Newsroom

Sokoman Minerals Provides Summer Exploration Update

Budgets $1.2 Million to Central Newfoundland Gold Projects

St. John’s, NL, May 9, 2019 – Sokoman Minerals Corp. (TSX-V: SIC) (OTCQB: SICNF) (the“Company” or “Sokoman”) is pleased to provide the following update and outlook for the next 6 months for its portfolio of gold properties in Central Newfoundland. The bulk of the exploration will be directed at the flagship Moosehead Gold Project, including a Phase 4 diamond drilling program, with additional funding for the Company’s other gold projects including Clarks Brook, East Alder and Crippleback Lake. All four projects lie in the emerging Central Newfoundland Gold District, an area anchored by the 4.2 million ounce gold project at Valentine Lake, operated by Marathon Gold (TSX: MOZ).

Timothy Froude, P.Geo., President and CEO, states: “We are looking forward to our summer exploration programs with great anticipation. Our focus has been, and will remain, the Moosehead Project, where we are following up on our 2018 high-grade gold discovery on the Eastern Trend, which is generating continuously strong results. We are now working on a 3-D model for the Moosehead mineralized zones and look forward to our Phase 4 drilling program expected to start mid-summer. Our other gold properties, although earlier stage, all show good potential too. Since they require continued option payments if we decide to keep them, we are spending what we feel is necessary to properly evaluate them. Scheduling, and forthcoming option requirements, means that work at Clarks Brook will begin as soon as possible (pending some approvals), followed by the Phase 4 drilling at Moosehead, with East Alder and Crippleback Lake programs commencing later in the summer.”

The summer 2019 operating budget has been pegged at $1.20 million of which $750,000 is planned for the Moosehead Project, with the remaining $450,000 spread between the other three projects, with Clarks Brook accounting for about $250,000. The Company currently has $2.7 million in cash in the treasury and does not need to raise funds for the upcoming programs.

Moosehead

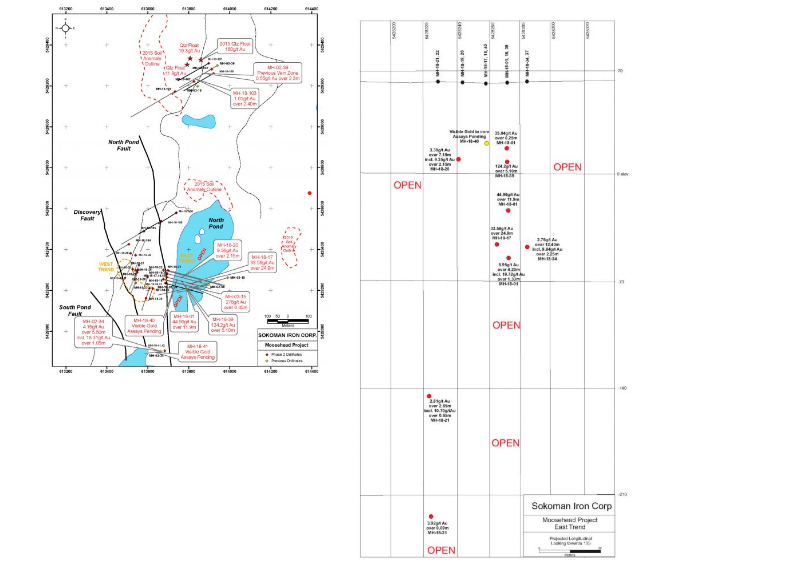

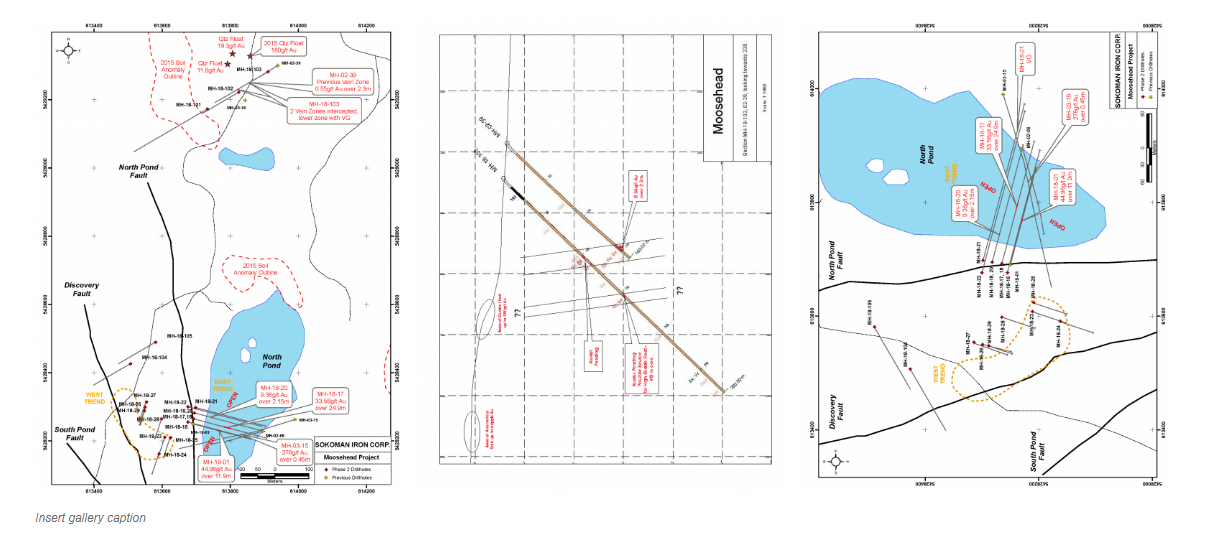

The Company has drilled in excess of 14,000 metres of NQ size core in three phases since July 2018. The programs include, and are highlighted by, the discovery of a previously unrecognized shear zone hosting high-grade gold mineralization with a strike and dip different from other areas of mineralization on the property (see drill plan map with magnetics). The shear zone, dubbed the Eastern Trend, has been tested over a strike length of 200 metres, to at least 200 metres vertically, and with a thickness not yet clearly defined, but locally tens of metres in apparent thickness. Gold mineralization in the shear zone is hosted in altered sedimentary units, as well as mafic dikes, with quartz vein(s) that carry very high gold grades (i.e. 1.10 metres of 550.30 g/t Au from MH-18-39) with extensive visible gold. The wall rocks to the high-grade veins also carry significant gold values allowing for the inclusion of wider intervals of potentially economic mineralization (i.e. 5.10 metres grading 124.20 g/t Au from MH-18-39). The Eastern Trend mineralization has a northeast strike and a moderate east dip fluctuating between 40 and 60 degrees. The zone has by far been the most consistent in terms of continuity, as well as having a greater thickness than other zones on the Moosehead property and it remains open for expansion. In contrast, the Western Trend, located 250 metres to the west, consists of a series of near surface, east-west trending and moderate to gently north dipping quartz veins, locally with significant visible gold (i.e. 1.50 metres of 96.72 g/t Au from MH-01-13).

The Company is compiling all data from all three of its drilling programs (including a portion of the historical drilling) as well as downhole camera surveying of selected 2018/2019 drill holes, and a ground magnetic survey. The resulting model will be used to guide future drilling programs. The Phase 4 drilling will entail a proposed 5,000 metres of drilling, mainly towards expanding the high-grade Eastern Trend with a portion of the budget directed towards developing additional targets as well as reconnaissance drilling.

Clarks Brook

The Clarks Brook Property was optioned from Metals Creek Resources in late 2017 as a drill ready opportunity. The property is host to high-level, epithermal style, gold mineralization which was never drill tested by previous operators. Historical surface sampling has given grab sample values ranging from 2.98 to 24.5 g/t Au from float and outcrop. Sokoman commenced diamond drilling immediately after acquiring the property, completing a seven-hole program with all holes intersecting gold mineralization including 3.74 g/t Au over 3.10 m including 14.73 g/t Au over 0.60 m. Sokoman believes the mineralization intersected represents the upper portion of an epithermal style deposit and that higher gold grades could exist at relatively shallow depths (200-300 metres vertically). The Company plans to drill through the centre of the mineralized zone to target deep-seated mineralization.

While Sokoman is in receipt of some of the required permits to begin exploration at Clarks Brook, several new environmental requirements have been added to the conditions necessary to begin active work. The Company is addressing those items, however cannot give a definitive start date for the drilling program. While we do not expect a long delay, we are preparing for an earlier start of the Phase 4 drilling program at Moosehead if necessary.

East Alder and Crippleback Lake

These projects are much earlier in the exploration stage, however they lie on the northeast extension of the Valentine Lake structural corridor, 25 and 65 km respectively, to the northeast of Valentine Lake (see property location map). Both properties have significant anomalous gold in soil and till anomalies as well as mineralized float. The Company is planning a trenching program to evaluate the anomalies and define drill targets. If no targets are defined, the properties will be returned to the vendors.

