Newsroom

Sokoman Minerals Enters Into Strategic Option Agreement With Trans Canada Gold Corp. For Its Crippleback Lake Gold Project In Central Newfoundland

St. John’s, NL, June 3, 2021 – Sokoman Minerals Corp. (TSXV: SIC) (OTCQB: SICNF) (the “Company” or “Sokoman”) is pleased to announce that the Company has entered into an option agreement with Trans Canada Gold Corp. (TSXV: TTG) (“Trans Canada”), whereby Trans Canada can earn a 100% interest in the 121 claim (3,025 ha or 7,475 acres) Crippleback Lake Gold property (the “Property”), subject to a 1% net smelter returns royalty (“NSR”), by issuing a total of 1,250,000 shares of the company to Sokoman as well as cash and work commitments totaling $600,000 over a 4-year period. The Property is located in proximity to the Trans-Canada Highway in north-central Newfoundland, is easily accessible by a network of secondary logging roads and is only a short drive away from assaying and diamond drilling services in Springdale.

The Crippleback Lake Gold project covers the northeastern extension of the regional-scale Valentine Lake fault zone and lies roughly midway between the Valentine Lake gold deposits (Marathon Gold) and Sokoman’s own Moosehead Gold Project in the rapidly emerging Central Newfoundland Gold Belt.

Tim Froude, President and CEO of Sokoman Minerals Corp., stated: “We are very pleased to partner with Trans Canada and their experienced gold group at Crippleback Lake, and we will assist in whatever way we can towards the advancement of the Property. Historically, the area has attracted explorers for the renowned base-metal potential of Central Newfoundland. Today, however, the focus has shifted in a monumental way to the gold potential of the region, and Crippleback is exquisitely positioned in one of Canada’s hottest exploration camps and shares many of the attributes of the advanced stage Valentine Lake Project (Marathon Gold) including the crucial structural corridor (Rogerson Lake Conglomerate), as well as the presence of the Crippleback Lake Quartz Monzonite, the on-strike equivalent of the Valentine Lake Intrusive Suite, host to Marathon’s Valentine Lake gold deposits. Sokoman shareholders receive the benefit of an experienced team advancing a project that we were not advancing as rapidly as it deserves due to our focus on Moosehead. We look forward to Trans Canada’s success on the Property.”

“By acquiring this strategically located block of gold claims in Central Newfoundland in this modern-day gold rush, our geological team of gold experts is extremely excited about optioning and forming a strategic alliance with Sokoman Minerals in this option agreement, which will be a great opportunity for both world-class gold teams of exploration geologists to perform exploration work and share drilling knowledge while drilling between Marathon Gold’s Valentine Lake gold deposit and Sokoman’s 100% owned Moosehead Gold project and discovery. We will be submitting exploration permit applications immediately with the Government of Newfoundland and Labrador. Trans Canada is excited about the new addition of this premier gold exploration asset to our growing gold asset portfolio situated in Canada,” commented Tim Coupland, President & CEO of Trans Canada.

Project Highlights:

121 mineral claims (3,025 ha or 7,475 acre), fully road accessible from the Trans-Canada Highway with numerous secondary logging roads internal to the claims.

Covers a 13-kilometre strike length of the gold-rich Valentine Lake Structural Zone midway between Marathon Gold’s Valentine Lake project and Sokoman Minerals high-grade Moosehead project.

Robust gold in lake sediment and till samples, with multiple till samples exhibiting delicate (proximal to source) gold grains as well as angular float samples assaying up to 1.7 g/t gold.

All previous exploration efforts focused on base metals.

Exploration permits pending.

Summary Terms of Agreement

Trans Canada can acquire 100% of Crippleback Lake by issuing 1,250,000 common shares of Trans Canada Gold and cash and work commitments totaling $600,000 over a 4-year period. Sokoman will retain a 1.0 % net smelter return royalty on Crippleback Lake, with Trans Canada Gold having the right to buy down 0.5% of the royalty for $1,000,000.

The Option agreement, including the issuance of Trans Canada Gold Shares, is subject to TSX Venture Exchange (the “Exchange”) approval. The Trans Canada share will be subject to a statutory hold period.

Option Payment Summary:

$10,000 cash and 250,000 common shares of the Company to Sokoman within 10 days of the effective date, subject to a six-month escrow period from the Effective Date following the Exchange approval: on the Exercise Date, granting Sokoman a net smelter royalty to the buydown of 0.5% for 1,000,000 on the terms and conditions set forth in the Option Agreement.

$15,000 cash and $50,000 in property expenditures and the issuance of 250,000 common shares to Sokoman on or before the first anniversary of the Effective Date.

$25,000 cash and $100,000 in property expenditures and the issuance of 250,000 common shares to Sokoman on or before the second anniversary of the Effective Date.

$25,000 cash and $150,000 in property expenditures and the issuance of 250,000 common shares to Sokoman on the Property on or before the third anniversary of the Effective Date.

$25,000 cash and $200,000 in property expenditures and the issuance of 250,000 common shares on the Property on or before the fourth anniversary of the Effective Date.

QP

Tim Froude, P.Geo., a Qualified Person as defined by National Instrument 43-101, has reviewed and approved the technical information disclosed in the news release.

About Sokoman Minerals Corp.

Sokoman Minerals Corp. is a discovery-oriented company with projects in Newfoundland & Labrador, Canada. The Company’s primary focus is its portfolio of gold projects: Moosehead, Crippleback Lake (optioned to Trans Canada Gold Corp.) and East Alder (optioned to Canterra Minerals Corporation) along the Central Newfoundland Gold Belt, and the recently acquired district-scale Fleur de Lys project in northwestern Newfoundland, which is targeting Dalradian-type orogenic gold mineralization similar to the Curraghinalt and Cavanacaw deposits in Northern Ireland, and Cononish in Scotland. The Company also recently entered into a strategic alliance with Benton Resources Inc. through three large-scale joint venture properties including Grey River, Golden Hope and Kepenkeck in Newfoundland. Sokoman now controls independently and through the Benton alliance over 150,000 hectares (>6,000 claims) of land, making the Company one of the largest landholders in Newfoundland, Canada’s newest and rapidly emerging gold districts. The Company also retains an interest in an early-stage antimony/gold project (Startrek) in Newfoundland, optioned to White Metal Resources Inc., and in Labrador, the Company has a 100% interest in the Iron Horse (Fe) project that has Direct Shipping Ore (DSO) potential.

Mineralization hosted on adjacent and/or nearby properties is not necessarily indicative of mineralization hosted on the Company’s property.

To learn more, please contact:

Timothy Froude, P. Geo.,

President & CEO

709-765-1726

tim@sokomanmineralscorp.com

Cathy Hume, Director,

Investor Relations

416-868-1079 x251

cathy@chfir.com

Website: www.sokomanmineralscorp.com

Twitter: @SokomanMinerals

Facebook: @SokomanMinerals

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Investors are cautioned that trading in the securities of the Corporation should be considered highly speculative. Except for historical information contained herein, this news release contains forward- looking statements that involve risks and uncertainties. Actual results may differ materially. Sokoman Minerals Corp. will not update these forward-looking statements to reflect events or circumstances after the date hereof. More detailed information about potential factors that could affect financial results is included in the documents filed from time to time with the Canadian securities regulatory authorities by Sokoman Minerals Corp.

Sokoman And Benton Jointly Acquire Grey River Gold Project In Southern Newfoundland

Property hosts multiple untested high-grade gold occurrences

St. John’s, NL, May 27, 2021 – Sokoman Minerals Corp. (TSXV: SIC) (OTCQB: SICNF) (the “Company” or “Sokoman”) is pleased to announce, together with Benton Resources Inc. (“Benton”) (TSXV: BEX), the joint acquisition of the 324 claim (8,100 hectare) Grey River Gold Project in southern Newfoundland. The Property includes 11 claim units (275 hectares) optioned from local interests under letter agreements, more details to be released in the coming weeks. The Grey River acquisition is consistent with the newly formed Sokoman/Benton Alliance, which is targeting district-scale gold opportunities in Newfoundland. Sokoman is now one of the largest land holders in Newfoundland with direct ownership or co-ownership of over 150,000 hectares (+6,000 claims) and is sufficiently funded to advance its portfolio of properties.

The Grey River Gold Project is centered on the community of Grey River, a deep-water, ice-free harbour on the south coast of the Island of Newfoundland, 32 km east of the town of Burgeo, and 38 km southeast of the recently acquired Golden Hope Joint Venture (see Press Release dated May 20, 2021). The SIC-BEX claims straddle a fundamental east-west trending ductile shear zone that separates a large enclave of Late Precambrian amphibolite, gabbro, metasediments, felsic metavolcanics and mafic orthogneisses from a batholith-scale, syn-kinematic suite of Siluro-Devonian granitoid rocks. The east-west trending amphibolite-grade metamorphic units are correlatives of the coeval basement block exposed on-strike, farther west in the Hermitage Flexure, near Burgeo and at Hope Brook. The east-west shear zone at Grey River, and parallel structures immediately offshore, are fundamental crustal breaks, along which several metal-rich mid- to late-Devonian granites were emplaced along the southern coast of the Island.

