Sokoman Reports Additional High-Grade Gold Assay Results At Moosehead Project, Central Newfoundland

4.0 m at 24.92 g/t Au, including 1.60 m at 61.68 g/t Au from Footwall Splay Zone

St. John’s, NL, January 29, 2021 – Sokoman Minerals Corp. (TSX-V: SIC) (OTCQB: SICNF) (the “Company” or “Sokoman”) is pleased to announce that ongoing Phase 6 drilling at the 100%-owned Moosehead Property continues to intersect near-surface, high-grade gold mineralization at the recently recognized Footwall Splay that adjoins the Eastern Trend Main Zone. Diamond drill holes MH-20-132 and MH-20-127, drilled prior to the Christmas break, have both returned high-grade gold values.

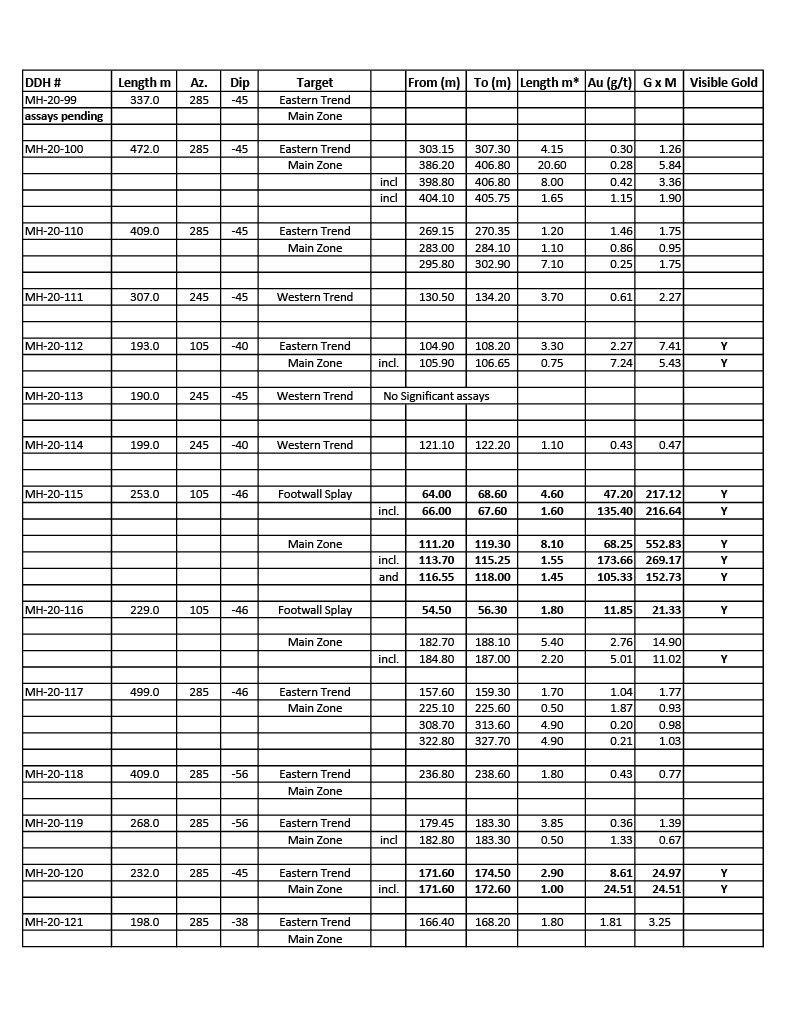

Metallic assay results (rush priority analysis) from MH-20-132 and MH-2-127 returned the following:

MH-20-132 – 4.0 m at 24.92 g/t Au, incl. 1.60 m at 61.68 g/t Au from 70.50 m downhole

MH-20-127 – 1.30 m at 9.23 g/t Au, incl. 0.50 m @ 22.72 g/t Au from 48.90 m downhole

*reported lengths are core lengths and are believed to be 70% to 85% of true thickness

In addition to the Footwall Splay mineralization, MH-20-132 also cut a lower zone of mineralization (possibly the Eastern Trend Main Zone) over 22.10 m (core length) averaging 1.65 g/t Au, including higher grade zones of up to 2.80 m of 4.36 g/t Au starting at 96.90 m downhole. This zone remains open and will receive further testing.

Tim Froude, President and CEO of Sokoman, says: “We are very pleased to report that the high-grade Footwall Splay has been expanded by about 27 metres and now has both a strike length and a down-dip length of approximately 40 m (the zone is largely flat-lying). The splay has been intersected in at least 5 drill holes – MH-18-01, MH-20-115, MH-20-116 – and now also MH-20-127 and MH-20-132 (see plan map for intersections). The mineralization in MH-20-132 and 127 extends the zone at least 27 m and remains open to the north, south and west. It is believed that the Splay merges with the adjacent Main Zone located immediately to the east. Mineralized zones of this nature include the high-grade Swan Zone at Fosterville in Australia which has limited strike and variable dip components in a geological setting analogous to Moosehead. A second drill rig will be mobilized in early February to test high-priority targets from the 2019/20 magnetics and till sampling programs. We expect a steady flow of results from the assays that are still outstanding to be reported in the next 3 to 4 weeks.”

