire property. ODM are specialists in till / overburden sampling for gold and were involved in planning of Sokoman’s early reconnaissance program over the Fleur de Lys Supergroup.

Till Sampling QA/QC

The till samples were collected by Sokoman personnel using field collection techniques provided by ODM. All samples were hand dug to the desired depth (C- Horizon Till) with a 10-12 kg sieved sample (8 mesh) placed in a clear plastic sample bag and sealed. Samples were shipped in plastic pails by bonded courier to the ODM lab in Ottawa, Ontario.

The till samples are processed using procedures designed to progressively concentrate the heavy minerals, expose the gold grains and prepare a split of the heavy mineral concentrate (“HMC”) suitable for geochemical analysis if requested.

The sample is wet screened at 2 mm with a preliminary concentrate extracted from the -2 mm fraction by tabling. Geological observations on the character of the sample are made during both the screening and tabling operations. The table concentrate is purposely large (typically 300-400 g) and of low grade (10-25% heavy minerals) in order to achieve a high, 80 to 90% recovery rate for all desired heavy minerals irrespective of their grain size or relative specific gravity. The gold grains, more than 95% of which are normally silt-sized (Averill 2001), are observed at this stage with the aid of micro-panning and are counted, measured and classified as to degree of wear (ie distance of glacial transport), then returned to the table concentrate. The pyrite content of the pan concentrate is estimated and the number of grains of heavier, visually distinctive indicator minerals such as arsenopyrite, galena, scheelite, cinnabar etc. is recorded.

Quality Control and Quality Assurance Measures

In addition to using field duplicates to monitor the quality of the indicator mineral data obtained from specific projects, ODM performs blind tests to ensure that the recovery rates for all targeted minerals are consistently in the 80 to 90% range. Furthermore, both the quality of the mineral separation and the overall mineralogy of the concentrate are visible at every stage of the concentration process, minimizing the potential for sample mix-ups, indicator mineral carryover between samples and other potential contamination issues. For example, gold grains, which are the most important indicator mineral on many surveys, are more susceptible to inter-sample carryover than any other indicator mineral due to their very small size, but these grains are physically observed during the first stage of mineral concentration, tabling, and, if anomalous concentrations are present, blank samples are tabled and carefully inspected for gold grains before the next project sample is processed.

QP

This news release has been reviewed and approved by Timothy Froude, P. Geo., a “Qualified Person” under National Instrument 43-101 and the President / CEO of Sokoman Minerals Corp.

Covid-19 Protocols

To ensure a working environment that protects the health and safety of the staff and contractors, Sokoman is operating under Federally and Provincially mandated and recommended guidelines during the current Level 5 (full lockdown) COVID-19 alert Level.

About Sokoman Minerals Corp.

Sokoman Minerals Corp. is a discovery-oriented company with projects in Newfoundland & Labrador, Canada. The Company’s primary focus is its portfolio of gold projects (Moosehead, Crippleback Lake and East Alder) in central Newfoundland on the structural corridor hosting Marathon Gold’s advanced stage Valentine Lake gold project. The 100%-owned Moosehead Gold Project is located along the Trans-Canada Highway in north-central Newfoundland, and adjacent to New Found Gold’s Queensway Project. Both the Moosehead and Queensway projects are targeting high-grade, turbidite-hosted, Fosterville-type gold mineralization. The gold mineralization in the Eastern Trend at Moosehead has been defined over a 500 m strike length and a 200 m vertical height and remains open, with high-grade drill results including 5.10 m of 124.20 g/t Au (MH-18-39). The Company is currently in the midst of a 20,000m drill program utilizing two rigs.

The Company also retains an interest in an early-stage antimony/gold project in Newfoundland optioned to White Metal Resources Inc. In Labrador, the Company has a 100% interest in the Iron Horse (Fe) project which has Direct Shipping Ore (DSO) potential.

Mineralization hosted on adjacent and/or nearby properties is not necessarily indicative of mineralization hosted on the Company’s property.

*Mineral Resource Statement, Curraghinalt Gold Project, Northern Ireland, SRK Consulting (Canada) Inc., May 10th, 2018

**Historical References;

Basha, M, 1999: First and second year assessment report on prospecting and geochemical and geophysical exploration for licences 5920m, 5925m, 5153m-5154m and 5156m-5157m on claims in the Baie Verte area, on the Baie Verte Peninsula, Newfoundland. Government of Newfoundland and Labrador, Geofile 12H/16/1463.

Jacobs, W, 1991: First year assessment report on geological and geochemical exploration for licence 3999 on claim blocks 6992-6993 in the Wild Cove Pond area on the Baie Verte Peninsula, Newfoundland. Report for Long Range Resources Ltd. Government of Newfoundland and Labrador, Geofile 12H/10/1251.

To learn more, please contact:

Timothy Froude, P. Geo.,

President & CEO

709-765-1726

tim@sokomanmineralscorp.com

Cathy Hume, Director,

Investor Relations

416-868-1079 x251

cathy@chfir.com

Website: www.sokomanmineralscorp.com

Twitter: @SokomanMinerals

Facebook: @SokomanMinerals

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Investors are cautioned that trading in the securities of the Corporation should be considered highly speculative. Except for historical information contained herein, this news release contains forward- looking statements that involve risks and uncertainties. Actual results may differ materially. Sokoman Minerals Corp. will not update these forward-looking statements to reflect events or circumstances after the date hereof. More detailed information about potential factors that could affect financial results is included in the documents filed from time to time with the Canadian securities regulatory authorities by Sokoman Minerals Corp.

Sokoman Minerals Cuts High-Grade Gold In Step-Out Drilling At Moosehead Project, Central Newfoundland

4.2 m of 64 g/t Au, including 1.2 m of 223.63 g/t Au at South Pond

St. John’s, NL, February 23, 2021 – Sokoman Minerals Corp. (TSX-V: SIC) (OTCQB: SICNF) (the “Company” or “Sokoman”) is pleased to announce that ongoing Phase 6 drilling program at the 100%-owned Moosehead Property has intersected near-surface (30 metres vertically), high-grade gold mineralization in step-out drilling at South Pond, where recent high-grade intersections including 5.0 m of 26.87 g/t Au from MH-20-123 were reported (see NR dated December 17, 2020). Diamond drill hole MH-21-141, drilled as a step-out 15 m to the north of MH-20-123, returned the following priority rush, total pulp, metallics assay results:

MH-21-141 – 4.20 m of 64 g/t Au, including 1.20 m at 223.63 g/t Au from 47.90 m downhole*

*reported lengths are core lengths and are believed to be 90% of true thickness

Tim Froude, President and CEO of Sokoman, says: “We are extremely pleased with the drill results from the South Pond target as it continues to develop into yet another potentially significant story at Moosehead. We are currently cutting additional pads to facilitate detailed drilling of this zone where Rig 1 will be focused for the next few weeks. We know that mineralization elsewhere on the property, and in particular our higher-grade zones, can have variable orientations within and adjacent to our main structural corridors, requiring detailed drilling to establish direction and maximize success. In the meantime, newly arrived Rig 2 will focus on high-priority targets outside of the known mineralized trends, and we consider the chances of additional discoveries to be quite high. Drilling operations will continue until the spring break-up. We have now drilled 37 holes for a total of 6,872 m in Phase 6 of the total planned 20,000 m.”