Moosehead is the only 100%-owned project, while the other three are under option from third parties with impending expenditure and/or share or cash commitments on them in 2019. The Company intends to evaluate the Clarks Brook, Crippleback and East Alder properties to see if they remain a fit for the Company, and if results do not warrant further work, the properties will be returned to the respective vendors prior to the required issuance of any cash and/or share payments.

QP

This news release has been reviewed and approved by Timothy Froude, P. Geo., a “Qualified Person” under National Instrument 43-101 and President and CEO of Sokoman Minerals Corp.

About Sokoman Minerals Corp.

Sokoman Minerals Corp. is a discovery-oriented company with projects in Newfoundland &Labrador, Canada. The Company’s primary focus is its portfolio of gold projects in CentralNewfoundland on the structural corridor hosting the 4.2 million ounce Valentine Lake gold project 150 km to the southwest of the Company’s high-grade Moosehead gold project. The Company also has a 100% interest in an early-stage antimony/gold project in Newfoundland recently optioned to White Metal Resources, as well as a 100% interest in the Clarks Brook Gold Property, 35 km southeast of Moosehead. In Labrador, the Company has a 100% interest in the Iron Horse (Fe/U/REE) project.

To learn more, please contact:

Timothy Froude, P. Geo.,

President & CEO

Cathy Hume, Director,

Investor Relations

Website: www.sokomanmineralscorp.com

Twitter: @SokomanMinerals

Facebook: @SokomanMinerals

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Investors are cautioned that trading in the securities of the Corporation should be considered highly speculative. Except for historical information contained herein, this news release contains forward- looking statements that involve risks and uncertainties. Actual results may differ materially. Sokoman Minerals Corp. will not update these forward-looking statements to reflect events or circumstances after the date hereof. More detailed information about potential factors that could affect financial results is included in the documents filed from time to time with the Canadian securities regulatory authorities by Sokoman Minerals Corp.

Sokoman Minerals Cuts 4.8 M Of 33.59 G/T Au At Moosehead Property, Newfoundland

High-Grade Eastern Trend Expanded and Remains Open

St. John’s, NL, April 16, 2019 – Sokoman Minerals Corp. (TSX-V: SIC) (OTCQB: SICNF)(the “Company” or “Sokoman”) is pleased to announce assay results from Phase 3 diamond drilling at the high-grade Moosehead Gold Project. The recently completed, 21 hole, 4,715 m winter program successfully extended the high-grade Eastern Trend, demonstrated the existence of higher grades in the area, and tested magnetic anomalies northeast of the presently defined Eastern Trend. A portion of the program was completed from the surface of North Pond with the majority of the remaining holes drilled from the eastern side of North Pond.

Program highlights, including a summary of significant results:

1) MH-19-62 cuts 4.8 m* of 33.59 g/t Au; including 0.90 m* of 124.15 g/t Au starting ata downhole depth of 239.85 m.

2) MH-19-62 intercept is located 110 m northeast of the MH-18-01 (discovery) intercept.

3) Strike length of the Eastern Trend shear zone is extended to at least 175 m, remaining open along strike to the north and south, and to depth.

4) Additional parallel or possibly stacked structures under North Pond require further testing.

5) Other significant intersections include: MH-19-52 (3.50 m of 11.95 g/t Au, incl. 0.80 m of 36.13 g/t Au); MH-19-63 (4.10 m of 9.94 g/t Au, incl. 0.55 m of 53.25 g/t Au); MH-19-56 (1.85 m of 9.08 g/t Au, incl. 0.45 m of 32.85 g/t Au).

Timothy Froude, P. Geo., President and CEO, states: “These are our best results in terms of expanding the strike length of the high-grade core of the Eastern Trend with additional drilling required to outline these high-grade zones. The winter program has defined the controls of higher-grade mineralization, with the majority of the higher-grade intercepts as trends or shoots spatially associated with a strong northeast trending, moderately east dipping shear zone. We have also intersected high-grade veining up-dip from the main shear zone at shallow depths (32.70 m downhole) in MH-19-55 that returned 0.50 m @ 17.94 g/t Au (core length) suggesting parallel or stacked structures. We need more drilling to better define the Eastern Trend, therefore our Phase 4 summer program will be designed to further test this area, to include a barge-based component on North Pond.”

Four holes (MH-19-47, 49, 51 and 54) were drilled to test magnetic targets under the northern portion of North Pond and were successful in cutting sheared and veined units, and while only returning anomalous results, they are mineralized and open along strike and to depth and will receive further drilling in 2019, including testing a soil geochemical anomaly (140 ppb Au) 250 m to the east of North Pond. Two holes (MH-19-43 and 44) were drilled to test historical results from 2003 drilling near South Pond, approximately 500 m to the south of North Pond, with both holes intersecting anomalous values, further drilling contemplated. The Company also plans to expand the magnetic survey to cover the South Pond area to outline possible shear zones that extend from the gold bearing structures under North Pond, based on the new structural findings at Moosehead that resulted in the Eastern Trend discovery. The magnetic survey will also evaluate an area of gold bearing float in the vicinity of South Pond located by previous operators. These boulders lie up-ice from North Pond and are most likely from a source near South Pond not yet discovered.

The intercepts in MH-19-62 and 63, the final two holes of the Phase 3 program, significantly expand the strike length of the Eastern Trend and will be the primary target area for the barge- based program this summer. All data, including new televiewer data from several Phase 3 holes, is being compiled along with Leapfrog 3-D geological modelling software to complete a 3-D model of the Eastern Trend. The planned Phase 4 drilling will be based on the 3-D model, the magnetic survey results and the geological picture forming based on the logging of the Eastern Trend drilling to date.

Update on the Clarks Brook Property

The Company has also applied for permits to drill in Q2 2019 on the Clarks Brook epithermal gold property located 35 kms to the southeast of Moosehead. This will be a small program, under 2,000 m, testing below previous gold intercepts to see if higher grade mineralization, that often lies deeper in classic epithermal environments, exists. This exploration will be completed before the Phase 4 drilling at Moosehead.

QA/QC

A total of 1,070 saw cut samples, excluding duplicates, blanks and standards, have been submitted to Eastern Analytical Ltd. in Springdale, Newfoundland for gold and ICP analysis. One half of the saw cut sample was submitted for analysis while the other half was retained. Sample lengths varied from 0.07 m to 1.3 m in core length with an average length of 0.91 m. Samples with possible visible gold were submitted for total pulp metallics and gravimetric finish. All other samples were analyzed by standard fire assay methods. Eastern Analytical is an accredited assay lab that conforms to requirements of ISO/IEC 17025. Total pulp metallic analysis is a result of a whole sample being crushed to -10 mesh and pulverized to 95% -150 mesh. The total sample is then weighed and screened 150 mesh. The +150 mesh fraction is fire assayed for Au, and a 30 g subsample of the -150 mesh fraction is fire assayed for Au. A calculated weighted average of total Au in the sample is reported as well. The Company included in the sample stream one blank and one industry approved standard for every twenty samples submitted, as well as random duplicates of selected samples. This is in addition to the in-house standard and duplicate policy of Eastern Analytical.

QP

This news release has been reviewed and approved by Timothy Froude, P. Geo., a “Qualified Person” under National Instrument 43-101 and President and CEO of Sokoman Minerals Corp.

*True thicknesses from Phase 3 holes are believed to range from 75% to 100% of core length.

About Sokoman Minerals Corp.

Sokoman Minerals Corp. is a discovery-oriented company with projects in Newfoundland & Labrador, Canada. The Company’s primary focus is its portfolio of gold projects in CentralNewfoundland on the structural corridor hosting the 4.2 million ounce Valentine Lake gold project 150 km to the southwest of the Company’s high-grade Moosehead gold project. The Company also has a 100% interest in an early-stage antimony/gold project in Newfoundland recently optioned to White Metal Resources, as well as a 100% interest in the Clark’s BrookGold Property, 35 km southeast of Moosehead. In Labrador, the Company has a 100% interest in the Iron Horse (Fe/U/REE) project.

To learn more, please contact:

Timothy Froude, P. Geo.,

President & CEO

Cathy Hume, Director,

Investor Relations

Website: www.sokomaniron.com

Twitter: @SokomanIron

Facebook: @SokomanIron

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Investors are cautioned that trading in the securities of the Corporation should be considered highly speculative. Except for historical information contained herein, this news release contains forward- looking statements that involve risks and uncertainties. Actual results may differ materially. Sokoman Minerals Corp. will not update these forward-looking statements to reflect events or circumstances after the date hereof. More detailed information about potential factors that could affect financial results is included in the documents filed from time to time with the Canadian securities regulatory authorities by Sokoman Minerals Corp.

Sokoman Minerals Provides Phase 3 Drilling Update At Moosehead Gold Property, Newfoundland

Initial holes from ice surface intersect Shear Zone with visible gold bearing quartz veining

St. John’s, NL, March 1, 2019 – Sokoman Minerals Corp. (TSX-V: SIC) (OTCQB: SICNF) (the “Company” or “Sokoman”) is pleased to announce that diamond drilling operations are ongoing with two rigs, including the proposed drilling on North Pond, which began late last week.