Rocks in this segment of the Hermitage Flexure are unusually enriched in gold (Au), molybdenum (Mo), copper (Cu), tungsten (W), fluorine (F) and bismuth (Bi). A 5-km-wide by 10-km-long area within and adjoining the property, between Grey River and Gulch Cove, is particularly metal-rich, hosting: i) multiple mesothermal and intrusion-related Au-rich (+/- Bi-Ag-Sb-Pb-Zn) quartz veins; ii) a porphyry Mo-Cu deposit (Moly Brook); iii) a vein-type wolframite-rich W deposit (Grey River #10); and iv) a unique, diffusely bounded, high-purity, locally auriferous silica deposit (Gulch Cove) of equivocal origin. Each appear to be associated with distinct features in the regional aero magnetics and are also reflected in regional Government lake-sediment geochemistry coverage of the area. The primary focus of upcoming SIC-BEX exploration is quartz-vein-hosted, structurally controlled and intrusion-related, high-grade Au (+/- Ag, Bi, Sb) in both the granitic and adjacent metamorphic terranes.

Previous exploration at Grey River identified gold in several settings: in base-metal-rich and sulfide-poor, quartz veins and veinlets in the gneisses and related metamorphic rocks, including regional-scale silica bodies; in quartz veins with coarse-grained sulfides in granite; in sulfide-poor, quartz stock-work in sericitized granite; and in stockwork-style quartz and quartz-sulfide veinlets with or without pervasive silica replacement in granite.

Gold grades reported from historic grab samples and channel samples from the property range from less than 1 g/t to over 225 g/t Au, locally with 200-300 g/t Ag, with or without anomalous Bi, Sb (antimony) and W. The 225 g/t Au chip sample is from a 20-30 cm wide zone of pyritic alteration immediately adjacent to an 8-km-long, diffusely bounded quartz zone. The latter coincides with the large, elongated high-purity silica body (12M tonnes >95% SiO) drilled by the Newfoundland Government in 1967 as part of an Island-wide silica assessment program. The diffusely bounded, irregularly shaped silica lies at the boundary of amphibolite gneisses and mica-schists, and within mica schists, along the flank of a prominent aeromagnetic high. Its origin is unclear and past workers have proposed differing origins (e.g., meta-quartzite; quartz vein; silica replacement zone). The style, grades, setting and Au-Ag-Bi-W-Sb geochemical signature of some of the gold mineralization led previous exploration groups to draw comparisons with the high-grade Pogo gold mine within the Tintina Gold Belt of Alaska and Yukon (gold in diffusely bounded quartz bodies within amphibolite grade gneisses). The Pogo mine, up to the end of 2019, had produced 3.9 million oz gold at 13.6 g/t gold, with reserves of over 7 million oz gold.

QP

This news release has been reviewed and approved by Timothy Froude, P. Geo., a “Qualified Person” under National Instrument 43-101 and President and CEO of Sokoman Minerals Corp.

COVID-19 Protocols

To ensure a working environment that protects the health and safety of the staff and contractors, Sokoman is operating under federally and provincially mandated and recommended guidelines during the current COVID-19 alert level.

About Sokoman Minerals Corp.

Sokoman Minerals Corp. is a discovery-oriented company with projects in Newfoundland & Labrador, Canada. The Company’s primary focus is its portfolio of gold projects Moosehead, Crippleback Lake and East Alder (optioned to Canterra Minerals Corporation) along the Central Newfoundland Gold Belt, and the recently acquired, district scale Fleur de Lys project in northwestern Newfoundland, which is targeting Dalradian type orogenic gold mineralization similar to the Curraghinalt and Cavanacaw deposits in Northern Ireland. Through recent acquisitions with Benton Resources Inc. (Sokoman Benton Alliance), Sokoman controls one of the largest land holdings in Newfoundland with over 150,000 hectares (1500 km2) of highly prospective ground in Canada’s newest and rapidly emerging gold districts. The Company also retains an interest in an early-stage antimony/gold project (Startrek) in Newfoundland, optioned to White Metal Resources Inc., and in Labrador, the Company has a 100% interest in the Iron Horse (Fe) project which has Direct Shipping Ore (DSO) potential.

Newfoundland Gold Exploration Properties

Grey River Property

To learn more, please contact:

Timothy Froude, P. Geo.,

President & CEO

709-765-1726

tim@sokomanmineralscorp.com

Cathy Hume, Director,

Investor Relations

416-868-1079 x251

cathy@chfir.com

Website: www.sokomanmineralscorp.com

Twitter: @SokomanMinerals

Facebook: @SokomanMinerals

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Investors are cautioned that trading in the securities of the Corporation should be considered highly speculative. Except for historical information contained herein, this news release contains forward- looking statements that involve risks and uncertainties. Actual results may differ materially. Sokoman Minerals Corp. will not update these forward-looking statements to reflect events or circumstances after the date hereof. More detailed information about potential factors that could affect financial results is included in the documents filed from time to time with the Canadian securities regulatory authorities by Sokoman Minerals Corp.

Sokoman Announces Strategic Alliance With Benton Resources To Acquire Gold Opportunities In Newfoundland

Joint Venture Arrangement to Include Newly Acquired Golden Hope and Kepenkeck Properties

St. John’s, NL, May 20, 2021 – Sokoman Minerals Corp. (TSXV: SIC) (OTCQB: SICNF) (the “Company” or “Sokoman”) is pleased to announce that it has entered into a strategic alliance with Benton Resources Inc. (“Benton”) (TSXV: BEX) to jointly acquire and explore gold opportunities in Newfoundland. The partners are also pleased to announce the acquisition, by staking, of the 3,146 claim (78,650 hectares) Golden Hope Joint Venture (“Golden Hope JV” or the “Property”) in south-central Newfoundland, one of the largest gold properties on the Island. (See map attached).

The Property covers extensions of two major structures linked to significant gold prospects and deposits in southern Newfoundland. Rock units and structures on the Property are likewise related to those associated with new orogenic gold discoveries in central Newfoundland, including Sokoman’s 100%-owned Moosehead Project and New Found Gold’s Queensway Project. The alliance will also include a 50-50 Joint Venture on Benton’s recently acquired Kepenkeck Gold Property, which, like the Golden Hope JV, lies along trend from Canstar Resources’ Golden Baie Property in the Central Newfoundland Gold Belt (see Benton Resources news release dated May 6, 2021).

The newly staked Golden Hope JV lies at the northwest edge of the Hermitage Flexure, the predominant geological feature of the south Newfoundland Appalachians. The western Hermitage Flexure is a structurally complex region with a diverse mineral endowment. The most prominent structures on the Property, and the focus of imminent exploration, are a linked system of west-verging thrust faults (Bay D’Est Fault Zone) and a transverse, wrench fault system (Gunflap Hills Fault Zone). These types of fault zones can be gold-bearing, and correlative rocks and structures elsewhere in Newfoundland are a prime focus of ongoing gold exploration and the site of major gold discoveries (e.g. Central Newfoundland Gold Belt). Historical exploration by major companies in the western Hermitage Flexure region led to the major gold discoveries at Hope Brook and Cape Ray, currently under advancement by First Mining/Big Ridge Gold and Matador Mines respectively, and spurred the first systematic gold exploration in northern and central Newfoundland. However, outside of these discoveries, the remainder of the west-central Hermitage Flexure remains underexplored, despite known occurrences of gold, the presence of unsourced till, soil and stream sediment geochemical anomalies, and the first-order commonalities and linkages between southern and central Newfoundland. The Golden Hope JV is transected by the paved Burgeo highway and a major power transmission line. Additional details will follow after the compilation of the previous work has been completed.

On the recently optioned Kepenkeck Project , consisting of 595 claim units over 15,625 hectares located near the NE extension of the Hermitage Flexure and along trend from Canstar Resources’ Golden Baie Project, Benton and Sokoman will share the cost of option payments and exploration cost (50-50) and initial exploration will commence shortly. Benton and Sokoman are excited to have acquired the project which has new road access, little historical work, and favourable geology located on a major structure. Recent prospecting completed by the vendor (the Keats) identified up to 2.45 g/t gold in grab samples, and visible gold has been panned from till in two locations on the property. The companies will apply for work permits immediately.

The new alliance with Benton provides Sokoman shareholders with an excellent opportunity to reduce exploration risk, employ the technical expertise of Benton, further strengthen Sokoman’s project portfolio while retaining a focus on Moosehead and Fleur de Lys.