Assays were also received for drill hole MH-21-140, collared approximately 15 m to the south of MH-20-123, which returned a 6.70 m interval averaging 3.24 g/t Au, including 1.20 m at 16.96 g/t Au from 42 m downhole. A drill plan and an updated table of results from the Phase 6 drilling at South Pond are appended to this release.

South Pond Zone

Gold mineralization was discovered in quartz float along the northern shoreline of South Pond by earlier workers and was further evaluated by Sokoman last summer. This evaluation resulted in the discovery of two types of mineralization, a high-grade cluster that averaged 36.59 g/t Au, and a previously known lower-grade cluster that averaged 1.91 g/t Au (see NR dated July 30, 2020). In 2020, drilling beneath the high-grade boulders returned a quartz vein zone at 47 m that averaged 26.87 g/t Au over 5 m, including 60.59 g/t Au over 2.15 m, the likely in-situ source of the high-grade boulders.

Based on the drilling to date, the mineralization occurs in a 3-7m wide zone of shearing and quartz veining, with 2-5% disseminated sulphides (pyrite+/-sphalerite+/-boulangerite). The high-grade sections are typically banded and/or stylolitic, locally vuggy, quartz veins, up to one metre thick, with multiple 1 to 5 mm blebs of visible gold in a zone of moderately sheared siltstones. Modeling suggests that the South Pond zone is the southern extension of the Western Trend, located 240 m to the north.

About the Moosehead Gold Project

The 100%-owned Moosehead Gold Project is located along the Trans-Canada Highway in north central Newfoundland, on the same structural trend as the advanced Valentine Lake Project (Marathon Gold), and adjacent to New Found Gold’s Queensway Project. Both the Moosehead and Queensway projects are targeting high-grade, turbidite-hosted, Fosterville-type gold mineralization. The gold mineralization in the Eastern Trend has been defined over a 500 m strike length and a 200 m vertical height and remains open, with high-grade drill results including 5.10 m of 124.20 g/t Au (MH-18-39) and 4.8 m of 33.59 g/t A, including 0.90 m of 124.15 g/t Au (MH-19-62). The Company is currently in the midst of a 20,000m drill program utilizing two rigs.

QP

This news release has been reviewed and approved by Timothy Froude, P. Geo., a “Qualified Person” under National Instrument 43-101 and President and CEO of Sokoman Minerals Corp.

COVID-19 Protocols

To ensure a working environment that protects the health and safety of the staff and contractors, Sokoman is operating under federally and provincially mandated and recommended guidelines during the current Level 5 (full lockdown) COVID-19 alert level.

Analytical Techniques / QA/QC

All core samples submitted for assay were saw cut by Sokoman personnel with one half submitted for assay and one half retained for reference. Samples were delivered in sealed bags directly to the lab by Sokoman Minerals personnel. Samples, including duplicates, blanks and standards, were submitted to Eastern Analytical Ltd. in Springdale, Newfoundland for gold analysis. Eastern Analytical is an accredited assay lab that conforms to requirements of ISO/IEC 17025. Samples with possible visible gold were submitted for total pulp metallics and gravimetric finish. All other samples were analyzed by standard fire assay methods. Total pulp metallic analysis includes: the whole sample is crushed to -10 mesh; then pulverized to 95% -150 mesh. The total sample is weighed and screened 150 mesh; the +150 mesh fraction is fire assayed for Au, and a 30 g subsample of the -150 mesh fraction is fire assayed for Au; with a calculated weighted average of total Au in the sample reported as well. One blank and one industry approved standard for every twenty samples submitted, is included in the sample stream. Random duplicates of selected samples are analyzed in addition to the in-house standard and duplicate policies of Eastern Analytical.

About Sokoman Minerals Corp.

Sokoman Minerals Corp. is a discovery-oriented company with projects in Newfoundland & Labrador, Canada. The Company’s primary focus is its portfolio of gold projects (Moosehead, Crippleback Lake and East Alder) in Central Newfoundland on the structural corridor hosting Marathon Gold’s Valentine Lake project. Valentine Lake is reported to host estimated Proven and Probable Mineral Reserves of 1.87 Moz (41.05 Mt at 1.41 g/t Au), and Total Measured and Indicated Mineral Resources (inclusive of the Mineral Reserves) of 3.09 Moz (54.9 Mt at 1.75 g/t Au). Additional Inferred Mineral Resources are 0.96 Moz (16.77 Mt at 1.78 g/t Au). Reserves and resource totals for the Valentine Lake Project were taken from “N.I. 43-101 TECHNICAL REPORT & PRE-FEASIBILITY STUDY ON THE VALENTINE GOLD PROJECT” prepared by Ausenco Engineering Canada on April 21, 2020.

The Company also retains an interest in an early-stage antimony/gold project in Newfoundland optioned to White Metal Resources Inc. In Labrador, the Company has a 100% interest in the Iron Horse (Fe) project which has Direct Shipping Ore (DSO) potential.

Mineralization hosted on adjacent and/or nearby properties is not necessarily indicative of mineralization hosted on the Company’s property.

The Company would like to thank the Government of Newfoundland and Labrador for financial support of the project through the Junior Exploration Assistance Program. Sokoman has been approved for funding for a portion of 2020 exploration activities.

To learn more, please contact:

Timothy Froude, P. Geo.,

President & CEO

709-765-1726

tim@sokomanmineralscorp.com

Cathy Hume, Director,

Investor Relations

416-868-1079 x251

cathy@chfir.com

Website: www.sokomanmineralscorp.com

Twitter: @SokomanMinerals

Facebook: @SokomanMinerals

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Investors are cautioned that trading in the securities of the Corporation should be considered highly speculative. Except for historical information contained herein, this news release contains forward- looking statements that involve risks and uncertainties. Actual results may differ materially. Sokoman Minerals Corp. will not update these forward-looking statements to reflect events or circumstances after the date hereof. More detailed information about potential factors that could affect financial results is included in the documents filed from time to time with the Canadian securities regulatory authorities by Sokoman Minerals Corp.

Phase 6 South Pond Table of Results

Sokoman Minerals Reports Second Drill Mobilizing To Moosehead Gold Project, Central Newfoundland

St. John’s, NL, February 12, 2021 – Sokoman Minerals Corp. (TSX-V: SIC) (OTCQB: SICNF) (the “Company” or “Sokoman”) is pleased to announce that a second diamond drill rig is mobilizing to the Moosehead Gold Project and will immediately begin testing high-priority targets that lie outside the known mineralized zones. Drill pads are currently being prepared to facilitate these holes.

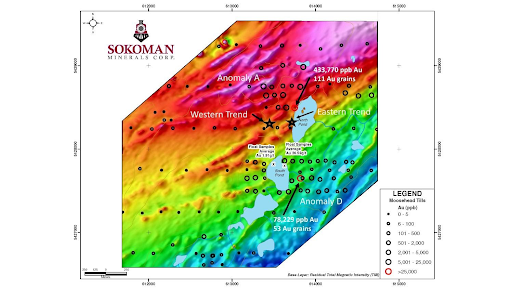

The first area to be tested is located approximately 200 m east of the main Eastern Trend and is situated within Till Anomaly B (see map). The target is highlighted by a coincident magnetic and soil/till anomaly with historical soil values ranging from less than 5 ppb Au to a maximum of 325 ppb Au, and the highest gold grain count of 139 grains, including 123 pristine grains. Pristine grains are considered to be less than 200 m from the source area. A total of five holes has been proposed for this area, of which three are first-priority and two are conditional on results. Other targets are being prioritized and will be discussed in detail in future news releases.