Highlights:

To date, 12 holes, totaling approximately 2,500 m, have been completed utilizing two rigs, including two holes (MH-19-52 and 53) from the surface of North Pond.

MH-19-52 cut a 2.50 m* wide visible gold bearing quartz vein starting at 91 m down-hole, in a broader section of weak to moderate deformation up to 10 m* thick.

MH-19-53, drilled on the same section approximately 50 m up-dip, encountered a more intense structure over a 12 m* width beginning at 28 m down-hole that carried broken and disrupted sections of visible gold bearing quartz veining up to 0.30 m thick.

The rig has been moved 25m north of MH-19-52 and 53 and will begin drilling a three- hole section through the shear zone focusing on depths between 50 and 100 m below surface and will attempt to extend northwards, the mineralization believed to have been largely missed by the section hosting MH-18-19 and 20.

MH-19-50, drilled on the same section as MH-18-01, intersected approximately 5 m of quartz veining with disseminated sulphide mineralization and at least 1 speck of VG beginning at 146.50 m down-hole.

MH-19-45, 46 and 48 were drilled from the East side of North Pond targeting the down dip extension of the shear zone hosting mineralization intersected in MH-18-34 and 37; all three holes intersected the east dipping shear zone with thicknesses of up to 24 m with variable amounts of quartz veining and sulphide mineralization; locally, mafic dikes have intruded along the shear zone.

Two holes were also completed (MH-19-43, 44) in the vicinity of historical hole MH-04- 02, 500 m south of the main Eastern Trend, where previous operators noted the presence of fine visible gold in irregular veined zones hosted by strong shear/fault zones up to 10 m in thickness (maximum assay of 0.27 m @ 2.19 g/t Au). Both holes intersected sheared and veined rock similar to 04-02 (no VG noted) and samples have been submitted for assay.

(*Drilled thicknesses reported from Phase 3 holes are believed to be nearly 100% of true thicknesses. Logging and sampling of many of the noted holes is ongoing, therefore sections will be provided once logging and sampling has been completed).

Diamond drilling on North Pond is currently drilling the third hole from the ice surface. The first two holes (MH-19-52 and 53) were designed to verify the location and thickness of the section containing the discovery hole MH-18-01 at approximately the same level as the discovery intersection (approximately 70 m below surface).

The mineralization observed in MH-19-52 and 53 is typical of the high-grade veins in previous holes, includes multiple (>20 specks in MH-19-52) sights of mm size visible gold, associated with stylolitic veining with minor amounts of pyrite, sphalerite, boulangerite and arsenopyrite.

There are currently between 24 and 27 inches of ice over most of the southern portion of North Pond, sufficient to support a single rig and limited support equipment. Ice thickness and its condition are being monitored continuously during the drilling operations as a safety precaution.

The Company is also pleased to report that a detailed magnetic survey, which was commissioned after receipt of the Earth Tectonics structural report, has outlined potentially significant anomalies that may represent extensions and/or repetitions of the gold mineralized Shear Zone identified by Earth Tectonics in January 2019 (see attached map). The high-grade intercepts to date all appear to have a strong spatial relationship to magnetic lows as shown on the magnetic plot (i.e. MH-18-17, etc.). The Shear Zone, as defined by Earth Tectonics, shows a close spatial relationship to an area of magnetic low intensity (lighter colours). The land-based rig is currently testing the pair of subparallel structures defined by the magnetic survey under the northern portion of North Pond with 50 to 100 m spaced sections. A total of four holes (MH-19- 47, 49, 51 and 54) have been completed by the land-based rig to depths of 268 m testing the magnetic anomalies, and have intersected significant zones of deformation and wide zones (up to 20 m drilled thickness) of intense quartz veining with variable sulphide content spatially associated with the linear magnetic anomalies (lows). No assays have been received to date and detailed logging and sampling is ongoing.

Timothy Froude, P. Geo., President and CEO, stated: “After a slow start to the ice-based program due to unseasonably mild temperatures and rain in January, we have finally begun testing the Eastern Zone mineralization and the geological model put forth by Earth Tectonics. We are also excited about the recent magnetic survey which has defined multiple structures that could represent extensions or repetitions of the high-grade shear zone. The limited drilling to date (two holes) on North Pond has shown that the shear zone is variable in intensity and thickness. It appears to “weave” with fluctuating dips, and in certain sections, it appears to feather or become branch-like. These are characteristics common to shear zones and continued drilling will allow for better definition of the fault system.”

QP

This news release has been reviewed and approved by Timothy Froude, P. Geo., a “Qualified Person” under National Instrument 43-101 and President and CEO of Sokoman Minerals Corp.

About Sokoman Minerals Corp.

Sokoman Minerals Corp. (TSX-V: SIC) is a discovery-oriented company with projects in Newfoundland & Labrador, Canada. The Company’s primary focus is its portfolio of gold projects in Central Newfoundland on the structural corridor hosting the 4.2 million ounce Valentine Lake gold project 150 km southwest of the Company’s high-grade Moosehead gold project. The Company also has a 100% interest in an early-stage antimony project in Newfoundland recently optioned to White Metal Resources, as well as a 100% interest in the Iron Horse (Fe/U/REE) project in Western Labrador.

To learn more, please contact:

Timothy Froude, P. Geo.,

President & CEO

Cathy Hume, Director,

Investor Relations

Website: www.sokomaniron.com

Twitter: @SokomanIron

Facebook: @SokomanIron

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Investors are cautioned that trading in the securities of the Corporation should be considered highly speculative. Except for historical information contained herein, this news release contains forward-looking statements that involve risks and uncertainties. Actual results may differ materially. Sokoman Minerals Corp. will not update these forward-looking statements to reflect events or circumstances after the date hereof. More detailed information about potential factors that could affect financial results is included in the documents filed from time to time with the Canadian securities regulatory authorities by Sokoman Minerals Corp.

Sokoman Iron Announces Name Change

Sokoman Iron Announces Name Change

St. John’s, NL, February 13, 2019 – Sokoman Iron Corp. (TSX-V: SIC) (OTCQB: SICNF) (the “Company” or “Sokoman”) today announced that TSX Venture Exchange has approved the change of name of the Company from “Sokoman Iron Corp.” to “Sokoman Minerals Corp.”, which becomes effective at the opening of the market on February 13, 2019. The stock symbol remains the same. The CUSIP number assigned to the Company’s shares following the name change is 83410M101.

The change of name better reflects the nature of the Company’s portfolio of properties that comprise various commodities, primarily gold.

Sokoman would also like to announce that the Company is currently working on a new user- and mobile-friendly website which is due to become live in the winter of 2019. The website address will be updated to reflect the new Company name when the upgrade is completed.

About Sokoman Minerals Corp.

Sokoman Minerals Corp. (TSX-V: SIC) is a discovery-oriented company with projects in Newfoundland & Labrador, Canada. The Company’s primary focus is its portfolio of gold projects in Central Newfoundland on the structural corridor hosting the 4.2 million ounce Valentine Lake gold project 150 km southwest of the Company’s high-grade Moosehead gold project. The Company also has a 100% interest in an early-stage antimony project in Newfoundland recently optioned to White Metal Resources, as well as a 100% interest in the Iron Horse (Fe/U/REE) project in Western Labrador.

To learn more, please contact:

Timothy Froude, P. Geo.,

President & CEO

Cathy Hume, Director,

Investor Relations

Website: www.sokomaniron.com

Twitter: @SokomanIron

Facebook: @SokomanIron

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Investors are cautioned that trading in the securities of the Corporation should be considered highly speculative. Except for historical information contained herein, this news release contains forward-looking statements that involve risks and uncertainties. Actual results may differ materially. Sokoman Minerals Corp. will not update these forward-looking statements to reflect events or circumstances after the date hereof. More detailed information about potential factors that could affect financial results is included in the documents filed from time to time with the Canadian securities regulatory authorities by Sokoman Minerals Corp.

Sokoman Iron Commences Phase 3 Drilling At Moosehead Gold Property, Newfoundland

Sokoman Iron Commences Phase 3 Drilling at Moosehead Gold Property, Newfoundland

St. John’s, NL, February 6, 2019 – Sokoman Iron Corp. (TSX-V: SIC) (OTCQB: SICNF) (the “Company” or “Sokoman”) today announced that Phase 3 drilling has commenced on their 100%-owned Moosehead Gold Property in Central Newfoundland. Two drill rigs will be contracted to drill targets resulting from Phase 2 assay results in the Eastern and Western Trends plus some outlying areas, as well as targets identified from a detailed structural review of the Eastern Trend drill holes.