WEBINAR ANNOUNCEMENT

Sokoman Minerals Corp. and Benton Resources Inc. will host a joint webinar next Thursday, May 27 at 2 pm EST to go over the details of the new strategic alliance. Investors can sign up using the following registration link:

https://onlinexperiences.com/Launch/QReg/ShowUUID=DE93F551-FCF4-4FB3-9102-6B8791B1FBC1

QP

This news release has been reviewed and approved by Timothy Froude, P.Geo., a “Qualified Person” under National Instrument 43-101 and President and CEO of Sokoman Minerals Corp.

COVID-19 Protocols

To ensure a working environment that protects the health and safety of the staff and contractors, Sokoman is operating under federally and provincially mandated and recommended guidelines during the current COVID-19 alert level.

About Sokoman Minerals Corp.

Sokoman Minerals Corp. is a discovery-oriented company with projects in Newfoundland & Labrador, Canada. The Company’s primary focus is its portfolio of gold projects: Moosehead, Crippleback Lake and East Alder (optioned to Canterra Minerals Corporation) along the Central Newfoundland Gold Belt, and the recently-acquired district-scale Fleur de Lys project in northwestern Newfoundland, that is targeting Dalradian-type orogenic gold mineralization similar to the Curraghinalt and Cavanacaw deposits in Northern Ireland. Sokoman controls one of the largest land holdings in Newfoundland with more than 50,000 hectares (250 km2) of highly prospective ground in Canada’s newest and rapidly emerging gold districts. The Company also retains an interest in an early-stage antimony/gold project (Startrek) in Newfoundland, optioned to White Metal Resources Inc., and in Labrador, the Company has a 100% interest in the Iron Horse (Fe) project that has Direct Shipping Ore (DSO) potential.

Sokoman’s Property Locations

To learn more, please contact:

Timothy Froude, P. Geo.,

President & CEO

709-765-1726

tim@sokomanmineralscorp.com

Cathy Hume, Director,

Investor Relations

416-868-1079 x251

cathy@chfir.com

Website: www.sokomanmineralscorp.com

Twitter: @SokomanMinerals

Facebook: @SokomanMinerals

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Investors are cautioned that trading in the securities of the Corporation should be considered highly speculative. Except for historical information contained herein, this news release contains forward- looking statements that involve risks and uncertainties. Actual results may differ materially. Sokoman Minerals Corp. will not update these forward-looking statements to reflect events or circumstances after the date hereof. More detailed information about potential factors that could affect financial results is included in the documents filed from time to time with the Canadian securities regulatory authorities by Sokoman Minerals Corp.

Sokoman Announces Results Of Extraordinary General Meeting Of Shareholders

St. John’s, NL, May 19, 2021 – Sokoman Minerals Corp. (TSX.V: SIC) (OTCQB: SICNF) (the “Company” or “Sokoman”) today announced that at the Company’s Extraordinary General Meeting of Shareholders held on Tuesday, May 18th, the Company received shareholder approval for Mr. Eric Sprott to become a greater than 20% shareholder of Sokoman.

About Sokoman Minerals Corp.

Sokoman Minerals Corp. is a discovery-oriented company with projects in Newfoundland & Labrador, Canada. The Company’s primary focus is its portfolio of gold projects Moosehead, Crippleback Lake and East Alder (optioned to Canterra Minerals Corporation) along the Central Newfoundland Gold Belt, and the recently acquired district-scale Fleur de Lys project in northwestern Newfoundland, which is targeting Dalradian-type orogenic gold mineralization similar to the Curraghinalt and Cavanacaw deposits in Northern Ireland. Sokoman controls one of the largest land holdings in Newfoundland with over 50,000 hectares (250 km2) of highly prospective ground in Canada’s newest and rapidly emerging gold districts. The Company also retains an interest in an early-stage antimony/gold project (Startrek) in Newfoundland, optioned to White Metal Resources Inc., and in Labrador, the Company has a 100% interest in the Iron Horse (Fe) project that has Direct Shipping Ore (DSO) potential.

Mineralization hosted on adjacent and/or nearby properties is not necessarily indicative of mineralization hosted on the Company’s property.

The Company would like to thank the Government of Newfoundland and Labrador for financial support of the Moosehead Project through the Junior Exploration Assistance Program.

To learn more, please contact:

Timothy Froude, P. Geo.,

President & CEO

709-765-1726

tim@sokomanmineralscorp.com

Cathy Hume, Director,

Investor Relations

416-868-1079 x251

cathy@chfir.com

Website: www.sokomanmineralscorp.com

Twitter: @SokomanMinerals

Facebook: @SokomanMinerals

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Investors are cautioned that trading in the securities of the Corporation should be considered highly speculative. Except for historical information contained herein, this news release contains forward- looking statements that involve risks and uncertainties. Actual results may differ materially. Sokoman Minerals Corp. will not update these forward-looking statements to reflect events or circumstances after the date hereof. More detailed information about potential factors that could affect financial results is included in the documents filed from time to time with the Canadian securities regulatory authorities by Sokoman Minerals Corp.

Sokoman Announces Additional High-Grade Results From The Moosehead Project, Central Newfoundland

Footwall Splay Results Show Consistency; Additional Mineralized Zone Reported from MH-20-115; South Pond Zones 1 and 2 Open in All Directions; Drilling Resumes with Two Rigs

St. John’s, NL, May 18, 2021 – Sokoman Minerals Corp. (TSXV: SIC) (OTCQB: SICNF) (the “Company” or “Sokoman”) is pleased to announce that ongoing Phase 6 drilling at the 100%-owned Moosehead Property has intersected additional near-surface, high-grade gold mineralization at the Footwall Splay/Eastern Trend. Initial results from South Pond confirm two discreet zones with a higher-grade shoot, and an additional zone of mineralization has been intersected in MH-20-115, drilled in the Eastern Trend Main Zone.

Footwall Splay/Eastern Trend

MH-21-165 – 4.10 m of 21.61 g/t Au, including 2.10 m of 41.39 g/t Au from 79.70 m downhole

MH-21-164 – 4.05 m of 22.62 g/t Au, including 20.95 m of 5.15 g/t Au from 79.95 m downhole

Drilling continues to demonstrate consistency in vein location and average grade at the Footwall Splay/Eastern Trend. Eight holes tested in the zones prior to the spring break-up, with multiple high-grade intersections returned as summarized in the appended Table of Results. An aggressive land-based program will commence immediately with an estimated 5,000 metres expected to be drilled to expand the zones and lay the groundwork for the barge-based program on North Pond scheduled to start later this summer.

The Footwall Splay is a north-south striking, shallow east-dipping zone, lying less than 50 m below surface that appears to be an offshoot of the Eastern Trend Main Zone. At Fosterville in Australia, offsets or splays off the main structures, such as the Swan Zone, carry high-grade gold mineralization. The Footwall Splay has been intersected in 14 holes over a strike length of 130 m, a minimum width of 25 m, and at least 2.5 m in thickness. Given the location of the zone, a barge-based program is the most effective way to test the targets and permitting is in progress to facilitate the program.

Additional sampling in MH-20-115 has resulted in a third zone of gold mineralization, approximately 50 m below the previously released results of 8.10 m of 68.25 g/t Au from 111.20 m downhole. The new intersection includes 10.40 m of 3.09 g/t Au, including 3.60 m of 5.69 g/t Au and 0.70 m of 14.09 g/t Au. While visible gold (“VG”) was not noted, the zone carries typical Moosehead sulphide mineralization of boulangerite and sphalerite, and it is believed to be the down-plunge extension of the Eastern Trend Main Zone.

South Pond

MH-21-152 – 3.00 m of 1.82 g/t Au, including 0.70 m of 3.08 g/t Au from 15.00 m downhole

MH-21-153 – 3.00 m of 1.61 g/t Au, including 1.60 m of 2.40 g/t Au from 12.00 m downhole

Drilling at South Pond has discovered a second mineralized structure (Z-2) approximately 50 m east of the initial zone (Z-1). Drill holes MH-21-152 and 153, the furthest holes south and east, both intersected shallow, near-surface shearing and veining similar in style and mineralogy (boulangerite, arsenopyrite, sphalerite) to higher-grade intersections at Moosehead. Although returning lower-grade results (no VG noted), the overall vein style and mineral assemblage are indicative of the high-grade veining intersected in previous holes at South Pond including MH-20-123 (5.00 m of 26.87 m) and MH-21-141 (4.20 m of 64.00 g/t Au). With only two closely-spaced holes cutting Zone Z-2, and an aggressive 9,000 m program proposed for the South Pond area, Sokoman believes that additional high-grade mineralization will be found in this area. Drilling will begin immediately.

Tim Froude, President and CEO of Sokoman, says: “We are extremely pleased with the results from the Footwall Splay/Eastern Trend as they demonstrate good continuity and grade, and provide a firm foundation for additional drilling in the area from our barge-based program to begin later this summer. At South Pond, a second mineralized structure intersected in the two eastern-most holes (MH-21-152 and 153) is shallow, just 5-10 m below surface and exhibits vein mineralogy consistent with high-grade zones with visible gold encountered in earlier South Pond drill holes, as well as in other zones on the property. As we have previously seen on the property, grade variability is expected when dealing with nuggety mineralization as represented by visible gold. With 38,000 m left to drill in the ongoing Phase 6 program, and four drills on the property later this summer, we are confident we will achieve our goals of enlarging the known zones along strike and to depth and also making additional discoveries at Moosehead. As of today, drilling has resumed with two rigs, one at South Pond and the other at the Footwall Splay/Eastern Trend area.”