Tim Froude, President and CEO of Sokoman, says: “We are very pleased to welcome Rig 2 to the Moosehead property. Sokoman’s team can now stretch our legs and start testing some of those high-priority targets we have outlined. Our goal now at Moosehead is to achieve two very important things: extend the known zones, and potentially make a new discovery on this highly prospective property. We expect to drill up to 5,000 m with Rig 2, testing upwards of 10 or more discreet targets across the property.”

About Moosehead Gold Project

The 100%-owned Moosehead Gold Project is located along the Trans-Canada Highway in North Central Newfoundland, on the same structural trend as the advanced Valentine Lake Project (Marathon Gold), and adjacent to New Found Gold’s Queensway Project. Both the Moosehead and Queensway projects are targeting high-grade, turbidite-hosted, Fosterville-type gold mineralization.

The mineralization has been defined over a 500 m strike length and a 200 m vertical height and remains open, with high-grade drill results including 5.10 m of 124.20 g/t Au (MH-18-39) and 4.8 m of 33.59 g/t A, including 0.90 m of 124.15 g/t Au (MH-19-62). The Company is currently in the midst of a 20,000m drill program utilizing two rigs. Approximately 8,500 metres have been drilled in 35 holes in the current phase which is expected to extend into the summer months after the spring breakup period.

QP

This news release has been reviewed and approved by Timothy Froude, P. Geo., a “Qualified Person” under National Instrument 43-101 and President and CEO of Sokoman Minerals Corp.

COVID-19 Protocols

To ensure a working environment that protects the health and safety of the staff and contractors, Sokoman is operating under federally and provincially mandated and recommended guidelines during the current COVID-19 alert level.

About Sokoman Minerals Corp.

Sokoman Minerals Corp. is a discovery-oriented company with projects in Newfoundland & Labrador, Canada. The Company’s primary focus is its portfolio of gold projects (Moosehead, Crippleback Lake and East Alder) in Central Newfoundland on the structural corridor hosting Marathon Gold’s Valentine Lake project. Valentine Lake is reported to host estimated Proven and Probable Mineral Reserves of 1.87 Moz (41.05 Mt at 1.41 g/t Au), and Total Measured and Indicated Mineral Resources (inclusive of the Mineral Reserves) of 3.09 Moz (54.9 Mt at 1.75 g/t Au). Additional Inferred Mineral Resources are 0.96 Moz (16.77 Mt at 1.78 g/t Au). Reserves and resource totals for the Valentine Lake Project are taken from “N.I. 43-101 TECHNICAL REPORT & PRE-FEASIBILITY STUDY ON THE VALENTINE GOLD PROJECT” prepared by Ausenco Engineering Canada on April 21, 2020.

The Company also retains an interest in an early-stage antimony/gold project in Newfoundland optioned to White Metal Resources Inc. In Labrador, the Company has a 100% interest in the Iron Horse (Fe) project which has Direct Shipping Ore (DSO) potential.

Mineralization hosted on adjacent and/or nearby properties is not necessarily indicative of mineralization hosted on the Company’s property.

The Company would like to thank the Government of Newfoundland and Labrador for financial support of the project through the Junior Exploration Assistance Program. Sokoman has been approved for funding for a portion of 2020 exploration activities.

To learn more, please contact:

Timothy Froude, P. Geo.,

President & CEO

709-765-1726

tim@sokomanmineralscorp.com

Cathy Hume, Director,

Investor Relations

416-868-1079 x251

cathy@chfir.com

Website: www.sokomanmineralscorp.com

Twitter: @SokomanMinerals

Facebook: @SokomanMinerals

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Investors are cautioned that trading in the securities of the Corporation should be considered highly speculative. Except for historical information contained herein, this news release contains forward- looking statements that involve risks and uncertainties. Actual results may differ materially. Sokoman Minerals Corp. will not update these forward-looking statements to reflect events or circumstances after the date hereof. More detailed information about potential factors that could affect financial results is included in the documents filed from time to time with the Canadian securities regulatory authorities by Sokoman Minerals Corp.

Sokoman Reports Additional High-Grade Gold Assay Results At Moosehead Project, Central Newfoundland

4.0 m at 24.92 g/t Au, including 1.60 m at 61.68 g/t Au from Footwall Splay Zone

St. John’s, NL, January 29, 2021 – Sokoman Minerals Corp. (TSX-V: SIC) (OTCQB: SICNF) (the “Company” or “Sokoman”) is pleased to announce that ongoing Phase 6 drilling at the 100%-owned Moosehead Property continues to intersect near-surface, high-grade gold mineralization at the recently recognized Footwall Splay that adjoins the Eastern Trend Main Zone. Diamond drill holes MH-20-132 and MH-20-127, drilled prior to the Christmas break, have both returned high-grade gold values.

Metallic assay results (rush priority analysis) from MH-20-132 and MH-2-127 returned the following:

MH-20-132 – 4.0 m at 24.92 g/t Au, incl. 1.60 m at 61.68 g/t Au from 70.50 m downhole

MH-20-127 – 1.30 m at 9.23 g/t Au, incl. 0.50 m @ 22.72 g/t Au from 48.90 m downhole

*reported lengths are core lengths and are believed to be 70% to 85% of true thickness

In addition to the Footwall Splay mineralization, MH-20-132 also cut a lower zone of mineralization (possibly the Eastern Trend Main Zone) over 22.10 m (core length) averaging 1.65 g/t Au, including higher grade zones of up to 2.80 m of 4.36 g/t Au starting at 96.90 m downhole. This zone remains open and will receive further testing.

Tim Froude, President and CEO of Sokoman, says: “We are very pleased to report that the high-grade Footwall Splay has been expanded by about 27 metres and now has both a strike length and a down-dip length of approximately 40 m (the zone is largely flat-lying). The splay has been intersected in at least 5 drill holes – MH-18-01, MH-20-115, MH-20-116 – and now also MH-20-127 and MH-20-132 (see plan map for intersections). The mineralization in MH-20-132 and 127 extends the zone at least 27 m and remains open to the north, south and west. It is believed that the Splay merges with the adjacent Main Zone located immediately to the east. Mineralized zones of this nature include the high-grade Swan Zone at Fosterville in Australia which has limited strike and variable dip components in a geological setting analogous to Moosehead. A second drill rig will be mobilized in early February to test high-priority targets from the 2019/20 magnetics and till sampling programs. We expect a steady flow of results from the assays that are still outstanding to be reported in the next 3 to 4 weeks.”

Phase 6 Drilling Program

Approximately 6,500 m has been completed in 30 holes to date. Logging and sampling is ongoing, along with the upgrading of the new core building. The program has increased from 10,000 to 20,000 m of which 15,000 m will be dedicated to the Western and Eastern Trends and the adjacent Footwall Splay. The remaining 5,000 m will test high-priority magnetic and geochemical targets elsewhere on the property. Additional assays have been received since the drilling re-started and are incorporated in the attached table. Some holes remain outstanding and a summary of all holes drilled prior to Christmas will be discussed in more detail once all results have been received. We have also switched to a new logging system, and integration with the in-hand data is ongoing with the assistance of Mercator Geological Services of Dartmouth, Nova Scotia.