Rig 1 has arrived and is currently testing targets several hundred metres south of the Eastern Trend, while Rig 2 will begin to test extensions of the Eastern Trend identified by a recently received preliminary report of the structural characteristics of the Eastern Trend. Cutting of new drill setups will begin immediately. The Company is also continuing its efforts to thicken the ice in the southern portion of North Pond to facilitate testing of the upper portions of the newly recognized Eastern Trend Shear Zone which hosts all of the high-grade intercepts, including MH-18-01 (11.90 m @ 44.96 g/t Au); MH-18-17 (24.90 m @ 33.56 g/t Au) and MH-18-39 (9.05 m @ 70.29 g/t Au).

The Company would also like to announce that, in accordance with its stock option plan and subject to regulatory approval, it has granted 500,000 incentive stock options, exercisable at $0.12 for a period of 5 years, to a Director of the Company.

About Sokoman Iron Corp.

Sokoman Iron Corp. (TSX-V: SIC) is a discovery-oriented company with projects in Newfoundland & Labrador, Canada. The Company’s primary focus is its portfolio of gold projects in Central Newfoundland on the structural corridor hosting the 4.2 million ounce Valentine Lake gold project 150 km southwest of the Company’s high-grade Moosehead gold project. The Company also has a 100% interest in an early-stage antimony project in Newfoundland recently optioned to White Metal Resources, as well as a 100% interest in the Iron Horse (Fe/U/REE) project in Western Labrador.

To learn more, please contact:

Timothy Froude, P. Geo.,

President & CEO

Cathy Hume, Director,

Investor Relations

Website: www.sokomaniron.com

Twitter: @SokomanIron

Facebook: @SokomanIron

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Investors are cautioned that trading in the securities of the Corporation should be considered highly speculative. Except for historical information contained herein, this news release contains forward-looking statements that involve risks and uncertainties. Actual results may differ materially. Sokoman Iron Corp. will not update these forward-looking statements to reflect events or circumstances after the date hereof. More detailed information about potential factors that could affect financial results is included in the documents filed from time to time with the Canadian securities regulatory authorities by Sokoman Iron Corp.

Sokoman Iron Acquires A 100% Interest In Moosehead Gold Project

Sokoman Iron Acquires a 100% Interest in Moosehead Gold Project

St. John’s, NL, February 1, 2019 – Sokoman Iron Corp. (TSX-V: SIC) (OTCQB: SICNF) (the “Company” or “Sokoman”) is pleased to announce that it now owns a 100% interest in the Moosehead Gold Property, subject to a 2% NSR, having spent a required minimum of $500,000 in exploration expenditures as operator within the first year as per its option agreement (the “Option”) with Altius Resources Inc.

Under the terms of an agreement announced on November 9, 2017 and approved by TSX Venture Exchange on March 23, 2018, Sokoman had the exclusive right to acquire a 100% interest in Altius’ high-grade Moosehead Gold Project in central Newfoundland, in part by committing to $500,000.00 in exploration expenditures within the first year of agreement.

Tim Froude, President and CEO commented: “This is a significant milestone for Sokoman and its shareholders. Altius has notified us of the transfer of ownership, and the transfer of License was approved by the Minister of Natural Resources. The Moosehead project consists of 98 claims encompassing 24.5 square kilometres. Our exploration activities to date include some 50 diamond drill holes (~9,500 m) that are being incorporated, along with historic assays, into a 3D software program to view and model the mineralized zones. Recently completed Phase 2 drilling has returned multiple high-grade intersections including 24.90 m grading 33.56 grams per tonne gold from the newly discovered Eastern Trend Shear Zone. The recent preliminary report on the structure of the Eastern Trend has greatly improved our understanding of the high-grade shear zone at the Eastern Trend and will guide exploration on that front. Phase 3 diamond drilling has begun and will focus on the Eastern Trend high grade shear zone as well as selected high priority targets elsewhere on the property.”

Altius, and a private, arms-length third party, will retain a combined 2.0% NSR royalty (1.5% to Altius) and certain preferential rights on any future royalties or streams granted on the Moosehead property, and will be granted a pro rata right to participate in future equity financings of Sokoman for three years. Altius and Sokoman will have the right to include as part of the property any additional claims acquired by them within a two kilometre area of interest.

QP

This news release has been reviewed and approved by Timothy Froude, P. Geo., a “Qualified Person” under National Instrument 43-101 and President and CEO of Sokoman Iron Corp.

About Sokoman Iron Corp.

Sokoman Iron Corp. (TSX-V: SIC) is a discovery-oriented company with projects in Newfoundland & Labrador, Canada. The Company’s primary focus is its portfolio of gold projects in Central Newfoundland on the structural corridor hosting the 4.2 million ounce Valentine Lake gold project 150 km southwest of the Company’s high-grade Moosehead gold project. The Company also has a 100% interest in an early-stage antimony project in Newfoundland recently optioned to White Metal Resources, as well as a 100% interest in the Iron Horse (Fe/U/REE) project in Western Labrador.

Timothy Froude, P. Geo., President & CEO

Cathy Hume, Investor Relations

Website: www.sokomaniron.com

Twitter: @SokomanIron

Facebook: @SokomanIron

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Investors are cautioned that trading in the securities of the Corporation should be considered highly speculative. Except for historical information contained herein, this news release contains forward-looking statements that involve risks and uncertainties. Actual results may differ materially. Sokoman Iron Corp. will not update these forward-looking statements to reflect events or circumstances after the date hereof. More detailed information about potential factors that could affect financial results is included in the documents filed from time to time with the Canadian securities regulatory authorities by Sokoman Iron Corp.

Report On Structural Analysis Of The Eastern Trend Moosehead Pro

SOKOMAN REPORTS FINAL ASSAYS FROM PHASE 2 DRILLING AND

RECEIVES REPORT ON STRUCTURAL ANALYSIS OF THE EASTERN TREND

MOOSEHEAD PROJECT, NL

St. John’s, NL; January 31, 2019 – Sokoman Iron Corp. (‘Sokoman’ or ‘the Company’) (TSX-V: SIC) is pleased to announce that it has received all outstanding assay results for drill holes completed during the Phase 2 diamond drill program on the high-grade Moosehead Gold Project in north-central Newfoundland. The results are mainly from the Western Trend and historical targets up to 1 kilometre to the north and south of the Western Trend. The results also include assays from infill sampling from MH-18-39, and two holes not previously reported on from the Eastern Trend, MH-18-37 and 40. All core intersections from the Phase 2 drilling that were thought to have intersected high-grade mineralization based on quartz veining and visible gold sightings, were cut and rush assayed in December 2018 with results reported in the December 14, 2018 News Release. The full results are in a table appended to this news release.

The Company is also pleased to announce that the Phase 3 diamond drilling will begin immediately and will focus on targets identified from a preliminary structural evaluation recently completed on the Eastern Trend. While the ice thickness on North Pond is currently not sufficient to support drilling equipment, extensions to the Eastern Trend can be tested by land-based drilling. In the meantime, the Company will continue with efforts to increase ice thicknesses, by flooding, at North Pond.

Eastern Trend Highlights include the intersections below (core lengths reported, true widths vary from 60% to 100% of intersected widths):

MH-18-40 14.70m @ 0.98 g/t Au incl., 0.65m @ 13.00 g/t Au

MH-18-39 9.05m @ 70.29 g/t Au (incl., 5.10m @ 124.21 g/t Au previously reported)

MH-18-37 3.70m @ 0.92 g/t Au incl., 0.70 m @ 2.45 g/t Au

Additional sampling in MH-18-39 immediately up-hole from the previously reported 5.10m high-grade section returned low grade gold values for an additional 3.95m including 1.40m @ 1.34 g/t Au. Sampling immediately downhole from the 5.10 high grade intercept returned only anomalous gold values to a maximum of 94 ppb. The revised intersection is: 9.05m @70.29 g/t Au from 75.45m downhole. Results from holes MH-18-37 and 40 suggest they did not properly intersect the plane of the newly recognized Eastern Trend shear zone.

Structural Analysis – Eastern Trend

In early January, 2019, the Company commissioned an analysis of the structural setting and possible controls of the high-grade, gold bearing system at the Eastern Trend. The preliminary study (final report in progress), was completed by Earth Tectonics Limited, the same firm that completed the 2016 structural report on the Moosehead property for then owner Altius Resources Inc. The 2016 report revealed that high-grade veins in the Western Trend were oriented East-West, nearly parallel to the direction of most of the historical drilling, thus calling into question the value of the earlier drilling. The structural analysis utilizes data from the Company’s 2018 televiewer survey, as well as the examination and relogging of holes recently completed on the Eastern Trend including MH-18-01. The report has identified the following features of the Eastern Trend:

The highest-grade intersections (e.g. MH-18-01, 17 and 39) occur in a ductile-brittle Shear Zone of uncertain width which has an overall dip of 50 degrees East and a strike trend of 010 degrees which is largely untested and of unknown strike length and depth extent;

The Shear Zone is a large-scale, kilometric, structure of uncertain regional strike trend beyond the small drilled area and with possible links to the regional faults/thrusts bounding the gold district. This may be the most important structure in the local district, and the central axis of the Au system. Strike continuations of this structure are unknown and undrilled. As well as along the strike continuation, the best potential may be at depth where the structure roots into the regional NE striking thrust faults.