Phase 6 Drilling Program

Approximately 6,500 m has been completed in 30 holes to date. Logging and sampling is ongoing, along with the upgrading of the new core building. The program has increased from 10,000 to 20,000 m of which 15,000 m will be dedicated to the Western and Eastern Trends and the adjacent Footwall Splay. The remaining 5,000 m will test high-priority magnetic and geochemical targets elsewhere on the property. Additional assays have been received since the drilling re-started and are incorporated in the attached table. Some holes remain outstanding and a summary of all holes drilled prior to Christmas will be discussed in more detail once all results have been received. We have also switched to a new logging system, and integration with the in-hand data is ongoing with the assistance of Mercator Geological Services of Dartmouth, Nova Scotia.

About Moosehead Gold Project

The 100%-owned Moosehead Gold Project is located along the Trans-Canada Highway in North Central Newfoundland, on the same structural trend as the advanced Valentine Lake Project (Marathon Gold), and adjacent to New Found Gold’s Queensway Project. Both the Moosehead and Queensway projects are targeting high-grade, turbidite hosted, Fosterville-type gold mineralization.

The gold mineralization has been defined over a 500 m strike length and a 200 m vertical height and remains open, with high-grade drill results including 5.10 m of 124.20 g/t Au (MH-18-39) and 4.8 m of 33.59 g/t A, including 0.90 m of 124.15 g/t Au (MH-19-62).

QP

This news release has been reviewed and approved by Timothy Froude, P. Geo., a “Qualified Person” under National Instrument 43-101 and President and CEO of Sokoman Minerals Corp.

COVID-19 Protocols

To ensure a working environment that protects the health and safety of the staff and contractors, Sokoman is operating under federally and provincially mandated and recommended guidelines during the current COVID-19 alert level.

Analytical Techniques / QA/QC

All core samples submitted for assay were saw cut by Sokoman personnel with one half submitted for assay and one half retained for reference. Samples were delivered in sealed bags directly to the lab by Sokoman Minerals personnel. Samples, including duplicates, blanks and standards, were submitted to Eastern Analytical Ltd. in Springdale, Newfoundland for gold analysis. Eastern Analytical is an accredited assay lab that conforms to requirements of ISO/IEC 17025. Samples with possible visible gold were submitted for total pulp metallics and gravimetric finish. All other samples were analyzed by standard fire assay methods. Total pulp metallic analysis includes: the whole sample is crushed to -10 mesh; then pulverized to 95% -150 mesh; the total sample is weighed and screened 150 mesh; the +150 mesh fraction is fire assayed for Au, and a 30 g subsample of the -150 mesh fraction is fire assayed for Au; with a calculated weighted average of total Au in the sample reported as well. One blank and one industry approved standard for every twenty samples submitted, is included in the sample stream. In addition, random duplicates of selected samples are analyzed in addition to the in-house standard and duplicate policies of Eastern Analytical.

About Sokoman Minerals Corp.

Sokoman Minerals Corp. is a discovery-oriented company with projects in Newfoundland & Labrador, Canada. The Company’s primary focus is its portfolio of gold projects (Moosehead, Crippleback Lake and East Alder) in Central Newfoundland on the structural corridor hosting Marathon Gold’s Valentine Lake project. Valentine Lake is reported to host estimated Proven and Probable Mineral Reserves of 1.87 Moz (41.05 Mt at 1.41 g/t Au), and Total Measured and Indicated Mineral Resources (inclusive of the Mineral Reserves) of 3.09 Moz (54.9 Mt at 1.75 g/t Au). Additional Inferred Mineral Resources are 0.96 Moz (16.77 Mt at 1.78 g/t Au). Reserves and resource totals for the Valentine Lake Project are taken from “N.I. 43-101 TECHNICAL REPORT & PRE-FEASIBILITY STUDY ON THE VALENTINE GOLD PROJECT” prepared by Ausenco Engineering Canada on April 21, 2020.

The Company also retains an interest in an early-stage antimony/gold project in Newfoundland optioned to White Metal Resources Inc. In Labrador, the Company has a 100% interest in the Iron Horse (Fe) project which has Direct Shipping Ore (DSO) potential.

Mineralization hosted on adjacent and/or nearby properties is not necessarily indicative of mineralization hosted on the Company’s property.

The Company would like to thank the Government of Newfoundland and Labrador for financial support of the project through the Junior Exploration Assistance Program. Sokoman has been approved for funding for a portion of 2020 exploration activities.

To learn more, please contact:

Timothy Froude, P. Geo.,

President & CEO

709-765-1726

tim@sokomanmineralscorp.com

Cathy Hume, Director,

Investor Relations

416-868-1079 x251

cathy@chfir.com

Website: www.sokomanmineralscorp.com

Twitter: @SokomanMinerals

Facebook: @SokomanMinerals

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Investors are cautioned that trading in the securities of the Corporation should be considered highly speculative. Except for historical information contained herein, this news release contains forward- looking statements that involve risks and uncertainties. Actual results may differ materially. Sokoman Minerals Corp. will not update these forward-looking statements to reflect events or circumstances after the date hereof. More detailed information about potential factors that could affect financial results is included in the documents filed from time to time with the Canadian securities regulatory authorities by Sokoman Minerals Corp.