About the Moosehead Gold Project

The 100%-owned Moosehead Gold Project is located along the Trans-Canada Highway in north central Newfoundland, on the same structural trend as the advanced Valentine Lake Project (Marathon Gold), and adjacent to New Found Gold’s Queensway Project. Both the Moosehead and Queensway projects are targeting high-grade, turbidite-hosted, Fosterville-type gold mineralization. At least five zones of significant gold-bearing mineralization have been identified to date at Moosehead and multiple high-priority targets independent of the known zones remain to be tested. The Company is currently in the midst of a 50,000 m drill program utilizing up to four drill rigs.

QP

This news release has been reviewed and approved by Timothy Froude, P.Geo., a “Qualified Person” under National Instrument 43-101 and President and CEO of Sokoman Minerals Corp.

COVID-19 Protocols

To ensure a working environment that protects the health and safety of the staff and contractors, Sokoman is operating under federally and provincially mandated and recommended guidelines during the current COVID-19 alert level.

Analytical Techniques / QA/QC

All core samples submitted for assay were saw cut by Sokoman personnel with one-half submitted for assay and one-half retained for reference. Samples were delivered in sealed bags directly to the lab by Sokoman Minerals’ personnel. Samples, including duplicates, blanks and standards, were submitted to Eastern Analytical Ltd. in Springdale, Newfoundland for gold analysis. Eastern Analytical Ltd. is an accredited assay lab that conforms to requirements of ISO/IEC 17025. Samples with possible visible gold were submitted for total pulp metallics and gravimetric finish. All other samples were analyzed by standard fire assay methods. Total pulp metallic analysis includes: the whole sample is crushed to -10 mesh; then pulverized to 95% -150 mesh. The total sample is weighed and screened 150 mesh; the +150 mesh fraction is fire assayed for Au, and a 30 g subsample of the -150 mesh fraction is fire assayed for Au; with a calculated weighted average of total Au in the sample reported as well. One blank and one industry approved standard for every twenty samples submitted, is included in the sample stream. Random duplicates of selected samples are analyzed in addition to the in-house standard and duplicate policies of Eastern Analytical. All reported assays are uncut.

About Sokoman Minerals Corp.

Sokoman Minerals Corp. is a discovery-oriented company with projects in Newfoundland & Labrador, Canada. The Company’s primary focus is its portfolio of gold projects Moosehead, Crippleback Lake and East Alder (optioned to Canterra Minerals Corporation) along the Central Newfoundland Gold Belt, and the recently acquired district-scale Fleur de Lys project in northwestern Newfoundland, which is targeting Dalradian-type orogenic gold mineralization similar to the Curraghinalt and Cavanacaw deposits in Northern Ireland. Sokoman controls one of the largest land holdings in Newfoundland with over 50,000 hectares (250 km2) of highly prospective ground in Canada’s newest and rapidly emerging gold districts. The Company also retains an interest in an early-stage antimony/gold project (Startrek) in Newfoundland, optioned to White Metal Resources Inc., and in Labrador, the Company has a 100% interest in the Iron Horse (Fe) project that has Direct Shipping Ore (DSO) potential.

Mineralization hosted on adjacent and/or nearby properties is not necessarily indicative of mineralization hosted on the Company’s property.

The Company would like to thank the Government of Newfoundland and Labrador for financial support of the Moosehead Project through the Junior Exploration Assistance Program.

Visible Gold from MH-21-165 at 80 m (Footwall Splay) – the scale shows 1 cm (from 3-4)

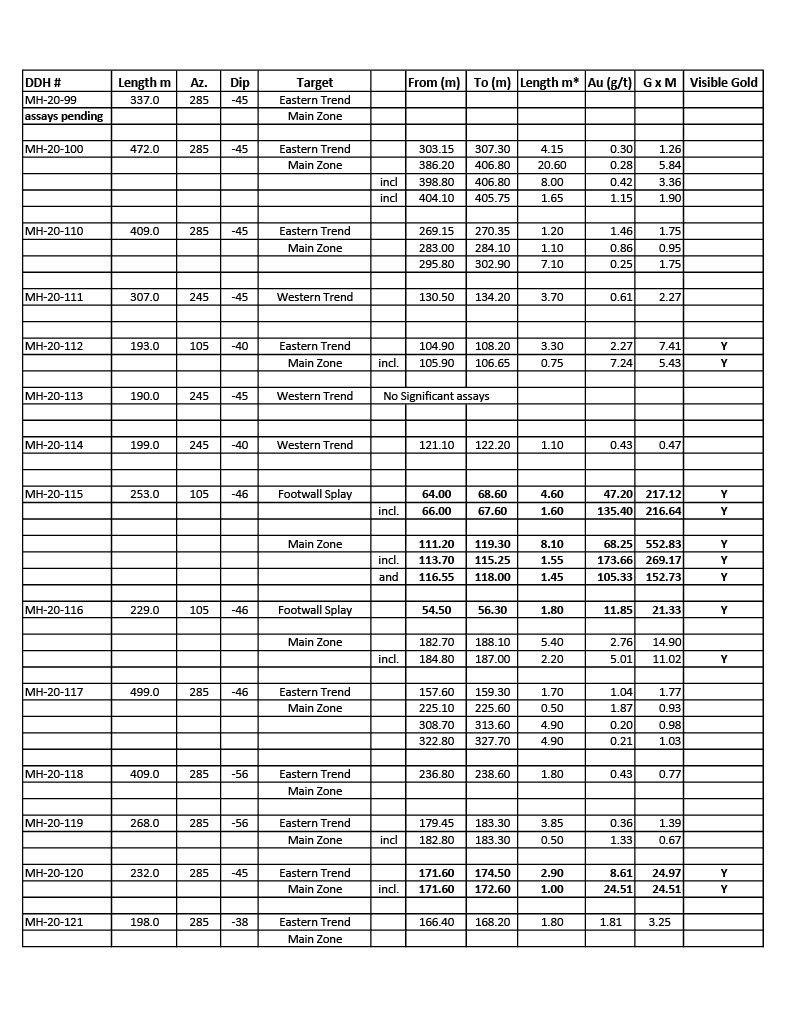

Table of Results – Footwall Splay/Eastern Trend/South Pond – May 18, 2021

To learn more, please contact:

Timothy Froude, P. Geo.,

President & CEO

709-765-1726

tim@sokomanmineralscorp.com

Cathy Hume, Director,

Investor Relations

416-868-1079 x251

cathy@chfir.com

Website: www.sokomanmineralscorp.com

Twitter: @SokomanMinerals

Facebook: @SokomanMinerals

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Investors are cautioned that trading in the securities of the Corporation should be considered highly speculative. Except for historical information contained herein, this news release contains forward- looking statements that involve risks and uncertainties. Actual results may differ materially. Sokoman Minerals Corp. will not update these forward-looking statements to reflect events or circumstances after the date hereof. More detailed information about potential factors that could affect financial results is included in the documents filed from time to time with the Canadian securities regulatory authorities by Sokoman Minerals Corp.

Sokoman Confirms New Discovery At South Pond And Additional High-Grade Intercepts At Footwall Splay, Moosehead Project, Central Newfoundland

MH-21-163 cuts 11.60 m of 21.07 g/t Au, including 5.1 m of 30.82 g/t Au at Footwall Splay

St. John’s, NL, April 28, 2021 – Sokoman Minerals Corp. (TSX-V: SIC) (OTCQB: SICNF) (the “Company” or “Sokoman”) is pleased to announce that ongoing Phase 6 drilling at the 100%-owned Moosehead Property has intersected additional near-surface, high-grade gold mineralization at the Footwall Splay and South Pond Zones, as well as discovered a new, near-surface, mineralized structure at South Pond. Visible gold-bearing quartz veins were intersected in eight recently completed drill holes at the Footwall Splay, including the following three holes.

Footwall Splay

MH-21-157 – 3.50 m of 12.39 g/t Au, including 1.50 m of 28.57 g/t Au from 36.30 m downhole;

MH-21-163 – 11.60 m of 21.07 g/t Au, including 5.10 m of 30.82 g/t Au from 44.0 m downhole;

MH-21-166 – 5.10 m of 15.51 g/t Au, including 2.80 m of 27.68 g/t Au from 9.00 m downhole, (MH-21-166 collared in a visible gold-bearing quartz vein)

South Pond

MH-21-147 – 3.05 m of 16.54 g/t Au, including 0.85 m at 58.91 g/t Au from 72.40 m downhole

New zone has been intersected in drill holes MH-21-152 and 153 – assays are pending.