About Moosehead Gold Project

The 100%-owned Moosehead Gold Project is located along the Trans-Canada Highway in North Central Newfoundland, on the same structural trend as the advanced Valentine Lake Project (Marathon Gold), and adjacent to New Found Gold’s Queensway Project. Both the Moosehead and Queensway projects are targeting high-grade, turbidite hosted, Fosterville-type gold mineralization.

The gold mineralization has been defined over a 500 m strike length and a 200 m vertical height and remains open, with high-grade drill results including 5.10 m of 124.20 g/t Au (MH-18-39) and 4.8 m of 33.59 g/t A, including 0.90 m of 124.15 g/t Au (MH-19-62).

QP

This news release has been reviewed and approved by Timothy Froude, P. Geo., a “Qualified Person” under National Instrument 43-101 and President and CEO of Sokoman Minerals Corp.

COVID-19 Protocols

To ensure a working environment that protects the health and safety of the staff and contractors, Sokoman is operating under federally and provincially mandated and recommended guidelines during the current COVID-19 alert level.

Analytical Techniques / QA/QC

All core samples submitted for assay were saw cut by Sokoman personnel with one half submitted for assay and one half retained for reference. Samples were delivered in sealed bags directly to the lab by Sokoman Minerals personnel. Samples, including duplicates, blanks and standards, were submitted to Eastern Analytical Ltd. in Springdale, Newfoundland for gold analysis. Eastern Analytical is an accredited assay lab that conforms to requirements of ISO/IEC 17025. Samples with possible visible gold were submitted for total pulp metallics and gravimetric finish. All other samples were analyzed by standard fire assay methods. Total pulp metallic analysis includes: the whole sample is crushed to -10 mesh; then pulverized to 95% -150 mesh; the total sample is weighed and screened 150 mesh; the +150 mesh fraction is fire assayed for Au, and a 30 g subsample of the -150 mesh fraction is fire assayed for Au; with a calculated weighted average of total Au in the sample reported as well. One blank and one industry approved standard for every twenty samples submitted, is included in the sample stream. In addition, random duplicates of selected samples are analyzed in addition to the in-house standard and duplicate policies of Eastern Analytical.

About Sokoman Minerals Corp.

Sokoman Minerals Corp. is a discovery-oriented company with projects in Newfoundland & Labrador, Canada. The Company’s primary focus is its portfolio of gold projects (Moosehead, Crippleback Lake and East Alder) in Central Newfoundland on the structural corridor hosting Marathon Gold’s Valentine Lake project. Valentine Lake is reported to host estimated Proven and Probable Mineral Reserves of 1.87 Moz (41.05 Mt at 1.41 g/t Au), and Total Measured and Indicated Mineral Resources (inclusive of the Mineral Reserves) of 3.09 Moz (54.9 Mt at 1.75 g/t Au). Additional Inferred Mineral Resources are 0.96 Moz (16.77 Mt at 1.78 g/t Au). Reserves and resource totals for the Valentine Lake Project are taken from “N.I. 43-101 TECHNICAL REPORT & PRE-FEASIBILITY STUDY ON THE VALENTINE GOLD PROJECT” prepared by Ausenco Engineering Canada on April 21, 2020.

The Company also retains an interest in an early-stage antimony/gold project in Newfoundland optioned to White Metal Resources Inc. In Labrador, the Company has a 100% interest in the Iron Horse (Fe) project which has Direct Shipping Ore (DSO) potential.

Mineralization hosted on adjacent and/or nearby properties is not necessarily indicative of mineralization hosted on the Company’s property.

The Company would like to thank the Government of Newfoundland and Labrador for financial support of the project through the Junior Exploration Assistance Program. Sokoman has been approved for funding for a portion of 2020 exploration activities.

To learn more, please contact:

Timothy Froude, P. Geo.,

President & CEO

709-765-1726

tim@sokomanmineralscorp.com

Cathy Hume, Director,

Investor Relations

416-868-1079 x251

cathy@chfir.com

Website: www.sokomanmineralscorp.com

Twitter: @SokomanMinerals

Facebook: @SokomanMinerals

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Investors are cautioned that trading in the securities of the Corporation should be considered highly speculative. Except for historical information contained herein, this news release contains forward- looking statements that involve risks and uncertainties. Actual results may differ materially. Sokoman Minerals Corp. will not update these forward-looking statements to reflect events or circumstances after the date hereof. More detailed information about potential factors that could affect financial results is included in the documents filed from time to time with the Canadian securities regulatory authorities by Sokoman Minerals Corp.

Sokoman Minerals Resumes Phase 6 Drill Program At Moosehead Gold Project, Central Newfoundland

St. John’s, NL, January 19, 2021 – Sokoman Minerals Corp. (TSX-V: SIC) (OTCQB: SICNF) (“the Company” or “Sokoman”) is pleased to announce that drilling operations have re-started with the first of two rigs at the high-grade Moosehead Gold Project in central Newfoundland. Initially the focus will be on further defining and expanding on areas of high-grade gold mineralization in the northern portion of the Eastern Trend, proximal to historical hole MH-02-38 that intersected a broad zone of gold mineralization from 76.38 m to 88.22 m, highlighted by a 2.02 m intercept grading 111.96 g/t Au from 83.82 m downhole. MH-02-38 lies approximately 300 m north of MH-20-115 that returned two zones of high-grade gold including 4.60 m @ 47.20 g/t Au, now known as the Footwall Splay, as well as a slightly deeper intersection from the Main Eastern Trend that returned 8.10 m @ 68.25 g/t Au (November 19, 2020 NR). Modelling suggests that the intersection in MH-02-38 could represent a splay off the main Eastern Trend similar to the upper intersection in MH-20-115. The rig will be coring HQ size core (63.5 mm diameter core versus 47.6 mm for NQ core) to maximize capture of free gold in the high-grade vein zones.

Rig 2 is expected to be mobilized in the first week of February and will focus on exploration targets generated by till and magnetic surveys completed in 2020.

Tim Froude, President & CEO, commented: “Our goal for the first half of 2021 includes the completion of at least 20,000 m of drilling, of which at least 15,000 m will test the core areas of the Eastern and Western Trends and 3,000 to 5,000 m will be directed towards testing the multitude of targets defined outside of the known zones. Key amongst these is the gold in till anomalies to the east of North and South Ponds, Anomalies B and D respectively, in areas with no previous drilling where the glacial history indicates the gold in the tills is derived from undiscovered bedrock mineralization. Many assays from holes drilled prior to Christmas are expected in the coming days and will be reported once all have been received. Portions of three holes remain to be logged in detail with sampling of mineralized sections expected to be completed in the next few weeks. We have received permits for drilling on the ice of North Pond, to begin once ice conditions allow.”

To date in the Phase 6 drill program, Sokoman has logged and sampled 22 holes totaling 6,650 m. The Phase 6 drilling has given excellent results including MH-20-115 that returned two discreet, high-grade zones including the newly recognized Footwall Splay of 4.60 m @ 47.20 g/t Au, as well as a slightly deeper intersection in the Main Eastern Trend that returned 8.10 m @ 68.25 g/t Au (November 19, 2020 NR).