Gold is occurring in two different styles and geometries of structures which need to be evaluated with carefully oriented drilling of each type;

The newly defined local orientation of the shear zone provides an explanation for the distribution of both the high-grade drill intercepts and the lower grade intercepts in the Eastern Trend, with the lower grade intersections drilled either just above or below the shear zone (e.g. MH-18-16, 18, 37, 40);

The shear zone has two internal shear and fabric elements, a 20-30 degree East dip and a 50-70 degree East dip, in an overall 45 to 50 degree dipping zone. The internal shear pattern may locally control the Au grade whilst the geometry of the shear sets suggests that structural ore shoots within the plane of the shear zone may be shallow plunging with lower grade zones between them.

Timothy Froude, P. Geo. and President and CEO of Sokoman Iron states; “The 7,643 metre, thirty-five hole, Phase 2 drilling campaign has expanded the footprint of both the Western and Eastern Trends, with key step-outs to the North and South of the Eastern Trend discovery hole, MH-18-01, as well as in the up-dip direction with the zone remaining open. In addition, the preliminary report from Earth Tectonics presents a positive view of the Eastern Trend mineralization and its potential, portions of which can be drilled from the east side of North Pond thus lessening the dependence on an “ice based” platform. The surface projection of the newly defined shear zone lies along the western shoreline of North Pond where previous workers have reported clusters of visible gold bearing quartz float assaying from 19 to 149 g/t Au, supporting the interpreted projection of the shear zone. Land-based drilling will commence immediately and will use the structural report for drill targeting in addition to high priority areas to the south. Once ice conditions are deemed safe, drilling from the ice surface to test other sections of the Eastern Zone will begin using a second rig.”

Western Trend Highlights Include (core thickness):

MH-18-28 2.00m @ 3.34 g/t Au, incl. 0.33m @ 11.76 g/t Au;

MH-18-31 1.40m @ 3.87 g/t Au, incl. 0.40m @ 13.07 g/t Au;

MH-18-32 1.35m @ 17.01 g/t Au, incl. 0.40m @ 38.58 g/t Au;

MH-18-36 5.85m @ 1.12 g/t Au, incl. 0.30m @16.48 g/t Au;

Additional Targets

Phase 2 drilling also resulted in the discovery of a potentially significant new zone of gold mineralization in MH-10-103, located approximately 1 km to the north of the Eastern Trend in the general vicinity of a cluster of historical quartz vein boulders that were drill tested by previous operators in 2002. Historical drill hole MH-02-39 reported an eight metre zone of quartz breccia and veining with assays of 552 ppb Au over 2.3 m* in a broader zone of anomalous gold values. (*Values reported are historical in nature and not verified by Sokoman Iron Corp.) Previously reported MH-18-103, collared 30 metres ahead (west) of MH-02-39, intersected the brecciated zone, but continued beyond the termination of the 2002 drill hole and intersected a second, more strongly mineralized (3-5% pyrite/sphalerite/boulangerite + 1 speck of visible gold) vein zone over a 2.40 m core length, similar in appearance to the Western Trend (true thickness unknown). The interval returned an average grade of 1.01 g/t Au, lower than anticipated, but not unexpected given the nuggety nature of gold mineralization on the property. Additional drilling included two step-out holes MH-18-107 and 109, 25 m to the north and south respectively, of MH-18-103. Both holes intersected only anomalous gold values, however, the Company believes that the source of the high-grade float is local and will consider additional work in the area.

Two holes (MH-18-41 and 42) have been drilled down-dip (25 and 40 m respectively) from historical hole MH-02-34 located 500 m to the south of the Eastern Trend intersections. Historical hole MH-02-34 returned a 5.50 m interval (core length from 67.64 m down-hole) averaging 4.15 g/t Au, including 1.05 m at 18.31 g/t Au* (with 28 total specks of gold reported). MH-18-41 reported 4 specks of visible gold between 91.50 and 93.90 m down-hole and returned a 7.20 m section with two mineralized intervals assaying: 2.29 g/t Au over 0.60 m from 91.05m downhole, and 1.43 g/t Au over 1.10m from 93.70m downhole, again reflecting the unpredictability of visible gold (all core thicknesses, true thickness not known). The company intends to test other property wide high priority targets while evaluating results to date from areas already tested. *Values reported are historical in nature and not verified by Sokoman Iron Corp.

QA/QC

A total of 2148 samples, including duplicates, blanks and standards, have been submitted to Eastern Analytical Ltd. in Springdale, Newfoundland for gold and ICP analysis. Samples with possible visible gold were submitted for total pulp metallics and gravimetric finish. All other samples were analyzed by standard fire assay methods. Eastern Analytical is an accredited assay lab that conforms to requirements of ISO/IEC 17025. Total pulp metallic analysis is a result of a whole sample being crushed to -10 mesh and pulverized to 95% -150 mesh. The total sample is then weighed and screened 150 mesh. The +150 mesh fraction is fire assayed for Au, and a 30 g subsample of the -150 mesh fraction is fire assayed for Au. A calculated weighted average of total Au in the sample is reported as well. The Company included in the sample stream one blank and one industry approved standard for every twenty samples submitted, as well as random duplicates of selected samples. This is in addition to the in-house standard and duplicate policy of Eastern Analytical.

QP

This news release has been reviewed and approved by Timothy Froude, P. Geo., a “Qualified Person” under National Instrument 43-101 and President and CEO of Sokoman Iron Corp.

Drilling services is being provided by the Diamond Drilling Division of Springdale Forest Resources Inc., a diversified natural resources-focused company based in Springdale, NL. The Company would also like to thank the Government of Newfoundland and Labrador for approving the Moosehead Phase 1 Program for 2018 JEA Funding.

About Sokoman Iron Corp.

Sokoman Iron Corp. (TSX-V: SIC) is a discovery-focused company with projects in Newfoundland & Labrador, Canada. Sokoman’s primary focus is its portfolio of gold projects in Central Newfoundland. The Company also has interests in early-stage gold, base-metal and antimony projects in Newfoundland, as well as a 100% interest in the Iron Horse (Fe/V/REE) project in Western Labrador.

To learn more, please contact:

Timothy Froude, P. Geo., President & CEO

Cathy Hume, Investor Relations

Website: www.sokomaniron.com

Twitter: @SokomanIron

Facebook: @SokomanIron

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Forward-Looking Statements:

Investors are cautioned that trading in the securities of the Corporation should be considered highly speculative. Except for historical information contained herein, this news release contains forward-looking statements that involve risks and uncertainties. Actual results may differ materially. Sokoman Iron Corp. will not update these forward-looking statements to reflect events or circumstances after the date hereof. More detailed information about potential factors that could affect financial results is included in the documents filed from time to time with the Canadian securities regulatory authorities by Sokoman Iron Corp.

Sokoman Iron Appoints New Director James F. Adams

Sokoman Iron Appoints New Director James F. Adams

St. John’s, NL, January 18, 2019 – Sokoman Iron Corp. (TSX-V: SIC) (the “Company” or “Sokoman”) is pleased to announce that James F. Adams, Ph.D., CFA has joined the Board of Directors.

Based in New York, Dr. Adams has over twenty-five years of financial industry experience at J.P. Morgan serving corporate, public and not-for-profit clients across regions and businesses. In his most recent role as Managing Director in Markets & Investor Services, he led Asset Owner sales and relationship management across all aspects of the investment portfolio, engaging with CIOs and COOs and their consultants as well as delivering emerging technology solutions. Prior to joining Investor Services, Dr. Adams spent fifteen years in interest rate and foreign exchange risk management advising multinational clients in corporate finance and risk management, as well as five years with the firm in Europe.

Dr. Adams recently left J.P Morgan to pursue teaching, consulting and advisory opportunities and is currently an Adjunct Professor of Finance and Risk Engineering at New York University’s Tandon School of Engineering. Dr. Adams holds a Ph.D. and M.A. in Economics from The Ohio State University and has been a Chartered Financial Analyst since 2001. He also currently serves as a member of the CFA Society New York 2019 Nominating Committee.

“We are pleased to welcome Dr. Adams to our Board. His background in financial services and investments will no doubt be of tremendous insight to Sokoman, especially now that we are listed on the OTCQB stock exchange in the US. We are excited to introduce James to the mining world and apply his knowledge of capital markets and corporate finance to further strengthen our Board of Directors”, commented Timothy Froude, President & CEO of Sokoman Iron Corp.

About Sokoman Iron Corp.

Sokoman Iron Corp. (TSX-V: SIC) is a discovery-oriented company with projects in Newfoundland & Labrador, Canada. The Company’s primary focus is its portfolio of gold projects in Central Newfoundland on the structural corridor hosting the 4.2 million ounce Valentine Lake gold project 150 km southwest of the Company’s high-grade Moosehead gold project. The Company also has a 100% interest in an early-stage antimony project in Newfoundland, as well as a 100% interest in the Iron Horse (Fe/U/REE) project in Western Labrador.