Tim Froude, President and CEO of Sokoman, says:

“Phase 6 is turning out to be one of best programs to date as we continue to make new discoveries while expanding the known zones at Moosehead with the Footwall Splay and South Pond Zones both showing high-grade, and near-surface results. MH-21-163 and 166 are 25 m and 40 m step-outs to the south of the previously reported MH-21-115 which cut both the Footwall Splay and the Main Eastern Trend, returning 4.60 m of 47.20 g/t Au and 8.10 m of 68.25 g/t Au respectively. MH-21-166, the southern-most hole in the Footwall Splay, collared in visible gold-bearing quartz veining, and the zone remains open to the south.”

Froude continues, “During the final two weeks of drilling, we focused both drills at the Footwall Splay to take advantage of the last of the “winter” ground conditions and we are very pleased with the results. It is still early days for these zones, but we see multiple mineralized structures emerging in the South Pond area. A barge-based drill program is required to test the intersection of the Footwall Splay and the Main Eastern Trend, a structural setting that could represent a scenario similar to the high-grade Eagle/Swan Zone at the Fosterville Mine in Australia. Permitting is underway for the barge-based drill program which is expected to start later this summer and where our fourth drill will focus. Drilling has been temporarily suspended and is expected to resume in mid-to-late May with two drills onsite, and a third drill expected in early June.”

Footwall Splay/Eastern Trend Main Zone

The Footwall Splay is a north-south striking, shallow east-dipping zone that lies less than 50 m vertically below surface that appears to be an offshoot of the Eastern Trend Main Zone. At Fosterville, offsets or splays off the main structures such as the Swan Zone carry high-grade gold mineralization. The Footwall Splay has been intersected in at least 14 holes over a minimum strike length of 130 m, up to 25 m in width, and at least 2.5 m in thickness, and remains open. A barge-based program will be most effective to test these targets and permitting is in progress to facilitate the program. The following table summarizes previously-released, selected intercepts from the Footwall Splay and adjacent Eastern Trend Main Zone area.

South Pond Zone

The recently completed drill program at South Pond has expanded the strike length to 125 m, the depth to 80 m (from surface), and the width to at least 3 m, with the zone remaining open along strike and to depth. Drill hole MH-21-147, reported in this release, cut 3.05 m of 16.54 g/t Au and further builds on this expanding zone. The recent drilling has also revealed a new, near-surface, mineralized structure that has been intersected in at least two holes, MH-21-152 and 153 (assays pending), the most easterly and southerly holes drilled, leaving the zone open for expansion. This structure is similar to the South Pond Zone with host units, variably deformed sediments, with locally-intense quartz veining carrying 1%-5% disseminated pyrite, arsenopyrite, sphalerite and boulangerite as accessory sulphides. Modelling is underway to determine the orientation of this new discovery that will be further tested once drilling resumes.

About the Moosehead Gold Project

The 100%-owned Moosehead Gold Project is located along the Trans-Canada Highway in north-central Newfoundland, on the same structural trend as the advanced Valentine Lake Project (Marathon Gold), and adjacent to New Found Gold’s Queensway Project. Both the Moosehead and Queensway Projects are targeting high-grade, turbidite-hosted, Fosterville-type gold mineralization. At least five zones of significant gold-bearing mineralization have been identified to date at Moosehead and multiple high-priority targets independent of the known zones remain to be tested. The Company is currently in the midst of a 50,000 m drill program utilizing up to four drill rigs.

QP

This news release has been reviewed and approved by Timothy Froude, P.Geo., a “Qualified Person” under National Instrument 43-101 and President and CEO of Sokoman Minerals Corp.

COVID-19 Protocols

To ensure a working environment that protects the health and safety of the staff and contractors, Sokoman is operating under Canadian federally and provincially mandated and recommended guidelines during the current COVID-19 alert level.

Analytical Techniques / QA/QC

All core samples submitted for assay were saw cut by Sokoman personnel with one-half submitted for assay and one-half retained for reference. Samples were delivered in sealed bags directly to the lab by Sokoman personnel. Samples, including duplicates, blanks and standards, were submitted to Eastern Analytical Ltd. in Springdale, Newfoundland for gold analysis. Eastern Analytical Ltd. is an accredited assay lab that conforms to requirements of ISO/IEC 17025. Samples with possible visible gold were submitted for total pulp metallics and gravimetric finish. All other samples were analyzed by standard fire assay methods. Total pulp metallic analysis includes: the whole sample is crushed to -10 mesh; then pulverized to 95% -150 mesh. The total sample is weighed and screened 150 mesh; the +150 mesh fraction is fire assayed for Au, and a 30 g subsample of the -150 mesh fraction is fire assayed for Au; with a calculated weighted average of total Au in the sample reported as well. One blank and one industry-approved standard for every twenty samples submitted, is included in the sample stream. Random duplicates of selected samples are analyzed in addition to the in-house standard and duplicate policies of Eastern Analytical Ltd.. All reported assays are uncut.

About Sokoman Minerals Corp.

Sokoman Minerals Corp. is a discovery-oriented company with projects in Newfoundland & Labrador, Canada. The Company’s primary focus is on its portfolio of gold projects: Moosehead, Crippleback Lake and East Alder (optioned to Canterra Minerals Corporation) along the Central Newfoundland Gold Belt, and the recently-acquired district-scale Fleur de Lys project in northwestern Newfoundland, which is targeting Dalradian-type orogenic gold mineralization similar to the Curraghinalt and Cavanacaw deposits in Northern Ireland. Sokoman controls one of the largest land holdings in Newfoundland, Canada’s newest and rapidly-emerging gold district, with over 50,000 hectares (250 km2) of highly-prospective ground. The Company also retains an interest in an early-stage antimony/gold project (Startrek) in Newfoundland, optioned to White Metal Resources Inc.; and in Labrador, the Company has a 100% interest in the Iron Horse (Fe) project that has Direct Shipping Ore (DSO) potential.

Mineralization hosted on adjacent and/or nearby properties is not necessarily indicative of mineralization hosted on the Company’s property.

The Company would like to thank the Government of Newfoundland and Labrador for financial support of the Moosehead Project through the Junior Exploration Assistance Program.

To learn more, please contact:

Timothy Froude, P. Geo.,

President & CEO

709-765-1726

tim@sokomanmineralscorp.com

Cathy Hume, Director,

Investor Relations

416-868-1079 x251

cathy@chfir.com

Website: www.sokomanmineralscorp.com

Twitter: @SokomanMinerals

Facebook: @SokomanMinerals

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Investors are cautioned that trading in the securities of the Corporation should be considered highly speculative. Except for historical information contained herein, this news release contains forward- looking statements that involve risks and uncertainties. Actual results may differ materially. Sokoman Minerals Corp. will not update these forward-looking statements to reflect events or circumstances after the date hereof. More detailed information about potential factors that could affect financial results is included in the documents filed from time to time with the Canadian securities regulatory authorities by Sokoman Minerals Corp.

Sokoman Minerals Options The East Alder Gold Project In Central Newfoundland To Canterra Minerals Corporation

St. John’s, NL, April 19, 2021 – Sokoman Minerals Corp. (TSX.V: SIC) (OTCQB: SICNF) (“Sokoman” or “the Company”) today announced that it has entered into an option agreement (the “Option Agreement”) with Canterra Minerals Corporation (“Canterra”) whereby Canterra can acquire 100% of the East Alder Gold Project (“East Alder”) which is contiguous with, and immediately northeast of, Canterra’s Wilding Project in central Newfoundland.

East Alder Highlights:

Rock samples from float ranging from 0.1 g/t to 5.3 g/t Au and from trace to 10.8% Cu.

2-kilometre gold-in-soil trend with gold results continuous with the gold-in-soil anomaly from Canterra’s Wilding Project.

Covers an additional 30 claims or 7.5 km2 of strike extent of the Valentine Lake Shear Zone that controls gold mineralization at Wilding and Marathon Gold’s Valentine Lake project.

Permits for drilling in place.

Summary Terms of the Agreement

Canterra can acquire 100% of East Alder by issuing to Sokoman a total of 750,000 common shares of Canterra and work commitments totaling $600,000 over a 4-year period. Sokoman will retain a 1.0% net smelter return royalty on East Alder, with Canterra having the right to buy down 0.5% of the royalty for $1,000,000. The Option Agreement, including the issuance of Canterra shares, is subject to approval by the TSX Venture Exchange (“Exchange”). The Canterra shares will be subject to a statutory hold period.

Tim Froude, President and CEO of Sokoman Minerals, said: “The East Alder Gold Project covers the northeastern extension of the same geological units that host gold mineralization at Canterra’s Wilding Project, and Marathon Gold’s Valentine Lake gold deposits in the rapidly emerging Central Newfoundland Gold Belt. We believe that this strategic agreement represents a great opportunity for both Canterra and Sokoman. We are pleased that Canterra is adding East Alder to their 2021 field program as it is clear that they are committed to this region and we look forward to them generating exciting exploration results in the coming months. This transaction will allow Sokoman to place even more focus on our flagship Moosehead Gold Project which is now in its extensive Phase 6, 50,000m, drill program with two drill rigs already in place and two more rigs scheduled to follow.”