Drilling at South Pond, 240 m south of the Western Trend, returned high-grade results (December 17, 2020 NR) of 5.0 m @ 26.88 g/t Au, including 2.15 m @ 60.59 g/t Au. The intersection in MH-20-123 is the in-situ source of the high-grade boulder cluster reported in July 2020 that averaged 36 g/t Au, indicating that the system comes to surface. These intersections, and many other previously reported, are similar in style and grade to the world-class Fosterville Mine in Victoria, Australia, and establish Moosehead as a Fosterville lookalike, fully supported by geological and structural criteria.

About the Moosehead Gold Project

The 100%-owned Moosehead Gold Project is located along the Trans-Canada Highway in North Central Newfoundland, on the same structural trend as the advanced Valentine Lake Project (Marathon Gold), and adjacent to New Found Gold’s Queensway Project. Both the Moosehead and Queensway projects are targeting high-grade, turbidite-hosted, Fosterville-type gold mineralization. The gold mineralization at Moosehead has been defined over a 500 m strike length and a 200 m vertical height and remains open, with high-grade drill results including 5.10 m of 124.20 g/t Au (MH-18-39) and 4.8 m of 33.59 g/t A, including 0.90 m of 124.15 g/t Au (MH-19-62).

Qualified Person

This news release has been reviewed and approved by Timothy Froude, P. Geo., a “Qualified Person” under National Instrument 43-101 and President and CEO of Sokoman Minerals Corp.

COVID-19 Protocols

To ensure a working environment that protects the health and safety of the staff and contractors, Sokoman is operating under federally and provincially mandated and recommended guidelines during the current COVID-19 alert level.

About Sokoman Minerals Corp.

Sokoman Minerals Corp. is a discovery-oriented company with projects in Newfoundland & Labrador, Canada. The Company’s primary focus is its portfolio of gold projects (Moosehead, Crippleback Lake and East Alder) in Central Newfoundland on the structural corridor hosting Marathon Gold’s Valentine Lake project. Valentine Lake is reported to host estimated Proven and Probable Mineral Reserves of 1.87 Moz (41.05 Mt at 1.41 g/t Au), and Total Measured and Indicated Mineral Resources (inclusive of the Mineral Reserves) of 3.09 Moz (54.9 Mt at 1.75 g/t Au). Additional Inferred Mineral Resources are 0.96 Moz (16.77 Mt at 1.78 g/t Au). Reserves and resource totals for the Valentine Lake Project are taken from “N.I. 43-101 TECHNICAL REPORT & PRE-FEASIBILITY STUDY ON THE VALENTINE GOLD PROJECT” prepared by Ausenco Engineering Canada on April 21, 2020.

The Company also retains an interest in an early-stage antimony/gold project in Newfoundland optioned to White Metal Resources Inc. In Labrador, the Company has a 100% interest in the Iron Horse (Fe) project which has Direct Shipping Ore (DSO) potential.

Mineralization hosted on adjacent and/or nearby properties is not necessarily indicative of mineralization hosted on the Company’s property.

The Company would like to thank the Government of Newfoundland and Labrador for financial support of the project through the Junior Exploration Assistance Program. Sokoman has been approved for funding for a portion of 2020 exploration activities.

To learn more, please contact:

Timothy Froude, P. Geo.,

President & CEO

709-765-1726

tim@sokomanmineralscorp.com

Cathy Hume, Director,

Investor Relations

416-868-1079 x251

cathy@chfir.com

Website: www.sokomanmineralscorp.com

Twitter: @SokomanMinerals

Facebook: @SokomanMinerals

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Investors are cautioned that trading in the securities of the Corporation should be considered highly speculative. Except for historical information contained herein, this news release contains forward- looking statements that involve risks and uncertainties. Actual results may differ materially. Sokoman Minerals Corp. will not update these forward-looking statements to reflect events or circumstances after the date hereof. More detailed information about potential factors that could affect financial results is included in the documents filed from time to time with the Canadian securities regulatory authorities by Sokoman Minerals Corp.

Sokoman Announces Closing Of Non-Brokered Private Placement

St. John’s, NL, December 16, 2020 - Sokoman Minerals Corp. (‘Sokoman’ or ‘the Company’) (TSX.V: SIC) (OTCQB: SICNF) today announces that it has received approval from the TSX Venture Exchange to close its non-brokered private placement of flow-through shares (the “Private Placement”) announced on December 2, 2020.

The Company will issue 15,000,000 flow-through shares at a price of $0.20 per flow-through share for aggregate gross proceeds of $3,000,000. The flow-through shares will entitle the holder to receive the tax benefits applicable to flow-through shares, in accordance with provisions of the Income Tax Act (Canada).

In connection with the private placement, the Company will pay $164,397 in finders’ fees and will issue 764,550 broker warrants exercisable at $0.20 for 12 months from the date of issue, as permitted by the policies of the TSX Venture Exchange. All securities issued pursuant to the private placement will be subject to a four-month hold period.

Sokoman would like to thank all the participants and interested parties for the overwhelming support in this Private Placement. The proceeds of the financing will be directed towards advancing the Company’s flagship Moosehead Gold Project. Sokoman is continuing with its Phase 6 drill program at Moosehead and after taking a break for Christmas holidays, it will resume drilling in early 2021 with multiple high-priority targets yet to be tested. With the necessary funds in place, the Company plans on expanding the program beyond initially announced 10,000 m.

About Sokoman Minerals Corp.

Sokoman Minerals Corp. is a discovery-oriented company with projects in Newfoundland & Labrador, Canada. The Company’s primary focus is its portfolio of gold projects (Moosehead, Crippleback Lake and East Alder) in Central Newfoundland on the structural corridor hosting Marathon Gold’s Valentine Lake project. Valentine Lake is reported to host estimated Proven and Probable Mineral Reserves of 1.87 Moz (41.05 Mt at 1.41 g/t Au), and Total Measured and Indicated Mineral Resources (inclusive of the Mineral Reserves) of 3.09 Moz (54.9 Mt at 1.75 g/t Au). Additional Inferred Mineral Resources are 0.96 Moz (16.77 Mt at 1.78 g/t Au). Reserves and resource totals for the Valentine Lake Project are taken from the Marathon Gold website, November 16, 2020.

The Company also has a 100% interest in an early-stage antimony/gold project in Newfoundland optioned to White Metal Resources Inc. In Labrador, the Company has a 100% interest in the Iron Horse (Fe) project.

Mineralization hosted on adjacent and/or nearby properties is not necessarily indicative of mineralization hosted on the Company’s property.

The Company would like to thank the Government of Newfoundland and Labrador for financial support of the project through the Junior Exploration Assistance Program. Sokoman has been approved for funding for a portion of 2020 exploration activities.

To learn more, please contact:

Timothy Froude, P. Geo.,

President & CEO

709-765-1726

tim@sokomanmineralscorp.com

Cathy Hume, Director,

Investor Relations

416-868-1079 x231

cathy@chfir.com

Website: www.sokomanmineralscorp.com

Twitter: @SokomanMinerals

Facebook: @SokomanMinerals

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Investors are cautioned that trading in the securities of the Corporation should be considered highly speculative. Except for historical information contained herein, this news release contains forward-looking statements that involve risks and uncertainties. Actual results may differ materially. Sokoman Minerals Corp. will not update these forward-looking statements to reflect events or circumstances after the date hereof. More detailed information about potential factors that could affect financial results is included in the documents filed from time to time with the Canadian securities regulatory authorities by Sokoman Minerals Corp.