Sokoman Iron Moosehead Project, Nl

SOKOMAN IRON DRILLS 5.10 m of 124.20 g/t Au INCLUDING 1.10 m of 550.30 g/t Au at EASTERN TREND, MOOSEHEAD PROJECT, NL

St. John’s, NL; December 14, 2018 – Sokoman Iron Corp. (‘Sokoman’ or ‘the Company’) (TSX-V: SIC) is pleased to announce that it has received additional assay results for diamond drill holes completed on the high-grade Moosehead Project in north-central Newfoundland. The recently received results include outstanding samples from previously announced holes, as well as results (generally rush assays) representing selected intervals from holes in the Eastern Trend (see table below). Drilling operations have been suspended for the holiday period and until all outstanding assays have been received, compiled and interpreted.

Drill hole MH-18-39 returned a 5.10 m (core thickness) intercept averaging 124.20 g/t Au, including a 1.10 m* visible gold bearing quartz vein averaging 550.30 g/t Au. This intercept lies 35 m up-dip (above) drill hole MH-18-01 that returned 11.90 m averaging 44.96 g/t Au, including a high- grade vein that averaged 385.85 g/t Au over 1.35 m (true thickness of vein is believed to be 90% of core length). The 5.10 m interval, beginning at a down-hole depth of 79.40 m (50 m vertically), includes two 1.0 m samples above the high-grade vein that averaged 2.89 g/t Au, as well as two 1.0 m samples below the vein which averaged 11.15 g/t Au. Assays are pending for 12.80 metres of core up- hole and 4.50 metres of core down-hole from the reported 5.10 m interval. The high-grade vein included a 0.60 m core length sample that assayed 199.99 g/t Au and a lower, 0.50 m core length sample that assayed 970.69 g/t Au. (*Note: vein true thickness estimated to be 95% of reported thickness).

Other Phase 2 program highlights include:

Eastern Trend mineralization extended by 34 m up-dip and at least 45 m north and 15 m south of the discovery hole MH-18-01, and remains open;

MH-18-34 returned 12.40 m core length grading 2.76 g/t Au including 9.84 g/t Au over a core length of 2.25 m in a 15 m step-out to the south of MH-18-01;

Gold mineralization in the Eastern Trend has now been traced to a vertical depth of 230 m and remains open;

MH-18-41, drilled 25 m behind historical hole MH-02-34, intersected sulphide bearing quartz vein zones with 4 specks of visible gold and assays are pending; MH-02-34 is 500 m south of Eastern Trend.

Timothy Froude, P. Geo., President and CEO, states: “Phase 2 has expanded the footprint of the Eastern Trend with step-outs to the North and South of the Discovery Hole, as well as 35 m up-dip. Assays are pending from two holes drilled up-dip from MH-18-01 and MH-18-17 and shoulder samples from the above noted 5.10 m intercept from MH-18-39. As we have reached the limit of practical drilling from the west side of North Pond, we are currently permitting a Phase of winter drilling from the ice of North Pond to more effectively test the Eastern Trend while also cutting costs.”

The Phase 2 program consisted of 7,243 metres of core in 35 holes, including 11 holes in the Eastern Trend, 13 holes in the Western Trend, and 11 holes focused on targets up to 1.0 km north and 500 m south of the Eastern and Western Trend areas. A total of 2,148 core samples were cut in the current Phase – 44% of which (approximately 945 samples) remain outstanding. The Company expects to have all results in hand by early January 2019, with drilling to resume shortly thereafter pending receipt of the required permits.

The Phase 2 additional 13 holes completed on the Western Trend showed 11 of 13 with quartz veining and associated wallrock sulphide mineralization extending for two to three metres from the veins including 4 holes with visible gold in the quartz veins ranging from 0.50 to 1.5 m in core length. All assays from the Western Trend holes are pending.

Phase 2 also saw the discovery of a potentially significant new zone of gold mineralization in MH-10- 103, located approximately 1 km to the north of the Eastern Trend and in the general vicinity of a cluster of historical quartz vein boulders that returned assays* ranging from less than 5 ppb Au to a maximum value of 180 g/t Au in rock float samples. The historical float samples occur over a 400 metre strike length and were drill tested by previous operators in 2002. Historical drill hole MH-02-39 reported an eight metre zone of brecciation and veining with maximum assays of 552 ppb Au over 2.3 m* in a broader zone of anomalous gold values. *Values reported are historical in nature and not verified by Sokoman Iron Corp.

MH-18-103, collared 30 metres ahead (west) of MH-02-39, intersected the historical brecciated zone, but continued beyond the termination of the 2002 drill hole and intersected a second, more strongly mineralized (3-5% pyrite/sphalerite/boulangerite) vein zone over a 2.40 m core length, similar in appearance to the Western Trend (true thickness is unknown at this time). The interval returned an average grade of 1.01 g/t Au, lower than anticipated, but given the nuggety nature of gold mineralization on the property and that gold mineralization is rarely uniform, additional drilling was completed. Two step-out holes were drilled 25 m to the north and south respectively of MH-18-103 – assays are pending. Sokoman believes that the source of the high-grade float is local.

In addition, two holes (MH-18-41 and 42) have been drilled down-dip (25 and 40 m respectively) from historical hole MH-02-34 located 500 m south of the Eastern Trend. MH-02-34 returned a 5.50 m interval (core length from 67.64 m down-hole) averaging 4.15 g/t Au, including 1.05 m averaging 18.31 g/t Au*. MH-18-41 reported 4 specks of visible gold between 91.50 and 93.90 m down-hole and all assays are pending. *Values reported are historical in nature and not verified by Sokoman Iron Corp.

Table of Results: Eastern Trend (Holes MH-18-16 to MH-18-20 previously reported)

Note: Core length intercepts reported are 50 to 95% of true thickness.

QA/QC

A total of 2148 samples, including duplicates, blanks and standards, have been submitted to Eastern Analytical Ltd. in Springdale, Newfoundland for gold and ICP analysis. Samples with possible visible gold were submitted for total pulp metallics and gravimetric finish. All other samples were analyzed by standard fire assay methods. Eastern Analytical is an accredited assay lab that conforms to requirements of ISO/IEC 17025. Total pulp metallic analysis is a result of a whole sample being crushed to -10 mesh and pulverized to 95% -150 mesh. The total sample is then weighed and screened 150 mesh. The +150 mesh fraction is fire assayed for Au, and a 30 g subsample of the -150 mesh fraction is fire assayed for Au. A calculated weighted average of total Au in the sample is reported as well. The Company included in the sample stream one blank and one industry approved standard for every twenty samples submitted, as well as random duplicates of selected samples. This is in addition to the in-house standard and duplicate policy of Eastern Analytical.

QP

This news release has been reviewed and approved by Timothy Froude, P. Geo., a “Qualified Person” under National Instrument 43-101 and President and CEO for Sokoman Iron Corp.

Drilling services is being provided by the Diamond Drilling Division of Springdale Forest Resources Inc., a diversified natural resources-focused company based in Springdale, NL. The Company would also like to thank the Government of Newfoundland and Labrador for approving the Moosehead Program for 2018 JEA Funding.

About Sokoman Iron Corp.

Sokoman Iron Corp. (TSX-V: SIC) is a discovery-focused company with projects in Newfoundland & Labrador, Canada. Sokoman’s primary focus is its portfolio of gold projects in Central Newfoundland. The Company also has interests in early-stage gold, base-metal and antimony projects in Newfoundland, as well as a 100% interest in the Iron Horse (Fe/V/REE) project in Western Labrador.

To learn more, please contact:

Timothy Froude, P. Geo., President & CEO

Cathy Hume, Investor Relations

Website: www.sokomaniron.com

Twitter: @SokomanIron

Facebook: @SokomanIron

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Forward-Looking Statements:

Investors are cautioned that trading in the securities of the Corporation should be considered highly speculative. Except for historical information contained herein, this news release contains forward-looking statements that involve risks and uncertainties. Actual results may differ materially. Sokoman Iron Corp. will not update these forward-looking statements to reflect events or circumstances after the date hereof. More detailed information about potential factors that could affect financial results is included in the documents filed from time to time with the Canadian securities regulatory authorities by Sokoman Iron Corp.

Sokoman Iron Cuts 24.90 M Of 33.56 G/T Au At Eastern Trend, Nl

SOKOMAN IRON CUTS 24.90 m OF 33.56 g/t Au AT EASTERN TREND,

MOOSEHEAD PROJECT, NL

RIG 2 CUTS GOLD BEARING SYSTEM 1 km NORTH OF EASTERN TREND

St. John’s, NL; November 16, 2018 – Sokoman Iron Corp. (‘Sokoman’ or ‘the Company’) (TSX-V: SIC) is pleased to announce that it has received assay results for five of seven holes completed to date in the Eastern Trend, part of the Phase 2 drilling on the Moosehead Project, Central Newfoundland, and that diamond drilling is continuing with two drill rigs. Approximately 5,000 metres in 19 holes have been completed property wide thus far in Phase 2. Program highlights include:

Eastern Trend high-grade mineralization extended in two step-outs to the north of MH-18-01;

MH-18-17 returns 24.90 m core length grading 33.56 g/t Au (15 m step-out north of

MH-18-01);

Rig #2 cuts gold bearing vein system 1 km north of the Eastern and Western Trend area.