About Sokoman Minerals Corp.

Sokoman Minerals Corp. is a discovery-oriented company with projects in Newfoundland & Labrador, Canada. The Company’s primary focus is its portfolio of gold projects (Moosehead, Crippleback Lake and Fleur de Lys) in Newfoundland. The 100%-owned, flagship Moosehead Gold Project is located along the Trans-Canada Highway in north-central Newfoundland on the same structural corridor that hosts Marathon Gold’s advanced Valentine Project, and adjacent to New Found Gold’s Queensway Project. Both the Moosehead and Queensway projects are targeting high-grade, turbidite-hosted, Fosterville-type gold mineralization. The gold mineralization in the Eastern Trend at Moosehead has been defined over a 500 m strike length and a 200 m vertical height and remains open, with high-grade drill results including 5.10 m of 124.20 g/t Au (MH-18-39). The Company is currently in the midst of the Phase 6 drill program, expanding the Eastern Trend, the Western Trend, South Pond and Footwall Splay zones and high-priority exploration targets on the property.

The Company also retains an interest in an early-stage antimony/gold project in Newfoundland optioned to White Metal Resources Inc. In Labrador, the Company has a 100% interest in the Iron Horse (Fe) project which has Direct Shipping Ore (DSO) potential.

To learn more, please contact:

Timothy Froude, P. Geo.,

President & CEO

709-765-1726

tim@sokomanmineralscorp.com

Cathy Hume, Director,

Investor Relations

416-868-1079 x251

cathy@chfir.com

Website: www.sokomanmineralscorp.com

Twitter: @SokomanMinerals

Facebook: @SokomanMinerals

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Investors are cautioned that trading in the securities of the Corporation should be considered highly speculative. Except for historical information contained herein, this news release contains forward- looking statements that involve risks and uncertainties. Actual results may differ materially. Sokoman Minerals Corp. will not update these forward-looking statements to reflect events or circumstances after the date hereof. More detailed information about potential factors that could affect financial results is included in the documents filed from time to time with the Canadian securities regulatory authorities by Sokoman Minerals Corp.

Sokoman Minerals Closes Subscription Receipts Financing

St. John’s, NL, April 13, 2021 – Sokoman Minerals Corp. (‘Sokoman’ or ‘the Company’) (TSX.V: SIC) (OTCQB: SICNF) is pleased to announce that, in addition to its non-brokered private placement (the Placement”) which closed on April 5, 2021, it has received approval from the TSX Venture Exchange (the “Exchange”) to close its subscription receipts financing (the “Subscription Receipts Financing”) , each subscription receipt being issued at $0.26 and convertible into units of the Company having the same attributes as the units issued pursuant to the Placement for gross proceeds of $980,353 (the “Subscription Receipts”). The participant of the Subscription Receipts Financing is strategic investor Eric Sprott.

Mr. Sprott, the Company’s largest shareholder, recently subscribed for 15,460,177 units of the Placement investing $4,019,646 which took his holdings in the Company to 19.70%. Since his participation in the Subscription Receipts Financing would have created a potential new Control Person, as that term is defined by Exchange policies, the Company will be asking shareholders to approve the creation of a new Control Person at a Special Meeting of Shareholders set for May 18, 2021. The additional Subscription Receipts Financing of $980,353 by Mr. Sprott will be held in trust until the Special Meeting of Shareholders approve the creation of his control position of greater than 20%.

Mr. Sprott’s additional investment in the Company by way of this Subscription Receipts Financing, once approved by shareholders, brings his total investment in these two rounds of financings to $5,000,000 or 19,230,769 common shares and 9,615,385 warrants.

The Subscription Receipts Financing was effected with one (1) insider of the Company, Eric Sprott, subscribing for $980,353 for 3,770,588 Subscription Receipts, that portion of the Subscription Receipts Financing a “related party transaction” within the meaning of Policy 5.9 of the Exchange and Multilateral Instrument 61-101 – Protection of Minority Security Holders in Special Transactions (“MI 61-101”). In connection with the participation of the insiders, the Company intends to rely upon the exemptions from the formal valuation and minority shareholder approval requirements of MI 61-101 set forth in sections 5.5(a) and 5.7(1)(a) of MI 61-101 on the basis that the fair market value (as determined under MI 61-101) of the participation does not exceed twenty-five percent (25%) of the market capitalization of the Company (as determined under MI 61-101).

In connection with the Subscription Receipts Financing and in accordance with Exchange policies, the Company will pay a $24,509 finder’s fee.

The proceeds of the additional Subscription Receipts Financing and the Placement announced last week allows Sokoman to increase the current Phase 6 drill program at the flagship Moosehead Gold Project from 20,000 m to 50,000 m total with four drill rigs. Recent highlights from Phase 6 include significant intercepts from MH-21-141 of 4.20 m @ 64.00 g/t Au at South Pond; and from MH-21-115 of 4.60 m @ 47.00 g/t Au (Footwall Splay), and 8.10 m @ 68.70 g/t Au in the Eastern Trend Main zone. All zones remain open.

About Sokoman Minerals Corp.

Sokoman Minerals Corp. is a discovery-oriented company with projects in Newfoundland & Labrador, Canada. The Company’s primary focus is its portfolio of gold projects (Moosehead, Fleur de Lys, Crippleback Lake and East Alder) in central Newfoundland on the structural corridor hosting Marathon Gold’s advanced stage Valentine Lake gold project. The 100%-owned Moosehead Gold Project is located along the Trans-Canada Highway in north-central Newfoundland, and adjacent to New Found Gold’s Queensway Project. Both the Moosehead and Queensway projects are targeting high-grade, turbidite-hosted, Fosterville-type gold mineralization. The gold mineralization in the Eastern Trend at Moosehead has been defined over a 500 m strike length and a 200 m vertical height and remains open, with high-grade drill results including 5.10 m of 124.20 g/t Au (MH-18-39). The Company is currently in the midst of the Phase 6 drill program.

The Company also retains an interest in an early-stage antimony/gold project in Newfoundland optioned to White Metal Resources Inc. In Labrador, the Company has a 100% interest in the Iron Horse (Fe) project which has Direct Shipping Ore (DSO) potential.

Mineralization hosted on adjacent and/or nearby properties is not necessarily indicative of mineralization hosted on the Company’s property.

To learn more, please contact:

Timothy Froude, P. Geo.,

President & CEO

709-765-1726

tim@sokomanmineralscorp.com

Cathy Hume, Director,

Investor Relations

416-868-1079 x251

cathy@chfir.com

Website: www.sokomanmineralscorp.com

Twitter: @SokomanMinerals

Facebook: @SokomanMinerals

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Investors are cautioned that trading in the securities of the Corporation should be considered highly speculative. Except for historical information contained herein, this news release contains forward- looking statements that involve risks and uncertainties. Actual results may differ materially. Sokoman Minerals Corp. will not update these forward-looking statements to reflect events or circumstances after the date hereof. More detailed information about potential factors that could affect financial results is included in the documents filed from time to time with the Canadian securities regulatory authorities by Sokoman Minerals Corp.

Sokoman Minerals Announces Senior Management Appointment

St. John’s, NL, April 8, 2021 – Sokoman Minerals Corp. (TSX-V: SIC) (OTCQB: SICNF) (“the Company” or “Sokoman”) is pleased to announce the appointment of Daniel Lee to the position of Vice President Exploration. His career spans over 30 years focused on base and precious metals projects in Newfoundland and Labrador beginning with Noranda in the late 1980’s, working on VMS properties in central NL, notably the delineation of the Duck Pond Deposit. After joining Archean Resources in 1996, Dan was a key member of the geological team that developed the Voisey’s Bay Project, originally as a core logging geologist, and continuing with succeeding companies to Senior Geologist working with Vale on multi-disciplinary teams providing key inputs to pre-feasibility and feasibility studies at Voisey’s Bay. He subsequently joined Coastal Gold at the former Hope Brook Gold mine in 2010 as Project Manager where efforts were directed at assessing the remaining resource for completion of a Preliminary Economic Analysis. Dan joined the Sokoman Minerals team in 2018 and has been guiding exploration at the project ever since.

Tim Froude, President & CEO of Sokoman, said: “I have known Dan since we were students at Memorial University in the 1980’s. I have admired his progress and accomplishments over the years and was fortunate enough to convince him to join our team after we acquired the Moosehead Project in 2018. There isn’t anyone that knows as much about Moosehead as he does and much of the success we have enjoyed is a direct result of his tireless efforts and passion for the project. As we ramp up activities at Moosehead, Dan’s experience with advanced stage projects will be critical in bringing the project to the next level.”