Sokoman Files For Exchange Approval To Close Non-Brokered Private Placement

St. John’s, NL, December 14, 2020 - Sokoman Minerals Corp. (‘Sokoman’ or ‘the Company’) (TSX.V: SIC) (OTCQB: SICNF) today announces that it has filed documents with the TSX Venture Exchange seeking final approval for its non-brokered private placement of flow-through shares (the “Private Placement”) announced on December 2, 2020.

On receipt of all regulatory approvals, the Company will issue 15,000,000 flow-through shares at a price of $0.20 per flow-through share for aggregate gross proceeds of $3,000,000, including $48,500 taken by the insiders of the Company. The flow-through shares will entitle the holder to receive the tax benefits applicable to flow-through shares, in accordance with provisions of the Income Tax Act (Canada).

Upon receipt of regulatory approval and in connection with the private placement, the Company will pay $164,397 in finders’ fees and will issue 764,550 broker warrants exercisable at $0.20 for 12 months from the date of issue, as permitted by the policies of the TSX Venture Exchange. All securities issued pursuant to the private placement will be subject to a four-month hold period.

The proceeds of this financing will be directed towards advancing the Company’s flagship Moosehead Gold Project.

About Sokoman Minerals Corp.

Sokoman Minerals Corp. is a discovery-oriented company with projects in Newfoundland & Labrador, Canada. The Company’s primary focus is its portfolio of gold projects (Moosehead, Crippleback Lake and East Alder) in Central Newfoundland on the structural corridor hosting Marathon Gold’s Valentine Lake project. Valentine Lake is reported to host estimated Proven and Probable Mineral Reserves of 1.87 Moz (41.05 Mt at 1.41 g/t Au), and Total Measured and Indicated Mineral Resources (inclusive of the Mineral Reserves) of 3.09 Moz (54.9 Mt at 1.75 g/t Au). Additional Inferred Mineral Resources are 0.96 Moz (16.77 Mt at 1.78 g/t Au). Reserves and resource totals for the Valentine Lake Project are taken from the Marathon Gold website, November 16, 2020.

The Company also has a 100% interest in an early-stage antimony/gold project in Newfoundland optioned to White Metal Resources Inc. In Labrador, the Company has a 100% interest in the Iron Horse (Fe) project.

Mineralization hosted on adjacent and/or nearby properties is not necessarily indicative of mineralization hosted on the Company’s property.

The Company would like to thank the Government of Newfoundland and Labrador for financial support of the project through the Junior Exploration Assistance Program. Sokoman has been approved for funding for a portion of 2020 exploration activities.

To learn more, please contact:

Timothy Froude, P. Geo.,

President & CEO

709-765-1726

tim@sokomanmineralscorp.com

Cathy Hume, Director,

Investor Relations

416-868-1079 x231

cathy@chfir.com

Website: www.sokomanmineralscorp.com

Twitter: @SokomanMinerals

Facebook: @SokomanMinerals

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Investors are cautioned that trading in the securities of the Corporation should be considered highly speculative. Except for historical information contained herein, this news release contains forward-looking statements that involve risks and uncertainties. Actual results may differ materially. Sokoman Minerals Corp. will not update these forward-looking statements to reflect events or circumstances after the date hereof. More detailed information about potential factors that could affect financial results is included in the documents filed from time to time with the Canadian securities regulatory authorities by Sokoman Minerals Corp.

Sokoman Minerals Announces Non-Brokered Flow-Through Private Placement

St. John’s, NL, December 2, 2020 - Sokoman Minerals Corp. (‘Sokoman’ or ‘the Company’) (TSX.V: SIC) (OTCQB: SICNF) today announces that, subject to all regulatory approvals, the Company intends to complete a non-brokered private placement of flow-through shares (the “Private Placement”). The Private Placement is expected to be filed with the Exchange on or around December 11, 2020.

Sokoman intends to issue flow-through shares at a price of $0.20 per flow-through share for gross proceeds of up to $2,000,000. The flow-through shares will entitle the holder to receive the tax benefits applicable to flow-through shares, in accordance with provisions of the Income Tax Act (Canada).

In connection with the Private Placement, the Company will pay finders’ fees of 6% cash and 6% broker warrants, as permitted by the policies of the TSX Venture Exchange. All securities issued pursuant to the Private Placement will be subject to a four month and one day hold period.

The proceeds of this financing will be directed towards advancing the Company’s flagship Moosehead Gold Project.

“With approximately 6,000 m of a proposed 10,000 m Phase 6 completed and with excellent results so far, including MH-20-115 returning 4.60 m at 47.2 g/t Au and 8.1 m at 68.7 g/t Au (November 17, 2020 News Release), we are tapping into seasonal flow-through funds available now to ensure we have the flexibility to expand our current Phase 6 program this winter. We still have numerous high-priority targets to be tested and it is becoming clear that 10,000 m will not be enough to test all key targets. We expect to be drilling well into 2021, quite possibly until spring breakup,” said Tim Froude, Sokoman’s President & CEO.

About Sokoman Minerals Corp.

Sokoman Minerals Corp. is a discovery-oriented company with projects in Newfoundland & Labrador, Canada. The Company’s primary focus is its portfolio of gold projects (Moosehead, Crippleback Lake and East Alder) in Central Newfoundland on the structural corridor hosting Marathon Gold’s Valentine Lake project. Valentine Lake is reported to host estimated Proven and Probable Mineral Reserves of 1.87 Moz (41.05 Mt at 1.41 g/t Au), and Total Measured and Indicated Mineral Resources (inclusive of the Mineral Reserves) of 3.09 Moz (54.9 Mt at 1.75 g/t Au). Additional Inferred Mineral Resources are 0.96 Moz (16.77 Mt at 1.78 g/t Au). Reserves and resource totals for the Valentine Lake Project are taken from the Marathon Gold website, November 16, 2020.

The Company also has a 100% interest in an early-stage antimony/gold project in Newfoundland optioned to White Metal Resources Inc. In Labrador, the Company has a 100% interest in the Iron Horse (Fe) project.

Mineralization hosted on adjacent and/or nearby properties is not necessarily indicative of mineralization hosted on the Company’s property.

The Company would like to thank the Government of Newfoundland and Labrador for financial support of the project through the Junior Exploration Assistance Program. Sokoman has been approved for funding for a portion of 2020 exploration activities.

To learn more, please contact:

Timothy Froude, P. Geo.,

President & CEO

709-765-1726

tim@sokomanmineralscorp.com

Cathy Hume, Director,

Investor Relations

416-868-1079 x231

cathy@chfir.com

Website: www.sokomanmineralscorp.com

Twitter: @SokomanMinerals

Facebook: @SokomanMinerals

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Investors are cautioned that trading in the securities of the Corporation should be considered highly speculative. Except for historical information contained herein, this news release contains forward-looking statements that involve risks and uncertainties. Actual results may differ materially. Sokoman Minerals Corp. will not update these forward-looking statements to reflect events or circumstances after the date hereof. More detailed information about potential factors that could affect financial results is included in the documents filed from time to time with the Canadian securities regulatory authorities by Sokoman Minerals Corp.