Timothy Froude, P. Geo., President and CEO, states: “Early results from the Phase 2 drilling have expanded the extent of high-grade gold mineralization in the Eastern Trend, as well as discovering a potentially significant new zone of gold mineralization in MH-18-103, one km to the north of the Eastern Trend. The drill holes have also demonstrated that the orientation of the structure hosting the Eastern Trend mineralization is different than initially thought, and that future drill testing of the Eastern Trend would be more effectively completed during the winter from the ice on North Pond. This will result in shorter drill holes required to intersect and define the lateral extent of the Eastern zone, than drilling from the west of North Pond. Moosehead is a complex system and we are learning with every hole. Rig #2 has made a potentially significant discovery in MH-18-103, located approximately 1 km to the north that requires further testing in an area with little previous drilling.”

A total of 2,493 metres in seven holes, MH-18-16 to 22, have been completed in the Eastern Trend by Rig #1 following up on results from drill hole MH-18-01 that returned 11.90 m grading 44.96 g/t Au (Sokoman Iron News Release July 24, 2018). Two step-out holes (MH-18-17 and MH-18-20), drilled 15 and 30 metres respectively to the north of MH-18-01 (see plan attached), intersected multiple zones of visible gold bearing quartz veins hosted in altered and mineralized sediments highlighted by MH-18-17 that returned a core length of 24.90 m grading 33.56 g/t Au. Drill holes MH-18-16, and 18 and 19 on the Eastern trend gave weak to moderate gold values over variable core lengths (see Table) with additional assays pending from hole 20. No drilling has yet been carried out to the south of MH-18-01, but holes are planned in the coming weeks.

The Phase 2 drilling also indicates that the Eastern Trend mineralization appears to be moderately north to northeast dipping, not a subvertical, west dipping structure as initially thought. This new structural interpretation also suggests that the Eastern and Western trends may be linked, with deformation and therefore gold mineralization, stronger in the Eastern Trend area. The idea of this linkage was initially proposed in a structural report on the Moosehead property by previous operators in 2016. Seven holes totaling 777 metres have been completed in the Western Trend following up on results from Phase 1 that included 2.28m grading 42.36 g/t Au from MH-18-08 (Sokoman News Release August 29, 2018).

Results for holes MH-18-21 and 22 (Eastern Trend), and MH-18-23 to 29 (Western Trend) are pending.

Note: Core length intercepts reported are 50 to 90% of true thickness.

Rig #2 has completed five holes (1,331 metres, holes MH-18-101 to 105) testing targets up to one km to the north of the Eastern and Western Trend areas (see attached plan). These include a zone of historical anomalous soil and float samples with values ranging from less than 5 ppb Au to a maximum of 64 ppb Au in soils, and from less than 5 ppb Au to a maximum value of 180 g/t Au in rock float samples* outlined over a 400 metre strike length by previous operators. A 2002 drill hole, MH-02-39, in the vicinity of the historical anomalies, reported an eight metre zone of brecciation and veining with maximum assays of 552 ppb Au over 2.3 m* in a broader zone of anomalous gold values. *Values reported are historical in nature and not verified by Sokoman Iron Corp.

Sokoman drill hole MH-18-103, collared 30 metres ahead (west) of MH-02-39, intersected the historical brecciated zone, but continued beyond the termination of the 2002 drill hole and intersected a second, more strongly mineralized vein zone, 2.40 m in core length (true thickness unknown at this time). This lower zone, with 3-5% pyrite, sphalerite and sulphosalt (boulangerite) with visible gold, lies approximately 30 metres beyond the termination of the 2002 drill hole. The lower vein zone is similar to high-grade mineralized veins in the Western Trend, located one km to the south, and to the high-grade boulders located just west of the collar. Sokoman believes this second vein zone is the source of the high-grade float found in this area immediately to the west of the collar. Additional drilling is ongoing in this area, which represents the northernmost holes drilled on the property.

QA/QC

A total of 1300 samples, including duplicates, blanks and standards, have been submitted to Eastern Analytical Ltd. in Springdale, Newfoundland for gold and ICP analysis. Samples with possible visible gold were submitted for total pulp metallics and gravimetric finish. All other samples were analyzed by standard fire assay methods. Eastern Analytical is an accredited assay lab that conforms to requirements of ISO/IEC 17025. Total pulp metallic analysis is a result of a whole sample being crushed to -10 mesh and pulverized to 95% -150 mesh. The total sample is then weighed and screened 150 mesh. The +150 mesh fraction is fire assayed for Au, and a 30 g subsample of the -150 mesh fraction is fire assayed for Au. A calculated weighted average of total Au in the sample is reported as well. The Company included in the sample stream one blank and one industry approved standard for every twenty samples submitted, as well as random duplicates of selected samples. This is in addition to the in-house standard and duplicate policy of Eastern Analytical.

QP

This news release has been reviewed and approved by Timothy Froude, P. Geo., a “Qualified Person” under National Instrument 43-101 and President and CEO for Sokoman Iron Corp.

Drilling services is being provided by the Diamond Drilling Division of Springdale Forest Resources Inc., a diversified natural resources-focused company based in Springdale, NL. The Company would also like to thank the Government of Newfoundland and Labrador for approving the Moosehead Program for 2018 JEA Funding.

About Sokoman Iron Corp.

Sokoman Iron Corp. (TSX-V: SIC) is a discovery-focused company with projects in Newfoundland & Labrador, Canada. Sokoman’s primary focus is its portfolio of gold projects in Central Newfoundland. The Company also has interests in early-stage gold, base-metal and antimony projects in Newfoundland, as well as a 100% interest in the Iron Horse (Fe/V/REE) project in Western Labrador.

To learn more, please contact:

Timothy Froude, P. Geo., President & CEO

Phone: 709-765-1726

Email: tfroude@sokomaniron.com

Cathy Hume,

Investor Relations

Phone: 416-868-1079

Email: cathy@chfir.com

Website: www.sokomaniron.com

Twitter: @SokomanIron

Facebook: @SokomanIron

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Forward-Looking Statements:

Investors are cautioned that trading in the securities of the Corporation should be considered highly speculative. Except for historical information contained herein, this news release contains forward-looking statements that involve risks and uncertainties. Actual results may differ materially. Sokoman Iron Corp. will not update these forward-looking statements to reflect events or circumstances after the date hereof. More detailed information about potential factors that could affect financial results is included in the documents filed from time to time with the Canadian securities regulatory authorities by Sokoman Iron Corp.

Plan Map

Sokoman Iron Commences Phase 2 Moosehead, Central Newfoundland

SOKOMAN IRON MOBILIZES RIG #1 AND COMMENCES PHASE 2 DRILLING AT MOOSEHEAD, CENTRAL NEWFOUNDLAND

St. John’s, NL, October 1, 2018 – Sokoman Iron Corp. (“Sokoman” or “the Company”) (TSX-V: SIC) is pleased to announce that the first of two diamond drill rigs have been mobilized to the Moosehead Gold Project and will begin core drilling immediately.

The proposed program will consist of up to 10,000 metres of NQ-sized core utilizing two diamond drill rigs operating 24 hours a day with two shifts per rig. At least 50% of the proposed meterage will focus on the Eastern and Western Trends to follow up and expand on the very successful Phase 1 program completed last month, with the exact number of holes to be determined by results received.

Rig #1 will focus on the Eastern Trend area immediately surrounding the high-grade intercept from MH-18-01 which cut 11.90 m @ 44.96 g/t Au (core thickness) from the Eastern Trend (see NR July 24, 2018). A series of approximately 15 m to 25 m spaced bracket and undercut holes will be completed to depths of 250 to 300 metres to establish a strike, dip and/or plunge of the high-grade intercept reported from MH-18-01. These same holes will also target the historical intercept from MH-03-15 of 0.45 m of 278 g/t Au from drilling completed in 2003, which remains the deepest intercept to date (200 m vertically) on the property, and which was the original target of MH-18-01.

Rig #1 will also expand on open-ended mineralization in the Western Trend testing for extensions of near surface (less than 50 metres depth), high-grade gold bearing quartz veins similar to veins intersected by MH-18-08 which cut two vein zones assaying 1.05 m @ 207.51 g/t Au from 8.50 m downhole, and 2.28 m @ 42.36 g/t Au from 33.07 m downhole (see NR August 29, 2018).