The ongoing Phase 6 program is planned to continue through the spring breakup as long as it is technically feasible, with the 2 drills, now present, testing the Footwall Splay/Eastern Trend high grade zones, with a 10-hole program designed to expand the near-surface zones. Assay results from the South Pond and Footwall Splay / Eastern Trend areas are pending and will be released within the next two to three weeks, with a full review of all results to date provided at that time.

Although drilling is slower and more complicated due to logistical concerns during the breakup period, the Footwall splay / Eastern trend zones are relatively easy to access and the decision was made to take advantage of our location and to continue to drill through this period. Plans are to increase to the four drills, and the planned 50,000 m of drilling, announced earlier, as of June 1.

About Moosehead Gold Project

The 100%-owned Moosehead Gold Project is located along the Trans-Canada Highway in North Central Newfoundland, on the same structural trend as the advanced Valentine Lake Project (Marathon Gold), and adjacent to New Found Gold’s Queensway Project. Both the Moosehead and Queensway projects are targeting high-grade, turbidite-hosted, Fosterville-type gold mineralization.

Significant gold mineralization has been identified in at least five separate zones including the Eastern Trend where mineralization has been defined over a 500 m strike length and a 200 m vertical height and remains open, with high-grade drill results including 11.90 m of 44.96 g/t Au (MH-18-01) and 5.10 m of 124.20 g/t Au (MH-18-39).

Qualified Person

This news release has been reviewed and approved by Timothy Froude, P. Geo., a “Qualified Person” under National Instrument 43-101 and President and CEO of Sokoman Minerals Corp.

COVID-19 Protocols

To ensure a working environment that protects the health and safety of the staff and contractors, Sokoman is operating under federally and provincially mandated and recommended guidelines during the current COVID-19 alert level.

About Sokoman Minerals Corp.

Sokoman Minerals Corp. is a discovery-oriented company with projects in Newfoundland & Labrador, Canada. The Company’s primary focus is its portfolio of gold projects (Moosehead, Crippleback Lake, East Alder) in Central Newfoundland, and the recently acquired, district-scale Fleur de Lys Project in Northwestern Newfoundland which is targeting high-grade Dalradian style gold mineralization similar to the Curraghinalt deposit in Northern Ireland.

The Company also has a 100% interest in an early-stage antimony/gold project in Newfoundland optioned to White Metal Resources Inc., as well as the 100% owned Iron Horse iron ore project in Labrador.

Mineralization hosted on adjacent and/or nearby properties is not necessarily indicative of mineralization hosted on the Company’s property.

The Company would like to thank the Government of Newfoundland and Labrador for financial support of the project through the Junior Exploration Assistance Program. Sokoman has been approved for funding for a portion of 2020 exploration activities.

To learn more, please contact:

Timothy Froude, P. Geo.,

President & CEO

709-765-1726

tim@sokomanmineralscorp.com

Cathy Hume, Director,

Investor Relations

416-868-1079 x251

cathy@chfir.com

Website: www.sokomanmineralscorp.com

Twitter: @SokomanMinerals

Facebook: @SokomanMinerals

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Investors are cautioned that trading in the securities of the Corporation should be considered highly speculative. Except for historical information contained herein, this news release contains forward- looking statements that involve risks and uncertainties. Actual results may differ materially. Sokoman Minerals Corp. will not update these forward-looking statements to reflect events or circumstances after the date hereof. More detailed information about potential factors that could affect financial results is included in the documents filed from time to time with the Canadian securities regulatory authorities by Sokoman Minerals Corp.

Sokoman Minerals Closes Non-Brokered Private Placement Led By Eric Sprott

St. John’s, NL, April 6, 2021 – Sokoman Minerals Corp. (‘Sokoman’ or ‘the Company’) (TSX.V: SIC) (OTCQB: SICNF) is pleased to announce that, further to its March 19, 2021 and March 30, 2021 news releases, it has received approval from the TSX Venture Exchange (the “Exchange”) to close its non-brokered $0.26 Unit private placement financing (the “Financing”) for gross proceeds of $5,519,646. The participants of the Financing are strategic, long-term investors including Eric Sprott and Robert Moriarty.

The Company will now issue 21,229,408 units (the “Units”) each Unit consisting of 1 common share of the Company and ½ of a common share purchase warrant (the “Warrants”) with each full warrant being exercisable for an additional common share of the Company at an exercise price of $0.40 for a period of 24 months. All securities issued pursuant to the Financing are subject to a 4-month hold, expiring August 6, 2021.

Eric Sprott, the Company’s largest shareholder, has subscribed for 15,460,177 Units, investing $4,019,646 in the Financing. As this investment by Mr. Sprott has the potential to create a new Control person ( as that term is defined by Exchange policies) Mr. Sprott has undertaken not to exercise any warrants that he owns or controls which after exercise would take his ownership and control level above 20% of the shares outstanding until such time as the Company’s shareholders have, pursuant to a special meeting of shareholders scheduled for May 18, 2021, passed a resolution approving Mr. Sprott of becoming a Control person (the “Special Meeting”).

As disclosed in its March 30, 2021 news release, in addition to the Financing the Company intends on completing a subscription receipts financing (the “Subscription Receipts Financing”) with Mr. Sprott to raise an additional $980,353, such funds to be held in trust pending closing of the Subscription Receipts Financing. Pursuant to the Subscription Receipts Financing, each subscription receipt will be issued at a price of $0.26 and after obtaining shareholder approval at the Special Meeting for Mr. Sprott to exceed the 20% threshold, each subscription receipt will be converted automatically into units having the same terms as the Financing with each unit consisting of one (1) common share in the capital of the Company and one half (½) of a common share purchase warrant. Each full warrant will be transferable in accordance with applicable Securities Laws and will entitle the holder to purchase one (1) additional share for $0.40 at any time prior to 4:30 p.m. (Vancouver time) twenty-four (24) months after the closing date. The completion of the Subscription Receipts Financing is subject to obtaining shareholder approval at the Special Meeting. Mr. Sprott’s participation in the Financing and the Subscription Receipts Financing would bring his total investment in the Company in this round of financings to $5,000,000 or 19,230,769 common shares and 9,615,385 Warrants.

Eric Sprott, through 2176423 Ontario Ltd., a corporation which is beneficially owned by him, acquired the 15,460,177 Units pursuant to the Private Placement for consideration of $4,019,646. Prior to the Private Placement, Mr. Sprott owned 17,208,696 Common Shares of the Company and 13,975,000 Warrants. As a result of the Private Placement, Mr. Sprott beneficially owns and controls 32,668,874 Common Shares of the Company and 21,705,089 Warrants representing approximately 19.7% of the issued and outstanding Common Shares of the Company on a non-diluted basis and approximately 29.1% on a fully diluted basis assuming exercise of the Warrants.

The Units were acquired by Mr. Sprott, through 2176423 Ontario Ltd. for investment purposes. Mr. Sprott has a long-term view of the investment and may acquire additional securities of the Company including on the open market or through private acquisitions or sell securities of the Company including on the open market or through private dispositions in the future depending on market conditions, reformulation of plans and/or other relevant factors.

A copy of 2176423 Ontario Ltd.’s early warning report will appear on the Company’s profile on SEDAR and may also be obtained by calling (416) 945-3294 (200 Bay Street, Suite 2600, Royal Bank Plaza, South Tower, Toronto, Ontario M5J 2J1).

The Financing was effected with two (2) insiders of the Company, Eric Sprott and Cathy Hume, subscribing for $4,128,646, 15,879,408 Units, that portion of the Financing a “related party transaction” within the meaning of Policy 5.9 of the Exchange and Multilateral Instrument 61-101 – Protection of Minority Security Holders in Special Transactions (“MI 61-101”). In connection with the participation of the insiders, the Company intends to rely upon the exemptions from the formal valuation and minority shareholder approval requirements of MI 61-101 set forth in sections 5.5(a) and 5.7(1)(a) of MI 61-101 on the basis that the fair market value (as determined under MI 61-101) of the participation does not exceed twenty-five percent (25%) of the market capitalization of the Company (as determined under MI 61-101).

In connection with the Financing and in accordance with Exchange policies, the Company will pay $140,986 in finders’ fees to certain finders.

The proceeds of the Private Placement will allow Sokoman to increase the current Phase 6 drill program at the flagship Moosehead Gold Project from 20,000 m to 50,000 m total with four drill rigs. Recent highlights from Phase 6 include significant intercepts from MH-21-141 of 4.20 m @ 64.00 g/t Au at South Pond; and from MH-21-115 of 4.60 m @ 47.00 g/t Au (Footwall Splay), and 8.10 m @ 68.70 g/t Au in the Eastern Trend Main zone. All zones remain open.

Tim Froude, President and CEO commented: “We are very grateful to have this level of support from Mr. Sprott. This boost to our treasury will allow us to advance the Moosehead on multiple fronts at a much faster pace than ever before. 2021 will be a pivotal year for our shareholders.”

About Sokoman Minerals Corp.