Sokoman Minerals Announces Stock Option Grant

St. John’s, NL, November 27, 2020 – Sokoman Minerals Corp. (TSX-V: SIC) (OTCQB: SICNF) (the “Company” or “Sokoman”) today announces a stock option grant to officers, directors, employees and consultants of the Company, subject to TSX Venture Exchange approval, for up to a total of 3,000,000 common shares of the Company. These stock options are exercisable at CDN $0.22 per stock option, which represents a 30% premium to a current share price.

About Sokoman Minerals Corp.

Sokoman Minerals Corp. is a discovery-oriented company with projects in Newfoundland & Labrador, Canada. The Company’s primary focus is its portfolio of gold projects (Moosehead, Crippleback Lake and East Alder) in Central Newfoundland on the structural corridor hosting Marathon Gold’s Valentine Lake project. Valentine Lake is reported to host estimated Proven and Probable Mineral Reserves of 1.87 Moz (41.05 Mt at 1.41 g/t Au), and Total Measured and Indicated Mineral Resources (inclusive of the Mineral Reserves) of 3.09 Moz (54.9 Mt at 1.75 g/t Au). Additional Inferred Mineral Resources are 0.96 Moz (16.77 Mt at 1.78 g/t Au). Reserves and resource totals for the Valentine Lake Project are taken from the Marathon Gold website, November 16, 2020.

The Company also has a 100% interest in an early-stage antimony/gold project in Newfoundland optioned to White Metal Resources Inc. In Labrador, the Company has a 100% interest in the Iron Horse (Fe) project.

Mineralization hosted on adjacent and/or nearby properties is not necessarily indicative of mineralization hosted on the Company’s property.

The Company would like to thank the Government of Newfoundland and Labrador for financial support of the project through the Junior Exploration Assistance Program. Sokoman has been approved for funding for a portion of 2020 exploration activities.

To learn more, please contact:

Timothy Froude, P. Geo.,

President & CEO

709-765-1726

tim@sokomanmineralscorp.com

Cathy Hume, Director,

Investor Relations

416-868-1079 x231

cathy@chfir.com

Website: www.sokomanmineralscorp.com

Twitter: @SokomanMinerals

Facebook: @SokomanMinerals

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Investors are cautioned that trading in the securities of the Corporation should be considered highly speculative. Except for historical information contained herein, this news release contains forward- looking statements that involve risks and uncertainties. Actual results may differ materially. Sokoman Minerals Corp. will not update these forward-looking statements to reflect events or circumstances after the date hereof. More detailed information about potential factors that could affect financial results is included in the documents filed from time to time with the Canadian securities regulatory authorities by Sokoman Minerals Corp.

Sokoman Minerals Cuts Two High-Grade Intervals At Eastern Trend, Moosehead Project, Central Newfoundland: 4.6 M At 47.2 G/T Au And 8.1 M At 68.7 G/T Au

Near-Surface, High-Grade Splay Identified at Eastern Trend

St. John’s, NL, November 19, 2020 – Sokoman Minerals Corp. (TSX-V: SIC) (OTCQB: SICNF) (the “Company” or “Sokoman”) is pleased to announce that ongoing drilling at the Moosehead Project has returned high-grade gold in a near-surface, newly recognized splay off of the main Eastern Trend. Drill holes MH-20-115 and MH-20-116 were collared to the south of discovery hole MH-18-01, as part of the Company’s 10,000-metre Phase 6 program.

Rush assay results (metallics) from MH-20-115 returned two intersections* as follows:

upper interval of 47.20 g/t Au over 4.60 m from 64.00 m downhole

lower interval of 68.70 g/t Au over 8.10 m from 111.20 m downhole

*reported lengths are core lengths and are believed to be 60 to 70% true thickness

Rush assays for MH-20-116, located 10 m further south of MH-20-115, also intersected 2 zones, including an upper interval of 11.85 g/t Au over 1.80 m from 54.50 m downhole, and a lower interval of 2.94 g/t Au over 4.30 m, including 7.57 g/t Au over 1.25 m, from 183.80 m downhole.

Tim Froude, President and CEO of Sokoman, says: “The drill results continue to demonstrate the high-grade nature of the gold mineralization at the Moosehead Project. They also reinforce the importance of tighter drill hole spacing in these Fosterville style gold systems which provide key insights into high-grade gold variability and orientation. The Phase 6 program is continuing with one drill due to limited equipment availability given the high level of exploration in the province. As a result, we will be testing high-priority targets defined by till and magnetic surveys while we wait for all the pending assay results. We expect the drilling to continue into 2021, since several targets require winter conditions to allow access and we are also applying for permits for ice-based drilling in the winter.”

The upper intervals in MH-20-115 and 116 are interpreted to occur in a footwall splay off of the upper levels of the main Eastern Trend and correlate with an intercept in MH-18-01 (located ten metres to the north) that assayed 7.11 g/t Au over 1.25 m. MH-18-01 also included a higher-grade subinterval of a visible gold bearing quartz vein that assayed 35.04 g/t Au over 0.25 m. The splay is modelled as a northwesterly trending structure with a shallow 30-degree dip to the north. The location of the splay merger with the north trending Eastern Trend could influence and focus high-grade gold in this area.

The splay is open to the south and west, and due to its orientation was not targeted in earlier drilling campaigns. Further modelling of these intercepts will take place before additional drilling is proposed for this highly prospective area. Similar high-grade splays are associated with the high-grade Swan Zone at the Fosterville gold mine in Australia.

The lower intersections in MH-20-115 and 116 extend the Eastern Trend Main zone at least 20 m to the south (remains open), which includes the MH-18-01 intercept of 11.90 m grading 44.96 g/t Au among others. The mineralization in MH-20-115 and 116 is consistent with earlier intersections in the Eastern Trend and characterized by moderate to strong stylolitic quartz veining similar to the Fosterville deposit in Australia. The strong association with antimony sulphides, mainly boulangerite, represents an additional similarity to Fosterville. (see photos here)

Phase 6 Drilling Program

A total of 4,009 metres in 15 holes has been completed testing target areas including three holes in the Western Trend (MH-20-111, 113 and 114) and 12 holes in the Eastern Trend. Drilling in the Western Trend focused on testing deeper portions of the zone and all three holes intersected structures with variable quartz veining with disseminated pyrite and arsenopyrite. To date, only MH-20-114 has been sampled and assays are pending; the other two holes, MH-20-111 and 113, are in various stages of logging and sampling.

Drilling on the Eastern Trend has involved a combination of deeper, 50-100-m spaced holes testing below the 200-metre vertical level at the north end with shallow targets in the southern portion, where only a single shallow hole (MH-20-122) has tested the zone. This drilling also includes the lower intersections in MH-20-115 and 116 as discussed above.