Rig #2 will commence drilling approximately one week after Rig #1 and will be largely testing high-priority targets outlined by historical drilling elsewhere along the two-kilometre-long, roughly north south trending North Pond, South Pond and Discovery Faults. A total of 20-30 holes ranging from 100 to 300 metres in depth will test targets up to one kilometre north and south of the core area defined by the Western and Eastern Trends. The Western Trend is located between these key faults while the Eastern Trend appears to lie just east of the main structures and may be lying on a previously unrecognized structure. These targets include multiple historical drill holes that reported visible gold but had limited or no follow-up drilling. Additional details will be provided once the rig has been mobilized to the property.

Timeline

The program is expected to take two months to complete, however, certain targets may be more effectively and environmentally responsibly tested when the ground is frozen. These holes will be added to a Phase 3 program which would begin in early 2019 once all results from Phase 2 have been received and compiled. The Company expects to release drilling results in batches as the program progresses.

About Sokoman Iron Corp.

Sokoman Iron Corp. (TSX-V: SIC) is a discovery-oriented company with projects in Newfoundland & Labrador, Canada. The Company’s primary focus is its portfolio of gold projects in Central Newfoundland on the structural corridor hosting the 3.1 million ounce Valentine Lake gold project 150 km southwest of the Company’s high-grade Moosehead gold project. The Company also has a 100% interest in an early-stage antimony project in Newfoundland, as well as a 100% interest in the Iron Horse (Fe/U/REE) project in Western Labrador.

For more information, please contact:

Sokoman Iron Corp.

Timothy Froude, P. Geo., President & CEO

Phone: 709-765-1726

Email: tfroude@sokomaniron.com

CHF Capital Markets

Cathy Hume, CEO

Phone: 416-868-1079

Email: cathy@chfir.com

Website: www.sokomaniron.com

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Investors are cautioned that trading in the securities of the Corporation should be considered highly speculative. Except for historical information contained herein, this news release contains forward-looking statements that involve risks and uncertainties. Actual results may differ materially. Sokoman Iron Corp. will not update these forward-looking statements to reflect events or circumstances after the date hereof. More detailed information about potential factors that could affect financial results is included in the documents filed from time to time with the Canadian securities regulatory authorities by Sokoman Iron Corp.

Sokoman Iron Announces Phase 2 Drilling At Moosehead, Central Nl

SOKOMAN IRON ANNOUNCES START OF FIELD PREPARATIONS FOR PHASE 2 DRILLING AT MOOSEHEAD, CENTRAL NEWFOUNDLAND

St. John’s, NL, September 19, 2018 – Sokoman Iron Corp. (“Sokoman” or “the Company”) (TSX-V: SIC) is pleased to announce that it has awarded the Moosehead Project Phase 2 diamond drilling contract to Springdale Forest Resources (Diamond Drilling Division) of Springdale, NL, and that site preparations will begin immediately.

The proposed program will consist of up to 10,000 metres of NQ-sized core utilizing two diamond drill rigs operating 24 hours a day with two shifts per rig. At least 50% of the proposed meterage will focus on the Eastern and Western Trends to follow up and expand on the very successful Phase 1 program completed last month, with the exact number of holes to be determined by results received.

Rig #1 is expected to commence drilling on or about October 1, 2018 and will focus on the Eastern Trend area immediately surrounding the high-grade intercept from MH-18-01 which cut 11.90 m @ 44.96 g/t Au (core thickness) from the Eastern Trend (see NR July 24, 2018). A series of approximately 15 m to 25 m spaced bracket and undercut holes will be completed to depths of 250 to 300 metres to establish a strike, dip and/or plunge of the high-grade intercept reported from MH-18-01. These same holes will also target the historical intercept from MH-03-15 of 0.45 m of 278 g/t Au from drilling completed in 2003, which remains the deepest intercept to date (200 m vertically) on the property, and which was the original target of MH-18-01.

Rig #1 will also expand on open-ended mineralization in the Western Trend testing for extensions of near surface (less than 50 metres depth), high-grade gold bearing quartz veins similar to veins intersected by MH-18-08 which cut two vein zones assaying 1.05 m @ 207.51 g/t Au from 8.50 m downhole, and 2.28 m @ 42.36 g/t Au from 33.07 m downhole (see NR August 29, 2018).

Rig #2 will commence drilling approximately one week after Rig #1 and will be largely testing high-priority targets outlined by historical drilling elsewhere along the two-kilometre-long, roughly north south trending North Pond, South Pond and Discovery Faults. A total of 20-30 holes ranging from 100 to 300 metres in depth will test targets up to one kilometre north and south of the core area defined by the Western and Eastern Trends. The Western Trend is located between these key faults while the Eastern Trend appears to lie just east of the main structures and may be lying on a previously unrecognized structure. These targets include multiple historical drill holes that reported visible gold but had limited or no follow-up drilling. Additional details will be provided once the rig has been mobilized to the property.

The program is expected to take two months to complete, however, certain targets may be more effectively and environmentally responsibly tested when the ground is frozen. These holes will be added to a Phase 3 program which would begin in early 2019 once all results from Phase 2 have been received and compiled. The Company expects to release drilling results in batches as the program progresses.

About Sokoman Iron Corp.

Sokoman Iron Corp. (TSX-V: SIC) is a discovery-oriented company with projects in Newfoundland & Labrador, Canada. The Company’s primary focus is its portfolio of gold projects in Central Newfoundland on the structural corridor hosting the 3.1 million ounce Valentine Lake gold project 150 km southwest of the Company’s high-grade Moosehead gold project. The Company also has a 100% interest in an early-stage antimony project in Newfoundland, as well as a 100% interest in the Iron Horse (Fe/U/REE) project in Western Labrador.

For more information, please contact:

Sokoman Iron Corp.

Timothy Froude, P. Geo., President & CEO

Phone: 709-765-1726

Email: tfroude@sokomaniron.com

CHF Capital Markets

Cathy Hume, CEO

Phone: 416-868-1079

Email: cathy@chfir.com

Website: www.sokomaniron.com

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Investors are cautioned that trading in the securities of the Corporation should be considered highly speculative. Except for historical information contained herein, this news release contains forward-looking statements that involve risks and uncertainties. Actual results may differ materially. Sokoman Iron Corp. will not update these forward-looking statements to reflect events or circumstances after the date hereof. More detailed information about potential factors that could affect financial results is included in the documents filed from time to time with the Canadian securities regulatory authorities by Sokoman Iron Corp.

Eric Myung Appointed CFO And Issuance Of Incentive Stock Options

SOKOMAN IRON ANNOUNCES APPOINTMENT OF ERIC MYUNG AS CFO AND ISSUANCE OF INCENTIVE STOCK OPTIONS

St. John’s, NL, September 13, 2018 – Sokoman Iron Corp. (“Sokoman” or “the Company”) (TSX-V: SIC) today announced that Mr. John Ryan has resigned as CFO and Director of the Company to pursue other opportunities, effective immediately. Mr. Ryan will stay on as a consultant to ensure the year- end audit is completed on time. The Company extends its thanks to John and wishes him well in the future. Sokoman is pleased to welcome Mr. Eric Myung as its new CFO. The transition is expected to be seamless and orderly.

Mr. Myung is a Senior Financial Analyst of Marrelli Support Services Inc. and has previously worked in a public accounting firm focused on small and medium business for seven years. Mr. Myung is a Canadian Chartered Professional Accountant and has a Master of Accounting degree from University of Waterloo.

Issuance of Incentive Stock Options

The Company announces that, in accordance with its stock option plan and subject to regulatory approval, it has granted 3,950,000 incentive stock options, exercisable at $0.16 for a period of 5 years to directors, officers, employees and consultants of the Company.

About Marrelli Support Services Inc.

The Marrelli Group of Companies provides reporting issuers and private clients the following offerings – DSA Corporate Services and DSA Filing Services; MSSI Financial Accounting and MSSI Outsourced Chief Financial Officer Services. Working with public companies across all sectors of the economy, their client base consists of reporting issuers listed on the Toronto Stock Exchange (TSX), the TSX Venture Exchange (TSX-V), and the Canadian Securities Exchange (CSE), including many companies inter-listed on U.S. and other international markets.

About Sokoman Iron Corp.

Sokoman Iron Corp. (TSX-V: SIC) is a discovery-oriented company with projects in Newfoundland & Labrador, Canada. The Company’s primary focus is its portfolio of gold projects in Central Newfoundland on the structural corridor hosting the 3.1 million ounce Valentine Lake gold project 150 km southwest of the Company’s high grade Moosehead gold project. The Company also has a 100% interest in an early-stage antimony project in Newfoundland, as well as a 100% interest in the Iron Horse (Fe/U/REE) project in Western Labrador.

For more information, please contact:

Sokoman Iron Corp.

Timothy Froude, P. Geo., President & CEO

Phone: 709-765-1726

Email: tfroude@sokomaniron.com

CHF Capital Markets

Cathy Hume, CEO

Phone: 416-868-1079

Email: cathy@chfir.com

Website: www.sokomaniron.com

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.