Sokoman Minerals Corp. is a discovery-oriented company with projects in Newfoundland & Labrador, Canada. The Company’s primary focus is its portfolio of gold projects (Moosehead, Fleur de Lys, Crippleback Lake and East Alder) in central Newfoundland on the structural corridor hosting Marathon Gold’s advanced stage Valentine Lake gold project. The 100%-owned Moosehead Gold Project is located along the Trans-Canada Highway in north-central Newfoundland, and adjacent to New Found Gold’s Queensway Project. Both the Moosehead and Queensway projects are targeting high-grade, turbidite-hosted, Fosterville-type gold mineralization. The gold mineralization in the Eastern Trend at Moosehead has been defined over a 500 m strike length and a 200 m vertical height and remains open, with high-grade drill results including 5.10 m of 124.20 g/t Au (MH-18-39). The Company is currently in the midst of the Phase 6 drill program.

The Company also retains an interest in an early-stage antimony/gold project in Newfoundland optioned to White Metal Resources Inc. In Labrador, the Company has a 100% interest in the Iron Horse (Fe) project which has Direct Shipping Ore (DSO) potential.

Mineralization hosted on adjacent and/or nearby properties is not necessarily indicative of mineralization hosted on the Company’s property.

To learn more, please contact:

Timothy Froude, P. Geo.,

President & CEO

709-765-1726

tim@sokomanmineralscorp.com

Cathy Hume, Director,

Investor Relations

416-868-1079 x251

cathy@chfir.com

Website: www.sokomanmineralscorp.com

Twitter: @SokomanMinerals

Facebook: @SokomanMinerals

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Investors are cautioned that trading in the securities of the Corporation should be considered highly speculative. Except for historical information contained herein, this news release contains forward- looking statements that involve risks and uncertainties. Actual results may differ materially. Sokoman Minerals Corp. will not update these forward-looking statements to reflect events or circumstances after the date hereof. More detailed information about potential factors that could affect financial results is included in the documents filed from time to time with the Canadian securities regulatory authorities by Sokoman Minerals Corp.

Sokoman Minerals Restructures A Portion Of Its Non-Brokered Private Placement Led By Eric Sprott

St. John’s, NL, March 30, 2021 – Sokoman Minerals Corp. (“Sokoman” or “the Company”) (TSX.V: SIC) (OTCQB: SICNF) today announces that it is partially restructuring its non-brokered private placement of units (the “Private Placement”) for gross proceeds of $6,500,000 announced on March 19, 2021.

Eric Sprott, the Company’s largest shareholder to date, proposed to subscribe for $5,000,000 worth of units, which, together with his previous investments into Sokoman, would have taken his position above 20% of the Company’s stock ownership. Pursuant to its policies, the TSX Venture Exchange (“the Exchange”) requires shareholder approval for Mr. Sprott to exceed the 20% threshold. Accordingly, the Company will divide Mr. Sprott’s investment into two tranches: a) $4,919,647 will be taken down as part of the Private Placement, and b) $980,353 of his investment will be held in trust pursuant to a separate financing via subscription receipts which will convert into units with the same terms as that of the Private Placement upon the Company receiving shareholder approval for Mr. Sprott to go over the 20% threshold (the “Subscription Receipts Financing”). The Company has scheduled an Extraordinary General Meeting (“EGM”) for May 18, 2021 for the purposes of obtaining the required shareholder approval.

Pursuant to the Subscription Receipts Financing, each subscription receipt will be issued at a price of $0.26 and after obtaining shareholder approval for Mr. Sprott to exceed the 20% threshold, each subscription receipt will be converted automatically into units having the same terms as the Private Placement with each unit consisting of one (1) common share in the capital of the Company and one half (½) of a common share purchase warrant. Each full warrant will be transferable in accordance with applicable Securities Laws and will entitle the holder to purchase one (1) additional share for $0.40 at any time prior to 4:30 p.m. (Vancouver time) twenty-four (24) months after the closing date.

About Sokoman Minerals Corp.

Sokoman Minerals Corp. is a discovery-oriented company with projects in Newfoundland & Labrador, Canada. The Company’s primary focus is its portfolio of gold projects (Moosehead, Crippleback Lake and East Alder) in central Newfoundland on the structural corridor hosting Marathon Gold’s advanced stage Valentine Lake gold project. The 100%-owned Moosehead Gold Project is located along the Trans-Canada Highway in north-central Newfoundland, and adjacent to New Found Gold’s Queensway Project. Both the Moosehead and Queensway projects are targeting high-grade, turbidite-hosted, Fosterville-type gold mineralization. The gold mineralization in the Eastern Trend at Moosehead has been defined over a 500 m strike length and a 200 m vertical height and remains open, with high-grade drill results including 5.10 m of 124.20 g/t Au (MH-18-39). The Company is currently in the midst of the Phase 6 drill program.

The Company also retains an interest in an early-stage antimony/gold project in Newfoundland optioned to White Metal Resources Inc. In Labrador, the Company has a 100% interest in the Iron Horse (Fe) project which has Direct Shipping Ore (DSO) potential.

Mineralization hosted on adjacent and/or nearby properties is not necessarily indicative of mineralization hosted on the Company’s property.

To learn more, please contact:

Timothy Froude, P. Geo.,

President & CEO

709-765-1726

tim@sokomanmineralscorp.com

Cathy Hume, Director,

Investor Relations

416-868-1079 x251

cathy@chfir.com

Website: www.sokomanmineralscorp.com

Twitter: @SokomanMinerals

Facebook: @SokomanMinerals

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Investors are cautioned that trading in the securities of the Corporation should be considered highly speculative. Except for historical information contained herein, this news release contains forward- looking statements that involve risks and uncertainties. Actual results may differ materially. Sokoman Minerals Corp. will not update these forward-looking statements to reflect events or circumstances after the date hereof. More detailed information about potential factors that could affect financial results is included in the documents filed from time to time with the Canadian securities regulatory authorities by Sokoman Minerals Corp.

Sokoman Minerals Announces Non-Brokered Private Placement Led By Eric Sprott

St. John’s, NL, March 19, 2021 – Sokoman Minerals Corp. (‘Sokoman’ or ‘the Company’) (TSX.V: SIC) (OTCQB: SICNF) today announces that, subject to all regulatory approvals, the Company intends to complete a non-brokered private placement of units (the “Private Placement”) for gross proceeds of $6,500,000 with a lead order of $5,000,000 from Eric Sprott. The Company expects to file documents for approval with the TSX Venture Exchange (the “Exchange”) next week.

Subject to receipt of all regulatory approvals, Sokoman intends to issue units at a price of $0.26 per unit for gross proceeds of $6,500,000, with each unit consisting of one (1) common share in the capital of the Company and one half (½) of a common share purchase warrant. Each full warrant will be transferable in accordance with applicable Securities Laws and will entitle the holder to purchase one (1) additional share for $0.40 at any time prior to 4:30 p.m. (Vancouver time) on that date which is twenty-four (24) months after the closing date.

In connection with the Private Placement, the Company may pay finders’ fees of 5% cash to certain finders, in accordance with Exchange policies. All securities issued pursuant to the Private Placement will be subject to a four month and one day hold period.

The proceeds of this financing will be directed towards advancing the Company’s flagship Moosehead Gold Project, which includes increasing the current drill program from 20,000m to 50,000m total with four drill rigs.

About Sokoman Minerals Corp.

Sokoman Minerals Corp. is a discovery-oriented company with projects in Newfoundland & Labrador, Canada. The Company’s primary focus is its portfolio of gold projects (Moosehead, Crippleback Lake and East Alder) in central Newfoundland on the structural corridor hosting Marathon Gold’s advanced stage Valentine Lake gold project. The 100%-owned Moosehead Gold Project is located along the Trans-Canada Highway in north-central Newfoundland, and adjacent to New Found Gold’s Queensway Project. Both the Moosehead and Queensway projects are targeting high-grade, turbidite-hosted, Fosterville-type gold mineralization. The gold mineralization in the Eastern Trend at Moosehead has been defined over a 500 m strike length and a 200 m vertical height and remains open, with high-grade drill results including 5.10 m of 124.20 g/t Au (MH-18-39). The Company is currently in the midst of the Phase 6 drill program.

The Company also retains an interest in an early-stage antimony/gold project in Newfoundland optioned to White Metal Resources Inc. In Labrador, the Company has a 100% interest in the Iron Horse (Fe) project which has Direct Shipping Ore (DSO) potential.

Mineralization hosted on adjacent and/or nearby properties is not necessarily indicative of mineralization hosted on the Company’s property.

To learn more, please contact:

Timothy Froude, P. Geo.,

President & CEO

709-765-1726

tim@sokomanmineralscorp.com

Cathy Hume, Director,

Investor Relations

416-868-1079 x251

cathy@chfir.com

Website: www.sokomanmineralscorp.com

Twitter: @SokomanMinerals

Facebook: @SokomanMinerals