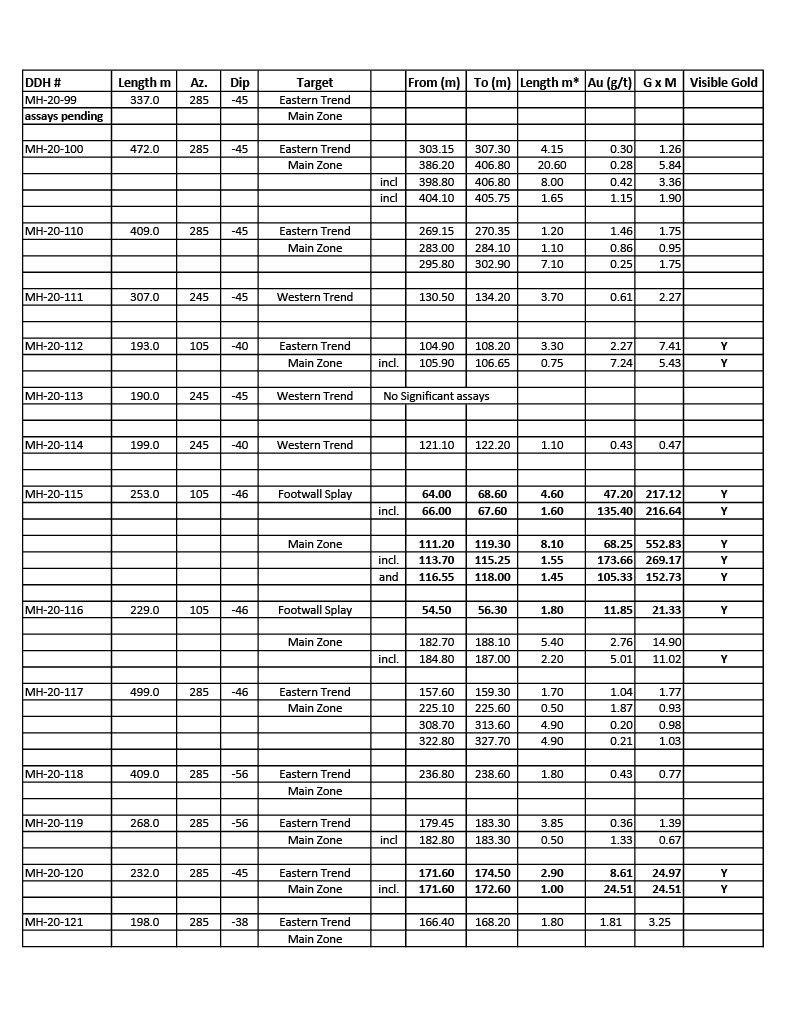

Mineralized shears and faults were encountered in all holes as expected, with detailed logging and sampling underway. Holes MH-20-112 and 120 intersected structures with quartz/sulphide veins with specks of visible gold in veins 30 to 50 cm wide in the main Eastern Trend shear zone. Numerous wide intervals (10-30 metres) of shearing with variable amounts of quartz veining with locally 1-3% pyrite and arsenopyrite were encountered in the deeper testing of the Eastern Trend, specifically holes MH-20-99 and 100. While not returning high grades, the holes did hit some of the thickest intersections of mineralized and altered rocks to date and suggest the zone continues to depth and will receive deeper testing later in the program. Several holes remain to be logged and sampled with assays pending for multiple holes except those in the accompanying table. Select intervals from holes with visible gold noted are being prioritized for rush analysis.

About Moosehead Gold Project

The 100%-owned Moosehead Gold Project is located along the Trans-Canada Highway in North Central Newfoundland, on the same structural trend as the advanced Valentine Lake Project (Marathon Gold), and adjacent to New Found Gold’s Queensway Project. Both the Moosehead and Queensway projects are targeting high-grade, turbidite hosted, Fosterville-type gold mineralization.

The mineralization has been defined over a 500 m strike length and a 200 m vertical height and remains open, with high-grade drill results including 5.10 m of 124.20 g/t Au (as in MH-18-39).

QP

This news release has been reviewed and approved by Timothy Froude, P. Geo., a “Qualified Person” under National Instrument 43-101 and President and CEO of Sokoman Minerals Corp.

COVID-19 Protocols

To ensure a working environment that protects the health and safety of the staff and contractors, Sokoman is operating under federally and provincially mandated and recommended guidelines during the current COVID-19 alert level.

Analytical Techniques / QA/QC

All core samples submitted for assay were saw cut by Sokoman personnel with one half submitted for assay and one half retained for reference. Samples were delivered in sealed bags directly to the lab by Sokoman Minerals personnel. Samples, including duplicates, blanks and standards, were submitted to Eastern Analytical Ltd. in Springdale, Newfoundland for gold analysis. Eastern Analytical is an accredited assay lab that conforms to requirements of ISO/IEC 17025. Samples with possible visible gold were submitted for total pulp metallics and gravimetric finish. All other samples were analyzed by standard fire assay methods. Total pulp metallic analysis includes: the whole sample is crushed to -10 mesh; then pulverized to 95% -150 mesh; the total sample is weighed and screened 150 mesh; the +150 mesh fraction is fire assayed for Au, and a 30 g subsample of the -150 mesh fraction is fire assayed for Au; with a calculated weighted average of total Au in the sample reported as well. One blank and one industry approved standard for every twenty samples submitted, is included in the sample stream. In addition, random duplicates of selected samples are analyzed in addition to the in-house standard and duplicate policies of Eastern Analytical.

About Sokoman Minerals Corp.

Sokoman Minerals Corp. is a discovery-oriented company with projects in Newfoundland & Labrador, Canada. The Company’s primary focus is its portfolio of gold projects (Moosehead, Crippleback Lake and East Alder) in Central Newfoundland on the structural corridor hosting Marathon Gold’s Valentine Lake project. Valentine Lake is reported to host estimated Proven and Probable Mineral Reserves of 1.87 Moz (41.05 Mt at 1.41 g/t Au), and Total Measured and Indicated Mineral Resources (inclusive of the Mineral Reserves) of 3.09 Moz (54.9 Mt at 1.75 g/t Au). Additional Inferred Mineral Resources are 0.96 Moz (16.77 Mt at 1.78 g/t Au). Reserves and resource totals for the Valentine Lake Project are taken from the Marathon Gold website, November 16, 2020.

The Company also has a 100% interest in an early-stage antimony/gold project in Newfoundland optioned to White Metal Resources Inc. In Labrador, the Company has a 100% interest in the Iron Horse (Fe) project.

Mineralization hosted on adjacent and/or nearby properties is not necessarily indicative of mineralization hosted on the Company’s property.

The Company would like to thank the Government of Newfoundland and Labrador for financial support of the project through the Junior Exploration Assistance Program. Sokoman has been approved for funding for a portion of 2020 exploration activities.

Phase 6 Current Table of Results

To learn more, please contact:

Timothy Froude, P. Geo.,

President & CEO

709-765-1726

tim@sokomanmineralscorp.com

Cathy Hume, Director,

Investor Relations

416-868-1079 x231

cathy@chfir.com

Website: www.sokomanmineralscorp.com

Twitter: @SokomanMinerals

Facebook: @SokomanMinerals

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Investors are cautioned that trading in the securities of the Corporation should be considered highly speculative. Except for historical information contained herein, this news release contains forward- looking statements that involve risks and uncertainties. Actual results may differ materially. Sokoman Minerals Corp. will not update these forward-looking statements to reflect events or circumstances after the date hereof. More detailed information about potential factors that could affect financial results is included in the documents filed from time to time with the Canadian securities regulatory authorities by Sokoman Minerals Corp.

Sokoman Minerals Receives Final Till Sample Results At Moosehead Gold Project; Multiple New Drill Target Areas Identified

Sokoman to Host a Webinar on Tuesday, October 20 at 2 PM EST